ISSN: 1204-5357

ISSN: 1204-5357

Michael Reid, Ph.D.

Director, Finance and Research Information Systems, Loma Linda University, California, USA

Postal Address: 24865 Taylor Street, Loma Linda, California, 92350, USA

Email: mhreid@llu.edu

Dr. Michael Reid is the Director of Finance and Research Information Systems at Loma Linda University. He joined the University in January 2008 and was promoted to director in December 2008. Prior to joining the school, Michael served as director of University Information Systems Services and adjunct lecturer in the Computer Science department at Northern Caribbean University, Mandeville, Jamaica, West Indies. He received his MS degree in Software Engineering from Andrews University, Berrien Springs, Michigan, and Ph.D. in Information Systems from Nova Southeastern University, Ft. Lauderdale, Florida.

Yair Levy, Ph.D.

Associate Professor, Graduate School of Computer and Information Sciences, Nova Southeastern University, Florida, USA

Postal Address: GSCIS 4058, 3301 College Avenue, Ft. Lauderdale, Florida 33314, USA

Email: levyy@nova.edu

Dr. Yair Levy is Associate Professor at Graduate School of Computer and Information Sciences at Nova Southeastern University. He joined the school as an Assistant Professor in 2003 and was promoted to an Associate Professor in 2007. Prior to joining the school, Yair was instructor and director of online learning at the College of Business Administration at Florida International University. During the mid to late 1990s, he assisted NASA to develop e-learning platforms as well as manage Internet and Web-based infrastructure. Yair earned his undergraduate degree in Aerospace Engineering from the Technion (Israel Institute of Technology). He received his MBA with MIS concentration and Ph.D. in Management Information Systems from Florida International University.

Visit for more related articles at Journal of Internet Banking and Commerce

trust, computer self-efficacy, technology acceptance model, banking information systems, information systems in Jamaica

Technological advances nowadays are providing the framework necessary to make easier the tasks that individual carry out on a daily basis (Guriting & Ndubisi, 2006; Ratnasingam et al., 2005; Srinivasan, 2004). With the rapid increase in Internet connectivity, security infrastructures, as well as computing speed, technological advances nowadays seek to provide efficient solutions to daily mundane tasks (Gefen et al., 2003; Guriting & Ndubisi, Lu et al., 2005). Several industries are utilizing these technological initiatives to make their services more accessible to customers (Gefen et al.; Lu et al.; Winch & Joyce, 2006). The banking industry is one such business entity that over the years has been using a variety of information systems (IS) to put their services in global reach (Chan & Lu, 2004; Lai & Li, 2005; Sachan & Ali, 2006; Wresch & Fraser, 2006). Today, these technologies form a consortium of what is called Banking Information Systems (BIS) and enable services such as online banking, online credit card management, and automated teller machines (ATM) services. The banking industry in Jamaica has also adopted BIS in an effort to make their services more available to customers (National Commercial Bank, n.d.; Royal Bank of Trinidad and Tobago Jamaica, n.d.; Scotiabank Jamaica, n.d.).

Some researchers have observed that while BIS are readily available, they are not fully utilized by some customers as anticipated (Cazier et al., 2006; Chang & Lu, 2004; Wang et al., 2003; Wresch & Fraser, 2006). Hence, there is a heightened need in IS research to understand the factors that impact an individual’s decision to use such technologies (Amin, 2007; Compeau & Higgins, 1999; Davis, Bagozzi, & Warshaw, 1989; Gefen et al., 2003; Legris et al., 2003; Venkatesh et al., 2003). The classical Technology Acceptance Model (TAM) has been a foundational model in understanding an individual’s decision to use technology (Davis, 1989; Davis et al.; Legris et al., 2003). TAM, however, accounts for only 40% of intentions to use (IU) an IS (Legris et al.). TAM has been modified and replicated over the past two decades in IS research and has proven to be a very robust model in understanding user’s IU an IS (Jackson et al., 1997; Legris et al.; Vankatesh & Davis, 2000). Other factors such as trust and CSE have also been cited as critical in determining an individual’s IU an IS (Compeau et al., 1999; Gefen et al., 2003; Tan & Sutherland, 2004; Wang & Emurian, 2005). With increased incidents of computer viruses, identity theft, and computer hacking, the issue of trust is especially noteworthy since BIS involves the exchange of personal and financial information in a remote environment (Komiak & Benbasat, 2004; Koufaris & Hampton-Soca, 2004; Wang et al.). Additionally, an individual’s belief about his or her ability to successfully use a computer or a technological service to accomplished a specific task, known as their computer self-efficacy (CSE) have also been cited as essential in determining that individual’s intention to engage in current or future use of an IS (Compeau & Higgins, 1995; Hasan, 2006). Researchers have also posited that men and women appears to accept technology differently; hence, gender differences appears to also play a role in individual’s trust, CSE, and their acceptance of technology (Cyr et al., 2007; Imhof et al., 2007; Yi et al., 2006). However, literature suggest that most of the current research conducted on TAM, trust, and CSE is done in developed nations, while very little attention has been given in literature to such investigation in developing nations, especially in the context of BIS.

