ISSN: 1204-5357

ISSN: 1204-5357

USAMA YAQOOB

The University of Lahore, Lahore, Pakistan

UMAIR KHALID

The University of Lahore, Lahore, Pakistan

Visit for more related articles at Journal of Internet Banking and Commerce

Liquidity risk Management is fundamental to sound banking practice. No doubt today all banking institutions face countless risks such as liquidity risk which can cause failure of a banking system. Therefore, a proper risk management technique is necessary for the existence and the growth of banks. Therefore, the purpose of this study is to examine the effectiveness of risk management practice that is liquidity risk their impact on performance or Profitability of Islamic and conventional banks. Liquidity risk is measured by loan to deposit ratio, cash to total asset ratio. Performance measure proxies were ROE and ROA for both Islamic and Conventional banks. Data are panel from 2011-2015 which is taken from the financial reports of Islamic and conventional banks. Regression analysis has been used to extract the results. The result of this study concluded that how this liquidity risk will affect the bank performance in conventional and Islamic banks.

ROA; ROE; Liquidity; Cash to Total Asset Ratio; Loan to Deposit Ratio; Islamic Banking; Conventional Banking; Pakistan; Malaysia; Indonesia

“It is monetary institutions which deals with the money of consumers as a deposit and then use their idle money (deposits) into lending activities, directly or through investment markets. It is mostly working as center man among those who have surplus capital and those who have shortage of such capital" [1].

According to Bank Companies Ordinance 1962:

“Banking is an activity which involves the deposit from the community and which can be repayable on their requirement of the function of lending. People can withdraw their money by cheques, drafts order or else means”.

From the above definition, we establish that bank is an economic institute, which is developed to fulfill the different purposes like depositing, lending, diminishing and to carry out the investment activities.

The financial condition of any country someway wholly or exclusively depends on the soundness and truth of the banking system [2]. The meaning of banking sector in any country is just like that with no “bank”, a financial system might stop. As we make out, the being of any human is not feasible without the heart, likewise without a bank any country’s development can’t be feasible [3]. The methods of banking business have been changed extremely as compared to the methods in the past [4].

Backdrop Review of Commercial and Islamic Banks

Bank is one of the most significant parts of any country. The banking business is very fundamental for financial growth of any society. Financial sector’s strength plays very critical role in a strong financial system. Developed economic systems of any country ensure to attain growth. The most important rule of the bank is to accommodate deposits for the principle of lending and savings. At this time, banking region provides lots of services which are very important for our everyday life. The banking region is important in the circumstance of inspiring people to save, provide threat free income for depositors, generate employment and manage financial welfare. It is essential to note that these services are very significant for our everyday life. For the reason of such significance and confidence, banks work as an intermediary between depositors and borrowers.

Pakistan Banking System

It is apparent that any nation in this world can be known by its socioeconomic culture, religion, norms and values. All these factors together differentiate the constancy and expansion of a country’s future. To locate out either the country enjoys the extent of success, one must verify the act of an economy either it is sound or not? Macroeconomic variables based on different resources like human resource, information resource, physical and financial resource to help build a constructive economic reliability and banks considered to be the major component for the management of all financial resources around the world. On 14 August 1947, a new country emerges on the map of the world which is known as Islamic Republic of Pakistan. With the enterprise of Pakistan, the banking sector also started its operations and performed its functions. There are just about 13 Islamic banks and 15 Commercial banks in Pakistan. Pakistan’s banking industry' has extremely improved its performance mainly after 1970’s and shows major transition during sixty eight years of its history. The study shows the brief history of progress and progressive success of the banking industry of Pakistan.

Malaysian Banking System

The third largest economy in South East Asia and ranked 28th economy in the world in 2007 was Malaysia. Its real GDP grew by 6.5% per year since 2003. Nowadays the GDP of Malaysia is equivalent to 0.45% of the world’s economy. Economy of Malaysia is one of the fastest growing and developing economy in the world (Global news and insight for corporate financial professionals).

The source of banking in Malaysia started from 1884 when Merchantile bank (HSBC) opened its office in Malaysia. Central bank of Malaysia i.e., Bank Negara Malaysia was established in 1957. Under Bank Negara Malaysia they started the dual banking system: Islamic and Conventional banking system. The first Islamic bank was recognized in Malaysia in 1983, named as Bank Islam Malaysia Berhad (BIMB). A national navigation committee was recognized by the government of Malaysia to appraise the features of introducing Islamic banking in Malaysia. As an effect of working on this committee, bank Islam Berhad was established under the Islamic banking act 1983 [5]. Malaysia after Bahrain is the second biggest Islamic banking. In 2013, there are 27 Commercial banks, including 8 domestic and 19 foreign and 18 Islamic owned banks.

