ISSN: 1204-5357

ISSN: 1204-5357

Suganthi, Balachandher and Balachandran

Center for Multimedia Banking

Multimedia University, 63100 Cyberjaya, Malaysia

Phone: +603-8312 5714

Fax: +603- 8312 5590

E-mail: b.shanmugam@mmu.edu.my

Visit for more related articles at Journal of Internet Banking and Commerce

The current trend in the electronic revolution which has set in motion the Malaysian banking sector inevitably appears to be Internet banking. The advent of Internet banking offers banking firms a new frontier of opportunities and challenges. Despite these possibilities, there are various psychological and behavioral issues such as trust, security of Internet transactions, reluctance to change, and preference for human interface which appear to impede the growth of Internet banking. Consequently, the action taken by bankers and policy makers in appropriately addressing these critical issues will determine the success of Internet banking. This study, therefore, is focused in providing an understanding of the factors that affect the adoption of Internet banking in Malaysia.

The decision by the Malaysian Central Bank to consolidate the Malaysian banking sector was made in line with the impending financial liberalization and the consequent anticipated increase in actual and potential competition from foreign banks. The objective of the consolidation process is to strengthen the financial sector and to enable them to face foreign competition in the not too distant future. This has resulted in ten core banking groups, which commenced operation as merged entities as of December 2000. Prior to this merging exercise there were 23 banking groups in the country.

Now, in a world, which is becoming increasingly open as a result of the Internet and the World Wide Web (WWW), Internet banking has been gaining ground around the globe. This offers banking institutions a new frontier of opportunities and challenges further augmenting competition in the global banking market. Thus, in order to get a share of the opportunities and to face the new challenges, the Malaysian government provided the legal framework for domestic banks to offer Internet banking services as of June 1, 2000.

However, the success of this new distribution channel for banking products and services depends on the rate at which the new technology is adopted by the Malaysian consumers both retail and corporate alike. Thus, the factors that affect the adoption of Internet banking in Malaysia will certainly be of concern to both bankers and policy makers. It is for this reason that this study is undertaken.

To this extent, the next section presents a description of the current state of Internet banking in Malaysia. This is followed by a review of the factors affecting consumer adoption of new technology and innovations. The methodology of this study is discussed in the next section. The findings are then reported and the final section provides the conclusion.

The electronic revolution in the Malaysian banking sector is claimed by Pang (1995) to have started in the 1970's. However, the first visible form of electronic innovation in the Malaysian banking industry was the introduction of Automated Teller Machines (ATMs) in 1981. The ATMs to a large extent released banks from the constraints of time and geographical location. They presented banks with a more economical substitute for brick and mortar branches.

Then in the early 1990's telebanking was introduced in Malaysia, which provided yet another delivery channel for branch financial services via telecommunications devices connected to an automated system of the bank by utilising Automated Voice Response (AVR) Technology.

Advances in telecommunications and information technology then culminated in banks offering their services through personal computers located at the customer's premises through the use of Intranet proprietary software. However, it is interesting to note that PC-banking or desktop banking was mainly popular among banks' corporate customers rather than their retail customers.

Finally, on June 1, 2000, the Malaysian Central Bank gave the green light for locally owned commercial banks to offer Internet banking services. On June 15, 2000, Maybank, the largest domestic bank in terms of assets as well as network distribution which commands its own portal at www.maybank2U.com became the first bank to offer Internet banking services in Malaysia. This service is currently provided to individual customers of the bank and the site boasts of the latest 128-bit encryption technology to allay fears of security among consumers. The services provided in this portal includes banking enquiry functions, bill payment, credit card payment, funds transfer, and accounts summary as well as transaction history. Customer support service is provided via e-mails as well as via telephone lines and is available daily from 6 a.m to 12 mid-night.

Subsequently, the Hong Leong Bank commenced its Internet banking operations known as 'ec-banking' which can be accessed via their web-site at www.hlbb.hongleong.com.my in December 2000. In addition to providing services that were previously included in their Phone banking service, they also offer options of assessing account transaction history in their 'ec-banking'. They too provide support services via emails and telephones from 7 a.m to 11.00 p.m, seven days a week

Another domestic bank, which has introduced Internet banking, is the Southern Bank, which offers its Internet banking services via www.sbbdirect.com.my. They currently provide all the services, which are offered by Maybank and Hong Leong Bank. An additional feature that was available in their site is the Personal Preference Setting option for their customers. However, no indication of online support was found at this site.