This research draw from the vast pool of studies on technology acceptance, trust, and CSE, in order to examine their integration in the context of customer’s IU BIS in Jamaica. Moreover, this study investigated gender differences on the aforementioned constructs. The following section will provide the theoretical background for the study followed by the research methodology. Then, analysis and results are provided. Finally, discussions are provided with limitations of the study, conclusions, and recommendations for future research.

The pervasive impact of technology nowadays is driving several businesses to find new ways of delivering services to customers (Guriting & Ndubisi, 2006; Srinivasan, 2004). Of the various business sectors, it was noted that the impact of IS and its use is most significant in the banking industry (Lallmahamood, 2007). While banks endeavor to heighten technological initiates to put its services in ubiquitous reach of customers, the factors that motivate individuals to use online services are still not fully known (Lallmahamood). This has propelled IS research in an effort to discover the factors that impact users’ IU an IS (Davis et al., 1989; Legris et al., 2003).

It is evident from prior IS research that an individual’s decision to engage in IS use is dependent on several factors. Some of these include the perceived ease of use (PEOU) and perceived usefulness (PU) of the IS, the individual’s trust in the IS, as well as their CSE in successfully using the IS (Amin, 2007; Davis, 1989; Gefen et al., 2003; Hasan, 2006). IS researchers believe that the TAM with its varied versions and revisions (i.e. TAM2 and TAME) is a foundationally sound model in predicting an individual’s intentions to use IS (Davis; King & He, 2006; Legris et al., 2003). Additionally, the IS literature is replete regarding the issue of trust in online environments (Ba & Pavlou, 2002; Gefen et al., 2003; Pavlou & Gefen, 2004; Wang et al., 2003). These concerns are especially relevant when the online interaction involves the exchange of personal and private information. This is significant against heightened concerns about computer security, identity theft, computer hacking, and computer viruses in most online environments. The literature reveals that trust is a complex concept for which researchers are still trying to get a better understanding of what it really is and what it is not (Corritore et al., 2003; Wang et al.). If properly understood, trust inducing factors can be built into the framework of IS, thus reducing individuals concerns and heightening their decision to use these systems (Gefen et al., Wang et al.).

CSE has also been repeatedly cited in the IS literature as an important factor in determining an individual’s IU an IS (Amin, 2007; Chan & Lu, 2004; Compeau & Higgins, 1995; Compeau et al., 1999). With all the IS services available, efficient use cannot be realized if end users lack the required skills to adequately use the service in carrying out their daily tasks. Both specific and general CSE have been examined as well as the factors that directly impact CSE beliefs (Hasan, 2006). A summary of TAM related literature over the years indicated that IU an IS is a valid predictor of actual IS use (Legris et al., 2003).

Gender issues with TAM, trust, and CSE were also examined in IS literature. While trust, CSE and TAM impact IU an IS, the gender is also important variable to consider (Cyr et al., 2007). Gender appears to be valid as communication and interaction between individuals even within the same cultural setting differ between men and women. Research has also shown that technology is not gender neutral, and gender plays an important role in the use and acceptance of IS (Cyr et al.; Gefen et al., 2007; Imhof et al., 2007). Research about the relationships between trust, CSE, TAM, and gender in the IS literature have concluded mixed results and researchers indicated that additional research on the role of gender differences in technology acceptance is warranted (Cyr et al.; Lai & Li 2005; Yi et al., 2006). Thus, this study also investigated the role of gender differences on the TAM related constructs as well as Trust and CSE.