Indonesian Banking System

Bank Negara Indonesia had approximately 115 Commercial banks, 1,630 rural banks and 18 Islamic banks. The largest four banks grasp over 45 percent of bank assets. As ranked by assets, the subsequent are the four largest state-owned banks: Bank Mandiri, Bank Rakyat Indonesia, Bank Negara Indonesia, and BNT. The Bank Indonesia (BI), the central bank of Indonesia and an independent state organization, and the Financial Services Authority (“Otoritas Jasa Keuangan” or OJK) regulate key aspects of the banking and economic system, including bank instruction and management.

The Islamic banking encouraged Indonesia to develop and seeks to raise its share of total banking assets to more than five percent. Islamic banking institutions in Indonesia comprised 3.74 percent of total banking system assets in February 2017. The Deposit Insurance Corp (LPS) guarantees bank deposits up to IDR 2 billion (about US$150,000). Only these financial records carrying interest rates equal to or below LPS maximum guaranteed reference rates are deemed suitable for LPS deposit guarantees. Those rates are 7.0 percent on rupiah deposits and 0.75 percent of foreign currency deposits.

The Indonesian Export Financing Agency (LPEI), which operates under the name of Indonesia Ex-Im Bank, provides spirited export financing and suggested other exports related services.

The agency’s purpose is to help and support access to international markets for Indonesia’s export-related produce, support Indonesia’s worldwide trade, and recover Indonesian exporter competitiveness in worldwide markets.

Subsequently, its initiation on January 9, 2004, the API has met with a spacious range of suggestions and constructive criticisms for the best combination of the API programs with programs of the national economy. International developments in banking also need different changes to be made to the API programs so that in a moment the national banking industry will be capable of holding the worldwide competition with the support of experienced human resources, sufficient information skill, and appropriate supporting transportation.

Objectives of the Study

Based on the theoretical literature, there follow hypothesis are formulated alternative form

• There is a significant impact of liquidity risk management on the performance of overall Islamic banks.

• There is a significant impact of liquidity risk management on the performance of overall Commercial banks.

• There is a significant impact of liquidity risk management on the performance of Islamic banks of Pakistan.

• There is a significant impact of the liquidity risk management on the performance of Commercial banks of Pakistan.

• There is a significant impact of liquidity risk management on the performance of Islamic banks of Malaysia.

• There is a significant impact of liquidity risk management on the performance of Commercial banks of Malaysia.

• There is a significant impact of liquidity risk management on the performance of Islamic banks of Indonesia.

• There is a significant impact of liquidity risk management on the performance of Commercial banks of Indonesia.

Sanwari and Zakaria conducted a study to assess the Islamic bank's performance in relation to the effect of both internal conditions and the external factors on Islamic bank's performance [5]. Financial data of 74 Islamic banks were used by authors; data collection was from 2000 to 2009. Multivariate regression analysis has been applied. Their findings reveal that the performance of these banks depend more on bank-specific distinctiveness such as capital, asset quality, and liquidity, while macroeconomic factors do not significantly influence Islamic banks’ profit.

Misra and Apa conducted a study to assess the financial position and performance of the state bank group using camel model [6]. The data collection period is from 2008 to 2012, where the authors have used financial data of 6 Commercial banks. It has been applied for Multivariate regression analysis. The consequences suggest that different banks obtained different ranks with respect to camel ratios. Their study also depicted that ranking of ratios is different for the different banks in-state group. But there is no statistically significant difference between banks the camel ratios. It signifies that overall performance of state group is same.

Ramzan et al. build up a study to review the factors affecting liquidity risk management. The data collected is from 2007-2011 where the authors used financial data of 5 Islamic banks. Permanent cause, OLS analysis has been applied. The analysis exposed statistically positive relationship of asset base or size of the bank and with liquidity risk in the predictable hypothetical model, whereas the rest of the net operating capital depicts statistically irrelevant relationship with liquidity risk [7].

sFerrouhi build up a study to assess the performance of major Islamic banks of Morocco. In Morocco, the author used financial data of the six Islamic banks, where the data collected was from 2001 to 2011. It was applied Pooled Ordinary Least Square (POLS). His findings were based on the standard ranking of each ratio, showed that the liquidity of Islamic banks in Morocco is better than others [8].

