ISSN: 1204-5357

ISSN: 1204-5357

HERYANTO

Baiturrahmah University, Jalan Raya By Pass KM 15, Koto Tangah, Padang 25158 West Sumatra-Indonesia, Indonesia

Visit for more related articles at Journal of Internet Banking and Commerce

The purpose of this study is to design software which can assist the Bank in determining who the prospective customer is eligible to receive KUR or not the computerized system so that the decision-making process can be more efficient, saving time and Human Resources (HR). AHP method is used to determine which prospective borrowers are deserving of KUR Bank Nagari taking into account the criteria that have been determined by the Bank. The criteria on which the decision by the Bank in determining the prospective debtors are credit status, business productivity, business conditions, and warranties. The result of the calculation of benefits and costs shows that template NPV greater than without template. This indication shows that the more effective use of KUR template and has a high accuracy rate.

KUR; AHP; Template; Bank Nagari

Today the demand for credit through the Bank has been growing very rapidly. Credit is not only used for the lower middle class people alone but by all walks of life to meet their basic needs. One type of credit is much demand today is the Kredit Usaha Rakyat (KUR). KUR is a type of loan given by the government for the perpetrators of, Micro, Small, Medium Enterprises and Cooperatives (SME-K). Bank Nagari is one bank that is trusted by the government to provide KUR facilities to the public. Heightened interest of the community to get KUR, making the Bank the difficulty in determining who is eligible to receive KUR or not. Moreover, the process of determining who is eligible to receive KUR is still done manually, making it less efficient in implementation. Therefore, it is necessary to design a system that can help the Bank in determining who is eligible to receive KUR in order of priority values globally the highest, so it can be more efficient in its implementation.

Problem Formulation

Based on the description on the background of the above problems, it can be formulated the problem to be solved in this research is to design a system that can assist the Bank in making decisions to determine who is eligible to receive KUR based on the order value global priority highest.

Research Objectives

The purpose of this study is to design software which can assist the Bank in determining who the prospective customer is eligible to receive KUR or not the computerized system so that the decision-making process can be more efficient, saving time and Human Resources (HR).

Benefits Research

Benefits of this paper is to assist the Bank in making decisions to determine who should receive the Kredit Usaha Rakyat (KUR) by looking at the value of the priority of each prospective customer compared.

Method of Assessment

There are several models that can be used to build a decision support system of one of them is the Analytical Hierarchy Process (AHP). AHP method is used to determine which prospective borrowers are deserving of KUR Bank Nagari taking into account the criteria that have been determined by the Bank. The criteria on which the decision by the Bank in determining the prospective debtors are credit status, business productivity, business conditions, and warranties. This decision support system will help the bank to make a credit decision KUR Bank Nagari.

In this study, the criteria on which to base the Bank Nagari in taking decisions KUR receivers 4 kinds as follows:

Credit Status

The purpose of these criteria is the candidate receiving the KUR is not receiving credit in any form either in Nagari Bank and other Banks. It is very important to see the load or dependents to be paid by the prospective recipient of KUR. The more he receives credit from banks more and more dependents. And if this is not in line with the client's ability to pay, then it is likely that customers receive KUR is very small, however, because the banks are not willing to bear the risk.

Business Productivity

The productivity of a business seen from several factors among business location, type of business and revenue potential recipients KUR per month. The better the value of these factors, the more productive the business also potential recipients of the KUR.

Business Conditions

Whether or not recipients KUR business conditions can also be seen from several factors such as human resources (HR) both in terms of quantity and quality, equipment and supplies business and of business management factors.

Security

Security is an important factor in considering a person is worthy or not accepts KUR Bank Nagari. Some things that can be used as collateral is a home/shop, land and vehicles BPKB.

Data Collection

The data used is secondary data from the Credit Division, Human Resources Division and the Information Technology Division and Accounting. The data required are:

• Development of Kredit Usaha Kecil (KUR)

• Salary and other income earned Micro Credit Officer (PKM)

• Duties and responsibilities PKM

Research Area, Object Research and Technical Analysis

Bank Nagari area of research is the research and the object is KUR Bank Nagari. The analysis technique used to determine the appropriateness or not the application of decision support systems is using the techniques of analysis of benefits and costs.