Overview and Research Questions

Figure 1 provides an overview of the concept model used for this research. The model proposed includes an extension of the traditional TAM constructs (i.e. PEOU, PU, ATT, and IU) with trust and CSE. Consistent with work done by Byrne (2001), this study used Structural Equations Modeling (SEM) to assess the impact of trust as well as CSE on the classical TAM’s constructs (PEOU, PU, ATT) and their overall impact on customer’s IU BIS in Jamaica. Specifically, this study examined the following research questions:

RQ1. How does trust impact perceived ease of use, perceived usefulness, and ultimately an individual’s intentions to use BIS in Jamaica?

RQ2. How does computer self-efficacy impact perceived ease of use, perceived usefulness, and ultimately an individual’s intentions to use BIS in Jamaica?

RQ3. Are there significant differences on trust, computer self-efficacy, perceived ease of use, and perceived usefulness for online bank customers in Jamaica base on gender?

RQ4. How does the integration of trust and computer self-efficacy to the classical TAM compares with the classical TAM in explaining individual’s intentions to use BIS in Jamaica?

This research was conducted through a quantitative research design using survey instrument to collect data from customers of three banks in Jamaica. Specifically, the Analysis of Moment Structures (AMOS™) software was used in addressing the first two research questions (RQ1 and RQ2). The third research question (RQ3) was analyzed by using the Mann-Whitney U Test due to the ordinal nature of the assessed constructs. RQ4 was analyzed by using AMOS™ to examine which model (‘original TAM’ versus ‘revised TAM’ as depicted in the concept map in Figure 1) provided better results for the model fit. Levy and Green (in press) outlined seven common measures of model fit. These include chi-square/degrees-of-freedom (χ2/df), goodness-of-fit index (GFI), adjusted goodness-of-fit-index (AGFI), normed fit index (NFI), non-normed fit index (NNFI), comparative fit index (CFI), and standardized root mean square residual (SRMSR). Thus, this study followed these recommendations when comparing the two model fits.