Tuna tried to calculate the monetary health of two banks in Indonesia in the duration of 2008-2012, using fie judgment aspects of the camel model (Capital, Asset, Management, Earnings, and Liquidity). The t-Test has been used to assess the difference between the two banks. Between these two banks, the consequences of research carried had no significant differences about bank’s soundness [9].

Ahmed et al. builds up a study to review the Islamic banks of Pakistan: a proportional study between Conventional and Islamic banks. The data collection is from 1994- 2009 where the authors have used financial data from 17 Islamic banks. It has been applied to Correlation and OLS analysis. The consequences suggest that total assets (size) are negatively related to liquidity. ROA positively correlates with liquidity. The provision of liquidity by the Islamic banking plays an important role in inflation and past inflation variables (CP). The gross domestic product is extensively directly comparative. In both models CAR negatively relates to liquidity [10].

Sample and Data Collection

For this study, the sample data of Malaysia and Indonesia consists of 5 Islamic banks and 5 conventional banks in Pakistan. The explanation of the time frame is all available data of 2011 to 2015. The type of sample which I used is convenes sampling.

Data for each year have been compiled from the financial statements of the two sets of banks. The data for all banks in the sample was compiled from a Bank scope database, with a few individual banks' data compiled from the annual reports from their respective websites. The collated secondary data derived from the bank's financial statements and were transformed into percentages and ratios, so that comparison can be made between the different types of banks.

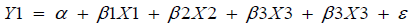

Research Model

Y =Dependent variable

α =intercept of the line

β =Regression coefficient

X =Independent variable

ε =Error term

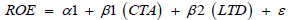

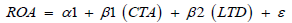

Model Specification

The following regression models will be used to test for the determinants of performance

Where;

α = Intercept

CTA = Cash to Total Asset Ratio

LTD = Loan to Deposit Ratio

α = Error Term

Liquidity risk is the independent variable of this study. Explanation of dependencies and independent variables along with their proxies are specified in table, and the list of Islamic and Commercial banks that are considered for this study are specified in table. Descriptive, correlations and regression analysis are applied to study and evaluate the effects of independent variables on the dependent variable. Eviews is used in investigating, measuring and comparing the liquidity risk for commercial and Islamic banks according to their diverse individuality.

Dependent Variables=Return on Equity, Return on Assets

Independent Variables=Cash to Total Asset Ratio, Cash to deposit Ratio

Schematic Diagram

Liquidity risk Management and its impact of performance of the banks a comparative study between Islamic and commercial banks of Pakistan Malaysia and Indonesia. The researcher checks the correlation of dependent and independent variables. In this researcher Loan to deposit ratio and cash to total asset ratio is independent variable and the dependent variable is Return on Asset (ROA), Return on equity (ROE) (Figure 1).

Hypothesis

The researcher alternate hypothesis estimates a positive impact of liquidity risk management on the performance of overall Islamic banks.

There are H1 and H2 are arranged in the following manner:

H1: ROA is positively correlated with the impact of liquidity risk management on the performance of overall Islamic banks.

H2: ROE is positively correlated with the impact of liquidity risk management on the performance of overall Islamic banks.

α =5%

Decision Criteria=Reject H0, if P value is less than α . Or “Accept” H0, if P value is greater than α

Descriptive Study

Descriptive statistics are brief descriptive coefficients that summarize a given data set, which can be either a representation of the entire population or a sample of it. Descriptive statistics are broken down into measures of central tendency and measures of variability, or spread. Measures of central tendency include the mean, median and mode, while measures of variability include the minimum and maximum variables, and the kurtosis and Skewness.

The descriptive analyses are conducted on all variables. There are two profitability indicators (ROA and ROE) and independent variables have positive mean values ranging from 0.78 to 11. On the additional, standard deviation measures the dispersion figures. The higher standard deviation value is (8.322). In contrast, the lower standard deviation is 0.22. ROA and cash to total asset ratio are negatively twisted. On the additional loan to deposit ratio and ROE are positively skewed. The probability values of all variables also show significant results. Because its values are less than 5%, which shows normality in the data (Table 1).