Method of Analytical Hierarchy Process (AHP)

Basically, the decision-making process is to choose an alternative. AHP is generally used for the purpose of setting priorities from a variety of alternative choices and those choices are complex or multiple criteria [1].

Setting priorities is an important part of the use of AHP [2]. Furthermore Mulyono [2], explains that basically AHP is a general theory of a concept of measurement. This method is used to find a good ratio scale of the paired comparison of discrete and continuous. This comparison can be drawn from the actual size or scale of a base that reflects the strength of feeling and the relative preferences will.

AHP was developed by Thomas L. Saaty can solve complex problems, where the criteria taken quite a lot, structural problems that remain unclear, uncertainty perception of decision makers as well as the uncertainty of the availability of accurate statistical data. Sometimes problems arise decisions that are difficult to measure quantitatively and needs to be decided as soon as possible and is often accompanied by a variety of diverse and complex that such data may not be able to be recorded numerically for qualitative data that can be measured is based on perceptions, preferences, experience, and intuition.

Some of the advantages of the use of AHP are as follows [3]:

1. Structure-shaped hierarchy as a consequence of the criteria selected until the deepest sub criteria.

2. Noting validity up to the limit of tolerance inconsistencies various criteria and alternatives selected by the decision makers.

3. Taking into account the durability or resistance output sensitivity analysis decision makers.

Furthermore AHP has the ability to solve the problem of multi-objective and multiple criteria are based on a comparison of the preferences of each element in the hierarchy. So AHP is a form of decision-making modeling very comprehensive [4].

Steps Using AHP Method

The steps in using AHP conducted in this study are as follows:

1. Determine the types of criteria KUR potential recipients.

2. Develop these criteria in a matrix form pairs.

3. The sum a column matrix.

4. Calculate the value of column elements criteria by the formula each element of the column divided by the number of column matrix.

5. Calculate the value of the priority criteria to add a row matrix formula results of step 4 and step 5 result divided by the number of criteria.

6. Determine alternatef would be an option.

7. Develop alternative that has been determined in a matrix form pairs for each criterion. So there will be as many as n matrix between alternate pairs.

8. Each matrix between alternate pairs of n matrices, each matrix is summed per column.

9. Calculating the value of alternative priority each - each matrix between alternate pairs of the formula as in step 4 and step 5.

10. Test the consistency of each matrix between alternate pairs of formula each matrix element pairs in step 2 multiplied by the value of the priority criteria. The result of each row add up, then the result is divided by the respective total value of the priority criteria λ1, λ2, λ3, ……, λn.

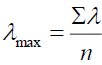

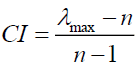

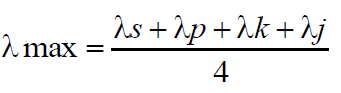

11. Calculate the maximum value of lambda by the formula:

12. Calculate the value of index Consistent with the formula

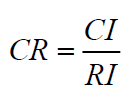

13. Calculate the ratio of consistency, with the formula  .

.

Where: RI is a random index value s derived from random table like Table 1.

Table 1: Index Random.

| N | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| RI | 0,00 | 0,00 | 0,58 | 0,90 | 1,12 | 1,24 | 1,32 | 1,41 | 1,45 | 1,49 | 1,51 |

If CR<0.1, then the value of pairwise comparison matrices given criteria consistent. If CR >0.1, then the value of pairwise comparison matrices given criteria inconsistently. So if it is not consistent, then filling the values of matrix elements in pairs on the criteria and alternatives should be repeated [5].

Establish inter-row matrix versus alternative criteria that content on the calculation process of step 7, step 8 and step 9.

The final result provides a global priority as the value used by decision makers based on the highest value.

Comparison of KUR to the PKM

Comparison between PKM with KUR management in 2010 the average for 1 PKM manage KUR Rp. 2,254,030,671.10. And then increased in 2011 nearly 400% that pengelolah by 1 PKM KUR amounted Rp.4,193,471,414.03. This shows that KUR management become less effective and less accountable because of the KUR which is managed by a person who is limited. For that we need to design a system/template credit will increase the effectiveness and efficiency of KUR management (Table 2).

