ISSN: 1204-5357

ISSN: 1204-5357

Stavropol State Agrarian University, Stavropol, Russian Federation

Elena Viktorovna Rodina

Stavropol State Agrarian University, Stavropol, Russian Federation

Anna Fedorovna Dolgopolova

Stavropol State Agrarian University, Stavropol, Russian Federation

Igor Petrovich Shepet

Don State Technical University, Stavropol, Russian Federation

Vladimir Nikolaevich Ryabov

North Caucasian Federal University, Stavropol, Russian Federation

Visit for more related articles at Journal of Internet Banking and Commerce

The article aims at developing a methodological approach that allows obtaining relevant information about the potential investment recipient of the agro-industrial complex in terms of its territory and objecting. The urgency of this area of research is explained by the circumstance that unstable nature of production in agriculture and instability of indicators of its dynamics require identifying reasons of the instability of its indicators, as well as revealing the most important factors and conditions that restrict the tempos of economic growth in the agrarian sector of the Russian Federation. This situation had the greatest effect on the investment activity of sub-sectors of the agro-industrial complex. It does not allow getting on the path of technological modernization of the agrarian sector, and, as a consequence, it accentuates issues related to the food safety of the country. In that context the research improves methodological approaches that allow obtaining the relevant information about the potential investment recipient of the agro-industrial complex in terms of its territory and objecting. The offered approach is based on the diagnostics of the system of indicators developed by the authors for differentiating territories according to the level of their investment development. The authors formed the linguistic characteristics and economic interpretation of the singled classification groups, as well as the next monitoring stage that allows identifying a specific economic subject for investing funds on the basis of forming investment passports of potential recipients.

Economy, Agriculture, Sectoral Monitoring, Intra-Sectoral Differentiation, Investments, Agrarian Policy, Food Safety

Transformational processes in the agrarian sector of the Russian economy had caused violations of system economic mechanisms and relations that had an impact on the results of the production activity of agricultural organizations. In the end, it pre-determined the disequilibrium of the sector and unstable nature of the economic growth. The decrease in the volumes of state support along with worsening of the investment attractiveness of the area affected the social position of the agrarian-focused territories where agricultural producers were system forming.

Evolutionary processes in the agriculture of the Russian Federation that worked their way from the planned to the market economy came with the transformation of the ownership relations, violation of systems related to fair reallocation of resources and benefits, and deficit nature of efficient approaches in the system of sectoral management to stimulate economic growth under changing conditions, ignoring the international experience, and other institutional transformations. Finally it has caused the reallocation of investment resources in favor of the tertiary sector of economy that is characterized by a high level of turnover and independence on the impact ofuncontrolled risks (natural and climate conditions, seasonality, etc.).

The current situation along with the crisis processes in economy complicate the process of production and technological modernization in agriculture that is required to solve the issue related to food safety and import replacement. At the same time the activation of processes related to state support of agriculture within implementing top-priority national projects and state programs had a positive impact on functioning of agricultural producers and stimulated the creation of efficient organizational and economic mechanisms of the investment development of the agro-industrial complex for the future innovational renovation of the production and technological potential of this sector of economy.

Today the key task of reforming the sector and accelerating the tempos of the agro-industrial complex development is the increase in the volumes of real investments within the state and private partnership that can involve the current natural and resourceful potential of rural territories and other territorial advantages.

General Provisions of the Methodological Approach

In order to make the research, the informational and empiric block was formed as an informational base by using data of the Federal Service of State Statistics in regions of the Russian Federation. A great amount of data and calculation information was accumulated and processed by using modern methods and tools of information processing. A system of authors’ indicators on estimating the investment activity of the agro-industrial complex was developed as a specific methodological tool. The offered approach is based on the diagnostics of the system of indicators developed by the authors for the purpose of differentiating territories according to the level of the investment development. The authors formed the linguistic characteristics and economic interpretation of the singled classification groups, as well as the stage of the further monitoring. The latter allows identifying a specific economic subject for investing funds on the basis of forming investment passports of potential recipients.

