ISSN: 1204-5357

ISSN: 1204-5357

Accounting Department, Babcock University, Nigeria

Rafiu Oyesola Salawu

Department of Finance and Accounting, Obafemi Awolowo University, Nigeria

Visit for more related articles at Journal of Internet Banking and Commerce

The study examined the effect of earnings quality on book value of quoted companies in Nigeria from 2000 to 2016. A sample of 51 firms was purposively selected for the study out of the population of 173 firms that were listed on the Nigerian Stock Exchange for the period. The study adopted Ex-post facto research design. Data extracted from the published audited financial statements of the firms. Pooled OLS technique was employed in data analysis. The study measured earnings quality with four separate earnings attributes: Accruals quality (AQ), earnings persistence (EPERS), earnings predictability (EPRED), and earnings smoothness (ESMOTH). The study revealed that earnings quality significantly affected book value of the listed firms in Nigeria. Specifically, accruals quality (AQ), earnings persistence (EPERS) and earnings smoothness (ESMOTH) each had a positive effect on book value while earnings predictability (EPRED) had negative effect on book value. By implication, since investors and analysts value high earnings quality, the study suggested that, constancy of earnings and discretionary nature of accruals should be considered, managers should equally ensure information disclosure to enhance quality of earnings and credibility of reported book value.

Accruals Quality; Book Value; Earnings Smoothness; Earnings Predictability; Discretionary Earnings

The global financial crisis and scandals ravaging nations‟ economies have caused panic and considerable concern in the mind of investors, financial analysts and market participants concerning the quality of earnings and financial reports Liu [1]. The results have practical implications for investors and analysts‟ continual reliance on financial reports for investment decisions and confidence in the capital market since investment returns and earnings are closely related to capital markets performances [2]. Adegbite [3] states that investors place doubts on the ability of stock market regulating authorities and professional bodies (policy makers, professional accounting and auditing associations) to completely regulate their members‟ professional conduct, which reflects on the financial report they produce. If reported earnings in form of book values, market share price and performance reports lack credibility and integrity, then, there is indeed a big problem. Hence, the question of how and whether earnings quality affect market values is fundamental to this study, as earnings quality are very critical to companies market values [4,5].

Poor earnings quality, opportunistic earnings and biased financial reporting create concern for analysts, investors and market participants in making rational investment projections and decisions. Despite the various studies on earnings quality to improve reporting quality and create confidence in the capital market, there seems to be an abuse of accounting reporting system as stated by Mangunyi and Roudaki [6,7]. Their views seem to be a follow-up reaction of capital markets that have generally recorded turbulent periods based on the studies of Brunnermeier, Calomiris and Marer [8-10] and the Nigerian economy was neither insulated, nor spared from the devastating impact of the financial crisis ravaging the world economy due to likely abuse of procedures affecting the quality of financial report and earnings quality by those saddled with firm‟s operational performance.

The objective of this study is to investigate the impact of earnings quality on the book value of the listed companies, review the trend of earnings from a new perspective and extend the frontier of accounting literature for the benefit of managers, investors and other accounting information users towards facilitating and enhancing firms performance, quality of earnings and reliable book values. To ensure the validity and reliability of the study, data were extracted from audited published financials statements of the selected companies. The rest of the study is organized in this manner; section 2 considers the review of literature related to earnings quality and book value and their measures. Section 3 discusses the methodology. Section 4 considers the results and discussion of findings. Finally, section 5 concludes the study with recommendations and contribution to accounting literature.

Earnings Quality

The concept of earnings quality has defined in the literature in two perspectives, the decision-usefulness perspective and the economic-based perspective [11]. From the decision- usefulness perspective, earnings quality is regarded as being high if the earning elements are useful for decision making purposes. This definition aligns with Schipper and Vincent [12] who argue that earnings quality can be explained from two perspectives, the contracting perspective and investment perspective. That from the contracting perspective, low quality of earnings may result in unintentional wealth transfer. For example, firms that reward mangers based on earnings may over compensate the managers if the earnings are overstated. And from the investing perspective, poor quality of earnings is challenging as it can mislead investors, leading in misallocation of resources [11,13].

