ISSN: 1204-5357

ISSN: 1204-5357

Emoarehi Eriki*, Francis O Iyoha, Dorcas Adetula

Department of Accounting, Covenant University, Ogun State, Nigeria

Received date: 04-05-2020, Manuscript No. jibc-20-10224; Editor assigned date: 06-05-2020, Pre QC No. jibc-20-10224(PQ); Reviewed date: 20-05-2020, QC No. jibc-20-10224; Revision date: 09-11-2022, Manuscript No: jibc-20-10224(R); Published date: 07-12-2022

Visit for more related articles at Journal of Internet Banking and Commerce

This paper examines the effect of e-dividend payment system and the management of unclaimed dividends in Nigeria. The object of this paper is to examine the effect of the introduction of e-dividend payments system to stem the tide of rising trend of unclaimed dividends in Nigeria. The paper examines the significance of the e-dividend policy between the pre and the post edividend payment periods. The study used the pre period of 2010 to 2014 and post period of 2015 to 2019 to determine the significant differences. The study used stochastic dominance to investigate the significant difference between the two periods. The paired sampled t-test was also employed as an additional statistical techniques for analysing the data collected to determine the significant difference. The study revealed that the introduction of e-payment of dividends in reducing the trend of increasing unclaimed dividends in Nigeria was not effective. The stochastic dominance between the two pre and post edividend payment system showed that the e-dividend payment system introduced has no impact on the rising unclaimed dividends in Nigeria. The study recommends that efforts should be made to focus on the relationship between the quoted companies and the registrars in the processing of payment of dividends in Nigeria.

e-dividend, Unclaimed Dividend, Quoted Companies, Nigerian Stock Exchange.

Dividend plays a very crucial role in the Nigerian stock market. It is expected that an investor gets its dividend from its investment. Dividend is distributable earnings to companies and dividend not distributed could be regarded as retained earnings. The importance of dividend determines what funds flow to investors and what funds are reserved or retained by investors, although information are been provided to stakeholders as regards the firms performance. Hence, the survival of any company is dependent on consistent investment policy or plan. This channel emphasise the importance of dividend payment and explains the reason why unclaimed dividend payment is still persistent till today. Owolabi and Obida explained that unclaimed dividend are dividend paid to companies but not yet claimed by investors or shareholders [1].

Around the world, reforms are been launched to strengthen the regulatory regime because of the increasingly competitive global financial system. The federal government in collaboration with the Central Bank of Nigeria (CBN) and other regulatory authorities introduced the e-dividend payment system in July, 2015. Most investors have given instructions to their bank account for direct payment of dividend through the e-dividend payment system [2].

The above development of unclaimed dividend in Nigeria provides an interesting avenue for examining the effect of e-dividend payment system and the management of unclaimed dividend in Nigeria. The study contributes to existing knowledge in two significant ways. First the study analyses the effect of the 19 company Registrars and the total number of 218 quoted companies each company registrar services in Nigeria. The choice of these companies is based on their ordinary shares and the available information from the Nigerian Stock Exchange (NSE). A comparison was made between the significant difference between the pre and post e-dividend payment system since the introduction of the e-dividend payment system in July, 2015. Secondly, the study analysis the causes of unclaimed dividend on company registrars. Previous studies on this topic are mostly based on developing countries particularly Nigeria which are mostly quoted companies in the Nigerian Stock Exchange (NSE). Therefore, the findings of the study may provide different policy implication for regulators [3].

The remaining paper is structured as follows. Section 2 describes the theoretical framework. Describes the research methods, model specification and data analysis. Section 4 discussed the result. Section 5 summarizes the concluding part of the study.

Previous research conducted, on the effect or perception of e-dividend payment system and the incidence of unclaimed dividend in Nigeria is relatively few in Nigeria. Most of the research relevant to this study includes both quantitative and qualitative studies. Recent studies like, study on the public perception of e-dividend payment system and the effect of unclaimed dividend in Nigeria. Data from the study used both primary and secondary sources through questionnaire and the Z-test statistical tools. The purpose of the studies explains why various theories used for the purpose of the studies are suitable for the effect of unclaimed dividend in Nigeria. The study provides evidences that 60% of the perception of investors are aware of dissemination of information on the e-dividend payment system. Unclaimed dividend directly affects the financial position of financial institutions and investors are more concerned with what happened to unclaimed dividend. Provides more insight on the impact of dividend pay-out and unclaimed dividend in Nigeria stock market. It was observed that the consistent increase of unclaimed dividend has a negative impact in attracting investors. The study employed the use of a cross sectional data analysis using 55 companies to perform the regression model by employing the use of Statistical Packages of Social Sciences (SPSS) using primary and secondary data analysis. The study revealed a positive relationship between unclaimed dividend and the current stock price [4].