Table 2: KUR Growth dan PKM.

| Year | KUR MK | % | KUR KI | % | KUR MK + Ki | PKM (People) | (KUR MK+KI)/PKM |

|---|---|---|---|---|---|---|---|

| 2010 | 60,135,220,089 | - | 5,231,669,373 | - | 65,366,889,462 | 29 | 2,254,030,671.10 |

| 2011 | 244,409,690,199 | 306,43 | 23,972,480,299 | 358,12 | 268,382,170,498 | 64 | 4,193,471,414.03 |

Duties, Powers, Borders and Responsibilities Operational and PKM

Scope of Duties PKM

a. PKM only duty within the scope of a particular credit schemes, such as the KUR, Micro credit Care (KPUM) and other schemes set forth the Board of Directors, with a maximum limit of up to Rp 50 million.

b. When do the changes to the size of the maximum limit on the scope of the above, it is stipulated in the Board of Directors of its own.

Tasks

a. Carry out the identification of potential markets for micro loans in accordance with the working area of the Branch Office related and operational boundaries PKM, and report the results of the identification of this potential market to superiors for guidance and follow-up.

b. To market the micro-credit schemes of the Bank within the working area of the Branch Office related and operational boundaries PKM.

c. Search for prospective clients who deserve Microcredit in the working area of the Branch/Sub Branch and the PKM operational boundaries.

d. Receive, check the completeness of the file and forwards the credit applications from prospective borrowers, in accordance with the terms and conditions of the applicable micro-credit scheme.

e. Based on an order (disposition) boss, PKM visits and field assessments (On the Spot/OTS) as well as interviews with prospective borrowers to get the data and information needed in the assessment of creditworthiness according to the formula or a set format for the micro credit scheme.

f. If in any collateral assessment process should ditaksasi, the appraisal done and signed by PKM and an analyst/loan officer Branch Office/Branch, to be guided by the provisions of the applicable collateral.

g. Pouring OTS results, interviews and assessment of collateral into the formula and format analysis applies to the credit worthiness of the micro-credit scheme.

h. Before the credits approved by the official credit breaker, then a Credit Analyst or directly carried out by the Leader of the Credit Section concerned, shall carry out on the spot again as a counter-checking the addresses, businesses, and other collateral.

i. The results of the analysis of creditworthiness to Credit Approval Officer signed by PKM and analyst/loan officers who do OTS contra checking.

j. Based on the decision of the credit breaker officials, PKM notify the debtor of approved credit and ask the debtor to come to the branch office to deliver or complete the credit requirements document, signed a credit agreement and other credit realization.

k. Prepare a notice of approval of credit, the credit agreement, the agreement succession and prepare slips realization.

l. Branch office administrative staff assists involved in making instalment card or credit card instalment managed microcredit borrowers PKM concerned.

m. Provide information needed for loan administration staff offices Branch/Sub Branch related to the purposes of the loan master data entry in the core banking system, the purpose of realization of credit and reporting needs.

n. Monitoring and coaching on customer Microcredit owned limited authority and limitations presented by the employer.

o. Perform billing or collecting loan repayments from debtors which it is responsible; to then be forwarded to the office related work units Branch/Sub Branch.

p. Check and verify the amount and the schedule of repayments that have been made of the debtor, with the amount and the schedule should have been listed in the card repayments or credit card instalments per debtor.

q. Perform billing and settlement of arrears of microcredit efforts were the responsibility of the PKM concerned.

r. Create and submit reports relating to the microcredit managed PKM concerned, in accordance with the request of the office supervisor branch/sub branch or a request from the central office.

s. For the purposes of monitoring and coaching per debtor becomes liable PKM is concerned, in addition to the card or card instalment payments, PKM is only allowed to organize and have a loan document that is a copy of, among others:

1. A copy of the credit agreement,1. A copy of the credit agreement,

2. A copy of the agreement succession,

3. Copy of the SPPK,

4. A copy of the assessment form,

5. Copy of letter-scrip realization or disbursement of credit and instalment loans such as receipts, notes, slip, journal keeping and so forth.