Accruals quality: Prapaporn [14] opined that Accrual quality shows the extent to which earnings deviate from a systematic association between firm performance and the agent‟s true contribution [15]. In theoretical relationship with agency theory, a high accrual quality indicates that earnings can represent the relationship between firm performance and the agent‟s true contribution. Firms with high accrual quality should assign more weight to earnings than to stock returns in compensation contracts. Richardson et al. [16] contend that in the absence of accrual accounting, the only asset or liability appearing on the balance sheet would be the cash asset account, that all other asset and liability accounts are products of accruals accounting process.

Earnings persistence: The concept of earnings persistence is associated with the idea that a company retains and sustains its earnings in the long-term period. In this regard, earnings have the features of quality if it can be continued in the future because investors desire repeatability or stability of performance and earnings. In relation with market share price, earnings persistence shows that the higher ability of a company to predict future earnings shows likely high market share price or higher earnings quality and in other words, the company‟s poor ability to predict future earnings shows poor earnings quality.

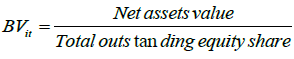

Book value: The book value of a company is seen as the total assets minus intangible assets and liabilities and often discussed as stockholders‟ equity, owners‟ equity, shareholders‟ equity or simply equity [17]. One of the measures of market and firm value is the book value. Investors reflect the ratio of capital market such as the ratio of price per book value to determine the stock whose price is reasonable. Book value reveals how much a company is worth especially if it were to be liquidated and all assets sold. Book value shows how much the company‟s; assets are worth as contained in the balance sheet, while market values reveal what investors think the company is worth, also market value reveals what investors think the company is worth and how much they will pay to buy stock in the firm.

Empirical Review

Georgescu et al. [18] in a study on fair value accounting and market reaction, using 64 Romanian listed companies is for a period of 2010 - 2011. The aim of the study is to estimate and test the existence of an influence of the accounting information on the market value, based on the multiple linear regressions. The study finds that earnings quality accounting information obtained as book value have greater influence on the market value compared to the information in the annual financial statement.

Fadiran and Olowookere [19] examined the determinant of share price on the Nigerian stock Exchange from companies listed for a period of 2000-2011. The study reveals that there was a negative relationship between market share price and exchange rates. The study goes further to reveal that there is a negative relationship between interest rate and exchange rates as expected and a positive relation between exchange rate and book share price. This could mean that company‟s economic performances coupled with macroeconomic environment are the main determinants of share price. The interplay of sustainable corporate good performance which translates to earnings persistence is a good indicator of market share price.

Poor earnings quality as reflected in the book value of firms instigates earnings management with its associated managerial activities that is harmful to firm reported book values [20]. As a result, determining the relationship between earnings quality and book value of shares provides one of the rationale this paper seek to investigate the extent earnings quality affects book value of shares of quoted companies in Nigeria.

Relationship between earnings quality and book value of shares of Quoted companies in Nigeria;

Theoretical Consideration

Theory of financial reporting: Theory of financial reporting plays a very important and significant role in the predictions and reporting of returns and stock prices is very important to financial users. Though the studies of Ali and Hwang [21], Ball et al. [22], Guenther and Sun [23] find that the usefulness of earnings in predicting returns and stock prices is lower in code law countries. Guenther and Young [24] argue that countries with better accounting quality, accounting earnings are more closely related financial reporting and to the underlying economic activity. Guenther and Young [24] find that the association between the accounting measure of returns and Gross Domestic Product (GDP) growth is high in the U.K. and the U.S., and low in France and Germany. Ball et al. [25] state that there is high demand of financial report by investors and other stakeholders for their investment guide. Leuz and Verrecchia [26] confirmed similar high demand in Germany. While Sengupta [27] finds that higher information reporting and commendable level of disclosure reduces the cost of public debt in the United States of America.

