ISSN: 1204-5357

ISSN: 1204-5357

Suleiman Al Oshaibat*

Tafila Technical University, Jordan, Tel: +968 2414 1971; Email: drslaimana@gmail.com

Ahmad Majali

Mutah University, Jordan.

Visit for more related articles at Journal of Internet Banking and Commerce

The study aims at clarifying the impact of key economic indicators inflation, interest rates, share liquidity and workers' remittances on stock returns in the Amman Stock Exchange (ASE), during the period (1980 - 2014). And to test hypotheses of the study, the self-Modeling non-liner regression (Vector Autoregressive) model has been used to test each of the: variance Decomposition analysis, co-integration test and Granger causality to analyze the causal relationship between these variables. The study showed that there is a positively affected, at a medium average, with the average of the inflation rates. And, the workers' remittances affect, on the long-term, on the stock returns in ASE through its impact on the overall demand and increasing the economic growth and thereby raise the stock returns. There is a limited effect of the turnover ratio of the share on the stock returns in the ASE. Also, there is a negative impact of interest rates on stock returns in ASE, any sudden change in the interest rate will negatively and directly affect the stock returns. There is an indirect, positive impact of workers' remittances on stock returns in ASE, and any change in them will positively impact the stock returns, but on the long term.

Indicators Inflation, Interest Rates, Share Liquidity, Workers' Remittances, Stock Returns

Financial markets play an important role in economic activity because they are means that work on providing the financial sources necessary for financing, whether for public or private sector; through channels through which funds flow from the units that achieve surplus to units that suffer a deficit. Then, gather and develop the savings and convert them into investments that contribute to the process of economic development.

As a result of the economic development, the importance of the financial markets has increased. They began to emerge in developing countries by the end of the seventies and early eighties due to the need of these countries, including Jordan, to scarce Capital for economic development. The investment in stocks is one of the most important activities in the field of financial investment of any country that has a regulated financial market which operates within legislation and rules governing transaction to ensure the safety of such transactions to protect investors.

Many investors are snapping up shares as they provide them good opportunities to get the appropriate returns, in addition to their ability to convert to liquidity within the lower costs, mainly in a market that is characterized by competition and high liquidity.

Capital market is considered a mirror for the economy in terms of the reflection of the economic variables in its performance. Hence, the importance of this study emerges of the impact of inflation, interest rates, workers' remittances and liquidity on stock returns in the Amman Stock Exchange.

The study launched a review of the most important key economic indicators such as inflation, interest rates, workers' remittances and share liquidity on the stock returns in ASE, as well as studying the complementary relationship between these variables.

This study provides a statistical test for the existence of a relationship between stock returns in ASE and some key economic variables. The (Vector Autoregressive) model will be applied to test each of the (Variance Decomposition) analysis, the (co-integration) test by using the (Johansen) method and the (Granger causality) application to analyze the causal relationship between these variables.

The period of this study extends from 1980-2014, and will examine the impact of these factors on the long term. The study tries to look into the impact of remittances on stock returns, and this step comes as a new contribution to the scientific research that has not been dealt with by previous studies to detect its effects on stock returns.

To achieve the goals of this study, data has been collected relying on references and books, periodicals, pamphlets, reports, global databases and scientific studies and theses related to the topic of the search.

The information related to the analysis has been obtained through a public shareholding companies guide issued by the ASE during the period (1980-2014) and statistical bulletins issued by the Central Bank for the period (1980-2014), in addition to reports issued by the Department of Statistics.

Financial markets are an important part of the financial system that serves the community, which consists of financial institutions and markets, individuals and governments that are involved in it and regulate its operations, because it is considered the appropriate place in which savings from individuals and units are being transferred and put at the disposal of the units which need them.

Financial markets are defined as a place where money supply (savers) meet with money demand (investors), where they help converting a part of the society's savings into useful investments.