The Multi-Purpose Bank is reported to have plans to launch its own Internet banking services towards the end of 2001. The bank intends to provide its Internet banking services via its MultiLink account.

Currently, the product features are being advertised in their web-site www.mphh.com.my to assess public acceptability.

A review of the Malaysian banking sites in the Internet revealed that all domestic banks, which have been accorded an anchor bank status by the central bank, have a web presence. However, apart from the four banks with transactional sites, the remaining six anchor banks are yet to commence their internet banking operations, but nevertheless display informational sites.

Thus, in summary, it can be said that based on the Deloitte model the four banks offering Internet banking services are currently at level II, that is, the prospecting level. The remaining domestic banks are clearly at Level I, which is basically having a web presence for advertising purposes.

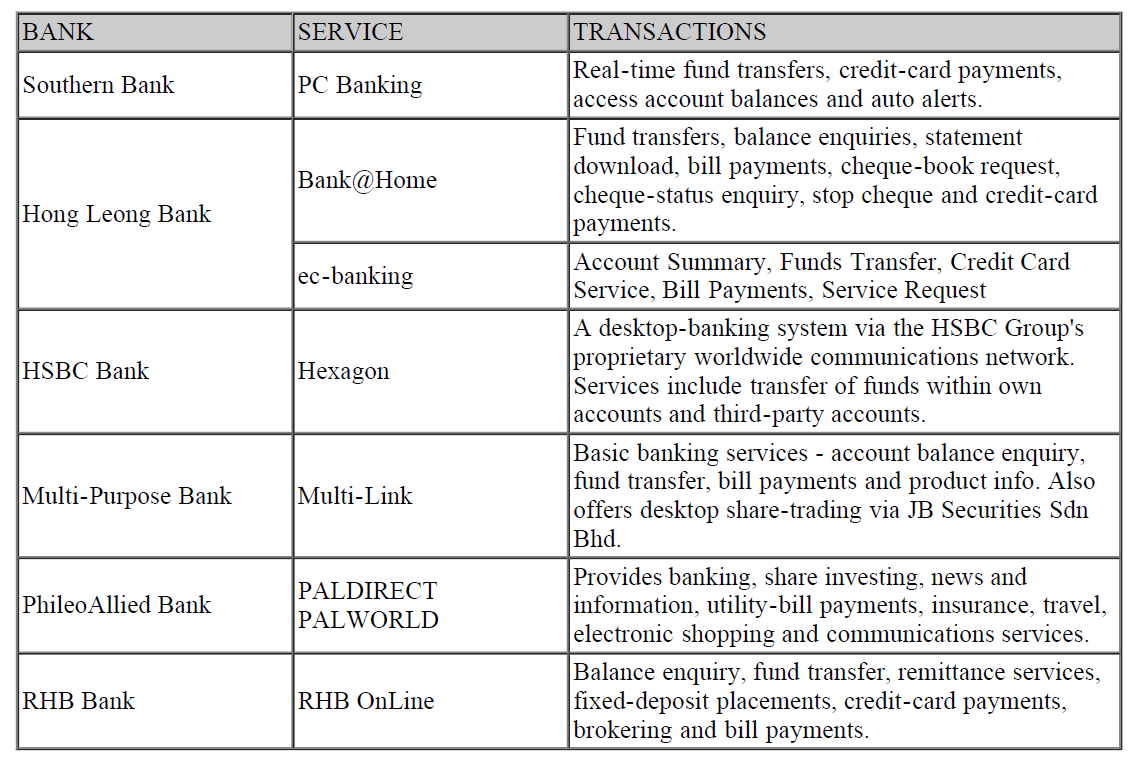

Given below is a summary table of e-banking services offered by Malaysian domestic banks.