Survey Instrument

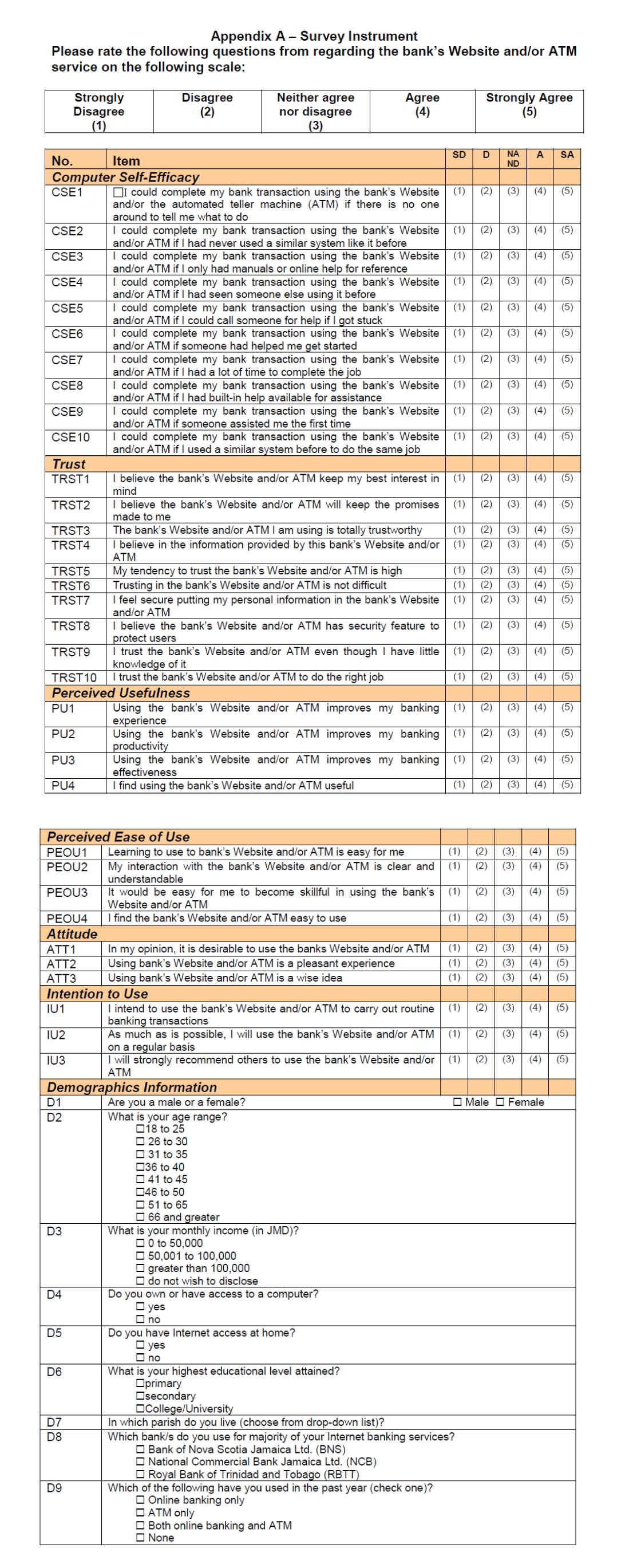

A survey instrument (Appendix A) was constructed by adapting measures from prior research of CSE (Compeau & Higgins, 1995), TRST (Gefen et. al., 2003; Koufaris & Hampton-Sosa, 2004), PEOU, PU, ATT, and IU (Davis, 1989; Taylor & Todd, 1995). The survey items were measured using a 5-point Likert-type scale for all constructs. All construct measures were adapted from their original source and slightly modified to fit the IS under study. This adaptation was done by first reviewing the original survey instrument and then making minor appropriate wording modifications, in an effort to clarify the intent of the questions for the three bank customers. Survey validation review process was done by experts from the field of information technology as well as the banking industry. Few word changes were recommended and incorporated in to the final survey instrument noted in Appendix A.

The survey items for PU, PEOU, ATT, and IU used in this study were adapted from Taylor and Todd (1995) as well as Davis (1989). These measures were reported to have high Cronbach’s Alpha indicating a good reliability for the measures. The CSE survey items were adapted from the classical Compeau and Higgins (1995) study. The development of Compeau and Higgins measures came about after they reviewed previous self-efficacy measures carried out by Gist, Schwoerer, and Rosen (1989), Webster and Martocchio (1992), as well as Burkhardt and Brass (1990). CSE has been reported in literature to demonstrate high reliability as well. The survey items for TRST were adapted from Gefen et al. (2003) as well as Koufaris and Hampton-Sosa (2004) study.

The survey instrument used in this study consisted of a total of 43 items. The demographic information had nine items (D1 to D9), while the measurable constructs consisted of a total of 34-items: CSE (CSE1 to CSE10), TRST (TRST1 to TRST10), PU (PU1 to PU4), ATT (ATT1 to ATT3), PEOU (PEOU1 to PEOU4), and IU (IU1 to IU3).

Data Collection

The survey instrument was designed and delivered via the Web. A solicitation e-mail was sent out to a total of 1,500 bank customers from the three banks in Jamaica. Data collection took place over 30 days. According to Levy (2006), data screening is conducted for four reasons: (a) to ensure the accuracy of the data collected; (b) to identify response-set; (c) to deal with missing data; and (d) to deal with extreme cases, or outliers. Following data screening 374 usable responses were available for further analyses.

Reliability Analysis

Cronbach’s Alpha tests were conducted for the CSE, TRST, PU, PEOU, ATT, and IU constructs to determine the internal consistency across items for each measure. Two CSE items (CSE1 and CSE2) had low inter-item correlations and the Cronbach’s Alpha for CSE with the two items was .86, while without it the CSE Cronbach’s Alpha was .90. It appears that the low reliability of CSE1 and CSE2 may have been due to users’ misunderstanding to the items wording. Accordingly, these two items were not included in subsequent analyses. Reliability analysis results for all constructs measured are presented in Table 1 indicating good reliability on all measures.

Structured Equation Modeling (SEM)

Structural Equation Modeling (SEM) procedures were used to determine the impact of TRST on PU, PEOU, ATT towards BIS, and IU a BIS (RQ1). SEM was also used to determine the relationship between CSE and TRST, as well as their impact on PU, PEOU, and ATT towards BIS, and IU a BIS (RQ2). Two models were tested. In the first model, the 10 trust items were used as the indicator variables for the trust construct. Similarly, the eight CSE items were used as the indicator variables for the CSE construct. However, as Little, Cunningham, Shahar, and Widaman (2002) noted that models with single-item indicators (especially when there are several items) are less parsimonious and often increase sampling error. Thus, in the second model, trust items were parceled using the item-to-construct balance method suggested by Little et al., into three indicator variables. The CSE items were also parceled into three indicator variables. The second model fit the data better than the first model; therefore, all subsequent analyses used the values from the second model.