They are also defined as a kind of financial transactions that help companies grow and investors to gain money. Hence, the financial markets gained importance because of their vital role of financing economic activities, and interest in them began to grow in terms of organization, mechanisms and processes, supervision and other aspects.

Perhaps one of the most important causes for the financial markets assuming the first position is the advance in information technology and communications and lifting restrictions on the movement of the Capital and other investments. And that's made the movement of investments, through different financial instruments and currencies, possible.

Hence, the financial market performance is considered as an indicator of the economic situation of any country. And through it we can infer the performance of companies and their share prices, and also through performance indicators, which in turn may be influenced by a range of internal and external factors.

So it's not only important to have appropriate conditions for the establishment of the financial market, but it is important for this market to succeed, continue and increase its activity.

Stock returns in the financial market are affected by many economic factors, and this is still the focus of attention of researchers to determine the extent of the link of the financial market performance with these factors. The impact of these factors differs due to different sectors and the states. Some of these factors have a positive impact on financial markets while others affect negatively. Here is a review of four economic factors, this study attempted to examine and look into their impact on the performance of the financial market:

a. Inflation: During periods of inflation, stock prices increase; because the investor tries to protect his savings against inflation by increasing investment in the stocks, which will lead to raise their prices and increase dividends at the same rate and possibly more.

As long as stocks represent ownership rights and are independent of the rate of inflation, then the shareholder preserves the purchasing power of his income. Yet, there are many difficulties that accompany the purchase of shares during the inflationary seasons, because it is difficult to predict the inflation itself.

On the other hand, many economic interpretations of the inverse relationship between inflation and stocks prices have emerged. Fama [1] has tried in his study to analyze the link between inflation and stock returns and the results indicated that there is an inverse relationship between the two. William Schwart believes that the relationship between inflation and stock returns may be positive or negative depending on the company's financial structure, which means the way the company finances its activities.

Companies that finance a large part of their activities by borrowing at a steady cost are indebted. The rising rate of Inflation leads to increasing their wealth, thereby increase their profits and demand for their shares and increase stock returns.

Whereas if the company was a creditor one, such as banks, and lends at a fixed cost, then the rise in the inflation rate leads to a decrease in its wealth and thereby reduce its stock returns.

The direction of the relationship between inflation and stock returns depends on whether inflation information represents good news for the debtor or bad for the creditor. And because the company might be a debtor or a creditor, the direction of the relationship between inflation and stock returns is unstable.

b. Interest rate: Securities price move in an opposite direction to the interest rates in the market. The increase in interest rates will lead to a decrease in the prices of financial assets. When interest rates rise, investors may find it is better to deposit their money in banks to get these benefits, and some may sell their shares to obtain liquidity which will increase the offer of stocks and thereby reduce their prices.

In cases of economic recession, the central bank will reduce the interest rates to boost consumer spending, therefore, individuals will not have a desire to put their savings in banks. With the growing rise in interest rates, the difficulties of the financial companies in the field of finance have increased, through the increase of debt costs of the borrowing companies, and this will be at the expense of the dividends of shareholders, which will reflect negatively on investor willingness to buy shares and thereby reduce their prices in the market.

In periods of inflation, the savers will demand a higher interest rate to compensate them for the decline that happened or expected to happen in the cash purchasing power.

c. Workers' remittances: They mean that part of cash transfers from salaries of nationals working abroad to their home countries. They are an important part of human investment overseas and main benefit for the labor migration. They are also important sources of revenue in foreign currency, in addition to being a source of savings and capital formation. Foreign remittances are the second largest reliable source of external funding for developing countries after the direct foreign investment [2].

The workers' remittances are affected by a range of internal and external factors, the most important. First: the external factors, which are represented in the economic situation of the hosting countries. Second: the internal factors, which are represented in inflation, policies and procedures necessary to transfer funds which as long as they encourage and support the flow of remittances, they increase their flow. Also, the political, cultural and social ties which link the countries, the development of the local labor market and the improvement of the level of wages which works on the encouraging foreign workers to return home. All pervious study shows there appositive relationship between stock price and worker's remittances.

d. Liquidity (Securities liquidity): In order the markets achieve their various objectives; there must be a liquidity of the securities. This means that investor and trader at the market can buy or sell at a fair price at the time they want, and that is called liquidity. And liquid investments can be defined as those investments that can be easily sold within a short period without losses.

