ISSN: 1204-5357

ISSN: 1204-5357

Omsk State University named after F.M. Dostoevsky, 55a, Mira str., Omsk Region, 644077 Omsk, Russian Federation

Irina Georgievna GorlovskayaOmsk State University named after F.M. Dostoevsky, 55a, Mira str., Omsk Region, 644077 Omsk, Russian Federation

Andrey Alexandrovich MillerOmsk State University named after F.M. Dostoevsky, 55a, Mira str., Omsk Region, 644077 Omsk, Russian Federation

Visit for more related articles at Journal of Internet Banking and Commerce

The paper explores the challenging issue of stimulating tax revenues to regional budgets. In the course of the study, the following results were obtained: a high degree of correlation of the levels of the development of the regional economy and the securities market was confirmed, the types of functional relationships between the participants in the securities market were determined, a mechanism of the development of the securities market in the interests of the regional budget was developed, a priority model of the interaction of the participants in the securities market was built, the effect (the growth of tax revenues) of implementing the changes within the framework of the proposed mechanism was evaluated. The obtained results are recommended for use in the development of the regional economic policy and programs for the socio-economic development of regions.

Regional Economy; Securities Market; Participants in the Securities Market; Interaction Model; Investment Activity

In the current context of complex economic conditions, the relevance of the issue of stimulating tax revenues to regional budgets increases. Currently, the regions face the problem of the lack of investment resources and the low level of effectiveness of the mechanisms of accumulation and redistribution of these resources within the framework of a certain territory (region).

In the world practice, the securities market is recognized as one of the most effective mechanisms for the redistribution of financial resources necessary for the development of the economy [1,2]. A specific feature of the securities market is the multi-level nature of its functioning, i.e. within the framework of the national securities market it is possible to conventionally distinguish territorial (regional) markets. The regional securities market is understood to mean a conventionally distinguished local securities market, the functioning of which is expressed in the activity of regional participants in the securities market [3].

One of the problem of the current state of the securities market is the fact that the securities market and the regional economy act as competing spheres of investment, among which continuous redistribution of investment resources takes place, which evens up the profit rates. The reason for this situation is the speculative direction of the activity in the securities market and the lack of actual demand for the securities market instruments on the part of economic entities [4]. Regional economy acts as a sphere of the use and circulation of real capital (invested in fixed assets and advanced in current assets).

Currently, the securities market is mostly represented by the relationships concerning the circulation of securities in the secondary market [5]. That is, the regional securities market involves the circulation of financial assets associated not with an increase in the real capital of economic entities of a region, but only with the redistribution of property and non-property rights on securities [6]. As a result, financial resources, accumulated by the regional securities market, are not used for the development of the regional economy, but flow to the national level for speculative operations in the organized securities market [7]. This model of interaction actually suppresses the redistributive function of the securities market in favor of its commercial and speculative functions.

The theoretical basis of the study is the theory of finance, which makes it possible to substantiate the functional relationships between the spheres of public and private finance, the impact of the financial market on the development of the economy, as well as the functions and tasks of the securities market.

The above-stated problem is regarded as one of the most pressing in the domestic economic science: in the modern context, Russian securities market is not an effective mechanism for the redistribution of investment [8]. At the same time, both foreign and domestic scientists note a great potential of the securities market in terms of the opportunity to stimulate economic growth [9-12]. In fact, the securities market acts as an alternative to the regional non-financial sector, as it draws away a large part of financial resources [7]. Inadequate funding within the framework of the economy of the region as a whole leads to the slowing down of the rates of restructuring the regional economy. Accordingly, the primary goal of the development and improvement of the regional securities market is establishing a qualitative interaction between the regional economy and the regional securities market [13].

The methodological basis of the study is the functional and relational approach, making it possible to explore the nature and completeness of the fulfilment of the functions of the securities market from the perspective of the specifics of the activity of the participants in this market. The achievement of any result (for example, a certain level of the ability to redistribute financial resources) is a consequence of the interaction of participants in the securities market.