Theory of financial reporting is relevant to this study considering the importance of financial reporting and information disclosure to the capital market and also the role of information plays in investment decisions generally. Therefore, this theory is important to this study as financial reporting and information disclosure is critical in ensuring reduction of information asymmetry. When the capital market participants are well informed, they will be in a better position to take the right investment decisions. The market share price of share ride on the availability of right information.

Accountability theory: Some scholars in their research work find that a more liquid market leads to better monitoring of managers as in Diamond [28], Dow and Gorton [29]. Similarly, Holmstrom and Tirole [30] state that better accounting information leads to better monitoring of managers. Also, the study of Leuz and Verrecchia [26] find that high accounting quality makes managers allocate assets more efficiently because stock markets can predict future cash flows more precisely and thus can motivate managers more efficiently. Better accounting information can facilitate the information flow among investors and managers through an informative stock market. However, a good financial accounting regime is a prerequisite for the existence of an informative stock market. Agency theory states the importance of accountability as required from the managers from the shareholders. The shareholders expect proper accountability of stewardship of their investment entrusted in the hands of the managers. Therefore, this theory is very relevant to the study as accountability is very germane in building strong confidence and trust on the operations of the firm and resources entrusted in their care.

The statistical population of this study is all the listed companies in the Nigerian Stock Exchange during 2000-2016. A purposive sampling technique was adopted in selecting 51 companies who made the following criteria: (i) Companies that had complete records of cash flows for the period under consideration; companies that had records of current assets and current liabilities for the period under consideration; companies that had financial and market records; and companies that were in the Stock Exchange as at the year 2000 to 2016. The panel data regression models were estimated using Unobserved Effects Model (UEM). The result of the Hausman test was the deciding factor in choosing between fixed effect model and random effect model, the study validated the normality, multicollinearity and heteroskedasticity assumptions by using Jarque-Bera (JB), variance inflation factor (VIF) and Breusch-Pagan/Cook-Wesberg tests.

Model Specification

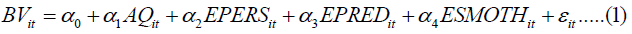

The starting model is the pooled regression model where it is assumed that any heterogeneity across firms has been averaged out. The pooled estimation models are given as:

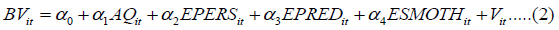

Random effect model: The random effect model assumes that the individual heterogeneity is uncorrelated with (or, strongly, statistically independent of all the observed variables. Going by this assumption the following models are specified;

Fixed panel regression model: The fixed effect model assumes that individual heterogeneity is captured by the intercept term. This means every individual is assigned its intercept while the slope coefficients are the same, and the heterogeneity is associated with the regressors on the right hand side. In the model also we introduced dummy.

Di=dummy variable i for n-1 cross sectional.

Generally, the purpose of the models is to determine whether there is any relationship between earnings quality and market values. The variables have been selected on the basis of their relevancy to the model, and because of their importance in depicting shareholders confidence. Some of the independent variables are likely to vary over time and across sections. The error term was included in the model to accommodate the effect of other measures of earnings quality proxies and the control variables not included in the model.

Variable Definition

Dependent variable

Book value: The book value used is the book value of the firms total assets less total liabilities divided by the outstanding shares as at the close of accounting years of the years under consideration. Book value is calculated thus as used by Gaio and Raposo [31].

Independent variables

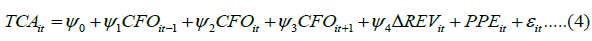

Accruals quality: Accruals quality as one of the attributes of earnings quality is measured as the standard deviation of residuals from a time series regression involving accruals to cash flows. The study follows modified Dechow and Dichev [2] model by Francis et al. [32] model. In this reasoning, High (low) standard deviation suggests low (high) accruals quality.

Where,

CFOit = Total Current Accrual: the firms‟ accruals in year t, which equals the current assets change in year t minus current liability changes, minus the changes of cash and cash equivalent changes in year t plus change of short-term liability with interest in year t.