The availability of liquidity in the market pushes the share to the intrinsic value and helps to easily price the share, leading to the fairness of prices, and the rise of the market efficiency in pricing due to the low costs of trading in the market.

Stocks are one of the most important liquid investments, as its buying and selling process is much easier than real estate and lands. But stocks are not all equal regarding liquidity. Liquidity is available in the active stocks that deliver a high turnover ratio, and here emerges the role of the investor in picking up investments.

One of the standards to measure the share liquidity is the turnover ratio. The share turnover ratio measures the demand for this share in the financial market, represented by the amount of shares traded in the financial transactions that occur on the share.

The availability of liquidity in the market helps to facilitate the process of investing on the long term and thereby enhance the predictions of a long-term economic growth, because most investors do not want to give up control of their money for a long period. In the case of shares, they are able to easily and quickly sell their shares whenever they want.

Al-Esamie showed that there is a long-term causal relationship between macroeconomic variables and the index of the industrial sector' stock prices on one hand, and the trading volumes in the insurance sector with the economic variables on the other hand. Al-Zoubi et al. [3] showed that there are only two factors that affect the stock returns, which are the expected and unexpected inflation. The study also showed that there is a long-term relationship between unexpected inflation and stock returns, and there is no relationship, on the short term, between the two variables. Bishtawi showed that a statistically significant relationship between the change in stock prices and the change in the money supply processes and index of the amount of industrial production. The study did not find a statistically significant impact for other economic variables such as inflation and interest rates on saving deposits. Alrweidhan indicated that there were indicators for a long-term equilibrium relationship between stock prices and unexpected inflation in ASE. The results also showed that this relationship is not unilateral and that does not comply with the Fisher hypothesis.

Arsheed focused on the nature of the relationship between the index of stock prices as a dependent variable in this market and macroeconomic variables for the period, The researcher found that there is a statistically significant correlation relationship between the index of stock prices as the index for industrial production, the rate of inflation and money supply. He also found that there is a statistically significant correlation relationship between the index and each of the discount rate and the exchange rate.

Zoubi [4] study aimed at testing the causal relationship between the index of stock prices in ASE and the rate of inflation in Jordan, The results showed that there is a negative relationship between two variables, but in one direction from the index of stock prices to the inflation rate.

Adam [5] study aimed at testing whether the Ghana market represents an appropriate haven against inflation on the long-term, The researcher found that there is a high correlation between stock prices and inflation in Ghana market, as this market represents an opportunity for investors to hedge against inflation on the long term. This study also provided an important lesson for developed countries, where the inflation rates continued to rise for decades, that the increase in the current inflation rate does not necessarily mean expecting low returns in the future.

Nsiah et al. [6] indicated that each 10% increase in workers' remittances will lead to 4% increase in Gross Domestic Product.

Alagidede [7] aimed at testing the Fisher hypothesis on six African countries (Kenya, Nigeria, Egypt, Tunisia, Morocco and South Africa) by identifying the relationship between stock returns and the rate of inflation there. The study reached to circulating Fisher's theory in Kenya, Nigeria and Tunisia that there is a positive relationship between inflation and the stocks return there, therefore, the stock is considered an appropriate haven to hedge against inflation on the long term.

The relationship between inflation and stock returns in the other countries was an inverse one with no statistically significance.

The Variables

The study included four independent variables and one dependent variable. It identified the independent variables with interest rate, inflation, share liquidity rate and workers' remittances. While dependent variable was the stock returns in the ASE.