As indicated in Table 2, the GFI, AGFI, NFI, and CFI values of the second model were all higher than the values of the first model. CFI, NFI, and GFI values greater than .90 indicate good model fit (Hu & Bentler, 1999). AGFI values greater than .70 indicate good model fit (Shumacker & Lomax, 2004). RMSEA values less than .06 also indicate a good model fit (Hu & Bentler, 1999) while values ranging from .08 to .10 indicate mediocre model fit and those greater than .10 indicate poor fit (Byrne, 2001). It was also observed that the RMSEA value of the second model was lower than the value of the first model. Further, all indicator variables loaded on highly and significantly to their respective constructs. The path coefficients pertaining to the Revised TAM are presented in Table 3.

The findings in Table 3 indicated that CSE did not significantly predict trust (Beta = .11, p > .05), CSE did not significantly predict perceived ease of use (Beta = .09, p > .05), CSE, however, significantly and positively predicted perceived usefulness of the BIS (Beta = .12, p < .05). Additionally, the findings indicated that Trust significantly and positively predicted perceived ease of use (Beta = .59, p < .001), Trust significantly and positively predicted perceived usefulness (Beta = .45, p < .001). Moreover, perceived ease of use positively and significantly predicted perceived usefulness (Beta = .43; p < .001), perceived ease of use positively and significantly predicted attitudes towards BIS (Beta = .38; p < .001). Also, the findings indicated that perceived usefulness significantly and positively predicted attitudes towards BIS (Beta = .55, p < .001), perceived usefulness significantly and positively predicted intention to use BIS (Beta = .23, p < .05). Finally, the findings indicated that attitude towards BIS significantly and positively predicted intention to use BIS (Beta = .67, p < .001).

Mann-Whitney U test was conducted to determine whether males and females varied significantly in their TRST, CSE, PEOU, and PU scores (RQ3). The means, standard deviation, and significant level of males and females are shown in Table 4. The findings showed that only trust varied significantly across males and females (Mann-Whitney U = 14809.50, p < .05). The group of males (M = 3.74) had a higher mean trust score than the group of females (M = 3.57).

To determine whether the revised TAM fit the data better than the original TAM (RQ4), SEM procedures were conducted. Figure 2 shows the SEM testing results for the original TAM model, while Figure 3 shows the SEM testing results for the revised TAM model. The chi-square statistics and the goodness-of-fit index values are presented in Table 5. The findings showed that the original TAM had a slightly better fit than the revised TAM.

Discussion

The purpose of this section is to provide the findings of all analyses performed and the results of the four research questions. The paper presented the results of an empirical examination designed to measure the contribution of trust, computer self-efficacy, perceived ease of use, perceived usefulness, attitude, and customers’ intentions to use banking information systems in Jamaica. Cronbach’s Alpha reliability tests were done indicating high reliability on all constructs measured. In order to determine the representativeness of the sample, demographic data were requested from the survey participants. The distribution of the data collected appears to be a good representation of the population of bank customers in Jamaica.

Two models were tested to determine which constitutes a better model fit. In the first model all the items were uses as indicator variables for each construct, while in the second model both TRST and CSE items were parceled using the item-to-construct balance method into smaller indicator variables. It was observed that the second model fit the data better than the first model; hence, it was used to evaluate the research questions. SEM using AMOS was used to analyze RQ1, RQ2, and RQ4, while the Mann-Whitney U test was used to analyze RQ3. Research results showed that while CSE did not significantly predict trust and PEOU, it significantly and positively predicted PU. Additionally, TRST significantly predicted PEOU and PU, while PU significantly predicted ATT and intentions to use BIS. It was observed that PEOU significantly predicted PU and ATT towards BIS. Furthermore, ATT towards BIS significantly predicted intention to use BIS. It was also observed from the findings of this study that only trust varied significantly across males and females. In comparing the original TAM with the revised TAM, research result showed that the original TAM had a slightly better fit the revised TAM.

Summary of Results

This research investigation examined the integration of trust and CSE in the TAM, by observing their impact on customers’ use of banking information systems in Jamaica. Researchers such as Cazier et al. (2006), Gefen et al. (2003), Lai and Li (2005), and Wang et al. (2003) inferred that understanding IS use in remote and online environments is an important concern and suggested additional research in investigating the factors that influence an individual’s decision to use technology. Following a comprehensive literature review, three main factors were identified as possible contributing factors to intention to use technology.

The first model identified in the literature that examined individuals’ intentions to use technology was TAM. Several studies have explored, manipulated, and replicated TAM and have found it to be a candidate model for understanding behavioral intentions to use IS (Chan & Lu, 2004; Davis, 1989; Gefen et al., 2003; Legris et al.; Lu et al., 2005; Venkatesh, 2000; Venkatesh & Davis, 2000; Wang et al., 2003). Therefore, the contributions of TAM to behavioral intention to use IS were explored in the context of BIS in Jamaica.

