ISSN: 1204-5357

ISSN: 1204-5357

Natalya Nikolayevna Natocheeva*

Banking Department of the Financial Faculty, Plekhanov Russian University of Economics, Stremyanny Lane, Moscow, Russia

Yuriy Yurievich Rusanov

Plekhanov Russian University of Economics, Stremyanny Lane, Moscow, Russia

Tatiana Viktorovna Belyanchikova

Plekhanov Russian University of Economics, Stremyanny Lane, Moscow, Russia

Roman Arturovich Ter-Karapetov

Plekhanov Russian University of Economics, Stremyanny Lane, Moscow, Russia

Visit for more related articles at Journal of Internet Banking and Commerce

The article shows that at the present time an urgent scientific and practical task is to estimate the efficiency of ensuring the credit safety of a commercial bank from the impact of external and internal economic threats. The estimation depends on saving on expenditures when taking preventive and operative measures related to ensuring the credit safety and on the amount of financial direct and indirect losses during the influence of threats that have dissimilar forces and duration. Based on the results of analyzing non-performing loans, dynamics of overdue credit debts, and changing the volumes of provisions, the gradual technology of ensuring the bank credit safety and methodology of estimating its efficiency as a result of taking safety measures were offered.

Economic Threats, Credit Safety, Action Force, Indicators, Incurred Loss, Aggregated Index, Credit Safety Efficiency

Commercial banks operate under unstable external conditions: tempos of economic development decrease, and there is an ambiguous regulator’s policy and imperfection of the banking legislation. Internal threats of commercial banks have considerably increased, especially in the banking lending: there is a growth of the overdue debts in retail and corporate areas, including uncollectible debts. Banks have developed a system on ensuring the credit safety and constantly adapt it to the changing conditions of the environment. However, the efficiency of such systems is not always on a high level. For a long time researchers have been interested in the issues related to risks, threats, and ensuring economic and financial safety including in banking.

The interrelation of the credit mechanism with risks and safety threats in economy and its separate areas is stated in works of such Russian economists as Bendikov et al. [1,2], Goncharenko [3], Kolosov [4], Kostin [5], and Rusanov et al. [6]. The works of Ivanov [7], Kornienko [8], Krasnoperova [9], Savinskaya [10], and Senchagov [11] touch upon the issues on economic safety of banks. The issues on ensuring the financial safety of credit organizations and interrelation with economic threats in banks are described in research works of Alenin [12], Artemenko [13], Vysotskaya et al. [14], Gamza et al. [15-17], Grebeniuk [18], Natocheeva [19-21], Nikitin [22], Stirozhuk [23], and Tihonkov [24]. Works of such foreign researchers as Demirgus-Kunt [25], Caprio et al. [26], Cull et al. [27], Martin [28], Mannasoo et al. [29], and Tomell [30] also study the impact of threats on the banking sector.

However, at the present time there are few works directly devoted to studying methodologies of efficiency related to ensuring the credit safety of banks, as well as choosing ways to improve it.

According to the authors, the bank credit safety is the state of the protected functioning of a commercial bank in the areas of customers’ crediting that guarantees the minimization of a loss from internal and external economic threats. An economic threat to the bank credit activity is interpreted as a credit risk of such volume whose implementing will cause quantitative, and what is the main, qualitative changes in the bank functioning.

The authors offer to classify economic threats of the bank credit activity into three categories depending on the levels of the bank activity: levels of international, national, and internal credit safety.

It is possible to refer threats affecting the credit activity of the bank beyond the country to the threats acting on the level of international credit safety of the bank. They include the limitations of the national banks’ access to credit resources on international markets, decrease in the credit rating of banks, and national banking system.

Threats acting on the level of the national credit safety of banks include threats that are external in relation to banks but operating on the macro-level within the country. Here we can mention the following threats: a decrease in the tempos of the economic development of the country, a low level of the national financial market development, inequality of regional banks development, insufficient level of borrowers’ profitability, etc.