Factors of the Inertial Development of the Agro-industrial Complex

The modern stage of the development of the agrarian economy in subjects of the Russian Federation is characterized by considerable institutional transformations of the doctrinal and ideological nature. Herewith, the increase in the investment attractiveness, growth of the role of the guarantee-based mechanisms aspiration for the maximum reclamation of the natural and resourceful potential, including due to attracting additional investments, stimulate bodies of the agro-industrial complex management to develop the mechanism for the state regulation of investment processes. These conditions objectively require developing components of this mechanism that are adequate to the challenges of the modern economic reality. On the sub-federal level, to an increasing degree, authoritative institutes need to develop efficient mechanisms thatcontribute to attracting investments to the agro-industrial sector. Under the conditions of nationwide implementation of large-scale program-targeted measures on stimulating the development of the agro-industrial complex and markets of agricultural products, this will worthily continue the nationwide initiatives on the regional and municipal levels.

The analysis of retrospective researches (Erokhin et al. [1]; Lapina et al. [2]; Yarkova et al. [3]; Trukhachev et al. [4]; Bobryshev et al. [5]; Taranova et al. [6]; Gerasimov et al. [7]; Sklyarov et al. [8]; Bobryshev et al. [9]) allowed to define basic factors of the inertial development of the agro-industrial complex and its low efficiency. It pre-determines the stimulation of processes related to applying mechanisms of state regulation of the agro-industrial complex focused on the formation of the organizational and functional scheme to eliminate negative opportunistic phenomena and processes that restrain economic growth of this sector of economy. We singled out the following factors:

• Decrease in the efficiency of processes related to the interaction of economic agents in the agrarian sector on the background of acute fluctuations of the market environment in the context of the financial crisis

• Worsening of the technological infrastructure of agricultural goods producers that complicates the transfer from the traditional to modern character by applying innovational mechanisms of the agro-industrial complex functioning

• Low spatial focus of the labor power [10] along with insufficient density of the economic space as a whole. It increases transactional expenses, as well as restrains distributing the effect of the internal competition and cooperation in the agrarian sector. It causes the limitation of the probability of natural and evolutionary development and distribution of new technologies [11-16].

• Insufficient investment activity along with the fragmentary nature of institutional transformations in the agrarian sector of economy.

These factors complicate economic and social transformation that produces the fundamental reorganization of the social structure of the society. They also make it impossible to increase the efficiency of labor in agriculture by limiting the potential of the balanced development of the majority of regional territories when the economic efficiency contributes to achieving social justice in the society.

As a whole, the investment development of the agro-industrial complex along with the clearly restraining factors has a number of internal and external pre-requisites for leveling negative effects. It is possible to single out the following internal pre-requisites for the investment development of the agrarian sector:

• Implementation of the concept related to providing food safety of the state and import replacement policy,

• Historically formed specialization and differentiation of labor and productive relations in agriculture, and

• Inversion of the social organization of rural communities as a result of the market reforming of economy.

The external factors that contribute to the increase in the investment activity of the agrarian sector may include the following:

• High social importance of the agrarian sector for a great number of regions of the Russian Federation where the share of the employed population remains rather high

• Natural and resourceful potential that has scientific and operational experience,

• Focus of the population on conducting a rural lifestyle as well as historical prerequisites to changing channels of the social and labor mobility without sacrificing mono-specialization of rural territories [17].

We will note that the modern system of the program-targeted management in agriculture requires a comprehensive pre-project monitoring [18] and methodological approaches in the area of diagnostics of basic territorial peculiarities of the agroindustrial complex development, revealing structural disproportions, and zones of the deficit nature of the resourceful potential for the purpose of forming the subjective area of state management.

Methodology of Selecting Investment Recipient on the Meso- and Micro-levels of Agrarian Economic Systems

During the research the authors formed the methodology of monitoring investment processes in the agro-industrial complex based on the system of authors’ indicators. According to the offered methodological approach at the initial stage the territorial level of the investment activity in the agrarian sector of economy is estimated. The use of the system of indicators formed by the authors promotes opportunities and increases the reasonability of the estimation of the level of the agrarian sector investment development both on the level of the regional social and economic system, and municipal level. This mechanism may also act as an additional way of diagnosing the reasonability of scales and areas of the state support in the system of the sectoral management within implementing the unified investment policy in relation to the agroindustrial complex. The formed system of indicators includes:

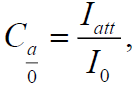

1. Coefficient of attracting/outflow of investments in the agro-industrial complex (Ca/o):

Where Iatt is the amount of investmentsattracted to the regional agro-industrial complex in the year of i, mln. RUB,

Iois the amount of the outflow of investments from the agro-industrial complex of other regions in the year of i, mln. RUB.

