ISSN: 1204-5357

ISSN: 1204-5357

First Author's Name: Sven Christian Berger

First Author's Title/Affiliation: Research Assistant, E-Finance Lab Frankfurt, University of Frankfurt, Germany

Postal Address: E-Finance Lab Frankfurt, c/o University of Frankfurt, Mertonstr. 17, 60054 Frankfurt, Germany

Author's Personal/Organizational Website: www.efinancelab.com

Email: sven.berger(at)efinancelab.com (please use to correspond with the authors)

Brief Biographic Description: Sven Christian Berger works as a research assistant at the Chair of Electronic Commerce at University of Frankfurt in the project E-Finance Lab. His research area is retail banking and the implementation of value-based customer management systems.

Second Author's Name: Sonja Gensler

Second Author's Title/Affiliation: Assistant Professor, E-Finance Lab Frankfurt, Goethe University, Germany

Postal Address: E-Finance Lab Frankfurt, c/o University of Frankfurt, Mertonstr. 17, 60054 Frankfurt, Germany

Author's Personal/Organizational Website: www.efinancelab.com

Email: sgensler (at) wiwi.uni-frankfurt.de

Brief Biographic Description: Sonja Gensler works as a vice director of the cluster “Customer Management in the Financial Industry” of the E-Finance Lab and as Assistant Professor at University of Frankfurt. Her research interests are in the areas of customer management, value-based marketing, marketing research, and marketing performance measurement.

Visit for more related articles at Journal of Internet Banking and Commerce

Online banking is wide spread among German banking customers. But what really characterizes those customers? Using data from a nation-wide survey of about 20.000 retail banking customers, the authors analyze the profile of online banking customers and their banking behavior.

Electronic Banking, Online Banking, Retail Banking, Internet Usage

The introduction of online banking was one of the major actions taken to cut costs in the retail banking industry within the last twenty years and the trend to migrate customers is still un-broken (Dianne, Ray, Steven, & Knight, 2002).

Whereas technical challenges and solutions have been the topic of many authors in existing literature, research now focuses on the profitability of customers using the different channels for sales and transactions (e. g. Böhm & Gensler, 2006; Gensler, Böhm, Leeflang, & Skiera, 2006). But a sound knowledge of costs and profitability of the channels is not enough for success in retail banking. The development of a customer-centric strategy, taking all relevant information into account, is urgently necessary. Naturally, a sound understanding of the customer is part of it.

In the following, we investigate differences between online banking and offline banking customers with respect to demographics, attitudes and financial product use.

The study

The survey is based on 19.119 interviews with German-speaking banking customers from the age of 14 belonging to private households in Germany. Addresses were selected at random to create a representative sample. The survey was organized by Burda Community Network and carried out by market research companies IFAK, Marplan, MMA and TNS Infratest in 2006 (Burda Community Network GmbH, 2006).

Demographics

Not surprisingly, online banking customers seem to be distinct from the banking customer not using any online facilities. Online banking customers tend to be younger, with an average age of 40 years compared to 51 years. Moreover, online banking customers are better trained than offline customers. Degrees of secondary education are most common with 82% of the offline banking customers. 60% of online banking customers have a secondary degree and 37% have a degree comparable to A-levels, whereas only 13% of the offline customers have a degree comparable to A-levels.

Reflecting the level of education, the occupational status show a shift to white collar jobs with less craftsmen (12% compared to 18%), but a rather comparable share of students (20% compared to 18%). This results in a higher net personal income among online banking customers (10% have an income of above EUR 3.000 compared to 2%). Online banking customers therefore seem to be more affluent.

Although there is a tendency for living in bigger cities with more than 500.000 inhabitants (17% of online banking customers compared to 13%), there is not a clear indication for those customers being more urbanized in general.

Online banking use is a clear indicator for higher telecommunication usage, since 53% of all online banking customers are using a flat-rate Internet tariff. This might indicate that online banking customers are used to the Internet and appreciate the convenience of this channel.