It is possible to refer the threats that affect the internal processes of the bank to the threats acting on the internal level of the credit safety of banks. The following threats can be indicated here: a low quality of credit operations, inefficient conducting of the credit process, a risky credit policy, a low level of management in the credit area of the bank, inefficient formation and structuring of the loan portfolio, and a low quality of bank assets in credit resources.

According to the authors, the international (national, internal) credit safety of the commercial bank is a protected state of the bank crediting operation when the losses from international (national, internal) threats are minimized. Every level of the credit safety has its own indicators. Actual values of indicators of the credit safety may be found within higher or lower of the recommended values. Herewith, the surpassing boundaries may say about the presence (increase, decrease) or lack of the threat in the bank credit activity.

Depending on the quantity and boundaries of the indicators of the bank credit safety in relation to the recommended values, three variants of its credit safety may occur: full, partial, or lack of the credit safety of the bank.

Full credit safety corresponds to such general level of the credit safety when all actual indicators are found within the recommended values.

The minimum level of the bank credit safety corresponds to such general level of credit safety when all actual indicators are not found within the recommended values. Herewith, there is a considerable difference between the actual and recommended values.

Partial credit safety of the bank says about the presence of at least two types of its credit safety: international and internal, national and internal. The internal credit safety is obligatory. On the contrary, it is possible to say about the lack of the bank credit safety.

The authors believe that economic threats differ according to the growth intensity and impact results. The intensity of the economic threat growth is its quantitative characteristic that includes three components: speed of the threat growth, frequency of the threat occurrence for the specific period of time, and scale of the threat occurrence according to the amount of the incurred loss. The result of the economic threat affect is its quantitative characteristic that defines the type of the incurred loss. Table 1 shows quantitative and qualitative characteristics of threats according to the growth intensity and impact results.

Table 1: Quantitative and Qualitative Characteristics of Threats According to Growth Intensity and Impact Results.

| Threat indicators | Indicator essence |

|---|---|

| Intensity of economic threat growth | |

| Speed of threat growth | Duration of negative changes of actual indicators of the credit safety of the bank for the specific period of time (hours, days) |

| Frequency of threat occurrence | Period of time between the end of one threat effect and the occurrence of the next threat (days, months, years) |

| Scale of threat occurrence | Amount of the loss incurred by the threat (RUB, thous.) |

| Result of the threat impact | |

| Character of the incurred loss | Renewed or inadmissible loss |

| Compiled by the authors | |

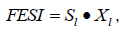

The force of the economic safety impact (FESI) combines one component of the quantitative characteristic of the threat and one component of its qualitative characteristic: scale of occurrence and character of loss, i.e. the amount of the loss and its character:

(1)

(1)

where Sl is a amount of the incurred loss (loss amount, RUB, thous.),

Xl is a numerical coefficient that shows the character of the incurred loss (renewed, inadmissible).

The authors interpret the force of the impact of the economic threat in the credit activity of the bank as an amount and character of the threat that resulted from the occurrence of a specific threat level. We will conditionally classify the force of the impact of the economic threat of the credit safety into three types according to the amount and character of the loss: inconsiderable, considerable, and destroying impact (Table 2).

Table 2: Gradation of Bank Credit Safety Intensity (Impact Force) According to Amount of the Incurred Loss.

| Force of the impact of the threat related to the bank credit safety | Loss amount |

|---|---|

| Inconsiderable | Inconsiderable renewed (replenished) loss |

| Considerable | Considerable renewed (replenished) loss |

| Destroying | Non-renewed (non-replenished) loss |

| Compiled by the authors | |

An inconsiderable impact of the economic threat of the bank credit safety comes with its financial losses related to monetary funds provided by the bank to the borrower as a loan. As a rule, these financial losses are stipulated by a partial non-repayment of the granted monetary funds.

A considerable impact of the economic threat on the bank credit safety comes with the bank’s considerable loss of monetary funds provided by the bank to the borrower as a loan, heavy expenses for renovating the credit activity, and compensating financial losses in the credit area of the bank.