Additional Tasks

In addition to basic tasks, PKM carry out other tasks given by supervisor in the Branch Office/Sub Brach.

Privileges PKM

a. Accepting credit application and file of the debtor to then be forwarded to the branch office registration/Sub branch

b. Sign a form or results of analysis of creditworthiness within the limit scope of the PKM concerned

c. Receive and collect payment instalment loans microcredit customers in the field to be deposited to the relevant work units in branch office/sub branch

d. Create and sign a proof while customer deposit receipt field

e. Negotiates the settlement of non-performing loans, insofar as it has been coordinated and got permission from superiors

Work Area Limits PKM

a. Considering that the monitoring, supervision and collecting microcredit should be conducted regularly (daily or weekly) using a motorcycle transportation, the boundaries of work or operational radius PKM is a maximum of 10 kilo meters of office branch/sub branch where the PKM duty.

b. Excluded from the provisions in number 4 letter a above, then the branch office/sub branch are based on topography, condition of the area, population density and occupancy, access roads, the level of competition and other considerations are assessed by the branch office concerned less probable or less optimal implementation of restrictions radius a maximum of 10 kilo meters above, the branch office/sub branch can propose delimitation work area in accordance with the branch office/sub branch through recommendations submitted to the board through the division of micro credit and banking.

c. Branch office recommendations referred to in item 4 letter b above, the minimum informs:

1. Background,

2. Data condition and potential work areas

3. Analysis and consideration for expanded outside the working area limitation of the normal PKM, all branch offices/sub branch they can monitor effectively.

4. Proposed Recommendations.

5. Upon the recommendation of the branch office as number 4 letter c above, the micro banking division of credit and follow up in the form of analysis and recommendations to the board of directors. based on the decision of the board of directors, then delivered a notice to the relevant branch office.

Process Business Implementation for PKM before KUR Template Design

In carrying out the duties and responsibilities of PKM by the SOP applicable, as described in point 2.2 above. PKM business implementation process can be described as the flowchart below.

Time Needed PKM Per Event

Estimated time required PKM in processing credit per customer up by doing the billing and delivery of reports is over 1005 minutes or 16.75 hours. Details of the estimated time of PKM as shown in Table 3 and Figure 1 below.

Table 3: PKM Time Estimation.

| Number | Kind of Activities | Time (Minute) |

|---|---|---|

| 1 | Receive, check the completeness of the file and forwards the credit application | 30 |

| 2 | On The Spot | 120 |

| 3 | Assessed | 120 |

| 4 | Credit feasibility analysis | 180 |

| 5 | Credit realization | 30 |

| 6 | Typing SPPK, PK etc | 30 |

| 7 | Help make a card installments | 30 |

| 8 | Provide information to the credit administration staff | 30 |

| 9 | Monitoring and development | 120 |

| 10 | Collecting | 120 |

| 11 | Check and verify the amount and the schedule of repayments | 30 |

| 12 | Perform billing and settlement efforts arrears | 180 |

| 13 | Create and submit reports | 15 |

| Total | 1005 |

Salaries and Other's Rights

1. Salaries

a. The salary scale determined by agreement between the bank and provider.

b. PKM get a salary every month paid through the provider.

c. In the event that the Bank use more than one provider, the Bank shall carry out and ensure that the inter-provider PKM salaries should be the same. Match between providers salary is ascertained and administered by the HR Division.

2. Supply clothing

a. PKM given supply of clothing every year in the form of three pants and three shirts and one pair of shoes marketing.

b. The color and model of uniforms and footwear showed the promotion of microcredit.

c. Award supply clothing and underwear model determination is based on the approval of the board of directors recommended by the division of credit and micro banking.

d. Implementation of the clothing supply is done through the corporate secretariat division.

3. Money field office

a. Officers Microcredit (PKM) that perform tasks drink money given field.

b. The amount of money to drink for the first time set at Rp. 5000, -per day field service and is paid on a weekly basis at the expense of post honorarium fee in each branch office/branch where relevant PKM placed.

c. When do the changes amount to drink PKM, submitted by letter of its own board of directors.

