ISSN: 1204-5357

ISSN: 1204-5357

Edwin Saidi, MBCS, MSc BIS, BSc CS, Cert Mgt.

IT Business Analyst, MALSWITCH Ltd, MALAWI

Postal Address: NICO House, Old Town, P O Box 199, Lilongwe, MALAWI

Author's Personal/Organizational Website: www.malswitch.com

Email: edsaidi@yahoo.com

Edwin Saidi holds a BSc in Computer Science, a Certificate in Management from Chancellor College, University of Malawi and an MSc in Business Information Systems from Royal Holloway, University of London. A practicing IT professional, Edwin is a professional member of the British Computer Society (BCS, the Chartered Institute for IT) and the ICT Association of Malawi (ICTAM). His areas of interest are the application of internet technologies, electronic commerce, and mobile commerce and other payment methodologies in government, public and private institutions. (please use to correspond with the authors)

Visit for more related articles at Journal of Internet Banking and Commerce

E-commerce is enjoying wide recognition in many countries but its adoption in developing countries is still a challenge. In such countries, m-commerce is being preferred especially due to the relative low costs associated with the deployment of the technology behind such applications. In Malawi, drivers of m-commerce such as banks and mobile network providers are gearing to implement m-commerce applications including m-banking, m-shopping, mobile information services, m-marketing and m-health. However, the range of applications is being limited by a number of technical, business and policy challenges. In this paper, solutions to the identified challenges are proposed by drawing from literature and experiences from other countries. It is envisaged that the proposed solutions will provide an organized technical and managerial approach to understanding and addressing the implementation challenges within the emerging domain of m-commerce.

e-commerce; m-commerce; m-commerce implementation; m-banking; m-shopping; m-marketing; m-health; electronic payment systems; Malawi; Africa

E-commerce is being embraced in many countries but its growth remains slow in most African countries. Mensah, et al. (2005) argue that this is mainly due to the lack of legal frameworks, inefficient banking and telecommunication systems, absence of security instruments and high illiteracy levels. M-commerce levels the playing field, presenting the opportunity for developing countries to compete equally with developed countries (Hu, et al., 2008). This has been demonstrated in Africa and Asia and is mainly due to the quickness with which mobile phone network infrastructure can be implemented but with less intense capital investment. Furthermore, people are much more willing to adopt mobile phone usage because most mobile phone operators offer prepaid services and this eliminates the need for credit or identity checks. In comparison with home computer usage, Hu, et al. (2008) observe that people in the developing countries prefer using mobile phones perhaps due to the high cost of the computers and the associated Internet connection charges. Like most developing countries in Africa, Malawi is beginning to adopt m-commerce. Saidi (2009) recognizes that the implementation of m-commerce in Malawi will face a number of issues which can be categorized as technical, business and policy problems. This paper aims to examine these identified issues and propose solutions by drawing from literature and the experiences of other developing and developed countries.

The paper is structured as follows: the study is introduced in the first section and the second section reviews m-commerce literature. In this context, the overview of m-commerce is highlighted and possible m-commerce applications in Malawi are explored. The third section highlights the research methodology employed. The paper then discusses m-commerce implementation problems in Malawi in section four before proposing technical and managerial solutions to the identified problems in section five. Conclusions summarize the discussion.

M-Commerce Overview

M-commerce has evolved through many similar definitions from ‘conducting commercial transactions via wireless networks and devices’ (Hu, et al., 2008: 84) to ‘the exchanges or buying and selling of commodities, service, or information on the Internet by using mobile hand-held devices’ (Lee, et al., 2003: 634). More vivid definitions have been ‘any transaction, involving the transfer of ownership or rights to use goods and services, which is initiated and/or completed by using mobile access to computer-mediated networks with the help of an electronic device’ (Tiwari, Buse & Herstatt, 2006: 40). Common to all these definitions is that electronic transactions are carried out on mobile terminals and data is transmitted via a wireless network. This paper adopts m-commerce simply as the use of mobile devices to buy or sell goods and services. M-commerce is similar to e-commerce in that it exhibits all the different types of e-commerce namely Business To Business (B2B), Business To Consumer (B2C), Consumer To Business (C2B) and Consumer To Consumer (C2C) (Bhasin, 2005; Saidi, 2009).