A destroying impact of the economic threat on the bank credit safety comes with such financial losses for it that causes the bank bankruptcy. Here financial losses are related to full non-repayment of the monetary funds provided by the bank to the borrower as a loan, unreal expenses for renovating the bank activity not only in the credit activity but also in functioning, as a matter of principle, and full loss of the missed profit.

When researching the impact of threats on the credit activity of banks, the authors used analytical and statistical, comparative methods, as well as methods of grouping and ranging, structuring, synthesis, generalization, and economic and mathematical methods. Economic threats that affect the credit activity of Russian commercial banks are mainly defined by the quality of the corporate loans portfolio. As on 01.01.2015 their share was 57% of the total volume of the granted loans.

According to the data of the report provided by the Bank of Russia [31], the overdue indebtedness for corporate loans increased by 33.9%, with a growth of the provided loans by 31.3% [31]. The ratio of the overdue indebtedness was 4.2%.

In 2015 according to the regulator’s data [31], Russia displayed the moderate tempos of the crediting growth: the aggregate amount of credits in the economy (for non-financial organizations and individuals) increased by 7.6% (by 25.9% in 2014) and was RUB 44.0 tn. As on 01.01.2016 the indebtedness related to the loans to small and medium-sized entrepreneurship was RUB 4.8 tn or 14.5% of the aggregated corporate loans portfolio of banks. As on 01.01.2016 in per year terms the amount of loans to small and medium-sized entrepreneurship decreased by 5.7% (by 0.8% in 2014). For the loans in rubles this indicator increased from 4.9% as on 01.01.2014 up to 5.4% as on 01.01.2015, and for the loans in foreign currencies it decreased from 1.9% down to 1.7%. It proves that borrowers experienced the increased difficulties in repaying loans with the interests. In 2015 the amount of indebtedness related to mortgage residential loans (MRL) increased by 12.9%, up to RUB 0.4 tn. The indebtedness related to loans in rubles still dominates – RUB 3.9 tn. During 2015 about 700 thous. mortgage loans were provided. Overdue debts say not only about the worsening of the loan portfolio quality and growth of the threats impact on the credit activity of banks but also about an increase in the banks’ problems related to the liquidity because such situation contributes to the growth of the provisions for possible losses from loans formed by banks. Table 3 shows the dynamics of the provisions for possible losses for “bad” loans in percent from the total volume of these loans.

Table 3: Dynamics of Share of Non-Performing Loans in Russian Banks in Total Volume of Loans, %.

| Date | 01.01.14 | 01.04.14 | 01.07.14 | 01.09.14 | 01.01.15 | 01.01.16 |

|---|---|---|---|---|---|---|

| Loans to legal entities | 68 | 66 | 59 | 60 | 65 | 66 |

| Loans to individuals | 78 | 76 | 77 | 79 | 82 | 83 |

| Changes in the amount of provisions for the corporate overdue indebtedness, % | - | 97.0 | 86.7 | 101.6 | 112.3 | 101.2 |

| Changes in the amount of provisions for the retail overdue indebtedness, % | - | 111.8 | 108.2 | 104.3 | 102.1 | 102.8 |

| Compiled by the authors according to the data [31] | ||||||

Table 3 shows that the amounts of the provisions to cover the corporate indebtedness most of all changed at the beginning of 2015, and provisions for the retail overdue indebtedness had changed in April of the reporting year – 2014. As on 01.01.2015 the standard of the maximum amount of loans, security bonds and bank guarantees provided by the credit organization (bank group) to its members (shareholders) (N9.1) included 306 credit organizations, or 36.7% of the operating ones (as on 01.01.2014 – respectively 338 credit organizations or 36.6%) [31].

The standard was violated by 6 credit organizations (in 2013 – 3). The total number of violations during the year was 84 against 144 in the previous year [19]. Non-repayment of loans by subjects of the economy contributes to financial losses of commercial banks and their loss-making activity.