Where ΔCA = Change in current assets; ΔCash = Change is cash/cash equivalent; ΔCL = Change in current liabilities; ΔSTDBET = Change in short term debt; CFOit = Firms operating cash flow; REV = Change in revenue; while PPEit = Property, plant and equipment.

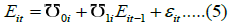

Earnings persistence: To compute earnings persistence, the study estimate for the selected firms in similar to Francis et al. [32] and in (Gaio and Raposo [31].

Where Eit = net income before extraordinary of firm i in year t; Eit-1 = net income before extraordinary items of firm i in year t-1; Ʊ0i = constant (intercept) coefficient; Ʊli = the non-constant (slope) coefficient; ε1i = the residual (error term). Higher and sustainable earnings persistence is an indication of higher earnings quality, which is desirable by investors.

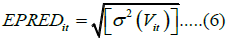

Earnings predictability: Earnings Predictability (PRED) describes the ability of the firm‟s current earnings to predict its future earnings. Hence, higher earnings predictability is an indication of higher earnings quality. This study adopts Gaio and Raposo [31] and therefore, we derive earning predictability measure from equation (5) as the square root of the estimated error variance:

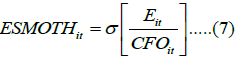

Earnings smoothness: The study measures earnings smoothness (ESMOTH) as the firm-level standard deviation of the earnings (Eit) and the standard deviation of operating cash flow (CFOit). Ideally, Smoothness signifies the natural result of accruals accounting Gaio & Raposo [31].

All variables scaled by total assets at the beginning of the accounting year t.

Where Eit = the firm i’s net income before extraordinary items of firm i in year t; CFO it = cash flow from operation of firm i in year t.

Trend of Book Value and Earnings Quality Indicators

As can be seen in Figure 1, book value (BV) grows by 132.99% in 2015 from 9.68 in 2005. However, accrual quality (AQ) and earnings persistence (EPERS) fall by 54.07% and 32.12% respectively between 2005 and 2015 while earnings predictability (EPRED) and earnings smoothness (ESMOTH) rise by 10.66% and 36.27% respectively between the periods with some fluctuations. These indicate that AQ and EPERS move in opposite direction of BV implying that the book values of the companies increase as accruals quality and earnings persistence improve over time. Similarly, despite the growth trend of EPRED and ESMOTH the study can still identify situations of divergence between the aforementioned and book value in recent years.

The likely reason for the growth in Book value during the period could be a reflection of the political and economic stability, and gradual effect of various economic polices put in place by the democratic government after a protracted military rule in Nigeria, while the decrease during the period particularly, the Accruals quality and earnings persistence could be due to cash flow variability‟s from operations and overheads cost of companies during the period.

Correlation Matrix

The result in Table 1 shows that there is no evidence of multi-collinearity among the variables given the fact that the correlations among the independent variables are generally weak. Specifically, the result shows that positive and significant association exists between BV and MSP (r=0.603). TQ is positively and significantly correlated with MSP (r=0.524) whereas it is positively but insignificantly correlated with BV (r=0.031). AQ is negatively and insignificantly associated with MSP, BV and TQ with the correlation coefficients of -0.068, -0.053 and -0.038 respectively. EPERS is positively and insignificantly correlated with MSP, BV and TQ (r=0.069, 0.061, 0.079).

| MSP | BV | TQ | AQ | EPERS | EPRED | ESMOTH | |

|---|---|---|---|---|---|---|---|

| MSP | 1 | 0.603* | 0.524* | -0.068 | 0.069 | 0.001 | -0.021 |

| BV | 1 | 0.031 | -0.053 | 0.061 | -0.128* | -0.059 | |

| TQ | 1 | -0.038 | 0.079 | 0.244* | 0.086* | ||

| AQ | 1 | -0.061 | 0.118* | -0.069 | |||

| EPERS | 1 | 0.017 | 0.097* | ||||

| EPRED | 1 | 0.241* | |||||

| ESMOTH | 1 |

Source: Author’s Computation, 2018. Underlying data from annual reports of firms listed on NSE. MSP=Market Share Price. BV=Book Value. TQ=Tobin’s Q. AQ=Accrual Quality. EPERS=Earning Persistence. EPRED=Earnings Predictability. ESMOTH=Earnings Smoothness. The earnings quality indicators are computed using a 5-year rolling window. *P-value< 0.05.