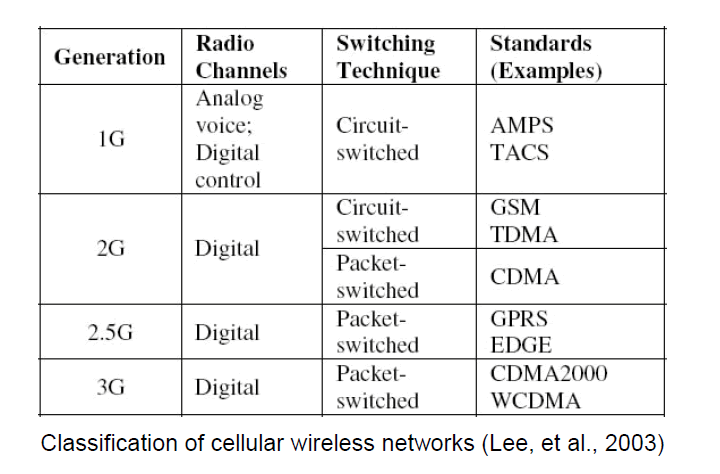

The success of m-commerce has partly been due to developments in mobile communication technologies. Cellular networks were originally designed for voice-only communication. To support m-commerce transactions which are data-based, there has been an evolution of these networks from analogue to digital and from circuit-switched to packet-switched networks (Lee, et al., 2003). Today, a number of these mobile communication technologies are available. Unlike fixed-line communication technologies, which have followed gradual developments, developments in mobile communication technologies have been concurrent even within the same country (UNCTAD, 2002). These technologies are classified into the so-called first generation (1G), second generation (2G), third generation (3G) and fourth generation (4G) network technologies as shown in the table below:

1G comprise analogue networks, which use circuit-switched connections for data transfer and has data transmission rates of up to 2400 bps. These technologies have a disadvantage in that they provide low security, limited bandwidth and can be costly when deployed over many applications. Some of the 1G standards in wide use are Advanced Mobile Phone System (AMPS), Narrow-band Advanced Mobile Phone System (N-AMPS), Nordic Mobile Telephone (NMT) and Total Access Communications Systems (TACS). Lee, et al. (2003) observe that 1G networks are becoming obsolete and will not play any role in m-commerce. 2G are digital communication systems supporting both data and voice transmission at transmission rates ranging from 9.6 to 14.4 Kbps. Just like 1G, 2G uses circuit-switched connections but offer increased bandwidth, increased security and reliable data transfer. 2G network technologies reduce the congestion problems inherent in 1G technologies by sharing multiple users over a single channel. These technologies offer additional capabilities such as short messaging, faxing and roaming of mobile end-stations. Some 2G standards currently available are Global System for Mobile communications (GSM), Time Division Multiple Access (TDMA) and Code Division Multiple Access (CDMA). With all its advantages, the transmission rate for 2G technologies is still not enough for the transmission of video and graphic images. Consequently, an intermediate technology, the so-called second-plus generation (2G+ or 2.5G) has been developed. 2.5G supports transmission rates of 57.6Kbps or higher and offers parallel voice and data transmission, including Internet access in mobile handsets (UNCTAD, 2002). 2.5G standards in use include General Packet Radio Service (GPRS), High Speed Circuit Switched Data (HSCSD) and Enhanced Data rates for GSM Evolution (EDGE). 2G and 2.5G cellular wireless networks are the most common mobile networks employed by mobile phone operators in developing countries, including Malawi, and these can provide a sufficiently robust platform for m-commerce. 3G networks have much higher network capacity for data and voice transmission. They provide bandwidths comparable to a wired broadband connection with speeds of up to 2 Mbps (128 Kbps when a device is in a car, 384 Kbps when stationary and 2 Mbps in fixed applications). The high transmission rates are suitable for Internet access, satellite navigation, video and audio streaming, video conferencing and access to other multimedia content. Unlike 1G and 2G technologies, 3G uses packet-switched connections. Some 3G standards are Wideband Code Division Multiple Access (W-CDMA), Code Division Multiple Access 2000 (CDMA2000) and Time Division-Synchronous Code Division Multiple Access (TD-SCDMA). With some operators just starting to embrace 3G mobile technologies, 4G networks have already started emerging with promising possibilities of about 20Mbps bandwidth (though there are possibilities of up to 100Mbps transmission rates) and the ability to roam across different wireless network standards with one device.