This indicator characterizes the investment equity of the region. This information contributes to taking decisions related to the level of the investment attractiveness of the territory, as well as potential investments in the real sector.

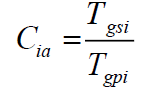

2. Coefficient of the investment advance (Cia):

Where Tgsi is the basic tempo of the growth of state investments in the agro-industrial complex of the region, %.

Tgpi – is the basic tempo of the growth of private investments in the agro-industrial complex of the region, %.

The value of this coefficient says about the level of advance of state investments as compared to private investments (Cia>1), or vice versa (Cia<1).

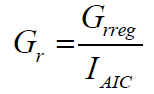

3. Gross receipts of the regional agro-industrial complex as per an investments unit (Gr):

Where GrregIAIC is the amount of investments in the agro-industrial complex in the year of i, mln. RUB. is the gross receipts according to the regional agro-industrial complex in the year of i, mln. RUB,

The gross receipts of the regional agro-industrial complex as per an investments unit show the share of investment resources in the aggregate value of the gross receipts of the regional agro-industrial complex.

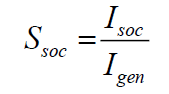

4. Share of investing in objects of the social area of the agro-industrial complex (Ssoc):

Where IsocThis indicator allows to identify the value of investments directed to the social area for the purpose of improving the local population’s life. is the amount of investments directed for developing the social area of the agro-industrial complex in the year of i, mln. RUB.

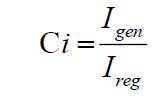

5. Coefficient of investments in the agro-industrial complex (Ci):

where IregThe value of this coefficient shows the share of investments made in the projects in the agro-industrial complex in the total value of funds invested in the economy of the region. This indicator is an index of the investment activity of the sector. is the total volume of investments in the economy of the region in the year of i, mln. RUB.

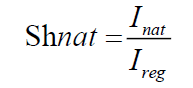

6. Share of investing in the area of the nature protecting area of the agro-industrial complex (Shnat):

Where Inat is an amount of investments in the area of nature protecting area of the agro-industrial complex in the year of i, mln. RUB.

It shows the level of the investment activity in the area of taking nature protecting and ecological measures in the agro-industrial complex of the region.

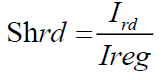

7. Share of financing research and development works in the agro-industrial complex (Shrd):

where Ird is an amount of investments directed for financing research and development works in the agro-industrial complex in the year of i, mln. RUB.

This coefficient shows the investment activity in the area of innovational and development activity in the agro-industrial complex of the region.

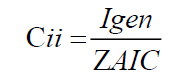

8. Coefficient of the investment impact on the formation of the aggregate expenses (Cii) shows to what degree the expenses of the agricultural goods producer are covered by the investment resources:

Where ZAIC is the aggregate expenses for the agricultural production in the year of i, mln. RUB.

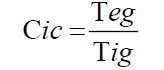

9. Ratio of expenses related to creating the favorable investment climate as to the total amount of the investments attracted to the agro-industrial complex (Cic) shows the level of the economic efficiency of investments:

where Teg is the tempo of growth of expenses on forming the favorable investment climate in the agro-industrial complex in the year of i, mln. RUB,

Tig is the tempo of growth of investments raised for the agro-industrial complex in the year of i, mln. RUB.

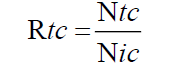

10. Ratio of the terminated investment contracts (Rtc) is a comparative indicator that specifies the efficiency of the contract execution:

Where Ntc is a number of the terminated investment contracts, units, Nic is a number of the concluded investment contracts, units.

The developed scheme of indicators is a rather efficient tool to diagnose the level of the investment development of the agro-industrial complex in terms of the region and territory.

Singling out Typological Groups of Territories According to the Level of Investment Development of the Agro-industrial Complex

The next stage of analytical actions is the development of the methodology to make comprehensive rating estimation of separate regions by using the method of summing positions. The authors modified this approach by including the criteria indicator of the investment development. According to the results of the estimation, the region with theleast amount of points uses the investment potential the most fully and rationally. In these regions the investment activity to the greatest degree contributes to increasing the efficiency of functioning of the sector and the whole regional social and economic system. The offered approach also allows to more comprehensively estimating the level of the differentiation in the area of the investment activity of regions.