Table 1: Correlation Matrix.

The result in Table 1 shows that there is no evidence of multi-collinearity among the variables given the fact that the correlations among the independent variables are generally weak. Specifically, the result shows that positive and significant association exists between BV and MSP (r=0.603). TQ is positively and significantly correlated with MSP (r=0.524) whereas it is positively but insignificantly correlated with BV (r=0.031). AQ is negatively and insignificantly associated with MSP, BV and TQ with the correlation coefficients of -0.068, -0.053 and -0.038 respectively. EPERS is positively and insignificantly correlated with MSP, BV and TQ (r=0.069, 0.061, 0.079).

Variance Inflation Factor

For robustness, the variables considered in this study are subjected to multicollinearity test using variance inflation factor (VIF) and the result is presented in Table 2. VIF that is not above 10 and a tolerance value that is approaching 1 indicate no harmful effect of multicollinearity.

| Model Without Control Variables (Panel A) |

||

|---|---|---|

| Variable | VIF | 1/VIF |

| EPRED | 1.08 | 0.924 |

| ESMOTH | 1.08 | 0.925 |

| AQ | 1.03 | 0.973 |

| EPERS | 1.01 | 0.988 |

| LEV | ||

| FRMSIZE | ||

| BOARDINDP | ||

| Mean VIF | 1.05 | |

Source: Author’s Computation, 2018. Underlying data from annual reports of firms listed on NSE. MSP=Market Share Price. BV=Book Value. TQ=Tobin’s Q. AQ=Accrual Quality. EPERS=Earning Persistence. EPRED=Earnings Predictability. ESMOTH=Earnings Smoothness. The earnings quality indicators are computed using a 5-year rolling window.

Table 2: Variance Inflation Factor.

Judging from the result, the average VIF values are 1.05 (for model without firms‟ characteristics) and 1.08 (model without firms‟ characteristics) which are far less than 10. Specifically, EPRED, ESMOTH, AQ and EPERS have VIF values of 1.08, 1.08, 1.03 and 1.01 in panel A while EPRED, ESMOTH, AQ, EPERS.

Normality Test

One of the assumptions of the regression model that guarantee the validity of p-values, t-tests or F-tests is that the regression error term behave „normal‟. In other words, normality assumption assures the validity of all tests. This study uses Jarque-Bera test to assess the normality in the error terms (residuals) of the models. The null hypothesis is „normality‟ and if this is rejected, it indicates „non-normality‟. The results as presented in Table 3 shows no indication of normality except for the model II of MSP and EQI. Nevertheless, this does not represent much of a problem since we are dealing with a sufficiently large sample of data [33].

| Regression | Models | Jarque-Bera normality test |

|---|---|---|

| MSP and EQI | I | 4260.000 [0.000] |

| II | 0.988 [0.610] | |

| BV and EQI | I | 1314.000 [0.000] |

| II | 14.640 [0.000] | |

| TQ and EQI | I | 4096.000 [0.000] |

| II | 8884.000 [0.000] |

Source: Author’s Computation, underlying data from annual reports of firms listed on NSE. MSP=Market Share Price. BV=Book Value. TQ=Tobin’s Q. EQI=Earnings Quality Indicator. The figures in brackets are probability values and Chi2 are outside the bracket. The figures in brackets are probability values.

Table 3: Normality Test.

Heteroskedasticity Test

This study used Breusch-Pagan/Cook-Wesberg test to assess the variance in the error terms (residuals) of the models, and the results as presented in Table 4 indicates that all the models except for model I of MSP and EQI regression suffer from heteroskedasticity. As a result of this, panel robust standard error was employed to control the heteroscedasticity.

| Regressions | Model | Breusch-Pagan test for heteroscedasticity |

|---|---|---|

| MSP and EQI | I | 0.030 [0.860] |

| II | 10.040 [0.002] | |

| BV and EQI | I | 9.88 [0.002] |

| II | 135.60 [0.000] | |

| TQ and EQI | I | 84.140 [0.000] |

| II | 50.790 [0.000] |

Source: Author’s Computation, underlying data from annual reports of firms listed on NSE. MSP=Market Share Price. BV=Book Value. TQ=Tobin’s Q. EQI=Earnings Quality Indicator. The figures in brackets are probability values and Chi2 are outside the bracket. The figures in brackets are probability values.