Identifying Solutions to M-Commerce Implementation Problems

There exists a known demand for m-commerce solutions in Malawi among key stakeholders such as mobile network operators, banks and consumers especially young people (Wandawanda, 2005). Literature has established that banks, mobile phone operators, the central bank and the government are the key stakeholders to drive the implementation of m-commerce in Malawi. The country can feasibly deploy m-commerce applications in a number of business domains such as banking, shopping, financial information services, agriculture, marketing, news, health, tourism and insurance banks and mobile phone operators. Saidi (2009), therefore, identifies m-banking, m-shopping, mobile information services, m-marketing and m-health as the range of m-commerce applications that can feasibly be deployed in Malawi. Drivers of m-commerce are now starting to implement m-commerce applications in form of m-banking whereby a bank account holder is able to access account management services (balance enquiries, funds transfers, Personal Identification Number (PIN) change, mini statements, bill payments, mobile top up, stop payments, cheque book requests and transaction alerts) by sending a Short Message Service (SMS) using a registered mobile phone number. Other service providers are also in the process of deploying similar m-commerce applications which will offer a number of services including bill enquiries and payments, bill distribution and mobile top up (Nyasa Times, 28th September 2009).

The range of m-commerce applications being implemented in Malawi is being limited by a number of factors. These factors have already been discussed elsewhere (Saidi, 2009). The implementation of m-commerce in the country has been known to face technical, business and policy challenges. Although, academic literature exhaustively addresses m-commerce implementation problems, research on the solutions to the known problems in the context of Malawi is mostly scanty or simply unavailable. An attempt will therefore be made in this paper to close this knowledge gap by examining and proposing solutions to potential problems in the implementation of m-commerce applications in Malawi.

The implementation of m-commerce in Malawi will raise a number of questions. By answering some of these questions, this paper attempts to form the basis for understanding and addressing the issues likely to emerge in m-commerce implementation in Malawi. The research methodology used is a review of m-commerce literature on the experiences of developing and developed countries. The literature review also specifically examines the m-commerce implementation problems in Malawi. This literature search generated data that was interpreted to draw meaningful insights into the study.

Saidi (2009) has identified a number of technical, business and policy problems likely to occur during the implementation of m-commerce in Malawi. These problems are discussed below:

1. Technical Problems

a) Authentication problems: Lack of formal addressing systems in Malawi will pose challenges to m-commerce. Identification of mobile phone owners may be ambiguous and Subscriber Identity Module (SIM) authentication methods in m-commerce applications may not be reliably employed in the country.

b) Mobile handset limitations: Interactive m-commerce applications deploy Java for user-friendly Graphical User Interface (GUI). With the majority of mobile telephone subscribers in Malawi using mobile phones that are not Java-enabled, the range of m-commerce applications that may be implemented in Malawi may be limited.

c) Inadequate telecommunication infrastructure: Malawi does not have adequate telecommunication infrastructure and m-commerce specialists to successfully launch m-commerce in the country. Some parts of the country have neither mobile network coverage nor supporting infrastructure. Until the recent commissioning of the first optic fiber network running across the country (Daily Times, 17th September 2009), network service providers relied on the use of E1 wireless links and leased lines for channeling traffic. It is not uncommon to have unreliable signals leading to calls being cut midway through transmission and an SMS taking several hours to be delivered to recipients. Such interruptions may pose a serious challenge to m-commerce in Malawi due to delays in the transmission of data.

2. Business Problems

a) Huge capital investments: Beefing up the telecommunication infrastructure to create a reliable platform for deploying m-commerce solutions will incur huge capital investments and service providers may not be ready for such a costly undertaking.

b) Low levels of user adoption: The adoption of m-commerce solutions in Malawi by users will be slow. Security is likely going to be an issue in m-commerce. Users would want to be guaranteed on the security of such applications and the associated devices before they can commit themselves to make a payment using a mobile handset since a mobile phone or any mobile hand-held device may easily get lost or stolen.

c) Low levels of literacy amongst users: Malawi has high illiteracy levels, especially among the rural communities. Consequently, the majority of users will face problems in using m-commerce applications and erroneous or unintended transactions are likely going to be common.

d) Reliance on cash as the only medium of exchange: The majority of payments in Malawi are cash-based. Payment by cash has a number of advantages including no transaction costs, privacy and immediacy. However payment using mobile devices presents a number of issues. M-commerce applications present a privacy concern since they leave a trace of one’s habits and lifestyle. Additionally, processing of payment may result in delays. Consumers would likely weigh the benefits of paying for a product or service using cash against payment using a mobile phone.