4. Overtime

PKM implement given overtime pay overtime in accordance with the applicable provisions of the bank.

5. Official travel money

PKM conducting works department awarded official travel money equals Employees not shaking UPD rates in accordance with the applicable provisions of the bank.

Business Process Execution for PKM Using KUR Templates

Application of KUR template will save PKM job completion for jobs such as credit worthiness analysis, preparation of the SPPK, PK, etc., card installments, and ensure the correctness of the amount and schedule of payments. Estimated time for the KUR PKM handling each customer as Table 4 below into 795 minutes.

Table 4: PKM Time Estimation with KUR Template.

| Number | Kind of Activity | Time (Minute) |

|---|---|---|

| 1 | Receive, check the completeness of the file and forwards the credit application | 30 |

| 2 | On The Spot | 120 |

| 3 | Assessed | 120 |

| 4 | Analysis of credit feasiblity, the preparation of the SPPK, PK, etc., set up card installments and ensure the correctness of the amount of installment | 30 |

| 5 | Credit realization | 30 |

| 6 | Provide information to the credit administration staff | 30 |

| 7 | Monitoring and development | 120 |

| 8 | Collecting or billing loan installment | 120 |

| 9 | Perform billing and settlement efforts arrears | 180 |

| 10 | Create and submit reports | 15 |

| Total | 795 |

Furthermore, the business process flowchart PKM KUR template for each activity can be seen as follows.

Credit Template Design by Using AHP

The orders of the troubleshooting steps in this study are as following:

1. Determine the types of criteria KUR potential recipients. Criteria are required KUR candidate namely credit status, business productivity, business conditions, and warranties.

2. Develop criteria for KUR candidates in the matrix of pairwise as Table 5.

Table 5: Matrix Couples for Criterion KUR candidates.

| Criteria | Credit Status | Business Productivity | Business Condition | Guarantee |

|---|---|---|---|---|

| Credit Status | ||||

| Business Productivity | ||||

| Business Condition | ||||

| Guarantee | ||||

| Total |

How to fill the elements of the matrix in Table 4, are as follows:

a. Element a[i,j]=1, where i=1,2,3,.....n. For this study, n=4.

b. Triangular matrix elements above as input

3. Triangular matrix elements have the formula a [j, i]=1/a [ [i , j] For i≠j.

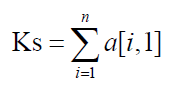

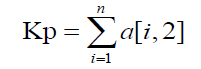

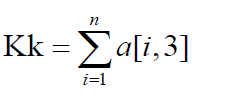

The sum of each column in Table 5.

Information:

i=row

j=column

n=many criteria (4)

Ks=number of columns credit status

Kp=column number of business productivity

Kk=number of columns business conditions

Kj=number of columns guarantee

4. Determining the value of column elements of criteria according to the formula of each cell in Table 5 divided by the respective number of columns in step 3.

Hks=(Xs1…Xs5)/Ks

Hkp=(Xp1…Xp5)/Kp

Hkk=(Xk1…Xk5)/Kk

Hkj=(Xj1…Xj5)/Kj

Information:

n=many criteria (4)

Xsn=each cell column credit status

Xpn=every business productivity Sel column

Xkn=every business conditions Sel column

Xjn=each column Sel guarantee

Hks=result for each cell column credit status with the number of credit status column

Hkp=result column for each cell with a number of business productivity column

business productivity

Hkk=result column for each cell operating conditions with a number of columns

business conditions

Hkj=result column for each cell columns guarantess with the number of columns guarantees

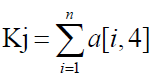

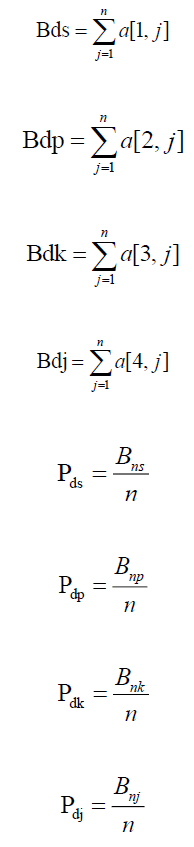

5. Determine the priority criteria for each row in Table 5 of the formula the number of lines divided by many criteria.

Information:

n=many criteria (4)