The influence on tax revenues to the regional budget is exerted within the framework of the proposed regional model “Securities market – Economy – Budget”. This model includes two types of interaction: “Securities market – Economy” and “Economy – Budget”. This is also reflected in the relationship between indicators. In case of the interaction “Securities market – Economy”, the indicators of the securities market (the amount of redistributed resources) are factor indicators, and the indicators of the regional economy (gross regional product and its components, as well as the cost of fixed assets) are resulting indicators. In turn, in case of the interaction "Economy -Budget”, the factor indicators are the indicators of the regional economy, and the resulting indicators are the indicators of the regional budget, i.e. tax revenues themselves.

The securities market is in the process of continuous development (both at the national level in general and at the regional level). Currently, in the scientific literature and in practice there is no single approach to grouping the factors of the development of the regional securities market and the content of these factors. Depending on the territory of the impact, factors are divided into national (influencing the development of the securities market throughout the country) and regional (influencing the development of the securities market within a specific region) [14,15]. Within the framework of a region, it was proposed to specify general and specific factors of development. General factors include economic factors, i.e. the factors determined by the functioning and development of the regional economy. Specific factors are factors determined by the specifics of the activity of the participants in the regional securities market. The specified features of the activity are able to strengthen or, conversely, reduce the degree of the impact of economic factors on the development of the regional securities market [16].

Mirkin specifies fundamental factors, influencing the securities market, at the national level. However, the scientist reveals the essence of the impact on the securities market: “the fundamental nature of the factors is manifested in the fact that they significantly influence the economic interests of entities, acting in the stock market, changing their economic behaviour on a scale, resulting in the deep changes in the securities market as a system” [17]. It is reasonable to supplement this relationship: the securities market, changed in this way, has a positive impact on the economy (at both national and regional levels), which is subsequently expressed in the growth of tax revenues to the budgets of all levels [18].

The interrelation of the levels of the development of the regional economy and the regional securities market is confirmed by empirical data. The study of the relative levels of the development of regional securities markets in the Russian Federation was carried out by determining the rank positions of regions in terms of the level of the development of the economy and the level of the development of the regional securities market. The results of the assessment make it possible to formulate two conclusions:

1. As already noted, the levels of the development of the regional economy and the regional securities market are characterized by interrelation. The value of the correlation coefficient is 86.2% (in 2008 – 88.0%), which indicates a high degree of interrelation of the levels of the development of regional securities markets and regional economies, in spite of the deviations, demonstrated by a number of federal subjects of the Russian Federation.

2. The deviations in the levels of the development of the regional economy and the regional securities market are attributable to the action of the specific factors of development, including the specifics of the activity of the regional participants in the securities market.

The results of the evaluation of the levels of the development of regional securities markets of Western Siberia are presented in Table 1. In the Republic of Altai, Novosibirsk and Omsk Regions, the level of the development of the regional securities market outruns the level of the development of the regional economy (i.e. the rank position of these regions in terms of the level of development of the regional securities market among all the federal subjects of the Russian Federation is higher than the rank position of the regional economy).

| Region code | Region | The rank of the region according to the level of the development of economy | The rank of the region according to the level of the development of securities market | The difference in ranks |

|---|---|---|---|---|

| 04 | Altai Republic | 79 | 57 | 22 |

| 22 | Altai Territory | 28 | 32 | -4 |

| 42 | Kemerovo Region | 16 | 31 | -15 |

| 54 | Novosibirsk Region | 15 | 11 | 4 |

| 55 | Omsk Region | 26 | 18 | 8 |

| 70 | Tomsk Region | 35 | 42 | -7 |

Table 1: The results of the evaluation of the level of the development of the regional securities markets of Western Siberia (ranking among all the federal subjects of the Russian Federation).