Within the estimation all regions were prior ranged according to the value of parameters included in the above system of indicators in order to comprehensively characterize the modeled multidimensional phenomenon. The highest positions were given to the territories with the maximum value of indicators. After calculating the value of the sum of the positions according to all indicators, the rank of the territory was determined according to the level of the investment activity and the level of these processes efficiency in the development of the agro-industrial complex of the region. Then the threshold values were defined for ranging regions according to 3 classification groups. Table 1 shows their linguistic characteristics.

Table 1: Classification Groups of Territories According to the Level of Investment Development of Agro-industrial Complex.

| Group | Linguistic characteristics of the typological group |

|---|---|

| I Developed | Regionsof this classification group are characterized by the most favorable investmentconditions that contribute to the efficient agrarian production and technicaland technological modernization of the innovational basis. The investments obtainedby the agrarian sector of these regions contribute to achieving the emergent effectin the development of both the sector itself and the majority of sub-sectors andrelevant types of the economic activity. Objective natural and resourceful competitiveadvantages contribute to maintaining the positive balance of investment resources.The investments raised for the sector stimulate economic, social, infrastructural,and innovational growth. The raised resources cover the greatest part of agriculturalorganizations expenses. It is possible to observe a high ratio of private investmentsin the aggregate value of funds directed for reproduction processes in the agro-industrialcomplex. The share of social investments as well as investments in the ecologicalarea and nature protecting activity is rather high. The system of sectoral managementis focused on implementing the strategy of the innovational development of theagro-industrial complex. Indicators of financing researches say about it. |

| II Medium developed | Territoriesfrom this classification group are characterized by an average level of the investmentactivity. Herewith, their investment balance is ranged as neutral. The greatestpart of investments directed to the agrarian sector of economy is state, due toinsufficient attractiveness of the territory for the private capital. Investmentsmade in the sector almost do not contribute to increasing its development stability.Insufficiently high share of investments in objects of the social area strengthenthe processes of stratification of urban and rural population according to thelevel and quality of life. Financing of scientific researches and developmentworks has a deficit nature. |

| III Depressive | Territoriesfrom this classification group are characterized by an insufficient level of theinvestment activity. As a rule, they have the negative balance of investment resourcesrelated to the excess of the amount of the outflow of the investment capital fromthe region over its inflow. It happens due to the inertial behavior of regionalauthorities in the area of creating their own territorial investment projects,insufficient natural and resourceful attractiveness of the territory, non-optimalgeographical location, etc. The level of interrelation of the real sector withthe “holders” of investment resources is insufficient and is characterized bymutual antagonism in the area of executing investment agreements. It determinesdepressive nature of the territory development. Except very rare exceptions, privatecapital does not participate in social and ecological development of territories,and the agrarian sector functions exceptionally in the dotation mode. The experienceof implementing investment projects gives evidence about their insufficient efficiency.It is possible to observe facts of terminating investment contracts. |

Results of the Typological Grouping

As a result of implementing the offered complex of analytical procedures, the territories under research were classified according to three typological groups (Table 2). We will note that the methodological approach we used is rather universal and can be applied to reveal the level of the spatial differentiation in the development of territories according to specific parameters. The classification of territories to these typological groups will allow developing measures related to the differentiated support of the agro-industrial complex in the future. As a whole, it will increase the efficiency of spending budgetary funds in the system of sectoral management.

Table 2: Allocation of Regions of the Russian Federation According to Typological Groups of the Investment Development of the Agro-industrial Complex.

| Typological group. Interval values | Territories Republics |

|---|---|

| I Developed (42-168) | Krasnoyarsk Krai; the Irkutsk Region;Krasnodar Region; Amur Region; Leningrad Region; the Republic of Kalmykia; Komi Republic; Stavropol Region; Novosibirsk Region; Belgorod Region; Kemerovo Region; Tomsk Region; Jewish Autonomous Region; Voronezh Region; the Republic of Adygea; Volgograd Region; PrimorskyKrai; the Republic of Khakassia |