The Dependent Variable

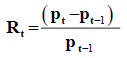

Earnings per share during the year. The annual stock return will be measured by using the following equation:

Where R: Earnings per share in the year, pt: the share price in the current year, pt-1: the share price in the previous year

The Independent Variables

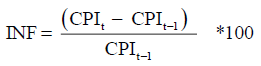

The annual inflation rate: The inflation rate is measured using the following equation:

INF: inflation rate, CPIt: consumer prices index of the current year, CPIt-1: the index of consumer prices of the previous year.

The share liquidity in the banking sector: It is the ability to convert some assets into cash within a short period and without a loss, while the liquidity of the securities means the sale of the securities, easily and quickly, at the price prevailing in the market at the lowest cost and at a fair price. The liquidity was measured using the turnover ratio, which will be obtained from the financial reports of the ASE. The stock turnover ratio will measure the demand for that stock in the market, represented by the following equation: The stock turnover ratio = number of stocks traded / number of stocks subscribed * 100% The turnover ratio was adopted as a measure of share liquidity as reported in previous studies of Narayan et al. [8].

Workers' remittances: It is the process of transferring money by foreign worker to his homeland. They play a significant and growing role in the economies of countries and economic growth. They were obtained from the statistical bulletins of the Central Bank.

Rate of interest prices on deposits: The interest price is the amount of return or the rate obtained by the owner of capital in exchange for depositing a certain amount of money in the bank.

Models and statistical methods used

The relationship between stock returns in ASE and some key economic variables was tested, through applying the (Vector Autoregressive) model to test each off the (Variance Decomposition), and the (Impulse Response Function) test. The stability of data integration and the Co-integration test VAR.

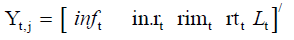

There are no (Exogenous Variables) in the VAR model, and all variables were dealt with as (Endogenous Variables). The study variables were linked in the form of a simplified model, free from complications in (VAR) model (Vector Auto-regression) as follows:

inf: inflation rate

in.r: interest rates on deposit

rim: workers' remittances

rt: earnings per share

L: turnover ratio as a measure of the share liquidity.

The Unit Root Test

Since variables are mostly non-stationary and because the OLS approach gives spurious results which requires testing that the variables are stationary or not, which measured through testing the stability of mean and variance through a period of time (no trend exists). In addition, the value of covariance between any two closed values depends only on the lag period. In this field, both of Dickey and Fuller improved a test for the above mentioned conditions. In order to analyze the deterministic trends, we used modified versions of the likelihood ratio tests suggested by Dickey and Fuller [9]. Variables are being judged by comparing the tabulated value with the calculated value. If the first is greater than the second (in absolute value), this refers to the non-stationary of the variable. Table 1 shows ADF calculated and tabulated values as follows:

| Variables | The Level | First difference | ||||

|---|---|---|---|---|---|---|

| ADF calculated value |

ADF tabulated value |

Result | ADF calculated value |

ADF tabulated value |

Result | |

| Inf | -3.1 | -3.6 | non stationary | -4.2 | -3.6 | stationary |

| in.r | -2.0 | -3.6 | non stationary | -3.6 | -3.6 | stationary |

| Rim | 0.6 | -3.6 | non stationary | -3.5 | -3.6 | stationary |

| Rt | -2.4 | -3.6 | non stationary | -5.4 | -3.6 | stationary |

| L | -1.0 | -3.6 | non stationary | -5.4 | -3.6 | stationary |

Table 1: Results of the Augmented Dickey- Fuller test of the stability (ADF).

By extrapolating the table numbers, it is clear that all the variables are considered I (1), which means stationary of first degree (after taking the first difference), while they are non-stationary in their levels.