Table 1: Descriptive statistic overall commercial banks.

| ROA | ROE | Loan_to_deposit_ratio | Cash_to_total_asset_rati | |

|---|---|---|---|---|

| Mean | 0.780000 | 8.840000 | 11.10197 | 6.626876 |

| Median | 0.800000 | 8.700000 | 9.817533 | 7.350359 |

| Maximum | 1.000000 | 16.00000 | 26.67705 | 7.608189 |

| Minimum | 0.400000 | 3.900000 | 2.524676 | 5.349231 |

| Std. Dev. | 0.224210 | 4.256283 | 8.322266 | 1.042960 |

| Skewness | -0.617031 | 0.551314 | 1.074040 | -0.389072 |

| Kurtosis | 2.079344 | 2.107802 | 2.774950 | 1.178077 |

| Jarque-Bera | 7.407863 | 6.286895 | 14.57780 | 12.26535 |

| Probability | 0.024627 | 0.043134 | 0.000683 | 0.002171 |

| Observations | 75 | 75 | 75 | 75 |

The descriptive analyses are conducted on all variables. There are two profitability indicators (ROA and ROE) and independent variables have positive mean values ranging from 0.71 to 16. On the additional, standard deviation measures the dispersal figures. The higher standard deviation value is (4.84). In distinction, the lower standard deviation is 0.02. ROA and cash to total asset ratio are negatively skewed. On the other hand, loan to deposit ratio and ROE are positively skewed. The probability values of all variables also show significant results. Because its values are less than 5%, which shows customariness in the data (Table 2).

Table 2: Descriptive statistic Overall Islamic Banks.

| ROA | ROE | Loan_to_deposit_ratio | Cash_to_total_asset_rati | |

|---|---|---|---|---|

| Mean | 0.706000 | 1.054000 | 3.935757 | 16.20390 |

| Median | 0.720000 | 1.040000 | 1.738343 | 14.80218 |

| Maximum | 0.730000 | 1.090000 | 12.50744 | 25.40216 |

| Minimum | 0.680000 | 1.020000 | 0.000000 | 11.73174 |

| Std. Dev. | 0.021686 | 0.026712 | 4.754609 | 4.842785 |

| Skewness | -0.316963 | 0.208146 | 0.950446 | 1.183896 |

| Kurtosis | 1.228597 | 1.432464 | 2.374481 | 2.855081 |

| Jarque-Bera | 11.06166 | 8.220212 | 12.51458 | 17.58576 |

| Probability | 0.003963 | 0.016406 | 0.001916 | 0.000152 |

| Sum | 52.95000 | 79.05000 | 295.1818 | 1215.293 |

| Sum Sq. Dev. | 0.034800 | 0.052800 | 1672.867 | 1735.490 |

| Observations | 75 | 75 | 75 | 75 |

Regression Analysis and interpretation

The regression analysis is a domain form to estimate the risk management in the banking sector. This risk management is done in both Islamic and conventional banking. When variables are stationary, then pool regression is applied to data after that run the random effect model and fixed effect model. After running both the models Hausman test is applied, which gives the suggestion for which model is best to be applied to the fixed model or random mode.

Hausman null hypothesis representing that a random model is appropriate and alternative hypothesis fixed effect is appropriate. If the null hypothesis is rejected then fixed effect model can be applied, but if Hausman suggests that the random effect model is applied and then Lagrange test is applied to justify either the random effect model is better or pool is better. After that OLS assumption test is run to check the multicollinearity and there is no issue of multicollinearity in the data. Heteroscedasticity which is null hypothesis is constant variance and the alternative is no constant variance.

The models specified in the study were estimated using Ordinary Least Squares (OLS) multiple regression. The regression analysis was carried out by e-views version 9 statistical software. The panel data were obtained from the financial statements of the banks. The first result is that of return on equity as the dependent variable, while the second one is that of return on asset.

Overall Islamic Banks Pakistan, Malaysia and Indonesia

After applying the Hausman test the above mention table shows the result. The probability value is greater than 5%. It means we cannot reject the alternative hypothesis and accept the null hypothesis that is a random effect model is appropriate for our research.

The estimated regression result presented in Tables 3a and 3b is satisfactory in terms of the algebraic signs of the coefficients as they conform to our a priori theoretical expectation. Specifically the predictable equation shows that loan to deposit ratio and cash to total asset ratio are increasing functions of return on equity.