Product interest and use

It is not only the economic situation but also the intrinsic interest that results in a slightly higher interest in banking products (3.1 instead of 2.5 on a scale from 1 [very low interest] to 6 [very high interest]).

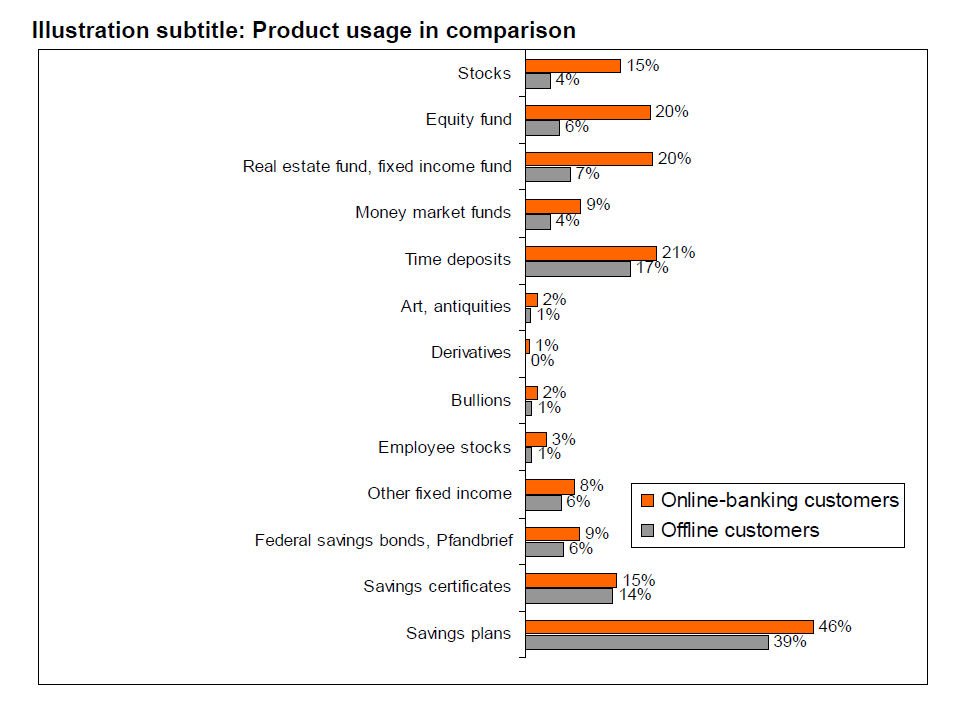

Especially riskier products like mutual funds or stocks are of greater interest for online banking customers: they score an average of 2.6 versus 1.8 (on a scale from 1 [very low interest] to 6 [very high interest]) for the population. Consequently, this is reflected in product use, since 32% of the online banking customers hold mutual funds, compared to only 11 %. It is nearly the same picture for stocks: 15% of the online banking customers hold them in their securities account, but not even 4% of the offline banking customers.

This comes along with the interest in s and derived banking productsretirementarrangement with a score of 3.2 for the online banking customers versus a score of 2.5 for the offline customers (on a scale from 1 [very low interest] to 6 [very high interest]).

Online banking customers are using payment products to a higher extent, among others due to the fact that credit cards are still one of the most common methods of payment on the Internet. Therefore, 68% of the online banking customers have a credit card in contrast to only 29% of the offline customers.

Risk aversion

Online banking customers are more willing to accept certain risks in exchange for higher interest rates (2.8 compared to 2.1 for the offline users (on a scale from 1-6). This is supported on the one hand by their willingness to raise a credit with an average score of 3.4 for online banking customers versus 2.7 on a scale from 1-6 for offline customers. On the other hand, online banking customers feel to a higher extent that contracting as much insurances as possible will increase their personal risk coverage. This characteristic has a positive effect on the sales potential – for the quantity of products saleable as well as for the complexity grade of saleable products.

But in contrast to the presumption that online banking customers are well-informed, independently-deciding risk-takers, they express a strong interest in personal consultancy from a bank officer, might it be via telephone or in a traditional brick-and-mortar branch.