| II Medium developed(169-294) | Saratov Region; Tambov Region; Sverdlovsk Region; the Republic of Bashkortostan; Tyumen Region; Kurgan Region; Rostov Region; Mari El Republic; Altai Republic; Ryazan Region; Chuvash Republic; Lipetsk Region; Udmurt Republic; Vladimir Region; the Republic of Mordovia; Arhangelsk Region; Altai Region; Kirov Region; Bryansk Region; the Republic of Buryatiya; Omsk Region; the Republic of Karelia; Kostroma Region; Penza Region; Astrakhan Region; Chelyabinsk Region; Moscow Region; Vologda Region; |

| III Depressive (295-420) | the Republic of Sakha (Yakutia); Transbaikal Region; Kaliningrad Region; Ulyanovsk Region; Karachay-Cherkess Republic; Orenburg Region; Yaroslavl Region; Ivanovo Region; Oryol Region; the Republic of Dagestan; Khabarovsk Region; Kursk Region; Tyva Republic; Nizhny Novgorod Region; Tula Region; the Republic of Tatarstan; Novgorod Region; Perm Region; Kabardino-Balkar Republic; Kaluga Region; Samara Region; Tver Region; the Republic of North Ossetia-Alania; Smolensk Region; Pskov Region; Chechen Republic; the Republic of Ingushetia |

Mechanism of Selecting Investment Recipient on the Micro-level

When pursuing the agrarian policy focused on the innovational vector, it is important for the sectoral management system to have efficient mechanisms of selecting the investment recipient on the micro-level of agrarian economic systems. In this context we propose to use the investment passport of the enterprise shown in Table 3.

Table 3: Example of Investment Passport of Agricultural Organization.

| Sections and indicators | 2009 | 2014 | ||

|---|---|---|---|---|

| Level of development | Partial coefficient of priority | Level of development | Partial coefficient of priority | |

| Efficiency of investment activity subjects: | ||||

| Level of using the lands, thous. RUB, | 1.69 | 1.2 | 2 | 1.2 |

| Return on fixed assets, | 1.65 | 1.3 | 2.77 | 1.3 |

| Return on capital investments | 2.9 | 1.5 | 3.7 | 1.5 |

| Production activity: | ||||

| Capital-labor ratio, RUB | 60 | 1.2 | 165 | 1.2 |

| Wear and tear of fixed assets, % | 36 | 1.0 | 29.6 | 1.0 |

| Investment activity: | ||||

| Level of investing, thous. RUB. | 9.6 | 1.0 | 17.4 | 1.5 |

| Acquisition of capital investments, % | 59 | 1.1 | 100 | 1.1 |

| Ratio of uncompleted construction included in fixed assets, % | 4.3 | 1.1 | 6 | 1.5 |

| Capital investments, % | 110 | 1.6 | 166 | 1.6 |

| Social infrastructure: | ||||

| Availability of nonproductive fixed assets, thous. RUB | 5.7 | 1.2 | 3.2 | 0.9 |

| Capital investments, thous. RUB | 0.8 | 0.6 | 1.2 | 0.9 |

| Ratio of nonproductive assets included in fixed assets, % | 5.6 | 1.1 | 0.3 | 0.7 |

Such approach will contribute to making an objective analysis by providing objects of investment activity with passports, and taking efficient tactical and strategic decisions on the basis of the relevant information that was formed, including by rating regions according to the level of their investment attractiveness.

The data specified in the investment passport allows defining factorial and result indicators that display the efficiency of the investment activity. Finally, it allows to calculate partial coefficients of priority according to every type activity as a correlation of the actual value to normative or average regional. These coefficients show the level of the completeness of any standard, increase in its actual values over normative, and say about the oversupply of the object, for example, with resources. Low value of the index shows the problematic zone in economy and restrains further development of the economic subject. The total coefficient of priority gives a comprehensive estimation of the investment attractiveness of agricultural enterprises. It is defined as a sum of partial coefficients.

Thus, at this stage we have developed a two-staged methodological approach to the comprehensive analysis and estimation of the potential investment recipient. It includes the stage of identifying the level of the investment activity of subjects of the agro-industrial complex in terms of territories by using authors’ indicators, as well as the stage of developing investment passports of recipients of investment resources. As a whole, it enables the investor to select the object for investing.

General Results of Discussing in the Scientific-and-Expert Community

The obtained results of the research were critically correlated to the opinion of the scientific-and-expert community within research and practical conferences and discussions. The analysis of the results of the conducted research compared to the existing empiric data [19-21], allowed to confirm a number of hypothetic suppositions. In this context we will note that in the process of overcoming the consequences of the world economic crisis there is a necessity to search for ways to increase the investment activity of the agrarian sector of economy. Technical and technological modernization of the sector and consequently the improvement of the country food safety are impossible without such activity.

