ISSN: 1204-5357

ISSN: 1204-5357

Kiran Jindal

Department of Commerce, MCM DAV College for Women, Chandigarh, India

Hasrat

Department of Commerce, MCM DAV College for Women, Chandigarh, India

Visit for more related articles at Journal of Internet Banking and Commerce

In recent years, digitalization has grasped almost whole of the world. So, the banking sector could not be left behind. Cashless banking is the need of the hour and all the banks need to catch up with that. HDFC Bank being the leader in private sector aiming at providing ‘World Class banking’, has come up with various digital banking facilities like net banking, payzapp, chillr, etc. But to capture the interest of the market, there is a requirement to establish a strong digital footprint in the market, on which this research paper focuses on. This paper is based on an empirical study to check the awareness and preference of people for HDFC Banking products.

Digitalization; Digital Banking; Net Banking; HDFC Bank; Banking

The changing habits of consumers and the new competitive environment are forcing technology to change on daily basis so as to survive in the market with a reasonable profit. The banking sector has also become a part of race by addressing the digitalization process as a matter of urgency. This sector also does not want to be left behind in a market where it finds itself in the full forms of transformation. Banks are not known to be fast movers in general. But with the ever growing competition within the industry; they, especially the private sector banks, had initiated the facilities of digital banking. The various banks are responding to this digital challenge by using different approaches and at varying speeds but all companies don’t understand what it means to transform into a digital bank in the same way. They have introduced various innovative methods of doing banking with a click and make it hassle free. Now there is no need to visit the bank branch for petty information like knowing the account balance or to seek advice for investment. Phone banking, net banking, and mobile banking all are made available by different banks for easier access. The ATMs have also been installed in distant areas where previously the banking facilities were hardly found. Plus the initiation of smart cards like debit card or credit card, making recharge and bill payments effortlessly while sitting in the comfort of homes and some better offers and discounts are made available to customers as a part of such digital banking facilities. The public sector banks have been in a very stagnant position with a low turnover. But now they have also started to follow the lead of private sector banks in adopting the digital banking system in Indian financial market. From net banking to e-wallets, all of these have been introduced and is being embraced by the public at large.

Even though digitalization has created a sense of freedom in the banking services but there are still some security issues which resist a part of the population from using digital banking. Another major reason of resistance to digital banking is the lack of computer related knowledge and discomfort of using these facilities by the uneducated people. Keeping aside the limitations which could be handled in the long run, cashless banking is the need of the hour and all the banks need to catch up with that. There is something of a consensus that the concept of digital banking above all applies to retail banking. It is generally expected that digital banking will give priority to the needs of every end customer for whom the customized product is created. Therefore, the awareness of retail customers should be checked and their problems should be addressed properly to ensure the success of digital banking.

A number of studies have been carried out by the banks in particular and researchers in general, to check the awareness and preferences of retail customers towards digital banking products. To quote a few, Milind conducted a study to measure the factors affecting the adoption of Internet banking by Australia. Taking the sample of individual residents and business firms in Australia, he concluded that security concerns and lack of awareness were major obstacles to the adoption of Internet banking in Australia [1].

Mittal and Rajeev studied E-CRM in Indian Banks. The study highlighted the importance, current status of E-CRM, techniques used by banks in India and its future prospects. It was concluded that for high end products, customer cannot rely only on e-banking whereas for social interactions, people would like to visit their traditional brick and mortar branches. The success of e-CRM depends upon the development of robust and flexible infrastructure, e-commerce capabilities, reduction of cost through higher productivity, lower complexity and automation of administrative functions [2].

Avinandan studied the role of interactions of a retail bank with its customers on various dimensions of online banking. Using sample of 510 Internet users of various profiles in India, he observed that shared value is most critical for developing trust as well as relationship commitment. Highlighting the fact that communication has a moderate influence on trust, the study also concluded that opportunistic behavior has significant negative effect [3].

Sadique and Sankar conducted a study aiming at evaluating the service quality of internet banking (e-banking) services in India from customer's perspective. A structured questionnaire containing 44 quality items is administered to various target groups. Seven quality dimensions, viz. reliability, accessibility, user-friendliness, privacy/security, efficiency, responsiveness and fulfilment were also identified based on principal component factor analysis. The results of the study showed that customers were satisfied with quality of service on dimensions such as reliability, accessibility, privacy/security, responsiveness and fulfilment, but least satisfied with the 'user-friendliness' dimension [4].