Empirically analysed the factors influencing the adoption of e-dividend payment method by Nigerian banks. Primary data analysis were used. A statistical showed that non adopters and adopters of e-dividend payment system expressed a common view on the support of e- dividend payment methods but they were also in a different view on the issues associated with e-dividend payment system. They attributed the issue on the part of the Securities and Exchange Commission (SEC), Government and the flexibility of e-dividend payment system [5].

Electronic Dividend Payment System and Unclaimed Dividend

The essence of the electronic dividend payment system is to address the problem and the increasing rise of unclaimed dividend in Nigeria. The e-dividend payment system was introduced in July, 2015 by the Securities and Exchange Commission (SEC) and other regulatory authorities. This idea was to make the dividend process easy and better. The e-dividend payment system is on online payment of dividend due to investors, through a direct credit into a nominated bank account Norrie. The e-dividend payment system has taken a centre stage in the economy because the capital market in Nigeria has witnessed a lot of transformation, both in infrastructure and human development. The Nigerian Stock Exchange (NSE) and the Securities and Exchange Commission (SEC) major objective were to ensure that investors adheres to the strict compliance of using the e-dividend payment system. The essence of e-dividend payment system is that it will enhance the capital market and shareholders will be able to invest their money in other to eradicate the era of quoted companies declaring dividend when they do not actually have facts [6].

Dividend could be broadly known as returns on investment in financial assets. The investors usually expect reward from their investment and this reward comes in form of dividend. Normally, a warrant is being issued to investors and not all investors receive their warrants. Warrants not received by investors is known as unclaimed dividend. The issue of unclaimed dividend has been existing in Nigeria and the factors that give rise to unclaimed dividend include change of address without proper communication, death without proper information postal address, loss of dividend warrant by investors, lack of awareness on the part of the general public among others. Although, there are speculations that companies and registrars are beneficiaries to unclaimed dividends and this has created more concern on the part of investors.

The issue of unclaimed dividends is not peculiar to Nigeria alone. Some countries have made adequate provisions for the appropriation of unclaimed dividend. An example of such country is Kenya. According to unclaimed dividend assets amounted to 9.2billion Kenya Shillings and 200 billion Kenya Shillings respectively. And from 2011, 2010 and 2009 unclaimed dividends amounted from 573 billion Shillings, 384 billion Shillings and 148 million shillings respectively. A parliament was established by the government of Kenya to set up an Appropriation Bill which was called unclaimed financial assets Authority Board to carry out unclaimed financial assets. The bill was passed and sent to the president but the parliament that deals with this bill abandoned the property [7].

In the United Kingdom, unclaimed dividend was properly estimated between 15 billion dollars and 20 billion in 2012 and 2013 respectively. And in Malaysia, the 1965 Act that governs the administration of unclaimed dividend presents a claim to company registrars for payment of unclaimed dividend and when the dividends are not claimed after one year, it is expected that the shareholders reapply to the registrar [8].

According to the issue of unclaimed dividend has been prevalent in the Nigerian stock market. The investors, shareholders are interested with the issue despite the effort made by regulatory agencies but the integrity seems to be the prevailing question in the management of unclaimed dividend despite the consistent increase, unclaimed dividend has been a major issue. Odejayi further explained that a bill was being passed to manage the increase in unclaimed dividend but this bill fell out from the investing public and this has constituted a serious problem to both shareholders and investors because distribution of earnings forms part of public expectation. Dividend decision has to do with the firm’s ability, to adopt a certain cash or amount that will be given to shareholders. This will enable the firm to actualize the objective of profit and shareholder’s maximization. The major problem of unclaimed dividend can be traced as far as 1972 to 1977 were the Nigerian Stock Exchange (NSE) was introduced and other subsequent companies across. Records were not properly kept during this period, the issue arose with the provision of CAMA 1990 that when dividend are not claimed within a year. Several other reasons that contributed to unclaimed dividend in Nigeria includes delay in postal services, change in address of house location and poor identification of house number of street, failure to effect changes in shareholders account, mistake as a result of commission or omission and failure to post dividend warrant in other to manipulate figures and many others [9].