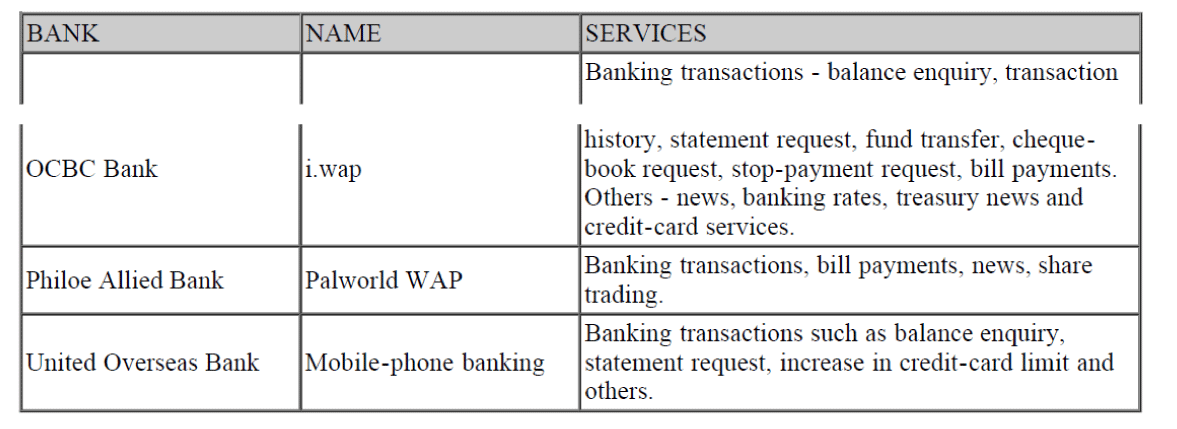

Offering even more convenience is mobile e-banking using the Wireless Application Protocol (WAP), although there are many complaints about the slow transmission of data. United Overseas Bank says that with the introduction of Global Packet Radio Services (GPRS) and 3G phones in the future, speed will no longer be an issue. The other Malaysian banks offering WAP banking are the Overseas Chinese Banking Corporation (OCBC), and Phileo Allied Bank.

The primary factor determining the level of demand for Internet banking services will be a function of the number of people connected to the Internet. This number can be extremely difficult to estimate, because of the dispersed nature of the users. Furthermore, for each Internet subscriber registration there may be more than one user. Based on a recent report in the local newspaper, the estimates of Internet subscribers until March 2000 was 1.3 million which is approximately 7 percent of the Malaysian population (The STAR, 2000).

Much has been written on the factors affecting adoption or usage of new products and services. Some of the major psychological and behavioural factors which affect the adoption of any new innovation such as Internet banking includes, consumer awareness, ease of use, security, accessibility, techno phobia or simply reluctance to change, preference for personalised services and cost of adopting the innovation.

One of the more important characteristic for adoption or acceptance of any innovative service or product is the creation of awareness among the consumers of the product or service. To this extent Rogers and Shoemaker (1971), asserted that consumers go through a series of process in knowledge, conviction, decision and confirmation before they are ready to adopt a product or service and the adoption or rejection of the innovation begins when the consumer becomes aware of the product. Howard and Moore (1982), and Guiltian and Donnelly (1983) also emphasised on importance of awareness for the adoption of any new innovation. In this sense, Malaysian banks' initial step of commencing informational sites before converting to transactional sites, is a step in the right direction.

However, awareness alone is not sufficient since consumers would reject an innovation if it was very complex and not user friendly. In this context, Cooper (1997) reported that ease of use of innovative product or service as one of the three important characteristics for adoption from the customer's perspective. The user friendliness of domain names as well as the navigation tools available in the websites is an important determinant for ease of use. The design of the web-sites with appropriate use of graphical user interface is also considered as an important determinant.

Web content and design have also been found to influence consumer satisfaction. To this extent, Doll et. al (1995), and Muylle et. al (1998) found that product information content, the amount of product information, product information format, language(s) and layout features affect customer satisfaction. Malaysian banks have been sensitive to this feature and are conveying their messages in all the major languages utilised in the country. It is also worth noting that proper navigation attributes and search facility will also certainly be helpful to consumers when they surf the Internet. In addition, the level of interactivity of the site will certainly have an effect on the consumers' perception of the user friendliness of the Internet banking site.

According to Cooper (1997) and Daniel (1999) another important factor affecting the acceptance and adoption of new innovation is the level of security or risk associated with it. Even in countries where Internet banking has long been established, one of the most important factors slowing progress of this new innovation is the consumers concern for security of financial transactions over the Internet. An empirical survey by Sathye (1999) of Australian consumers confirmed this fact.