Bs=number of rows of credit status

Bp=number of rows of business productivity

Bk=number of rows of business conditions

Bj=number of guarantee rows

Ps=credit status priority

Pp=business productivity priority

Pk=business conditions priority

Pj=assurance priority

6. Entering data nominations for KUR in matrix form pairs such as Table 6.

Table 6: Matrix of pairwise candidates KUR.

| Credit Status | Marina | Gilang | Ari | Hendra | Andi |

|---|---|---|---|---|---|

| Marina | |||||

| Gilang | |||||

| Ari | |||||

| Hendra | |||||

| Andi | |||||

| Total |

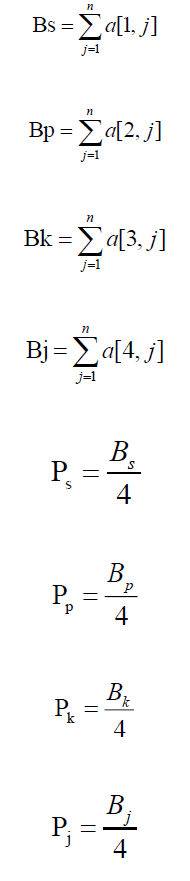

7. The sum of each column in Table 6.

Information:

i=row

j=column

Kds=number of customer columns per credit status

Kdp=number of customer columns per business productivity

Kdk=number of customer columns business conditions

Kdj=number of customer columns per guarantees

8. Determining the value of customerâÃâ¬Ãâ¢s column elements with a formula each cell in Table 6 divided by the number of columns in step 7.

Hdks=(Xds1…Xnsn)/Kds

Hdkp=(Xdp1…Xnpn)/Kdp

Hdkk=(Xdk1…Xdkn)/Kdk

Hdkj=(Xdj1…Xdjn)/Kdj

Information:

n=many customers

Xdsn=each column cells per customer credit status

Xdpn=each column cells customers per business productivity

Xdkn=each column cell customers per business conditions

Xdjn=every customer column cell per guarantee

Hdks=result column for each cell customer per credit status with a number of credit status column

Hdkp=result column for each cell of customers per business productivity by the number of business productivity columns

Hdkk=result column for each cell of customers per business conditions with the number of columns business conditions

Hdkj=result for each column cells per customer assurance guarantee the number of columns

9. Determining the priorities of customers in each row of Table 6 with the formula the number of rows divided by many prospective customers (in this study there were 5).

Information:

Bds=number of customer rows per credit status

Bdp=number of customer rows per business productivity

Bdk=number of customer rows per business conditions

Bdj=number of customer rows per assurance

Pds=customers priority per credit status

Pdp=customers priority per business productivity

Pdk=customers priority per business conditions

Pdj=customers priority per guarantee

10. Test the consistency matrix of pairwise

Rs=(Xs1…Xsn) * Ps

Rp=(Xp1…Xpn) * Pp

Rk=(Xk1…Xkn) * Pk

Rj=(Xj1…Xjn) * Pj

Information:

Rs=multiplication credit status column cells with priority criteria for the status credit row

Rp=multiplication business productivity column cells with the priority criteria of business productivity row

Rk=multiplication column cells operating conditions with the priority criteria row of business conditions

Rj=multiplication guarantee column cells with priority criteria of guarantees row

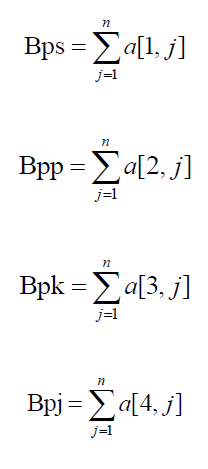

The number of rows the result of multiplying the input criteria with priority criteria

Information:

i=row

j=column

Bps=number of rows the result of multiplying the input columns credit status with priority credit status

Bpp=number of rows the result of multiplying the business productivity column input with business condition priority

Bpk=number of rows the result of multiplying the input column with business conditions priority

Ppj=number of rows the result of multiplying the guarantee input column with guarantees priority