Table 3a: ROE.

| Test Summary | Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. | |

|---|---|---|---|---|

| Cross-section random | 0.000000 | 2 | 1.0000 | |

| Cross-section test variance is invalid. Hausman statistic set to zero. | ||||

| WARNING: estimated cross-section random effects variance is zero. | ||||

| Cross-section random effects test comparisons: | ||||

| Variable | Fixed | Random | Var(Diff.) | Prob. |

| Loan_to_deposit_ratio | 0.000291 | 0.000291 | 0.000000 | 1.0000 |

| Cash_to_total_asset_rati | 0.003708 | 0.003708 | 0.000000 | 1.0000 |

Table 3b: ROE.

| Variable | Coefficient | Std. Error | t-Statistic | Prob. | |

|---|---|---|---|---|---|

| C | 0.992778 | 0.012466 | 79.63999 | 0.0000 | |

| Loan_to_deposit_ratio | 0.000291 | 0.000662 | 0.439508 | 0.6257 | |

| Cash_to_total_asset_rati | 0.003708 | 0.000650 | 5.704728 | 0.0000 | |

| Effects Specification | |||||

| Cross-section fixed (dummy variables) | |||||

| R-squared | 0.415088 | Mean dependent var | 1.054000 | ||

| Adjusted R-squared | 0.254709 | S.D. dependent var | 0.026700 | ||

| F-statistic | 2.588170 | Durbin-Watson stat | 2.482086 | ||

| Prob(F-statistic) | 0.003364 | ||||

On the other hand, a percentage increases in loans to deposit ratio and cash to total asset ratio. It would affect the return on equity positively 0.000291 percent and 0.003708 percent respectively.

sThere is a positive significant relationship between Loan to Deposit Ratio and profitability indicator ROE in other words, as Loan to Deposit Ratio increases the Bank profitability also Increases. Vice versa on the other hand Cash to total Asset ratio shows insignificant on profitability indicator ROE.

The arithmetical characteristics of the equation are quite strong. This is because the prob (t-static) of the coefficient estimates are less than 0.05 which by inference from statistical decision theory is indicative of statistical significance.

The R2, coefficient of determination of 0.415088 is moderate. It indicates a moderate goodness of fit of the estimated regression line. This means that if we plot the actual data to the estimated regression line moderate of the data will cluster around it. In addition, the R2 shows that 41.51 percent of the total variation in returns on equity is explained by the joint influence of independent variables. The balance 59.49 percent is explained by other variables not captured by the model which is why the stochastic error term was specified in the econometric model.

The overall regression result is statistically significant at the 5 percent level. This assertion is based on the F-statistic with a value of 2.588170 and probability (F=statistic) which is less than 0.05 and thus is statistically significant in line with statistical decision theory.

The Durbin-Watson statistic of 2.4821 thus, the t- statistic, R2 and F- statistic are statistically reliable and the entire regression result is acceptable. According to Mule et al. the DW statistic values in the range of 1.5 to 2.5 are relatively normal. Further, Field suggests that values under 1 or more than 3 are a definite cause for concern.

The consequence also showed the Loan to Deposit Ratio and has an insignificant relationship with probability indicator ROE because the probability value in greater than 5% which can be interpreted as the acceptance of the null hypothesis. On the other hand, Cash to Total Asset Ratio has a positive relationship with ROE because its probability value is less than 5%, which can be interpreted as the rejection of the null hypothesis.

After applying the Hausman test the over mention table shows the result. The probability value is greater than 5%. It means we cannot reject the alternative hypothesis and accept the null hypothesis that is a random effect model is appropriate for our research.

The estimated regression result presented in Tables 4a and 4b is satisfactory in terms of the algebraic signs of the coefficients as they conform to our a priori theoretical expectation. Specifically the estimated equation shows that loan to deposit ratio is decreasing function of return on asset. The estimated equation shows that cash to total asset ratio is increasing function of return on asset.

Table 4a: ROA.

| Test Summary | Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. | |

|---|---|---|---|---|

| Cross-section random | 0.000000 | 2 | 1.0000 | |

| WARNING: estimated cross-section random effects variance is zero. | ||||

| Cross-section random effects test comparisons: | ||||

| Variable | Fixed | Random | Var(Diff.) | Prob. |

| Loan_to_deposit_ratio | -0.003514 | -0.003514 | 0.000000 | 1.0000 |

| Cash_to_total_asset_rati | 0.000510 | 0.000510 | 0.000000 | 1.0000 |

Table 4b: ROA.