Two methods were used in this study to ascertain the effectiveness of the e-dividend payment system of unclaimed dividends in Nigeria. First is the use of the mean difference between before and after, the introduction of e-dividend payment system in Nigeria. Weather, the e-dividend payment system has been effective in reducing the increasing trends of unclaimed dividend in Nigeria. The second method is the use of stochastic dominance to test if there was any difference in the impact of the after and before period intervention of the e-dividend payment system. The sample size used in the study is the unclaimed dividends of 218 quoted companies on the Nigerian Stock Market (NSE) between the pre and post e-dividend payment system periods from 2010 to 2014 and from 2015 to 2019 [10].

The study employs two model which are t sampled mean test and stochastic dominance analyses to explore the pre and post e -dividend payment system. The adopted data are tailored to address the significant differences between the pre and post e-dividend payment system in Nigeria for a period. While the purpose of stochastic dominance are statistical means of determining the superiority of one distribution over another. We used the first order stochastic dominance which is considered adequate for the study. It would be a very rare problem where the cumulative distributions of two options can be selected for no better reason than a very marginal ordering provided by a statistical test. In the real world, there are usually far more persuasive reasons to select one option over another. We use stochastic dominance to choose between after and before options in terms of the dominance of one over the other. Stochastic dominance has found its relevance in management sciences and social science. The application of this test is possible since we have distribution figures of unclaimed dividends for the companies for the two periods. And each has data values or data points that will enable us to calculate the cumulative distributions of the variable and subject them to the stochastic dominance tests. It will assist management to ascertain which of these variables or options cumulatively dominate the other in the determination of unclaimed dividends in the Nigerian Stock Market. This will enable supervisory authorities, like the Nigerian Securities and Exchange Commission, the Nigerian Stock Exchange focus on the option in order to ensure global best practices among the institutions charged with the responsibility of processing dividends to shareholders.

Model 1: The following model is used to examine the significant relationship between the two variables. This equation can be expressed as.

TUCD= β2010/2014 ≠ β 2015/2019 ………………… (1)

Where,

β2010/2014=the period before (pre) e-dividend payment system

β 2015/2019=the period after (post) e-dividend payment system.

The study adopted the t-paired sample means tests and all tests were done at 5% level of significance or 95% confidence level.

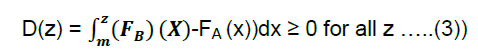

Model 2. Stochastic Dominance MODEL and Test

First order stochastic dominance Consider options A, B, that have the cumulative distribution functions FA(x) and FB(x), where it is desirable to maximize the value of x.

If:

FA(x) ≤ FB(x) for all x …….(2)

then option A dominates option B. That amounts to saying that the cumulative density function (cdf) of option A is to the right of that of option B in an ascending plot.in an ascending plot as in Figure 1.

If

Then option A has second order stochastic dominance over option B. The figure shows that option A having second (but not first) order stochastic dominance over option B. The function D(z) is also plotted to show it is always positive as in Figure 2

We checked whether the after and the before variables are normally distributed. There are many models to do this. For example, the Box Plot, Q-Q Statistics, Kolmogrov-Smirmov and Histogram. We chose to use Histogram to test the normality of the variables, after taking the frequency of the variables (Table 1 and Figure 3).

| Bin | Frequency |

|---|---|

| 97800000000 | 1 |

| 1.16E+11 | 5 |

| 1.34E+11 | 6 |

| More | 3 |

Table 1: Data frequency of unclaimed dividends after e-dividends payment.

The Hypothesis is specified as follows;

H0: There is no mean difference between the BEFORE and AFTER the introduction of e-payment system of paying dividends to reduce the rising trend of unclaimed dividends in Nigeria

H1: There is a mean difference between the BEFORE and AFTER the introduction of e-payment system of paying dividends to reduce the rising trend of unclaimed dividends in Nigeria. The next section is the result table of the paired sample means.