3. Policy Problems

a) Absence of a regulatory framework on m-commerce: Malawi has no legal framework and policy for regulating mobile payment systems. This creates fears amongst key stakeholders that any m-commerce solution implemented now will meet obstacles in future once the central bank sets up a regulatory policy which restricts m-commerce services already in use.

b) Lack of technical expertise: The development of m-commerce regulatory polices by the central bank of Malawi will be faced with human resource challenges. M-commerce being a new phenomenon in Malawi, the central bank naturally has no expert in the field and will rely on consultations with banks, financial institutions and other service providers. However, it is unpractical for the central bank to develop a framework to regulate a payment system it does not understand. Again, it is not being effective for the central bank to rely on the very same institutions it is supposed to regulate to formulate the modalities.

This section will attempt to suggest solutions to the identified m-commerce implementation problems in Malawi by drawing from literature and experiences from other countries.

1. Technical Problems

a) Authentication problems: SIM is only used for identification in m-commerce applications. In order to authenticate a subscriber, Tiwari, et al. (2006) observe that SIM identification combines PIN code usage and renders redundant any complicated and inefficient authentication mechanisms. Future applications may use biometrics to positively authenticate users. However, literature (McDermott, et al., 2003) has established that although the use of biometric identification methods reinforces the security of transactions, users may be worried with hygienic or medical issues. Furthermore, care must be taken to ensure that the biometric technology is not unjustifiably time-consuming and privacy-insensitive (Tarasewich, et al., 2002).

b) Mobile handset limitations: The perceived problem that the limitation of mobile devices will affect m-commerce is a known issue in literature. Limited processing power, slow Central Processing Units (CPUs), smaller screens, low battery power and limited input capabilities are a common constraint of mobile phones (Tarasewich, et al., 2002; Lee & Benbasat, 2003; Lee, et al., 2003). While many of the potential m-commerce applications in Malawi may be feasibly implemented via SMS, interactive m-entertainment services such as gaming, chatting and dating, will face obstacles. Advanced m-entertainment services use Java-based GUI, as is the case with i-mode, a wireless Internet service by NTT DoCoMo (Tarasewich, et al., 2002). Such services may be constrained by the limited capabilities of mobile handsets. Java-enabled mobile handsets are available on the Malawi market, but these may not be affordable to most consumers. The solution would be to either concentrate on the provision of m-commerce services via SMS or mobile phone operators must provide Java-enabled phones to post-paid (pay-monthly) subscribers to increase the flexibility of m-commerce services as is done in Japan (Hattori, et al., 2003). Mobile operators must be ready for this flexibility to bundle mobile phones and subscriptions otherwise the slow adoption of advanced m-commerce services that hit Finland (Carlsson, et al., 2005) is likely to occur in Malawi. Whether such a business model is viable or not in Malawi is beyond the scope of this research.

c) Inadequate telecommunication infrastructure: The vast majority of the potential m-commerce applications in Malawi can be deployed over 2G networks. GSM, a 2G technology standard is already employed by both Zain and TNM, the two mobile network operators in Malawi (GSM, 2008). Ideally, Malawi is already ready for the implementation of m-commerce with no significant infrastructure investments. Other countries that have deployed m-commerce solutions over 2G networks are South Africa (Thomas, 2006), Nigeria (Ayo, et al., 2007) and Kenya (Economist, 11th July 2007). However, migrating to robust 3G mobile communication technologies, which offer better services such as satellite navigation, video and audio streaming, video conferencing and access to other multimedia content, will incur huge costs. 3G would be ideal for interactive m-entertainment services, enabling consumers to download Multimedia Message Service (MMS) content combining images, text, sound or video (Leung, et al., 2003).

M-commerce transactions preserve the concept of atomicity, that is, they are guaranteed to either execute in their entirety or they are cancelled (Veijalainen, et al., 2003). Therefore, even if a connection is cut during a transaction or delays are experienced, the correct processing is always guaranteed.