11. Calculate the maximum λ, CI and CR.

Information:

n=many of the criteria (4)

λs=λ credit status

λp=λ business productivity

λk=λ business conditions

λj=λ guarantee

Information:

CI: consistency index

CR: consistency ratio

λmax: eigenvalue maximum (The maximum weight of each element)

n: many criteria

12. Calculating the value of global priorities.

Pts=(Pds1… Pdsn) * Ps

Ptp=(Pdp1… Pdpn) * Pp

Ptk=(Pdk1… Pdkn) * Pk

Ptj=(Pdj1… Pdjn) * Pj

Priority objectives: Multiplication customer priority value per criteria with priority Criteria

Information:

Pts=customer destination priority per credit status

Ptp=customers destination priority per business productivity

Ptk=customers destination priority per business conditions

Ptj=customers destination priority per customer assurance

Global Priority: The sum of the value row of goal priority.

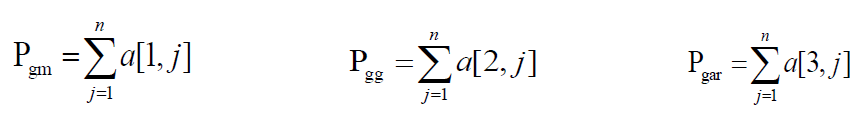

Information:

Pgm=marina global priority

Pgg=gilang global priority

Pgar=ari global priority

Pgh=hendra global priority

Pgan=andi global priority

Flowchart design or flow charts will be easier for developers to implement the system into the programming language, as it will explains how to work the system from beginning to end. Flowchart to be designed on the decision support system consists of a flowchart prioritization criteria, prioritization of customers each criterion and global priority setting. Following each flowchart for the process (Figures 2 and 3).

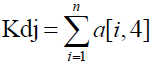

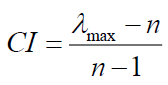

Calculation of Benefits and Costs

Calculation of benefits and costs, as shown in Tables 7 and 8 for NPV before KUR template obtained a positive NPV of Rp. 50,042,669,395 and Tables 9 and 10 to NPV KUR template Rp. 59,530,353,001. Both NPV indicates that the result is greater than 1. That KUR without a template and the template is feasible.

Table 7: Cash Flow Before KUR Template.

| Year1 | Year2 | Year3 | Year4 | Year5 | |

|---|---|---|---|---|---|

| Cash In | |||||

| -Interest income from loans | 24.154.395.345 | 25.362.115.112 | 26.630.220.868 | 27.961.731.911 | 29.359.818.507 |

| Total Cash In | 24.154.395.345 | 25.362.115.112 | 26.630.220.868 | 27.961.731.911 | 29.359.818.507 |

| Cash Out | |||||

| Overhead Cost | |||||

| -Salary costs | 325.000.000 | 357.500.000 | 393.250.000 | 432.575.000 | 475.832.500 |

| -Cost of funds | 10.399.809.107 | 10.919.799.562 | 11.465.789.540 | 12.039.079.017 | 12.641.032.968 |

| -Cost of stationary & others | 1.341.910.852 | 1.409.006.395 | 1.479.456.715 | 1.553.429.551 | 1.631.101.028 |

| Total Cash Out | 12.066.719.959 | 12.686.305.957 | 13.338.496.255 | 14.025.083.568 | 14.747.966.496 |

| Net Cash Flow | 12.087.675.386 | 12.675.809.155 | 13.291.724.613 | 13.936.648.343 | 14.611.852.010 |

Asumptions used:

1) Purchase/manufacture of system Rp. 50 million taking into account the level of difficulty making program

2) The increase in interest income and KUR MK & KUR KI average of 5% per year; position in December 2011 KUR MK Rp.244,409,690,199 & KUR KI Rp. 23,972,480,299

3) The increase in salary costs PKM annual average of 10%; PKM monthly salary of Rp. 5 million

4) Cost of funds for savings sikonci 2% per annum and deposits 5.75% per annum or the average cost of funds 3.875%, with growth funds on average by 5% per year

5) Cost of ATK and others assumed 0.5% of the cost of funds and increased by 5% per year