Co-integration Test

If the data are stationary at the same level I (1), then it would be possible to the linear combination of the variables to be stationary at the zero level I (0) which means that the data are co-integrated (Table 2). It is also possible to have more than one linear combination, and so more than co-integration relationship between the variables exists.

| No. of CE(s) | Eigen-value | Trace Statistic | Critical Value 0.05 | Prob.** |

|---|---|---|---|---|

| None* | 0.9 | 103.3 | 69.8 | 0.0000 |

| At most 1* | 0.6 | 54.5 | 47.9 | 0.0103 |

| At most 2* | 0.5 | 34.5 | 29.8 | 0.0135 |

| At most 3* | 0.4 | 17.5 | 15.5 | 0.0245 |

| At most 4* | 0.3 | 6.6 | 3.8 | 0.0100 |

Table 2: Co-integration.

The co-integration test points out to the existence of four complementary relationships between variables, therefore, the variables are integrated and there is no reason to use the error correction model.

The Lag-Length Selection Test

The first step in multivariate co-integration analysis is the appropriate lag selection for the variables [10]. For selection of appropriate lag length, the study used two criteria Akaike Information Criteria (AIC) and Schwarz Bayesian Criteria (SBC) (Table 3). The criteria AIC shows the optimal lag is 3 and SBC selected lag length of 3.

| Number of periods | SBC | AIC |

|---|---|---|

| 0 | 19.47 | 19.71 |

| 1 | -14.19 | -12.77 |

| 2 | -29.77 | -27.15 |

| 3 | -37.04 | -33.23 |

Table 3: Testing the number of periods of time deceleration.

Causality Test

Granger causality test is considered as one of the common tests used to determine the direction of the causality between inflation and interest rates, and workers' remittances and liquidity on stock returns in ASE [11]. It is either a Unidirectional from the stock returns in ASE to the interest rates or the opposite from interest rates to stock returns in ASE. Or it can be reciprocal, which means that both variables affect each other, or they do not have a causality relationship between them.

While applying this test, the results were described as in Table 4. Results of the Causality test have showed the existence of a reciprocal causal relationship between inflation and interest rates, and workers' remittances and liquidity on stock returns in ASE.

| Causality direction | (F) calculated | Probability | Causality Result |

|---|---|---|---|

| INFF does not Granger Cause RT | 39.2 | 0.0000 | Causing |

| RTF does not Granger Cause INF | 16.1 | 0.0000 | Causing |

| INRF does not Granger Cause RT | 184.7 | 0.0000 | Causing |

| RTF does not Granger Cause INR | 16.4 | 0.0000 | Causing |

| LF does not Granger Cause RT | 151.3 | 0.0000 | Causing |

| RTF does not Granger Cause L | 13.5 | 0.0001 | Causing |

| RIMF does not Granger Cause RT | 61.8 | 0.0000 | Causing |

| RTF does not Granger Cause RIMF | 38.6 | 0.0000 | Causing |

| INRF does not Granger Cause INF | 17.7 | 0.0000 | Causing |

| INFF does not Granger Cause INR | 3.0 | 0.0712 | Not causing |

| LF does not Granger Cause INF | 8.2 | 0.0020 | Causing |

| INFF does not Granger Cause L | 94.3 | 0.0000 | Causing |

| RIMF does not Granger Cause INF | 22.4 | 0.0000 | Causing |

| INFF does not Granger Cause RIMF | 13.0 | 0.0002 | Causing |

| LF does not Granger Cause INR | 11.0 | 0.0004 | Causing |

| INRF does not Granger Cause L | 39.1 | 0.0000 | Causing |

| RIMF does not Granger Cause INR | 29.8 | 0.0000 | Causing |

| INRF does not Granger Cause RIMF | 2.4 | 0.1099 | Not Causing |

| RIMF does not Granger Cause L | 81.1 | 0.0000 | Causing |

| LF does not Granger Cause RIMF | 8.8 | 0.0014 | Causing |

Table 4: Results of the Causality test.