2. Business Problems

a) Huge capital investments: This problem is related to the lack of telecommunication infrastructure for m-commerce. This paper has established that m-commerce communication technology already exists in Malawi for most of the proposed applications. The paper cites South Africa (Thomas, 2006), Nigeria (Ayo, et al., 2007) and Kenya (Economist, 11th July 2007) as examples of African countries where m-commerce solutions have been deployed over GSM, a 2G network standard available in Malawi. Intense capital investments will, however, be an issue when Malawi joins the race for 3G or even the yet to be introduced 4G mobile communication technologies. While 3G would offer higher bandwidth and more complex m-commerce applications, rushing into upgrading to 3G without having a clear understanding of the profit models can create a huge investment burden on 2G operators (Kuo & Yu, 2006). Kuo & Yu (2006) suggest that this capital pressure on mobile telecommunication operators may be reduced by introducing unique 3G value-added services that attract a large number of users to increase traffic volume, thereby generating more revenue to cover the cost. To establish the value of 3G to consumers, the services being provided must be those not already available on 2G or 2.5G networks.

b) Low levels of user adoption: The active research on m-commerce user adoption (Khalifa & Cheng, 2002; Sarker, et al., 2003; Jarvenpaa, et al., 2003; Carlsson, et al., 2005; Harris, et al., 2005; Karjaluoto, et al., 2006; Ayo, et al., 2007; Bouwman, et al., 2007; Saidi, 2009) signifies the existence of adoption problems in m-commerce applications. Ensuring high levels of user adoption in m-commerce is the responsibility of both service providers and policymakers. Organizations should not just introduce m-commerce applications for the sake of it; these applications must add value to consumers. Additionally, since research has revealed that the younger population in Malawi can adopt and help the spread of m-commerce solutions (Wandawanda, 2005), service providers should engage in rigorous marketing campaigns especially targeting these young people. Policymakers should also ensure that m-commerce regulations in Malawi exhaustively address issues of consumer protection and data privacy. Carlsson, et al., (2005) argue that low levels of m-commerce adoption are also prevalent amongst firms, as is the case for Austria and Finland. One of the reasons for this is the lack of stakeholder confidence in prevailing regulatory polices. Any m-commerce regulations developed should, therefore, not hinder the innovation and adoption of m-commerce by both users and service providers (Hu, et al., 2008).

c) Low levels of literacy amongst users: High illiteracy levels in Malawi imply a good number of consumers are denied access to a number of services, for example banking, because only a few people can produce the paperwork required or possess the skills to operate a computer. As m-commerce bypasses most of the requirements for accessing services, it is likely to be adopted by illiterate consumers. For example Kenya’s M-PESA, an m-banking service targeting the un-banked, has witnessed mass adoption (Economist, 11th July 2007). Within 3 months of introduction, the service had 150,000 customers, and about 2,500 were signing up daily. Although such m-commerce services are user-friendly even to the illiterate consumer, the use of SMS-based services will not be so straightforward to some consumers. In SMS-based m-commerce applications, users are required to type in commands (which can be likened to writing HyperText Markup Language (HTML) code) to request a service or effect a payment. Service providers must, therefore, be willing to engage in massive civic education to ensure unproblematic usage and secure good patronage.

d) Reliance on cash as the only medium of exchange: Malawi’s economy is largely rural-based with cash being the main mode of payment (Ngalande, 2003). Developments in payment systems, for example the establishment of Malswitch, to facilitate the implementation of a clear, secure and guaranteed electronic payment infrastructure, are aimed at reducing the usage of cash in the economy. M-commerce would not only be another avenue for service providers to get their services to consumers, but also promote the central bank’s strategy of moving towards a cashless society. High m-commerce patronage is expected amongst the rural consumers, especially in mobile information services and m-banking. M-commerce presents the opportunity to this class of consumers to overcome the identity proof requirement and hefty fees associated with owning a bank account as has been demonstrated in m-banking services in Kenya (Economist, 11th July 2007). In this regard, m-commerce in Malawi is also expected to reduce the cost of sending and receiving money, and can be a preferred alternative to the traditional ways of funds transfer amongst consumers.

3. Policy Problems

a) Absence of a regulatory framework on m-commerce: Similar to e-commerce, lack of enabling polices is one of the problems being faced by m-commerce in most countries (Mensah, et al., 2005; Tiwari, et al., 2006). In Malawi, the development of bilateral and multilateral agreements on mobile payment systems, as is the case with other electronic payment systems like the Electronic Cheque Clearing House (ECCH) and the Real Time Gross Settlement (RTGS), can create the necessary basis on which to base m-commerce solutions. This is the responsibility of the country’s central bank as mandated by the Reserve Bank of Malawi and the Banking Acts of 1989. This would ultimately remove fears amongst the key stakeholders that proposed m-commerce applications would meet obstacles from the central bank in future. Tiwari, et al. (2006) observe that m-commerce regulatory policies should follow five guiding principles namely consumer protection, legal enforceability, data privacy, data confidentiality and the right of self-determination. However, just like is the case for ECCH and RTGS, the applicability of m-commerce agreements can be severely tested in a court of law in cases of legal disputes between stakeholders. Malawi, therefore, needs to work towards developing specific laws on payment systems.