Table 4: Heteroskedasticity test.

The Relationship between Earnings Quality Indicators and Book Value of Quoted Companies in Nigeria

From the result, the Breusch and Pagan Lagrangian multiplier test for random effects value of 665.83 (P=0.000) rejects the null hypothesis of “no panel effect”. The Hausman test to differentiate between the fixed effects and the random effects model suggested that the null hypothesis cannot be rejected and the non-rejection of the null hypothesis implies the adoption of random effects model.

BV=9.766+0.101AQ+0.489EPERS-13.514EPRED+0.061ESMOTH.

From the result, the Breusch and Pagan Lagrangian multiplier test for random effects value of 665.83 (P=0.000) rejects the null hypothesis of “no panel effect”. The Hausman test to differentiate between the fixed effects and the random effects model suggested that the null hypothesis cannot be rejected and the non-rejection of the null hypothesis implies the adoption of random effects model.

The result of the panel regression estimates for Model 2 indicate that Accruals quality (AQ); Earnings persistence (EPERS) and Earnings smoothness (ESMOTH) as a measure of earnings quality each had positive effect on book value, while Earnings predictability (EPRED) has a negative effect on book value of quoted companies in Nigeria. These are indicated by the sign of their respective coefficients. Thus AQ, EPERS and ESMOTH are in tandem with expectation, while EPRED is inconsistent with a priori expectation. Consequent on the coefficient of the variables, the result further reveals that an increase in accruals quality, earnings persistence and earnings smoothness will lead to an increase of 0.101, 0.489 and 0.061 respectively on book value while a unit increase in earnings predictability will lead to a decrease of 13.514 in book value. The results of the pooled, random and fixed effect regressions that investigate the relationship between earnings quality indicators and the firms‟ performance indicator proxied by Book value (BV) as presented in Table 5.

| -1 | -2 | -3 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Variables | OLS | RE | FE | ||||||||

| Coeff. | t-stat | p -value | Coeff. | t-stat | p-value | Coeff. | t-stat | p -value | |||

| AQ | -0.450*** | -2.96 | 0.003 | 0.101 | 0.5 | 0.615 | 0.169 | 0.82 | 0.416 | ||

| EPERS | 0.915 | 1.4 | 0.163 | 0.489 | 0.62 | 0.535 | 0.456 | 0.55 | 0.582 | ||

| EPRED | -29.843*** | -4.38 | 0 | -13.514 | -1.04 | 0.297 | -10.093 | -0.72 | 0.475 | ||

| ESMOTH | -0.198*** | -4.36 | 0 | 0.061** | 2.46 | 0.014 | 0.091*** | 3.69 | 0.001 | ||

| Constant | 10.910*** | 15.73 | 0 | 9.776*** | 6.32 | 0 | 9.564*** | 12.59 | 0 | ||

| Observations | 561 | 561 | 561 | ||||||||

| R-squared | 0.024 | 0.004 | 0.005 | ||||||||

| Firm Effect | NO | YES | YES | ||||||||

| Year Effect | NO | NO | NO | ||||||||

| F-test | 12.39 | 13.11 | 5.927 | ||||||||

| Prob > F | 0 | 0.011 | 0.001 | ||||||||

| Hausman [Prob.] | 5.57 [0.234] | ||||||||||

| LM Test [Prob.] | 665.83 [0.000] | ||||||||||

| Post Estimation Test | |||||||||||

| Jarque-Bera Normality Test [Prob.] | 1314.00 [0.000] | ||||||||||

| Breusch-Pagan test for Heteroskedasticity[Prob.] | 9.88 [0.002] | ||||||||||

Source: Author’s Computation, 2018. Underlying data from annual reports of firms listed on NSE. MSP=Market Share Price. BV=Book Value. TQ=Tobin’s Q. AQ=Accrual Quality. EPERS=Earning Persistence. EPRED=Earnings Predictability. ESMOTH=Earnings Smoothness. The earnings quality indicators are computed using a 5-year rolling window. The dependent variable is the Book Value (BV). ***P-value<0.01, **P-value<0.05, *P-value<0.1.