In addition, Internet bank customers would also be curious to find out how the banks would generally deal with erroneous transactions occurring in online transactions. Will the burden of proof be on the customers or the banks would be willing to settle the issue up front and investigate the problem later. The element of trust in this context would determine the security of transacting for consumers generally and determine the acceptability rate of this alternative delivery channel in the long run. On this issue, Stewart (1999) claimed that the failure of the Internet as a retail distribution channel has been attributed to the lack of trust consumers have in the electronic channel and in the web merchants.

Another factor that would stand in the way of consumer adoption of Internet banking is the cost factor. In Internet banking, two types of costs are involved. First, the normal costs associated with Internet access fees and connection charges and secondly the bank fees and charges. Rothwell and Gardiner (1984) observed that there are two fundamental sets of factors affecting user needs, namely price factors and nonprice factors. To this extent, Guadagni and Little (1983), Gupta (1988), Mazursky et al., (1987) identified price as a major factor in brand switching. If consumers are to use new technologies, the technologies must be reasonably priced relative to alternatives. Otherwise, the acceptance of the new technology may not be viable from the standpoint of the consumer. In view of the Malaysian Government's encouragement to move towards the digital era essential costs (access and connection) have been kept at a minimum.

Reluctance to change is also another factor that affects adoption because the existing mode of service or product delivery fulfils the customer's needs adequately. In the context of Internet banking, telephone banking and brick and mortar branches are the existing alternative modes of transacting banking business. For customers to change their present ways of operating and to take up new technology, it must " fulfil a specific need". Unless such a need is fulfilled, consumers may not be prepared to change from the present ways of operating. Many ways can be introduced to overcome the reluctance to change. Provision of personalised customer service personnel to assist consumers in performing transactions via the Internet as well as providing specific value added service, which are currently not provided through traditional banking channels can also help to reduce the customers reluctance to change.

Availability of access to the Internet is a essential prerequisite for the adoption of Internet banking. The more widespread the access to computers and the Internet, the greater the possibility of use of Internet banking. O'Connell (1996) identified lack of access to computers as one of the possible reasons for the slow adoption of Internet Banking. The Malaysian government in a move to encourage consumers to embrace information technology has encouraged purchases of computers in the last two years by allowing a deduction of RM500 (US $130) from taxable incomes when computers are purchased.

Studies have also revealed that there is a significant correlation between Web-site download speed and Web user satisfaction [Hoffman and Novak, (1996); Muylle et al. 1998)]. In this context, the use of highresolution graphics and inefficient web servers has a significant negative impact. However, it must be acknowledged that download speed is also dependent on the user's computing hardware and method of connection. As Malaysian Web services are at an infancy state, this factor may not play a major role in adoption decisions.

A vast majority of bank customers would still like to opt for personal interaction when doing their bank transactions. The personal touch of officers and managers adds value to each transaction. In the Malaysian context, a personal relationship between customers and bankers transcends many boundaries especially so in the rural areas. Research by Guru et. al (1999) reported that 90 percent of the Malaysian respondents valued human tellers as very important.

Some consumers have generally been afraid of new technology. These consumers may not have the knowledge or know-how in dealing with computers specifically and thus trust human beings more than computers and machines. Their fear for computers and technology generally grows and eventually develops into a phobia for technology. Thus, technology phobia can also be a factor affecting the customers' reluctance to opt for Internet banking.

The data for this study was collected using online surveys. Two survey instruments were used one for Internet bank users, and the other for non-internet bank users. The respondents were mainly from the Klang valley, which is probably one of the most developed regions in the country. The Klang Valley is 20 kilometres south of the capital city Kuala Lumpur. Home for a population of just less than one million people it serves as a satellite town for a vast majority of the population that works in the capital city.

The data was analysed to see if there were any demographic differences between the users and non-users of Internet banking services in an effort to investigate the general belief that the younger, more educated and the more affluent of the population are more likely to adopt Internet banking.

In line with prior studies (mentioned in earlier section), all factors which were expected to affect the adoption of Internet banking were included in the study. The factors being Internet accessibility, consumer awareness, cost of adoption, security concerns, trust in one's bank, convenience and ease of use. The survey instruments were basically divided into sections covering these aspects. Each section involved several related items and multivariate factor analysis was used to isolate the factors, which tended to affect the adoption of Internet banking in Malaysia.