If a similar ranking is done only for the discussed regions, the differences are less pronounced. In fact, it confirms the "multi-level regionality" of the securities market: being an open system, a regional securities market goes beyond the boundaries of a particular region and transforms into an interregional securities market (i.e. a securities market of a group of federal subjects of the Russian Federation). Accordingly, within the framework of a group of regions the convergence of the levels of the development of the regional economy and the securities market is more evident (as compared to the study of all the federal subjects of the Russian Federation).

The purposeful development of the regional securities market involves the formation of the mechanism of functioning and development of the regional securities market. The essence of this mechanism resides in the strengthening of the important (for the interested parties) relationships between the participants in the regional securities market.

The mechanism of the development of a regional securities market includes the following elements:

• The goal of the development of the securities market in the region.

• Entities interested in the development of the regional securities market.

• Requirements for the model of interaction of the participants in the regional securities market.

• The priority model of interaction of the participants in the regional securities market (according to the purpose of the development of the regional securities market).

• The tools of the impact on the participants in the regional securities market and the regional market as a whole.

• A system of qualitative and quantitative indicators making it possible to assess the achievement of the goal of the development.

Currently, the most relevant is the development of the regional securities market as a source (a mechanism of redistribution) of the development of the regional economy. The implementation of this goal is focused on the economy of a region as a whole. As a consequence, the level of the business activity in a region is increased, the restructuring of a regional economy is implemented, the living standards of the population rise, the tax and non-tax revenues to the consolidated budget of a region are increased.

The implementation of the goal of the impact on the regional securities market as a factor of the development of the regional economy affects the interests of regional authorities, regional issuers, as well as the entire population and economic entities of a region. Within the framework of the priority model of the interaction in the securities market, the main type of functional relationships is the interaction of regional issuers and investors (both regional and quasi-regional) regarding the redistribution of financial resources.

One of the most important elements of the complex implementation of the goal of the development of the securities market as a source of the development of the regional economy is an active information and organizational support on the part of regional authorities [19]. The creation and functioning of a corresponding investment fund should be logically congruent with the priorities of the development of a region and the programs for the stimulation of individual branches of the regional economy, implemented in a region.

To ensure the interest of issuers (i.e. the potential investment objects of the investment fund) and potential investors in the effective functioning of the regional investment fund, it is recommended to provide for the measures aimed at tax and non-tax stimulation of the corresponding interaction between entities, which are in need for financial resources (issuers), and entities, willing to invest temporarily free funds.

In terms of the tax stimulation of enterprises – investment objects of investment funds, the most flexible taxes for solving the corresponding tasks are the corporate property tax and corporate profit tax. As the additional volume of financial resources is required mainly for the modernization of production, the increase of production capacity and other capital investments, reducing the corporate property tax rate for enterprises – objects of investment of the fund is the optimal way to stimulate the interaction between issuers and the regional investment fund. In this case, the most reasonable recommendation is to reduce the rate of corporate profit tax on the operations with equity units of regional investment funds. In this connection, it is proposed to secure at the federal level the right of regions to reduce the rate of profit tax not only for certain categories of taxpayers, but also for individual operations (in this case – for the operations with equity units of the regional investment fund). Consequently, this right should be enshrined in the Article 284 of the Tax Code of the Russian Federation.

Non-tax incentive measures include organizational and information support of issuers and investors on the part of regional bodies of executive power, subsidizing the costs of interest on credits, etc.

One more area of the development of the securities market as a source of the development of the regional economy is rendering assistance to regional issuers in entering the organized securities market. As a result of this interaction, issuers have an opportunity of the circulation of their securities in the organized market, as well as additional funding (in case of initial public offering) [20].

For the evaluation of the achievement of the set objective, it is proposed to use the following groups of indicators:

• Indicators characterizing the volume of investments and the number of investment objects;

• Indicators characterizing the quality of using investment resources.

Thus, the measures aimed at the development of the securities market as a source of the development of the regional economy are focused on creating institutional conditions for the formation of the resource base for funding the activity of regional issuers. The creation of such conditions depends primarily on the actions of regional authorities. Thus, the integrated development of the securities market of a region takes place both for the benefit of the participants in the securities market and for the benefit of regional authorities and the regional economy as a whole.