Table 5: Earnings Quality Indicators and Book Value (BV).

In random effect model, specifically the relationship between earnings quality indicators and book value, the estimated coefficients of accrual quality (AQ) and earnings persistence (EPERS) are positive but not significant. In the same way, the estimated coefficient of earnings predictability (EPRED) is negative and not significant. On the contrary, the coefficient estimate (0.061) on earnings smoothness (ESMOTH) is positive and significant, confirming that higher value of ESMOTH indicates higher value of BV.

The major outcome of the empirical analysis under this category is that earnings quality has an impact on book value of quoted companies in Nigeria. Explicitly, the estimated coefficients of accrual quality (AQ) and earnings persistence (EPERS) are positive but not significant. In the same way, the estimated coefficient of earnings predictability (EPRED) is not significant but negative. On the contrary, the coefficient estimate (0.061) on earnings smoothness (ESMOTH) is positive and significant, confirming that higher value of ESMOTH indicates higher value of BV.

Much has not been done on the effect of earning quality and book value, while some studies have argued that, there exist positive and significant relationship between firm performances and accounting information of book values and earnings, others argue on the contrary. The finding outcome is in consonance with Georgescu et al. [18] findings given what is documented in their study, that quality of book value has a positive influence on market value of listed companies in Romanian. However, the results are contrary to the finding of Obinta and Sudan [34] who examines the effect of earnings smoothing on book value and cash flow per share. The study finding reveals that earning smoothing have a negative relationship with book value. That income smoothing reduces the quality of earnings and as such lowers the book value and cash flow per share of the sampled companies.

Furthermore, our result contrast with the study of Hejazi et al. [35] who finds the firm performance is not influenced by income smoothing or earnings quality. The study finds that there were no significant differences between the performances of smoother companies and non-smoother companies on earnings quality. Similarly, the study of Nikoumaram et al. [36] finds that accounting information quality has positive relationship with book value when they considered various measure of performance. The results are also is consistent with the study of Solomon et al. [37] who find a positive significant of book value. Specifically, the study found a significant relationship between net book value per share and earnings with equity share investment in the listed companies in Nigeria. The finding could mean that the market value of as proxies with book value of quoted companies in Nigeria is influenced by the quality of earnings.

This study examined the impact of earnings quality on book values of listed companies in Nigeria, using four earnings quality attributes: (accruals quality, earnings persistence, earnings predictability and earnings smoothness). The study established that earnings quality significantly influenced book values.

The study recommends that analysts should pay greater attention of earnings quality properties especially, the magnitude signs exhibited by earnings persistence, earnings predictability and earnings smoothness. This is because their ability to forecaster lies largely on them. The investors should critically and objectively study and understand the dynamics of earnings quality proxies as a guide in making informed investment decisions and portfolios diversifications strategies particularly in time of investment uncertainties. Considering the study finding, earnings persistence revealed a negative significant influence on the market share price, making it difficult to have a predictive ability on future earnings and company likely share price. Therefore should pay more attention to the earnings consistency trend of the sampled companies.

The study contributes to the existing body literature in earnings quality and book values. It provided a clear understanding of the current state of earnings quality of the quoted companies in Nigeria for investors, analysts, and policymakers in government agencies in tax planning and economic management in checking tax evasion and capital flight activities. To the Accounting practice, this study extends the frontier of the emerging academic literature in the Accounting profession (Using full Accounting-based earnings measures (Investment Analysis).

Copyright © 2026 Research and Reviews, All Rights Reserved