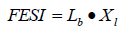

In the formula related to the force of the economic threat impact (Formula 1), the amount of the incurred loss (the loss amount) Sl corresponds to the material factor (ÃÂÃÅ) , and the numerical coefficient that reflects the character of the incurred loss (renewable, inadmissible Xl – to the main danger indicator (F) . It is possible to transform Formula (1) as follows:

(2)

(2)

The main danger indicator changes from 1% to 100%. If the impact of the threat is inconsiderable, the main indicator is 1%. The material factor, i.e. the incurred loss will also be inconsiderable [32]. The character of the loss depends on the intensity of the threat impact force. If the threat impact is considerable, the loss may grow from 50 to the total amount of the provided loans. If the threat impact is destroying, full loss is possible, i.e. direct loss of all loaned funds, as well as direct losses related to the loss of profits, fees, etc.

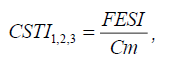

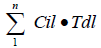

Let’s introduce the indirect losses coefficient (Cil) that in case of the inconsiderable impact of the threat will be 1.0 – 1.05. In case of the considerable threat impact it will be within 1.06 – 1.50, and in case of the destroying impact of the threat it will be 1.51 and more. This coefficient of losses must be taken into account in case of the threats impact and when calculating the loss. The credit safety threats index (CSTI) of the bank can be defined by using the following formula:

(3)

(3)

Where Cm is a coefficient of the threat monitoring.

Coefficient of the threat monitoring has limitations from 1 to 3. CSTI1 means the index of the internal credit safety of the bank, and CSTI2 and CSTI3 I- the indexes of the national and international credit safety respectively. The total index of the credit safety of the commercial bank is defined as the average weighted value of indices according to various levels of the credit safety: DICST - destroying impact of the credit safety threat, IICST - inconsiderable impact of the credit safety threat, and PICST – partial impact of the credit safety threat.

In order to overcome threats related to the credit safety of commercial banks and in accordance with the set tasks that provide prevention and forecasting of threats, as well as development and taking measures on operative reaction of the existing threats on the credit safety of commercial banks, taking into account the impact of threats, it is reasonable to develop the relevant measures.

Measures on overcoming threats of the credit safety can be taken according to two directions: preventive measures and operative reaction. It is reasonable to take preventive measures in case of a slow growth of the threat at all stages of its impact where there is time to correct the credit activity of the commercial bank and take the relevant management decisions. The measures related to operative reaction are taken in case of a quick growth of the threat. That is why it is necessary to adequately and quickly react and take operative management decisions related to the existing threat of the credit safety of commercial banks.

When ensuring the credit safety of the bank, it is necessary to comply with the gradual technology (Table 4).

Table 4: Gradual Technology of Ensuring Credit Security of Commercial Bank.

| Stage | Stage characteristics |

|---|---|

| Stage 1 – indicators and their monitoring | Defining fluctuations of the actual values of indicators – indicators according to the types of credit safety: internal, national, international - from the recommended values Monitoring of indicators according to the area of the threats growth taking into account the force of their impact |

| Stage 2 – indices according to types of the credit safety | Calculation of credit safety indices according to their types: index of internal, national, international safety taking into account the monitoring coefficient |

| Stage 3 – total index of the credit safety | Calculation of the total index of the credit safety on the basis of the indices according to levels of credit safety |

| Stage 4 - measures | Defining preventive safety measures or measures on operative reaction |

| Stage 5 – financial losses | Calculation the amount of financial losses (direct and indirect) from threats taking into account the taken measures |

| Stage 6 – economic effect | Defining the economic efficient of ensuring the credit safety: - full in case of providing and interrelation of all its components (internal, national and international), - partial in case of ensuring only internal and national, internal and international or only internal credit safety. |

| Compiled by the authors | |

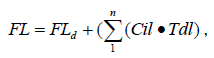

The calculation of the amount of financial losses (direct and indirect) from the occurrence of threats taking into account the taken measures includes defining financial losses that can be direct and indirect. It is possible to define financial losses taking into account the coefficient of indirect losses according to the following formula:

(4)

(4)

where Tdl is direct financial losses,

Cil is a coefficient of indirect losses, and

is a sum of indirect financial losses.

is a sum of indirect financial losses.