In addition, separate survey instruments were used to evaluate Internet bank users and non-Internet bank users. The average responses for each of the factors considered were compared for the two groups using the t-tests for two sample means. A total of 300 respondents participated in this limited survey, which was undertaken in December 2000.

It has often been argued that there are demographic differences between Internet bank users and non- Internet bank users. It is often thought that the younger generation who are generally more computer literate and have an affinity for the web are more likely to adopt Internet banking (Balachandran et al., 2000). Thus, the demographic characteristics of the internet bank users and the non-internet bank users among the sample respondents was analysed and the results are presented in Table 1.

The results in Table 1 indicates that there is no significant difference between the mean age of the two groups. Furthermore the percentage of graduates and undergraduates in the two groups are about 85 percent thus indicating that the two groups are equal in terms of literacy. The only significant difference appears to be in the average level of monthly income. The Internet bank users appear to come from the more affluent part of the society. This is not surprising since the more affluent are often the trend setters and they are also less likely to be concerned with the risk of Internet bank transactions in view of their greater financial security and resilience.

The factor analysis resulted in seven factors, which are appropriately named in line with the factors considered to affect the adoption of Internet banking and presented together with the factor loadings in Table 2.

Thus the pertinent factors which seem to affect the adoption of Internet bank can be summarised as Internet accessibility, reluctance to change, cost of computers and Internet access, trust in one's bank, security concerns, convenience and ease of use. It is however, interesting to note that awareness of Internet banking products and services did not seem to affect the adoption of Internet banking services. This may be due to the fact these respondents being Internet users are probably already quite aware of Internet banking services. Finally, the seven factors accounted for about 78% of the total variance.

The average value of the items included under each of the factors expected to affect Internet bank adoption was compared between the Internet bank user group and the non-internet bank user group. This was done by using the two-sample t-test for means and the results are presented in Table 3.

It must be noted here that in the case of accessibility, awareness and trust and security the higher the average value the greater the degree of accessibility, awareness and trust in bank and security of Internet banking transactions respectively. On the other hand, in the case of cost of computers and reluctance to change, the higher the value the more favorable the cost perception and the lesser the reluctance to change.

The findings thus seem to indicate that except for perception of cost of computers and Internet access, and trust in bank and security of Internet bank transactions, there was a significant difference between the Internet bank user group and non-internet bank user group.

In particular, the level of awareness of Internet banking was higher among the Internet bank users compared to non-users. This implies opportunities for banks to improve the adoption of Internet banking among its customers by creating greater awareness of their Internet banking products and services. In addition, Internet bank users' attitude towards change appears to be significantly more favorable compared to the non-internet bank users.

It was however, surprising to note that the accessibility to computers and the Internet was significantly higher for the non-users compared to the users. This implies that there are many potential customers who have access to the Internet but who are not using Internet banking services.

Since all the respondents were obtained via online surveys, the only significant factors, which seem to affect the adoption of Internet banking services, appear to be greater awareness and a favorable attitude towards change.

This study showed that Internet accessibility, awareness, attitude towards change, computer and Internet access costs, trust in one's bank, security concerns, ease of use and convenience are the major factors affecting the adoption of Internet bank services in Malaysia. The factors identified are in line with findings reported in previous studies mentioned earlier in the paper.

Evidence also indicates that there are greater promotional efforts on the part of banks to create greater awareness of Internet banking and its benefits is important for the success of Internet banking services patronage. The level of such promotional activities at present is not surprising considering the fact that Internet banking is only slightly over six months old in Malaysia and only four out of the ten main banking groups are currently offering this services.

The demographic differences between Internet bank users and the non-users were not very evident in this study, particularly with reference to age and educational background. This may be due to the fact that the sample respondents were basically already Internet users and thus they would have some similar characteristics. However, in view of the security concerns and the risk involved in Internet banking transactions, the more affluent members of the sample appear to have a greater inclination towards Internet banking. Furthermore the fact that 20 percent of the sample respondents had already adopted Internet banking services is encouraging and is indicative of a bright future for Internet banking in Malaysia.

Copyright © 2026 Research and Reviews, All Rights Reserved