Analysis of Variance Decomposition

The Variance Decomposition was used to identify the amount of variance in the prediction that refers to the prediction error of the variable itself and the amount that refers to the prediction error in other variables [12]. The significance of this test is that it gives a relative importance of the impact of any sudden change in each variable of the study model variables on all the other variables. After applying the test, the results were as follow:

The results in this Table 5 show that, when analyzing the Variance Decomposition of stock returns in ASE, there is:

| Period | D(RIM) | D(L) | D(INR) | D(INF) | D(RT) |

|---|---|---|---|---|---|

| 1 | 0.00 | 0.00 | 39.01 | 12.51 | 48.48 |

| 2 | 0.69 | 1.87 | 39.16 | 10.09 | 48.19 |

| 3 | 4.55 | 3.82 | 35.66 | 8.22 | 47.76 |

| 4 | 15.05 | 3.86 | 30.33 | 6.55 | 44.22 |

| 5 | 29.01 | 3.26 | 23.87 | 10.05 | 33.81 |

| 6 | 34.40 | 4.65 | 19.11 | 18.21 | 23.63 |

| 7 | 33.68 | 6.44 | 16.90 | 23.00 | 19.98 |

| 8 | 32.55 | 7.46 | 15.95 | 23.09 | 20.95 |

| 9 | 31.88 | 7.93 | 15.34 | 20.52 | 24.34 |

| 10 | 31.38 | 8.27 | 14.58 | 17.42 | 28.36 |

Table 5: Analysis of Variance Decomposition of stock returns in ASE.

• Around (48.48%) of prediction error in its variance during the first period, due to the variable itself, reaches about (28.36%) in the tenth period.

• Around (39.01%) of the prediction error in its variance in the first period, due to the interest rate on deposits that reaches about (14.58%) in the tenth period. This means that the interest rates on deposits directly affect stock returns in ASE.

When banks raise interest rates, investors move to increase their investments in deposits in exchange for investing in stocks. And this result is consistent with previous studies and theoretical framework.

• Around (12.51%) of the error in its variance during the first period, due to the rate of inflation to reach about (17.42%) in the tenth period. And this means that the stock returns in ASE are moderately affected by the rate of inflation, because inflation rates impact the real return of stocks investment.

• Around (0.00%) of the error in its variance during the first period, due to workers 'remittances to reach about (31.38%) in the tenth period. This result indicates that workers' remittances affect, on the long-term, stock returns in the ASE, through its impact on the overall demand and, thereby, increase economic growth and stocks return.

• Around (0.00%) of the error in its variance during the first period, due to the turnover ratio as a measure of share liquidity to reach about (8.27%) in the tenth period. This result points out to the limited impact of the turnover ratio on stock returns in the ASE.

The former two variables in the VAR model were rearranged according to the distribution of (Cholaski Decomposition) to indicate the credibility of the results of Variance analysis [13]. Identical conclusions to these results were obtained, which fully supports the degree of confidence in the results of analyzing the Variance Decomposition.

Impulse Response Function

Impulse Response Function works on tracking timelines for various sudden shocks which the variables face in the VAR model, and it reflects how these variables response to these shocks by time. It helps clarify the variable response to a random shock of a one standard deviation in the same variable or in another variable of the model variables.

While applying this test to determine the effect of the economic variables on the index of stock prices, the results were as follow:

Response of stock returns in ASE to the inflation rate

Figure 1 shows an impulse response function of stock returns in ASE to a random shock of a one standard deviation of the inflation rate. Any sudden change in the inflation rate of a one standard deviation does positively and directly affect stock returns in ASE [14]. This effect continues to about four years, on the short-term and then starts dwindling. This reflects that the higher the prices are, the more the amount of money earmarked for spending is, which leads to increase prices. This is also consistent with the results of analyzing the Variance Decomposition in term of the explanatory power of inflation rate in explaining the stock returns in ASE.