In order to define the level of financial losses under various variants of the threat impact, we will represent the correlation of losses under the considerable (Tci) and destroying (Td max) impact to the minimum losses under the inconsiderable impact of the threat and in case of any kind of the credit safety (Table 5).

Table 5: Level of Financial Losses in Case of Various Variants of Threats Impact on Bank.

| Level of losses | Inconsiderable | Considerable | Destroying |

|---|---|---|---|

| Td min =1 |  |

- | - |

| Tci =1.01–3.0 | - |  |

- |

| Td max =3.01 and more | - | - |  |

| Compiled by the authors | |||

Table 5 shows that the minimum level of financial losses corresponds to the inconsiderable impact of the economic impact, and the maximum level – to the destroying impact of the threat. In other cases the level of financial losses will be medium but differentiated as well, being closer to the minimum or the maximum level.

In order to estimate the tightness of the interrelation between the level of financial losses and aggregated index of the credit safety, we will use the Chaddock correlations (Table 6).

Table 6: Tightness of Binding Force of Correlation Indices.

| Rather tight relation | Tight relation | Noticeable relation | Moderate relation | Weak relation |

|---|---|---|---|---|

| 0.9-0.99 | 0.7-0.9 | 0.5-0.7 | 0.3-0.5 | 0.1-0.3 |

Table 7 shows the interrelation of financial losses and aggregated index of the credit safety of the commercial bank.

Table 7: Interrelation of Financial Losses and Aggregated Index of the Credit Security of Commercial Bank.

| Tightness of the force of the relation of the aggregated index and financial losses | Aggregated total index of threats of the credit safety of the bank | Level of financial losses |

|---|---|---|

| 0.9-0.99 | DICSTt | Td max |

| 0.7-0.89 | PICSTt | Tci |

| 0.5-0.69 | ||

| 0.3-0.49 | ||

| 0.1-0.29 | IICSTt | Td min |

| Compiled by the authors | ||

Table 7 shows that the maximum value of the level of financial losses will correspond under rather tight relation of the aggregated total index of threats of the bank credit safety, and the minimum level of losses will be respectively under the weak relation of this index with the losses.

In our opinion, the actual level of financial losses under the impact of economic threats on the level of the credit safety of the commercial bank will differ from the one suggested above. The matter is that when defining the actual values of indicators, their monitoring and fulfilling of various measures of the function of various departments and services intercross. It is necessary to exclude doubling of functions of departments on defining the actual values of indicators and their monitoring, for example, at the stage of the inconsiderable impact of the threat all indicators are monitored only by the credit department, at the stage of considerable and destroying impact of the threat it is also done by the internal control service and security service. The situation is analyzed, above all, by the analytical department but not the credit department of information security service. The analytical department is assisted by the legal department, especially at the stages of considerable and destroying impact. The general situation on the national and especially global markets of the loan capital is monitored by the planning and forecasting department, and threats department. Due to a more accurate division of functions on defining values of indicators and their monitoring, the expenses for the relevant measures are reduced. This is the economy on expenses when taking measures (Ee). Besides, it is possible to save money when taking preventive measures and especially measures related to the operative reaction if preventive measures are taken qualitatively and fully. This economy is possible, first of all, in case of using the partial aggregated index of threats of the bank credit safety.

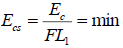

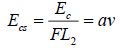

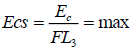

The efficiency of ensuring the bank credit safety (Ecs) for any of its types can be defined by using the following formula:

(5)

(5)

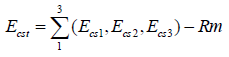

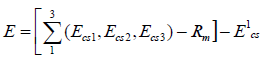

The total efficiency of ensuring the credit safety of the bank will be defined as a difference between the value of the sum of efficiencies of ensuring the credit safety on various levels, and the expenses for taking measures. It is calculated by using the following formula:

(6)

(6)

Where Ecs1,2,3 is the efficiency of ensuring internal (national, international) credit safety, Rm is a ratio of expenses for ensuring the credit safety and eliminating of doubling of functions in the bank in the total volume of its expenses and talking measures.