Direct banking affinity

All major retail banks offer an online channel for transaction processing as well as product sales to a certain extent. Still, the most advanced channels are often provided by direct banks, but by far not all direct banking customers are also online banking customers. A lot still prefer traditional telephone banking or ATMs and service terminals.

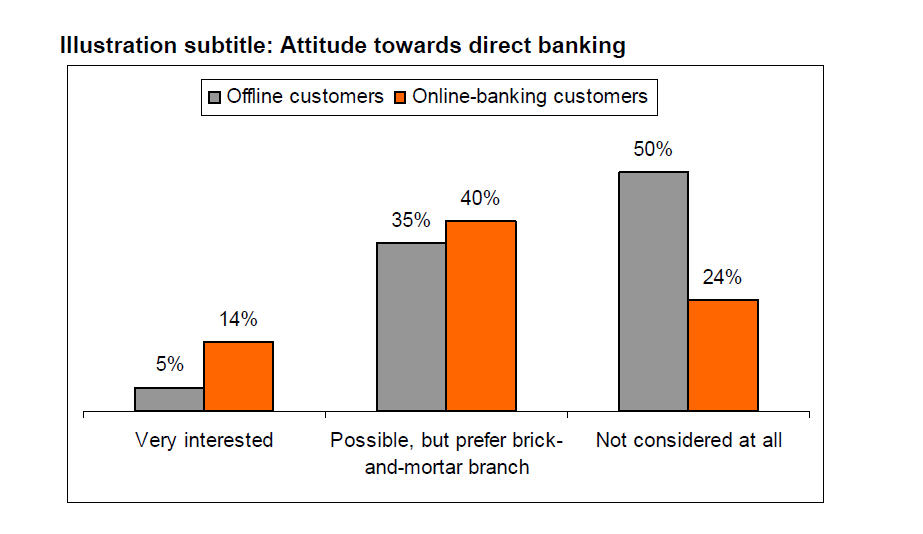

Of those, who are using online banking, 14% show a strong interest in direct banks, compared to only 5% of the offline customers. 50% of the offline customers do not take direct banks into their considerations, whereas only 24% of the online banking customers are totally reluctant.

Bank use

Not surprisingly, direct banks are more popular within online banking customers, but also the larger private retail banks have significantly higher market shares within the online banking segment. For the cooperative banks there is not a significant difference between online- and offline banking customers, but especially savings banks (with the largest market share of 57% for checking accounts with offline customers) show a much lower market share of only 47% for online banking customers. This might be caused by a less online-affine customer base or the savings banks failing to migrate their customers to the online channel successfully.

For a retail bank, online banking customers are of high interest – their economic situation is well above the average, they have a higher interest in and a higher demand for banking products and they are interested in more complex and even riskier products. Most of them are using the online channel regularly and for some of them there is no need for regular personal contacts with the bank’s sales personnel. Banks are challenged to identify those customers and make sure that they are paid attention to and their full sales potential will be tapped.

In some cases, this may result in a structural change of a business model, focussing the marketing activities clearly on online sales channels. This requires a further in-depth analysis of the customer base and the profitability of existing customer segments, to allow the strengthening of the online customer segment without major negative effects. The means of this analysis would incorporate an analysis especially of retention, share-of-wallet and cross-selling behavior of the specific customer base. A structural change of the business model can boost business and profits significantly, but is also linked to several risks as it could be experienced with some online banks on the European retail banking market in the past.

But even within the existing business model, a stronger focus on online banking customers, maybe as a part of a multi channel strategy, can result in major improvements. Especially the savings banks, mainly relying on a vast branch network, have a significant lower market share within online banking customers. For them, it is necessary to identify, whether this is a result from self-selection effects, from insufficient marketing or inadequacy of their online banking facilities which might result in a poaching of their customers by direct banks with a more advanced online channel.

Many retail banks may follow such a multi channel strategy, but at the end of the day, profitable online banking customers are among the most promising customer segments. Taking care of them and the online sales channels should be given top priority by the management.

Copyright © 2026 Research and Reviews, All Rights Reserved