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 0.711561 | 0.007174 | 99.18025 | 0.0000 |

| Loan_to_deposit_ratio | -0.003514 | 0.000381 | -9.224012 | 0.0000 |

| Cash_to_total_asset_rati | 0.000510 | 0.000374 | 1.364453 | 0.0325 |

| Effects Specification | ||||

| Cross-section fixed (dummy variables) | ||||

| R-squared | 0.706048 | Mean dependent var | 0.706000 | |

| Adjusted R-squared | 0.625448 | S.D. dependent var | 0.021677 | |

| F-statistic | 8.759913 | Durbin-Watson stat | 2.492849 | |

| Prob(F-statistic) | 0.000000 | |||

Conversely, a percentage decrease in loans to deposit ratio would affect return on asset negatively 0.003514 percent and increase cash to total asset ratio would affect return on asset positively 0.000510.

The statistical characteristics of the equation are quite strong. All the coefficient estimates are statistically significant at the 5 percent level. This is because the prob (t-static) of the coefficient estimates are less than 0.05 which by inference from statistical decision theory is indicative of statistical significance.

The R2, coefficient of determination, of 0.706048 is quite high. It indicates an excellent goodness of fit of the estimated regression line. This means that if we plot the actual data to the estimated regression line most of the data will cluster around it. In addition, the R2 shows that 70.60 percent of the total variation in returns on the asset is explained by the joint influence of independent variables. The balance 29.40 percent is explained by other variables not captured by the model which is why the stochastic error term was specified in the econometric model.

The general regression result is statistically significant at the 5 percent level. This assertion is based on the F-statistic with a value of 8.759913 and probability (F=statistic) which is less than 0.05 and thus is statistically significant in line with statistical decision theory.

The Durbin-Watson statistic of 2.4928 thus, the t- statistic, R2 and F- statistic is statistically reliable and the entire regression result is acceptable. According to Mule et al. the DW statistic values in the range of 1.5 to 2.5 are relatively normal. Further, Field suggests that values under 1 or more than 3 are a definite cause for concern.

The outcome also showed the Loan to Deposit Ratio and has a significant relationship with probability indicator ROA because the probability value is less than 5% which can be interpreted as the rejection of the null hypothesis. On the other hand, Cash to Total Asset Ratio has a significant relationship with ROA because its Probability value is less than 5%, which can be interpreted as the rejection of the null hypothesis.

Overall Commercial Banks Pakistan, Malaysia and Indonesia

After applying the Hausman test the above mention table shows the result. The probability value is greater than 5%. It means we cannot reject the alternative hypothesis and accept the null hypothesis that is a random effect model is appropriate for our research.

The estimated regression result presented in Tables 5a and 5b is satisfactory in terms of the algebraic signs of the coefficients as they conform to our a priori theoretical expectation. In particular the estimated equation shows that loan to deposit ratio and cash to total asset ratio are increasing functions of return on equity.

Table 5a: ROE.

| Test Summary | Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. | |

|---|---|---|---|---|

| Cross-section random | 0.000000 | 2 | 1.0000 | |

| Cross-section test variance is invalid. Hausman statistic set to zero. | ||||

| WARNING: estimated cross-section random effects variance is zero. | ||||

| Cross-section random effects test comparisons: | ||||

| Variable | Fixed | Random | Var(Diff.) | Prob. |

| Loan_to_deposit_ratio | -0.275430 | -0.275430 | 0.000000 | 1.0000 |

| Cash_to_total_asset_rati | -2.321321 | -2.321321 | 0.000000 | 1.0000 |

Table 5b: ROE.

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 27.28092 | 1.362176 | 20.02746 | 0.0000 |

| Loan_to_deposit_ratio | -0.275430 | 0.027247 | -10.10857 | 0.0000 |

| Cash_to_total_asset_rati | -2.321321 | 0.217418 | -10.67678 | 0.0000 |

| Effects Specification | ||||

| Cross-section fixed (dummy variables) | ||||

| R-squared | 0.862565 | Mean dependent var | 8.840000 | |

| Adjusted R-squared | 0.824651 | S.D. dependent var | 4.256283 | |

| F-statistic | 22.75104 | Durbin-Watson stat | 2.472124 | |

| Prob(F-statistic) | 0.000000s | |||

On the other hand, a percentage decrease in loans to deposit ratio and cash to total asset ratio would affect the return on equity negatively 0.275430 percent and 2.321321 percent, respectively.

The statistical characteristics of the equation are quite strong. All the coefficient estimates are statistically significant at the 5 percent level. This is because the prob (t-static) of the coefficient estimates are less than 0.05 which by inference from statistical decision theory is indicative of statistical significance.