Ruby and Pankaj studied the problems and prospects of E-Banking while focusing on the advantages and the risks arising due to growth of electronic banking. Using secondary source of information, the study concluded that E-banking offered a higher level of convenience for managing finances of everyone. However, it continued to present challenges to the financial security and personal privacy as many people have had their account details compromised, as a result of online banking [5].

Ankit and Singh conducted a study to analyses the impact of technology acceptance model (TAM) in the context of internet banking adoption in India under security and privacy threat. Keeping the TAM proposed by Davis as a theoretical basis, the paper revealed that perceived risk had a negative impact on behavioural intention of internet banking adoption and trust had a negative impact on perceived risk. A well‐designed web site was also found to be helpful in facilitating easier use and also minimizing perceived risk concerns regarding internet banking usage [6].

Simeon and Bamidele examined the implications of cashless banking on the Nigerian economy while employing aggregated approach. Employing descriptive statistics to highlight the effectiveness of the cashless policy of the CBN in Nigeria, the study concluded that the shift towards a cashless Nigeria seemed to be beneficial though it came with high level of concerns over security and management of cost savings resulting from its implementation [7].

Vishal et al. studied perceptions and opinions of urban mobile banking users for mobile banking in India focusing on practices, challenges and security issues related to it. Using quota sampling of 50 users and 50 non-users of Ghaziabad city, the study showed that ‘mobile handset operability’ was an important issue in mobile banking due to availability of various handset models supporting different type of technology in the market [8].

Rambalak and Swaroop conducted a study on private and public sector banks in India to measure environmental sustainability through green banking. For this purpose, the top performing banks (on the basis of net profit) from private and public sector were taken into consideration. Using secondary data, the study concluded that most of the banks were adopting and focusing only on those green initiatives which provides win-win situation for the bank [9].

Chandrawati and Pandey conducted a study to identify drivers of Digital Banking Transformation for Indian bank. E-Technology has become a tool that facilitates banks’ organizational structures, business strategies, customer services and related functions. Using exploratory research, the study concluded that digitalization changed the face of branch banking and mobile was being increasingly used as a primary channel of banking. Moreover, integration with social media components as their online channels was also a major driver for digital banking transformation [10].

Sahu and Kumar studied the important factors responsible for successful implementation of digital payment (e-Payment) system in India. Conducting a qualitative study with extensive literature review and using interview and expert opinion, 13 success factors namely Anonymity, Bank Involvement, Drawer, Infrastructure, Mobility, Parties, Popularity, Range of Payment, Risk, Security, Transfer limit, Transfer mode, and Transfer time were responsible for successful implementation of digital payment at Allahabad city [11].

A large no of studies have been carried out by the researchers across the globe to measure the impact of digitalization on banking sector. However, the studies related to the digital products of a particular bank are not that much in fashion. HDFC Bank, being the leader in private sector banks, aiming at providing ‘World Class banking’ has come up with various digital banking facilities like net banking, mobile banking, payzapp, chillr app, POS machine etc. These facilities have helped the bank to create loyal customer for the bank and also to grasp a major market share in India. Therefore, this study is focusing on the digital banking products offered by HDFC bank. This research paper is based on the preferences of the customer of HDFC bank regarding digital banking and also to check their awareness about the digital facilities provided by the bank.

The objective of the study is to get a better view of customer preferences regarding banking operations and also to make them aware about the digital services and facilities offered by HDFC bank so that a strong digital footprint can be established by the HDFC bank in the market.

The study is based on primary data. The descriptive research design is used to find out the perceptions of potential and actual customers of HDFC. The target population is taken as all the residents of tricity (i.e., Chandigarh, Panchkula and Mohali). Judgmental (non-probability) sampling method is used to select 133 customers and non-customers of various professions and age groups as the respondents. The data was collected by conducting a survey using questionnaire that was designed to collect information regarding digital banking facilities provided by HDFC bank. Comments of respondents through open ended questions were also recorded for understanding the opinions and expectations of consumers. Thus, the questionnaire is both subjective as well as objective in nature. For data analysis, chi-square test, descriptive statistics and pie-charts have been used through Statistical Package for the Social Sciences (SPSS).

Data Analysis and Interpretation

Firstly, the reliability test of the questionnaire for establishing a strong digital footprint for HDFC bank was carried out. It was performed on 14 questions of the questionnaire. Cronbach's alpha is a measure of internal consistency (reliability) that is used on multiple Likert scale questions used in the questionnaire. It is calculated to determine whether the scale is reliable. Table 1 shows the value of alpha as 0.807 which indicates a higher internal consistency for the scale used in the questionnaire.