The interrelation of the efficiency related to ensuring the credit safety and aggregated index of threats taking into account the data of financial losses  is shown in Table 8.

is shown in Table 8.

Table 8: Interrelation of Efficiency Related to Ensuring Credit Security and Aggregated Index of Threats.

| Aggregated index | Efficiency of ensuring the credit safety |

|---|---|

| DICSTt |  |

| PICSTt |  |

| IICSTt |  |

| Compiled by the authors | |

In Table 8 the highest efficiency corresponds to the index of credit safety threats under the inconsiderable impact of the danger, and the lowest efficiency – under the destroying impact. This statement is related to any type of the credit safety, but first of all to the credit safety. As for ensuring the credit safety as a whole in the commercial bank, the full effect will be achieved in case of ensuring three types of credit safety – internal, national, and international; and partial effect will be achieved in case of partial ensuring of credit safety; and the minimum effect – in case of non-ensuring of the bank credit safety.

In order to define the economic effect as a result of ensuring the credit safety of the bank as a whole and according to all three areas, or partially - only according to two areas, it is reasonable to define the difference between the total efficiency of the credit safety (Ecs) before taking measures, and after preventive and operative measures, as well as using methods, instruments and layers:

(7)

(7)

where E1cs is the efficiency of the total credit safety of the bank before taking preventive and operative reaction measures.

As a result of the research devoted to ensuring the credit safety of the commercial bank, the following results were obtained.

In the system of ensuring the safety of the bank operation, it is reasonable to distinguish its credit safety that protects the bank from economic threats and guarantees the minimum harm when they occur. The authors have come to the conclusion that the threat is a risk of such amount that, when occurring, may cause qualitative changes in the credit activity of the bank. When detailing processes related to protecting from threats, the authors offered to classify them into three levels according to the types of the bank activity: international, national, and internal. Every level has its own threats in the bank activity and, consequently, processes of protecting from them must be also relevant. The authors offer to differentiate the process of ensuring safety in the credit activity of the bank on the basis of the values of indicators because the bank protection may differ: full, partial, or lack of safe protection of the bank in the credit activity.

The authors offered a qualitative characteristic of threats according to their growth intensity and qualitative characteristic according to the nature of the incurred loss that depends on the force of the threat impact (it can be replenished and non-replenished).

Based on the results of the analysis of the banks’ credit activity over the recent three years, the authors revealed tendencies of changing the overdue credit debts and changes of the amounts of provisions formed for them.

The authors offered the gradual technology of ensuring the credit safety of the bank from monitoring the indicators values to calculating the economic effect from taking preventive and operative measures on preventing the impact of economic threats. The formalized approached enabled the authors to define the interrelation of the efficiency of ensuring the credit safety and aggregated index of threats. This efficiency depends on the economy of expenses for ensuring the credit safety and financial losses from the impact of threats of various force, area and time of impact.

The general efficiency of ensuring the credit safety of the bank is defined by its efficiency on every level and the expenses for the credit safety.

The economic effect is calculated as a difference of values of the general efficiency related to ensuring the credit safety before and after the preventive and operative measures.