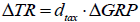

The application of the provisions of the finance theory in this study makes it possible to build the following model of the formation of tax revenues of a regional budget, reflecting the dependence of tax revenues on the value of the gross regional product (GRP) and the share of tax revenues in the structure of GRP:

(1),

(1),

where:

ΔTR – the change in the total amount of the tax revenues of a region;

dtax – actual share of tax revenues in the structure of the gross regional product;

ΔGRP – the change in the total value of the gross regional product.

The share of tax revenues in the structure of the gross regional product takes into account the revenue from both income taxes (personal income tax, corporate profit tax) and corporate profit tax. This indicator shows what part of the gross product, manufactured in the region, subsequently goes into the regional budget in the form of taxes. The value of this indicator depends not only on tax rates, but also on the effective functioning of the economy itself: the higher the average profitability of the economy of a region, the greater the volume of the total profit of the enterprises, and, consequently, the higher the income tax return.

According to the expert assessment of the Russian Venture Capital Association (RVCA), the average internal rate of return for venture investing is 35%, and in case of allocating the funds, which constitute the reserve of increasing the effectiveness of the securities market, for financing the regional economy, the payoff can be more substantial. In particular, it is proposed to determine the impact of venture funding on the development of the regional economy, using the above-stated internal rate of return. As calculation options, it is proposed to use two possible sizes of the venture investment fund: 280 mln rubles (the average size of regional venture capital funds in Russia) and the full amount of the reserve for increasing the effectiveness of the functioning of the securities market (Table 2).

| Indicator | Initial assets of the fund | |

|---|---|---|

| Option 1 280 mln rubles | Option 2 Full amount of the reserve of savings | |

| Growth of the GRP, mln rubles | 513.2 | 9,869.1 |

| Growth of the tax revenues to the regional budget, mln rubles | 39.5 | 759.9 |

Table 2: Forecast indicators of the efficiency of the development of the regional securities market (using the example of the Omsk Region).

If the first option is implemented (the establishment of a fund with an initial value of assets of 280 mln rubles), an increase of the contribution of issuers, financed from the regional venture capital fund, in the formation of the gross regional product, from 0.03% to 0.08% (2.6 times) is forecasted within the period from 2016 to 2020. The growth of tax revenues by the end of 2020 will amount to 39.5 mln rubles.

According to the second calculation option (allocating the entire reserve for increasing the effectiveness of the functioning of the securities market), the contribution of the issuers – investment objects of the regional venture capital fund in the formation of the GRP increases from 0.61% to 1.61% (also approximately 2.6 times). The resulting growth of tax revenues is 759.9 mln rubles (although the probability of the implementation of this option is minimal). For the purpose of balancing the risks of investing in venture projects, it is reasonable to distribute the investment resources between securities of a large amount of issuers from the innovation sector. Increasing the contribution of the issuers (i.e. the investments objects of venture capital funds) in the formation of the gross regional product by 2.6 times every five years is a very good indicator in the long term.

Thus, the problem of the development of the regional securities market as a source of the development of the regional economy consists in the involvement of regional issuers, investors and professional participants in the securities market in the collaboration. It should be noted that the proposed mechanism orients the participants toward the development of the securities market as a source of the development of the regional economy. The developed mechanism of the development of the regional securities market can have a large impact on the redistribution of financial resources in a region through the establishment of a regional investment fund or stimulating the issue of securities by regional issuers for further distribution of securities in the organized securities market.

Stimulating investment in the regional economy through the institutions of collective investment can have a significant positive impact on the restructuring of the economy and lay the foundations for stable socio-economic development of a region. This predictably leads to the increase in the amount of tax revenues to regional budgets. This option of stimulating tax revenues is preferable, as the point at issue is the formation of a stable (in the long term) tax base.

The work was carried out with the financial support of the Russian Foundation for Humanities, project No. 16-12-55008.

Copyright © 2026 Research and Reviews, All Rights Reserved