Table 1: Reliability Statistics.

| Cronbach's Alpha | Cronbach's Alpha Based on Standardized Items | No. of Items |

|---|---|---|

| 0.711 | 0.807 | 14 |

Descriptive Statistics

Table 2 shows the descriptive statistics of the respondents. Out of 133 respondents, 76 (i.e. 57.1%) respondents are male and 57 (i.e. 42.9%) respondents are female. 2.3% of the respondents are in the age bracket of below 18 years, 63.2% of the respondents are in the age bracket of 18-29 years, 27.8% of the respondents are in the age bracket of 30-49 years, 2.3% of the respondents are in the age bracket of 50-59 years and there are 4.5% respondent above 60 years of age. 6.8% of the respondents are businessmen, 39.1% of the respondents are in a service, 2.3% of the respondents are housewife, 45.1% of respondents are students and 6.8% of the respondents belong to others category. Out of 133 respondents, 79 respondents (i.e.59.4%) are having banking with HDFC Bank whereas 54 respondents (i.e., 40.6%) are non-customers of HDFC Bank.

Table 2: Descriptive statistics of respondents.

| Descriptive | Frequency | Percent | |

|---|---|---|---|

| Gender | Female | 76 | 57.1 |

| Male | 57 | 42.9 | |

| Total | 133 | 100.0 | |

| Age | Below 18 | 3 | 2.3 |

| 18-29 | 84 | 63.2 | |

| 30-49 | 37 | 27.8 | |

| 50-59 | 3 | 2.3 | |

| 60 and above | 6 | 4.5 | |

| Total | 133 | 100.0 | |

| Occupation | Businessman | 9 | 6.8 |

| Service | 52 | 39.1 | |

| Housewife | 3 | 2.3 | |

| Student | 60 | 45.1 | |

| Other | 9 | 6.8 | |

| Total | 133 | 100.0 | |

| Customer | Yes | 79 | 59.4 |

| No | 54 | 40.6 | |

| Total | 133 | 100.0 | |

Banks Preferred other than HDFC Bank

The respondents when asked to name the other banks in which they have their accounts other than HDFC Bank. They were given the option to choose more than one bank as per applicability on them. The majority of the respondents, i.e. 28.1%, selected State Bank of India which constitutes 43 out of 153 respondents followed by Punjab National Bank with 15.7% (24 out of 153 respondents). It means the customers still prefer Government banks over Private Banks (Tables 3 and 4).

Table 3: Preferred banks of respondents.

| Preferred Banks | N | Percent |

|---|---|---|

| SBI | 43 | 28.10% |

| PNB | 24 | 15.70% |

| Yes bank | 9 | 5.90% |

| Axis bank | 11 | 7.20% |

| ICICI bank | 12 | 7.80% |

| Canara bank | 7 | 4.60% |

| Bank of baroda | 1 | 0.70% |

| Union bank | 5 | 3.30% |

| IDBI bank | 3 | 2.00% |

| OBC | 4 | 2.60% |

| Kotak mahindra | 2 | 1.30% |

| Vijaya bank | 2 | 1.30% |

| Central bank | 2 | 1.30% |

| Punjab gramin | 3 | 2.00% |

| Syndicate bank | 1 | 0.70% |

| Cooperative bank | 2 | 1.30% |

| Punjab and sind | 1 | 0.70% |

| Dena bank | 1 | 0.70% |

| Paytm | 2 | 1.30% |

| None | 18 | 11.80% |

| Total | 153 | 100.00% |

Table 4: Frequency of bank visit.

| Frequency of visit | Frequency | Percent | Cumulative Percent |

|---|---|---|---|

| everyday | 2 | 1.5 | 1.5 |

| every alternate day | 2 | 1.5 | 3.0 |

| twice a week | 4 | 3.0 | 6.0 |

| once a week | 12 | 9.0 | 15.0 |

| thrice a month | 8 | 6.0 | 21.1 |

| twice a month | 22 | 16.5 | 37.6 |

| once a month | 27 | 20.3 | 57.9 |

| less than once a month | 48 | 36.1 | 94.0 |

| Never | 8 | 6.0 | 100.0 |

| Total | 133 | 100.0 |

Frequency of Bank Branch Visit

When asked about the frequency of branch visit, maximum respondents choose less than once a month with 36.1% (i.e. 48 out of 133 respondents), once a month with 20.3% (i.e. 27 out of 133 respondents), twice a month with 16.5% (i.e. 22 out of 133 respondents), 9% saying once a week, 6% for thrice a month, 3% twice a week and everyday and every alternate day standing at 1.5% each.