Table 8: NPV Calculation before KUR Template.

| Year | Net Cash flow | PVIF 10% | PV |

|---|---|---|---|

| 1 | 12.087.675.386 | 0,9091 | 10.988.795.805 |

| 2 | 12.675.809.155 | 0,8264 | 10.475.875.335 |

| 3 | 13.291.724.613 | 0,7513 | 9.986.269.431 |

| 4 | 13.936.648.343 | 0,6830 | 9.518.918.341 |

| 5 | 14.611.852.010 | 0,6209 | 9.072.810.482 |

| NPV | 50.042.669.395 |

Table 9: Cash Flow Template KUR.

| Th0 | Th1 | Th2 | Th3 | Th4 | Th5 | |

|---|---|---|---|---|---|---|

| Investasi awal | ||||||

| -Purchase/manufacture of system | 50.000.000 | |||||

| Cash In | ||||||

| -Interest income from loans | 24.154.395.345 | 26.569.834.879 | 29.226.818.367 | 32.149.500.204 | 35.364.450.224 | |

| Total Cash In | 24.154.395.345 | 26.569.834.879 | 29.226.818.367 | 32.149.500.204 | 35.364.450.224 | |

| Cash Out | ||||||

| Overhead Cost | ||||||

| -Salary cost | 325.000.000 | 357.500.000 | 393.250.000 | 432.575.000 | 475.832.500 | |

| -Cost of funds | 10.399.809.107 | 10.919.799.562 | 11.465.789.540 | 12.039.079.017 | 12.641.032.968 | |

| -Cost of stationary and others | 1.341.910.852 | 1.409.006.395 | 1.479.456.715 | 1.553.429.551 | 1.631.101.028 | |

| Total Cash Out | 12.066.719.959 | 12.686.305.957 | 13.338.496.255 | 14.025.083.568 | 14.747.966.496 | |

| Net Cash Flow | -50.000.000 | 12.087.675.386 | 13.883.528.922 | 15.888.322.112 | 18.124.416.636 | 20.616.483.728 |

Asumptions used:

1) Purchase/manufacture of system Rp. 50 million taking into account the level of difficulty making program

2) The increase in interest income and KUR MK and KUR KI average of 5% per year; position in December 2011 KUR MK Rp.244,409,690,199 and KUR KI Rp. 23,972,480,299

3) The increase in salary costs PKM annual average of 10%; PKM monthly salary of Rp. 5 million

4) Cost of funds for savings sikonci 2% per annum and deposits 5.75% per annum or the average cost of funds 3.875%, with growth funds on average by 5% per year

5) Cost of ATK and others assumed 0.5% of the cost of funds and increased by 5% per year

Table 10: NPV Calculation of KUR Template.

| Year | Net Cash flow | PVIF 10% | PV |

|---|---|---|---|

| 0 | -50.000.000 | 1,0000 | -50.000.000 |

| 1 | 12.087.675.386 | 0,9091 | 10.988.795.805 |

| 2 | 13.883.528.922 | 0,8264 | 11.473.990.845 |

| 3 | 15.888.322.112 | 0,7513 | 11.937.131.564 |

| 4 | 18.124.416.636 | 0,6830 | 12.379.220.433 |

| 5 | 20.616.483.728 | 0,6209 | 12.801.214.353 |

| NPV | 59.530.353.001 |

From result both the NPV shows that NPV Template is greater than the NPV without template. This is because the use of KUR template more effective and have a high level of accuracy (Figure 4).

From the results of the above studies can be drawn some conclusions as follows (Tables 7-10):

1. In order to improve the effectiveness and efficiency of PKM KUR need decision support system assisting the Bank in determining who is eligible to receive KUR.

2. The limited number of PKM personel makes PKM KUR management less effective and less accountable in its implementation.

3. Development of a decision support system design KUR using AHP to determine which prospective borrowers are deserving of KUR Bank Nagari taking into account the criteria that have been determined by the Bank.

4. The result of the calculation of benefits and costs shows that the NPV template is greater than without template. This indication shows that KUR template the more effective and has high accuracy.

Copyright © 2026 Research and Reviews, All Rights Reserved