From the probability value of P(T<=t) one-tail is 9.99. This is more than 5 percent level of significance. Therefore, we cannot reject the Null Hypothesis. The Null Hypothesis is that there is no mean difference between the period before and after the introduction of e-payment of dividends in Nigeria. The study therefore revealed that the introduction of e-dividend payments during the period under study in Nigeria is not effective in reducing the increasing trend of unclaimed dividends in Nigeria (Table 2).

| BEDV | AFEDV | |

|---|---|---|

| Mean | 79900000000 | 121000000000 |

| Variance | 295000000000000000000 | |

| Observations | 15 | 15 |

| Pearson Correlation | 0.87818 | |

| Hypothesized Mean Difference | 0 | |

| Df | 14 | |

| t Stat | -19.105 | |

| P(T<=t) one-tail | 0.00000000000999 | |

| t Critical one-tail | 1.76131 | |

| P(T<=t) two-tail | 0.00000000002 | |

| t Critical two-tail | 2.14479 |

Table 2: Test Paired Two Sample for Means.

The second method used was the stochastic dominance to ascertain the difference between the pre and post period of e-dividend payment system of unclaimed dividends in Nigeria. From the result of the data analysis using the Stochastic Dominance was inconclusive. There was no need to test for the second order stochastic dominance, because, the first order is inconclusive and therefore the second order would also be inconclusive. The cumulative data used is in the appendix below. The implication of the result is that there is no difference between Before and After the introduction of e-dividend payment system as an intervention method to stem the rising trend of unclaimed dividends in Nigeria. The impact of e-dividend payment system does not have impact in reducing the increasing trend of unclaimed dividends in Nigeria. Thus, the result is also in line with the first method (Tables 3 and 4).

| Before | After | |

|---|---|---|

| BEFORE | - | Inconclusive |

| AFTER | Inconclusive | - |

Table 3: Result of Stochastic Dominance between before and after.

| Before | After | CBFR | CAFT |

|---|---|---|---|

| 0.074558 | 0.054719 | 0.170856 | 0.091358 |

| 0.096298 | 0.036639 | 0.159915 | 0.090025 |

| 0.063617 | 0.053386 | 0.143158 | 0.085149 |

| 0.079541 | 0.031763 | 0.157348 | 0.064238 |

| 0.077808 | 0.032474 | 0.153601 | 0.075354 |

| 0.075793 | 0.042879 | 0.161077 | 0.053434 |

| 0.085284 | 0.010555 | 0.17886 | 0.076561 |

| 0.093576 | 0.066006 | 0.183294 | 0.139667 |

| 0.089719 | 0.073661 | 0.178414 | 0.105887 |

| 0.088695 | 0.032226 | 0.169282 | 0.061323 |

| 0.080586 | 0.029096 | 0.090523 | 0.111273 |

| 0.009937 | 0.082177 | 0.018909 | 0.179091 |

| 0.008972 | 0.096914 | 0.019389 | 0.12397 |

| 0.010417 | 0.027056 | 0.020836 | 0.035726 |

| 0.01042 | 0.00867 | 0.024341 | 0.19916 |

| 0.013921 | 0.19049 | 0.025565 | 0.270234 |

| 0.011644 | 0.079744 | 0.027715 | 0.115368 |

| 0.01607 | 0.035624 | 0.029215 | 0.051544 |

| 0.013145 | 0.01592 | 0.013145 | 0.01592 |

Table 4: Effect of e-dividend payment policy on unclaimed dividends.

Where,

CBFR=Cumulative figures of unclaimed dividends before the e-dividend period.

CAFT=Cumulative figures of unclaimed dividends After the e-dividend introduction.

From the analysis, the study revealed that the e-dividends payment system policy introduced by the supervisory authorities (the Federal Government, Nigerian Stock Exchange and the Nigerian Securities and Exchange Commission) has no impact on the rising trends of unclaimed dividends in Nigeria during the period studied. There is no mean difference between the two periods.

The study adopted two methods, the t paired means and stochastic dominance to investigate the impact of the use of e-dividend payment system introduced in 2015 to reduce the trend of unclaimed dividends in Nigeria. The results from the two methods reveal the e-dividend payment policies introduced in the Nigerian Stock market has not impact in stemming the rising trends of unclaimed dividends in Nigeria. There is need to continue to search for possible measures that could slow down the rising trend of unclaimed dividends in Nigeria.

The paper recommends that analysts and supervisory authorities should focus on the relationship between the quoted firms and the registrars in the process of dividend payment as the e-dividends payment introduced in 2015 might not be sufficient to reduce the present trend of unclaimed dividends in Nigeria.

We the authors of this research work hereby acknowledge Covenant University for the encouragement and financial support given us to participate in the journal of internet banking and commerce

Copyright © 2026 Research and Reviews, All Rights Reserved