The R2, coefficient of determination of 0.862565 is quite high. It indicates an excellent goodness of fit of the estimated regression line. This means that if we plot the actual data to the estimated regression line most of the data will cluster around it. In addition, the R2 shows that 86.26 percent of the total variation in returns on equity is explained by the joint influence of independent variables. The balance 13.74 percent is explained by other variables not captured by the model which is why the stochastic error term was specified in the econometric model.

The overall regression result is statistically significant at the 5 percent level. This assertion is based on the F-statistic with a value of 22.75104 and probability (F=statistic) which is less than 0.05 and thus statistically significant in line with statistical decision theory.

The Durbin-Watson statistic of 2.4721 thus, the t- statistic, R2 and F- statistic are statistically reliable and the entire regression result is acceptable. According to Mule et al. the DW statistic values in the range of 1.5 to 2.5 are relatively normal. Further, Field suggests that values under 1 or more than 3 are a definite cause for concern.

The result also showed the Loan to Deposit Ratio and has a significant relationship with probability indicator ROE because the probability value in less than 5%, which can be interpreted as the rejection of the null hypothesis. On the other hand, Cash to Total Asset Ratio has a positive relationship with ROE because its probability value is less than 5% which can be interpreted as the rejection of the null hypothesis.

After applying the hausman test the above mention table shows the result. The probability value is greater than 5%. It means we cannot reject alternative hypothesis and accept the null hypothesis that is random effect model is appropriate for our research.

The estimated regression result presented in Tables 6a and 6b is suitable in terms of the algebraic signs of the coefficients as they conform to our a priori theoretical expectation. Purposely the estimated equation shows that loan to deposit ratio are decreasing functions of return on asset. The estimated equation shows that cash to total asset ratio are increasing functions of return on asset.

Table 6a: ROA.

| Test Summary | Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. | |||

|---|---|---|---|---|---|---|

| Cross-section random | 0.000000 | 2 | 1.0000 | |||

| Cross-section test variance is invalid. Hausman statistic set to zero. | ||||||

| WARNING: estimated cross-section random effects variance is zero. | ||||||

| Cross-section random effects test comparisons: | ||||||

| Variable | Fixed | Random | Var(Diff.) | Prob. | ||

| Loan_to_deposit_ratio | -0.028448 | -0.028448 | 0.000000 | 1.0000 | ||

| Cash_to_total_asset_rati | 0.052045 | 0.052045 | 0.000000 | 1.0000 | ||

Table 6b: ROA.

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 0.750928 | 0.035792 | 20.98055 | 0.0000 |

| Loan_to_deposit_ratio | -0.028448 | 0.000716 | -39.73532 | 0.0000 |

| Cash_to_total_asset_rati | 0.052045 | 0.005713 | 9.110386 | 0.0000 |

| Effects Specification | ||||

| Cross-section fixed (dummy variables) | ||||

| R-squared | 0.965806 | Mean dependent var | 0.780000 | |

| Adjusted R-squared | 0.956374 | S.D. dependent var | 0.224210 | |

| F-statistic | 12.3889 | Durbin-Watson stat | 2.482050 | |

| Prob(F-statistic) | 0.000000 | |||

On the other hand, a percentage decrease in loans to deposit ratio would affect return on asset negatively 0.028448 percent and increase cash to total asset ratio would affect return on asset positively 0.052045.

The statistical characteristics of the equation are quite strong. All the coefficient estimates are statistically significant at the 5 percent level. This is because the prob (t-static) of the coefficient estimates are less than 0.05 which by inference from statistical decision theory is indicative of statistical significance.

The R2, coefficient of determination, of 0.965806 is quite high. It indicates an excellent goodness of fit of the estimated regression line. This means that if we plot the actual data to the estimated regression line, most of the data will cluster around it. In addition, the R2 shows that 96.58 percent of the total variation in returns on the asset is explained by the joint influence of independent variables. The balance 3.42 percent is explained by other variables not captured by the model which is why the stochastic error term was specified in the econometric model.

The overall regression result is statistically significant at the 5 percent level. This statement is based on the F-statistic with a value of 12.3889 and probability (F=statistic) which is less than 0.05 and thus is statistically significant in line with statistical decision theory.