Response of Stock returns in ASE to interest rate on deposits

Figure 2 shows the impulse response function of stock returns in ASE to a random shock of a one standard deviation in the interest rate on deposit. The Figure 2 shows that any sudden change in the interest rate on deposits of a one standard deviation affect, in a direct and negative way, on stock returns in ASE. And this means that individuals will move towards depositing their money in banks rather than investing them stocks, which will decrease their prices. And this is also consistent with the results of analyzing the Variance Decomposition in term of the explanatory power of interest rates on deposit in the explaining stock returns in ASE.

Response of stock returns in ASE to workers' remittances

Figure 3 shows the impulse response function of stock returns in ASE to a random shock of a one standard deviation in workers 'remittances. The Figure 3 shows that any sudden change in workers' remittances of one standard deviation affects positively and indirectly, on the long-term, on stock returns in ASE, through increasing the overall demand due to the rise of the remittances volume, reflecting a boost in the economic growth and thereby increase the demand for investment in stocks and thereby raise their price.

And this is also consistent with the results of analyzing the Variance Decomposition in term of the explanatory power of workers' remittances in explaining stock returns in ASE.

Response of stock returns in ASE to turnover ratio as a measure of share liquidity

Figure 4 shows the impulse response function of stock returns in ASE to a random shock of a one standard deviation in turnover ratio as a measure of share liquidity. The Figure 4 shows that any sudden change in turnover ratio as a measure of stock liquidity of a one standard deviation has a positive and limited impact on stock returns in ASE. This impact continues for about three years and then starts dwindling.

And this is also consistent with the results of analyzing the Variance Decomposition in term of the explanatory power of workers' remittances in the explaining stock returns in ASE.

Summary of the Results of Testing Hypotheses

The first hypothesis indicated that there an important and statistically significant relationship between inflation rate and stock returns in the ASE. The results of the study support this hypothesis and prove that there is a direct and positive link between them but the link is medium and lasts for a limited period, then it starts dwindling according to the results of causality test and the impulse response function.

The results were directly supportive for the second hypothesis which states that there is an important and statistically significant relationship between interest rates and stock returns.

The results showed that there is a mutual, causal relationship between them and explained that there is a direct and negative impact of the change in interest rates on stock returns.

While the results of the third hypothesis, which assumes that there is an important, statistically significant relationship between the share liquidity measured by the turnover ratio and stock returns, showed that there is a mutual, causal and positive relationship between them but with a limited impact that lasts for three years and then starts dwindling.

The fourth and final hypothesis stated that there is an important statistically significant relationship between workers 'remittances and stock returns in the ASE.

And the results confirmed the existence of this positive and indirect relationship, on the long term [15]. Any increase in workers' remittances will affect the overall demand and work on increasing the economic growth and thereby increase stock returns.

Results of the co-integration test to determine the nature of the relationship have showed that there is a first-degree integration between the variables of the study . Results of the (ADF) test showed stability of these variables by comparing the calculated value with the tabulated (in absolute value).

The relationship between the four variables (inflation, interest rate, share liquidity and workers' remittances), and stock returns in the ASE is a reciprocal and casual one, not unilateral.

The stock returns in ASE are positively affected by the average of inflation rates, due to the fact that the investor does not pay attention to that variable when investing in the financial market.

Workers' remittances affect, on the long-term, stock returns in ASE through their impact on the overall demand and increase the economic growth and thereby increase stock returns.

There was a limited effect of the share turnover ratio on the stock returns in the ASE due to the fact that the investor does not have an interest in this variable while investing in the financial market.

There is a positive and direct impact of inflation rate on stock returns in ASE. Any sudden change in the inflation rate would lead to a rise in stock returns in ASE and this impact lasts for four years and then begins to decrease.

There is a negative impact of interest rates on stock returns in ASE. Any sudden change in the interest rate will negatively and directly affect stock returns.

There is a positive, indirect impact of workers' remittances on stock returns in ASE. Any change in its which will positively affect the stock returns, but on the long term.

There is a positive, but limited, impact of the share turnover ratio on the stock returns in ASE. This impact continues for three years and then begins to decrease.

Copyright © 2026 Research and Reviews, All Rights Reserved