b) Lack of technical expertise: Although consultations are a necessary step in policy development, the central bank of Malawi needs to be in the forefront in m-commerce policy development. Being a member of the United Nations (UN), Malawi can benefit from the technical expertise of UN’s Economic Commission for Africa (ECA). It is within the work of ECA’s Department of Information for Sustainable Development to help member countries in the development of regulatory policies on m-commerce as well as e-commerce especially in the areas of security, data protection and wireless regulatory (Mensah, et al., 2005). ECA would bring to Malawi e-commerce and m-commerce policy experiences from other African countries including Tunisia, Egypt, Ghana, Cameroon, Tanzania and South Africa.

This paper has proposed solutions to potential problems in the implementation of m-commerce applications in Malawi. Although the list of solutions is not exhaustive, it forms a fundamental basis for addressing m-commerce technical and managerial issues in the country and presents an opportunity for further research within the emerging domain of m-commerce. M-commerce implementation problems identified elsewhere have been discussed.

The implementation of m-commerce in Malawi will face a number of technical, business and policy problems. On the technical front, inadequacy of telecommunication infrastructure, authentication problems and mobile handset limitations will pose a challenge to m-commerce. The paper recognizes that, while these issues pose a challenge, the majority of the proposed m-commerce applications can effectively be deployed over 2G, a network technology already available in Malawi. However, rich and interactive m-commerce applications will require operators to upgrade to 3G mobile communication technologies, which offer higher network capacity. Processing delays or connection cuts are handled by the atomicity preservation property of m-commerce transactions, whereby a transaction is guaranteed to either execute in its entirety or not to execute at all, even if the system fails midway during processing. The absence of national formal identification methods should not present an authentication challenge to m-commerce because m-commerce applications may use SIM in combination with PIN codes to authentication users. To address the technical limitation of mobile devices, the paper has suggested that organizations must either concentrate on providing SMS-based m-commerce applications or mobile phone operators must provide Java-enabled mobile phones as part of a bundle to their subscribers. However, such a move would require a thorough cost-benefit analysis.

The second set of problems in the implementation of m-commerce in Malawi is business-related and includes huge capital investments, low levels of user acceptance, low levels of literacy amongst users and reliance on cash as the only medium of exchange. Huge capital investments in m-commerce infrastructure may be avoided by using the existing 2G networks but for versatile m-commerce applications, there is need to migrate to 3G mobile communication technologies. However, organizations must be clear on the benefits of such an upgrade and what the profit models are. The paper also acknowledges the importance of user adoption to the success of m-commerce. To ensure high levels of patronage, service providers must provide m-commerce services that add value to the consumers and engage in marketing campaigns especially targeting the younger population. M-commerce regulatory policies also ought to sufficiently address issues of privacy and consumer protection. Although usage of m-commerce services will incur transaction costs, it is envisaged that consumers will still prefer m-commerce, especially for instant transfer of funds, because of the relative low transaction fees required as compared to traditional ways of sending and receiving cash. While on the one hand the low literacy level amongst consumers in Malawi is a challenge to m-commerce, on the other, it creates the surge for m-commerce. Because the traditional services, such as banking, require completion of paperwork and proof of identity, consumers would rather go for m-banking services, which cut through some of the requirements. Nonetheless, usage of m-commerce applications via SMS would be an issue amongst illiterate consumers, as users are expected to type in commands to access or pay for services. Consequently, civic education may be necessary.

The third challenge to the implementation of m-commerce applications in Malawi is in regulatory policies. Malawi has no legal framework and policy to regulate mobile payment systems. Additionally, the country has no expertise to develop such regulations and policies. To create the necessary basis for m-commerce solutions, it is suggested that the country’s central bank must develop a policy on mobile payment systems, as is the case with the country’s other electronic payment systems. While the development of this policy would draw from existing business practices, special attention must be paid to issues of consumer protection, legal enforceability, data privacy and data confidentiality. Malawi can benefit from the technical expertise of ECA, a UN regional commission.

Copyright © 2026 Research and Reviews, All Rights Reserved