The second factor identified in the literature as a possible contributor to intention to use technology was trust. Researchers generally suggest that trust is a significant and positive contributor to individuals’ intention to use technology especially in online and remote environment (Ba & Pavlou, 2002; Gefen et al., 2003; Pavlou & Gefen, 2004; Wang et al., 2003). Thus, the contributions of trust on individuals’ intention to use BIS in Jamaica were investigated.

The third factor identified in the literature as a possible contributor to intention to use technology was CSE. Research suggest that an individual’s ability to efficiently use an information system to successfully complete a task impacts his or her attitude and intentions to use such system (Chan & Lu, 2004; Compeau & Higgins, 1995; Compeau et al., 1999; Fagan et al., 2004; Hasan, 2006; Khorrami-Arani, 2001). Therefore, the contributions of CSE on individuals’ intention to use BIS in Jamaica were examined. Research also suggests that males and females, even within the same cultural setting, communicate in different ways in both offline and online environments (Colley & Maltby, 2008; Gefen et al., 2007; Gefen & Struab, 1997; He & Mykytyn, 2007; Imhof et al., 2007; Yi et al., 2006). Thus, gender interactions in online environments were investigated.

In an effort to better understand how these variables interact and impact each other, a predictive study was designed to investigate the incorporation of trust and CSE in TAM, and their effect on customers’ intentions to use BIS in Jamaica. Gender was examined as a controlled variable. In order to address the specific research question noted above, a Web-based survey instrument was developed based on prior research on CSE (Compeau & Higgins, 1995), TRST (Gefen et. al., 2003; Koufaris & Hampton-Sosa, 2004), PEOU, PU, ATT, and IU (Davis, 1989; Taylor & Todd, 1995).

A revised TAM model was proposed and SEM analysis using AMOS was used to investigate the impact of the variables on each other and an examination of the model (original TAM or revised TAM) that represented a better fit of the data was also investigated. Data were collected via a Web-based survey instrument from 374 customers from three banks in Jamaica. Research results showed that while CSE did not positively impact trust and PEOU, CSE significantly and positively predicted PU. Additionally, TRST positively impacted PEOU and PU, while PU significantly predicted ATT and intentions to use BIS. It was found that PEOU significantly predicted PU and ATT towards BIS. Furthermore, ATT towards BIS significantly predicted intention to use BIS. It was also observed that of all the constructs examined, only trust varied significantly among males and females since the group of males in the study had higher mean trust scores than the group of females. In comparing the original TAM with the revised TAM, research result showed that the original TAM had a slightly better fit than the revised TAM.

Limitations

Four limitations were identified in this study. The first limitation was that because CSE1 and CSE2 were removed from the measure of CSE, final results for CSE may have been impacted in some way. The second limitation was that the model was tested only with bank customers. Therefore, other researchers should be cautious when trying to generalize the results to other technologies or information systems. A third limitation stemmed from the fact that 80% of the respondents have college level education, and 65% were from a single bank. Furthermore, 30% of the respondents reside in the same parish. Different results may be obtained from users who had secondary or primary education or who used a different bank. A fourth limitation was that the study instrument targeted only bank customers who had access to a computer and the Internet. Different results may be obtained by in-branch customers who cannot be contacted via e-mail or those who use ATM only.

Suggestions for Future Research

Several areas for future research were identified in this study. Factors associated with customers’ intentions to use BIS were investigated. More work is needed to investigate other emerging technologies in the banking industry as well as replicating the study in other working environments. In addition, conducting this study in other cultural environments would be edifying. Furthermore, there is need to develop a methodology to more precisely adapt a measurement without affecting its internal reliability.

Acknowledgements

The authors would like to thank all the anonymous bank customers who participated in this study. Thanks also to the three Jamaican banks (Bank of Nova Scotia Jamaica Ltd., National Commercial Bank Jamaica Ltd., and Royal Bank of Trinidad and Tobago Jamaica Ltd.) for the generous assistance in this research. Moreover, the authors would like to thank the Editor-in-Chief, Dr. Nikhil Agarwal, the Deputy Editor-in-Chief, Joshua Fogel, and the anonymous referees for their careful review and valuable suggestions.

Copyright © 2026 Research and Reviews, All Rights Reserved