According to the scientific community, it is indisputable that there is a need in improving the methodological basis of activating investment processes in the agro-industrial complex. In this context the development of the relevant tools based on the authors’ system of indicators is acknowledged as urgent and timely [22]. This system reflects all aspects of implementing investment processes in the sector of economy under research. The results of applying this methodological approach are considerable for stipulating the reasonability to allocate investment resources.

Recommendations According to the Discussion Results

In the process of discussing the results obtained in this research with the specialists in the area of improving state support of the agro-industrial complex, the vector of further researches in this area was formed. It lies in the stipulation of recommendations of the organizational and economic, and institutional nature on improving the municipal system of supporting the investment activity in the agro-industrial complex, including changes on allocating authoritative powers of the local government bodies, establishment of specialized departments of the investment development of the agro-industrial complex on the level of municipal regions, and creation of the municipal fund of the target capital to stimulate investors’ initiatives [23]. It subordinates sub-federal and municipal economic activity on regulating the investment activity of the agro-industrial complex to the general vector. The researches in the area of developing a conceptual model of the regional target program related to developing the investment activity of subjects of the agro-industrial complex are also promising. This program is based on using the package of motivational measures on activating investment activity and a system of economic sanctions for violating conditions of investment agreements. It will contribute to the increase in the disciplinary order of implementing investment agreements between subjects of the agro-industrial complex.

Generalizing the results of the conducted research, we have got new methodological knowledge about the procedures of monitoring the territorial level of the investment activity in the agro-industrial complex. Unlike the existing approaches, this provision is based on the diagnostics of the system of the most relevant indicators in relation to the issues related to differentiating territories according to the level of the investment development. This diagnostics was synthesized during the research. In addition, the authors formed the linguistic characteristics and economic interpretation of singled classification groups, as well as the further monitoring stage. In its turn, it allows to identify the specific economic subject for investing funds on the basis of forming investment passports of potential recipients. The authors came to the understanding that when correcting provisions of the agrarian policy, it was necessary to take into account factors of the inertial development of the agro-industrial complex that had a negative impact on the development of agrarian-focused territories. The offered methodological approaches and practical recommendations can be applied in the activity of regional ministries of Agriculture and Ministries of Economic Development for developing the conceptual basis of strategies and target programs of the agro-industrialcomplex development and activating investment processes in its subjects. The research is practically important because the methodological approach offered by the authors can make up a basis for developing the relevant information for making appropriate management decisions in the area of activating the investment activity of subjects of the agro-industrial complex of the region or municipal formation.

The conducted research, its tasks that were stipulated according to the urgency and solved allow to make a number of conclusions that fill out the scientific and methodological gaps in the conceptual basis of the investment policy in the agrarian sector and define the perspectives of future researches.

1. The approaches to state regulation of the comprehensive development of the agro-industrial complex developed in the national practice are characterized by the contrariety in terms of a number of parameters. Herewith, to a great degree the efficiency of the development of the agro-industrial complex is defined by the efficiency of the state regulation system segmented according to the levels of administrative and territorial structure with the further formation of complexes of management decisions.

2. Evolutionary aspects of the state regulation of the agro-industrial complex point at the necessity to move from the principles and methods used in the system of the sectoral management to applying methodological approaches that allow to level factors of the inertial development of the agrarians sector. These are system repressors of the genesis processes. In this context it is necessary to make relevant corrections of basic areas of the regional investment policy in the agro-industrial complex.

3. The research determined that the modern national science and practice lacked monitoring approaches in the system of the sectoral management. It does not allow to apply adaptive and selective approach when allocating funds from budgets of all levels within the comprehensive and target programs for the agrarian sector development. The problem of actualizing the processes related to attracting investments in the agriculture stipulates the necessity to add the current methods and methodologies of estimating the investment attractiveness of both agrarian-focused territories and separate investment recipients. Taking into account this fact, the research improved the methodological approaches that allowed to obtain relevant information about the potential investment recipient of the agro-industrial complex in terms of its territory and object.

Copyright © 2026 Research and Reviews, All Rights Reserved