When researching economic threats and their impact on ensuring the credit safety of the commercial bank, disputable issues and problems that are to be solved occurred. The modern economic literature does not accurately define a threat. Opinions as for its disclosing and estimating differ, too. Some define a threat as a “combination of factors and conditions that make up a danger of infringement on normal functioning of subjects” [4]. Other researchers think that a threat is defined as “a sort of a loss, whose integral indictor characterizes the degree of the economic potential decrease for a specific period of time” [8]. Some state that “a threat is the most specific and direct form of danger” [3]. A threat is often identified with a risk. Some researchers think that “it is reasonable to distinguish a threat as a direct danger that requires a quick reaction from a risk as a possible danger that requires preventive measures and an exposure as an indicator of the safety state that say about its potential unprotecting. An economic safety threat is a subsystem of threats of national safety” [5]. As for the bank risk, researches define it as “a possible danger for various interests of the bank” [15,16], and the bank threat - as “a risk whose occurrence causes huge financial losses and damage, and inadmissible qualitative consequences” [19]. We share the authors’ opinions that the occurrence of bank risks and threats cause financial losses and destructive changes in the banking business.

The opinion of researchers as for the classification of economic threats is ambiguous, too. The estimation of the existing classifications of economic threats of commercial banks showed that in the majority of cases threats were classified into external and internal. Some researchers think that internal threats are of top priority in such classification. Their share is “on average 71%, while the internal threats account for only 29%” [22]. In this case, there is a conclusion that the problems roots are within banks themselves, i.e. they are caused by internal sources of threats and their safety. Other researchers classify threats into general and specific, in addition to external and internal ones. For example, researchers refer “destructive threats in the area of settlements and payments, as well as in banking crediting” [12] not to general threats, but specific ones that are peculiar of specific banks or even their structural subdivisions.

To our mind, it is impossible to categorically determine the priority of external and internal threats, because by giving priority to some sources of threats occurrence we detract either the role of the bank as an intermediary on the financial market, or the role of internal security services of the credit organization. The approach to solving this problem must be comprehensive, integrated and stipulated, because external and internal threats may inflict harm. However, it is reasonable to classify threats into external and internal from a different angle. The bank almost cannot influence external threats, but it can forecast them. As for internal threats, the credit organization can weaken their effect.

As for the efficiency of ensuring the bank credit safety, here positions of researchers are not identical. The majority of them think that the process of ensuring safety will be efficient if preventive measures more than measures of operative reaction are used. The authors share this point of view, i.e. the bank must be ready for the impact of economic threats. However, threats may occur unexpectedly. That is why it is also necessary to develop and take operative measures in the bank to ensure the credit safety. This is the reason why the main goal of the research was to improve the efficiency of ensuring the bank credit safety on the basis of the comprehensive approach when carrying out theoretical developments and offering practical recommendations.

Thus, when making the research we made the conclusions on theoretical developments in the area of credit safety related to the notions and terminology of the bank credit safety, its types, characteristics, interrelation with the impact of economic threats and formation of a system of indicators whose monitoring allows to estimate the current situation and to take the relevant measures and management decisions.

In order to minimize the consequences of the economic threats impact on the credit activity of the bank, we have offered a methodology of estimating the efficiency of the bank safety in crediting. The latter lies in the positive relation of economy in the expenses for safety measures to the amount of financial losses, as well as the calculation of the economic effect from taking measures on credit safety by defining the difference between the efficiency of the credit safety before and after taking such measures. The methodology was successfully tested in several commercial banks of Moscow.

The research is financed within the Grant from the funds of the “Plekhanov RUP” Federal State Budgetary Educational Institution of the Higher Professional Education “Plekhanov Russian University of Economy” for conducting the research work on the theme “Managing Financial Safety of Russian Commercial Banks”.

The authors express their gratitude to the management for supporting: Prorector Professor Grishina O.A., Scientific Supervisor of the University Professor Valentey S.D., and Head of the Banking Faculty Professor Rovenskiy Yu.A. The researchers were assisted in collecting materials. They obtained expert, organizational, and technical help from teachers of the Banking Faculty Professor Bunin G.A. and Associate Professor Badalov L.A. The authors were consulted in specific issues of the research related to insurance and risks by Professor Ahvlediani Yu.T.

The authors express their gratitude for considerable support provided during this research by Vice-President of the Association of Russian Banks Professor Kievskiy V.G. as consultations, expert opinions and materials provision.

Copyright © 2025 Research and Reviews, All Rights Reserved