The Durbin-Watson statistic of 2.4820 thus, the t- statistic, R2 and F- statistic is statistically reliable and the entire regression result is acceptable. According to Mule et al. (2013) the DW statistic values in the range of 1.5 to 2.5 are relatively normal. Further, Field suggests that values under 1 or more than 3 are a definite cause for concern.

The F statistics also show the significant results. The probability value of F statistics is less than 5%. The result also showed the Loan to Deposit Ratio and has a significant relationship with probability indicator ROE because the probability value is less than 5% which can be interpreted as the refusal of the null hypothesis. On the other hand, Cash to Total Asset Ratio has a positive relationship with ROE because its probability value is less than 5%, which can be interpreted as the rejection of the null hypothesis.

This chapter draws mutually the main findings of the observed results of the research study, including the implications of the findings, the limitations of the study and recommendations for future research.

As until that time stated, a country’s economic development, among numerous other factors, is based on its financial sector’s performance, particularly the financial institutions working in that country; with the banking sector being the most outstanding. Due to the banking sector's considerable role in the wellbeing and constancy of any economy, it is imperative to constantly monitor and evaluate banks' performance to guarantee that the economy's financial sector is operating competently. Accordingly, the principle of this research was to estimate the performance of banks in the Pakistan, Malaysia, and Indonesia over the period 2011-2015 using the regression model. The precise objectives of the study were; firstly to compare the performance of Islamic Vs conventional banks using; loan to deposit ratio, cash to total asset ratio and liquidity as performance determinants; secondly to test for any significant differences in the performance between Islamic banks and Commercial banks.

The conclusion of the first objective was achieved through descriptive statistics, and it was fulfilled that Islamic banks and conventional banks in a loan to deposit, cash to total asset ratio, while they are weaker in liquidity management.

Results show that the performance of Islamic banks is less profitable than Commercial banks. Financial position is determined by the financial statements of the relevant sector. The results of ratio analysis of profitability made clear that the return on asset or return on equity of Islamic banks is less than the Commercial banks. Banks are the financial sector of our economy.

Commercial banks take a huge hold in the economy it has a higher ability of managerial performance. But Islamic banks are also a well-known sector of our economy and get profit and growth day by day. This difference can also affect the behavior of depositors according to an investment decision. Every depositor likes to invest in those banks which give a high return on his investment.

Islamic country the banks of this country follow the Islamic rules and principles in banking and give knowledge to his customers or other people through some network that what is Islamic banking? And which products and functions are performed by Islamic banks as compared to Commercial banks. Commercial banks maximize the shareholder's wealth largely as compared to Islamic banks.

Commercial banks construct high return on ROA or ROE as compared to Islamic banks. We can’t neglect the Islamic banks and Commercial banks both have a big contribution to the economic development of the Pakistani economy day to day. Islamic banking attracts consumers or people to invest money and maximize profits according to Islamic law and within the limits of Islamic law. What is the return on total income is determined by the ratios. In this study find ROA or ROE of Commercial banks is higher than Islamic banks. Islamic banking grows rapidly both in size and number day to day.

The day will also come when Islamic banking is come to a large sector of our economy like Commercial banking and generate higher profits like Commercial banks. Islamic banking or Islamic products or function are the need of our economy nowadays because our economy is too much filled with interest based businesses which are prohibited in Islam.

Banks generate further cash for the economy by turning deposits into loans. Our study shows that deposits have a positive association with bank liquidity. Bonner et al. also had similar findings. On the other hand, Alger and Alger and Kashyap et al. found a negative relationship between deposits and bank liquidity. This finding implies that with an increase in deposits, banks should also increase their liquidity holding so that a bank run can be avoided in case of high deposit withdrawal [11,12].

Loan to total assets ratio Cash to deposit ratio has a positive and significant impact on the profitability (ROA, ROE) of overall commercial banks with the 5% significance level. This outcome shows that when the increase in the loans to total assets ratio cash to deposit ratio will generate the income that increases the profitability of overall commercial banks. This also found the similarity in the studies of Faisal, HusniKhrawish et al.and Syafri [13-17].

For the occasion, study works like to recommend the readers to explore the factors which affect the profitability, liquidity risk of commercial and Islamic banks. When we will know those factors, we can suggest better use of resources to enhance profitability, the liquidity of commercial and Islamic banks. If we know the factors affecting the profitability and find the better use of resources to manage those factors, we can lead small size banks to better profitability, which will lead to dividend payments and ultimately increase in shareholder’s wealth value as well.

Copyright © 2026 Research and Reviews, All Rights Reserved