When the visit frequency was compared within the customers and Non-customers of HDFC bank, maximum number of respondents visited their bank branch less than once a month with customers being 28 out of 79 and non-customers being 20 out of 53. It means all the customers visit their branch less than a month irrespective of the bank they have chosen. However, the Table 5 shows the visiting frequency of customers and non customers of HDFC bank so as to see whether there is a significant difference exist between frequency of branch visit among customers of HDFC banks and customers of banks other than HDFC banks in overall. This data is analysed using t test. It also confirmed that there is no significant difference exists between two groups as far as the visits to their concerned bank branches are concerned.

Table 5: Comparative analysis.

| HDFC account | Branch visit frequency | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Everyday | Every alternate day | Twice a week | Once a week | Thrice a month | Twice a month | Once a month | Less than once a month | Never | Active Margin | |

| Yes | 1 | 2 | 3 | 9 | 7 | 13 | 13 | 28 | 3 | 79 |

| No | 1 | 0 | 0 | 3 | 1 | 10 | 14 | 20 | 5 | 53 |

| Active Margin | 2 | 2 | 3 | 12 | 8 | 23 | 27 | 48 | 8 | 133 |

Most of the respondents visit the branches to make deposits with banks (40.5%) followed by inquiring the account balance with 16.3% and advice for investment and fund transfer standing at 14.4% and 14% respectively. The data is collected through a multiple type question where the respondents could select more than one option as their answer (Tables 6 and 7).

Table 6: Independent samples test.

| t-test for Equality of Means | |||

|---|---|---|---|

| T | df | Sig. (2-tailed) | |

| Equal variances assumed | 0.749 | 16 | 0.465 |

| Equal variances not assumed | 0.749 | 15.523 | 0.465 |

Table 7: Reasons of branch visit.

| Reasons of visit the branch | Responses | Percent of Cases | |

|---|---|---|---|

| N | Percent | ||

| Make deposit | 87 | 40.5% | 66.4% |

| Advice for investment | 31 | 14.4% | 23.7% |

| Fund transfer | 30 | 14.0% | 22.9% |

| Inquire balance | 35 | 16.3% | 26.7% |

| Order cheque book | 23 | 10.7% | 17.6% |

| Locker | 1 | 0.5% | 0.8% |

| Passbook update | 2 | 0.9% | 1.5% |

| Nil | 6 | 2.8% | 4.6% |

| Total | 215 | 100.0% | 164.1% |

The respondents for the concerned study were asked if they use digital banking or not. Out of 133 respondents, 93 (69.9%) said that they were using one or other type of digital banking while 40 respondents (30.1%) said that they do not use digital banking facilities (Table 8).

Table 8: Use of digital banking.

| Frequency | Percent | Cumulative Percent | |

|---|---|---|---|

| Yes | 93 | 69.9 | 69.9 |

| No | 40 | 30.1 | 100.0 |

| Total | 133 | 100.0 |

When a comparative analysis was done between the age and usage of digitalization for a clearer view (Table 9), the age group of 18-29 years was the one using maximum digital banking (78.6%). Whereas the age group of 50-59 and above 60 years were the ones using least digital banking standing at 66.7% and 100% respectively. The chi square analysis of the same shows 20.854 value with 4 degrees of freedom and the value is significant at 7 percent significance level. It means age is an important factor for using the digital banking products as younger population is more tech savvy in comparison to the people of other age groups (Table 10).

Table 9: Age-wise comparative analysis.

| Age | Digital banking | Percentage | ||

|---|---|---|---|---|

| Yes | No | Yes | No | |

| below 18 | 1 | 2 | 33.3 | 66.7 |

| 18-29 | 66 | 18 | 78.6 | 21.4 |

| 30-49 | 25 | 12 | 67.5 | 32.5 |

| 50-59 | 1 | 2 | 33.3 | 66.7 |

| 60 and above | 0 | 6 | - | 100 |

| Active Margin | 93 | 40 | 69 | 31 |

Table 10: Chi Square analysis.

| Dimension | Singular Value | Inertia | Chi Square | Sig. | Proportion of Inertia | Confidence Singular Value | |

|---|---|---|---|---|---|---|---|

| Accounted for | Cumulative | Standard Deviation | |||||

| 1 | 0.396 | 0.157 | 1 | 1 | 0.072 | ||

| Total | 0.157 | 20.854 | 0.000a | 1 | 1 | ||

a4 degrees of freedom

The reason opted by majority of consumers for not using digital banking was that they were ‘not interested’ with 27.5% followed by the reason that they ‘don’t get time’ with 25% and difficult to access with 20% (Table 11).

Table 11: Reasons of not using digital banking.

| Reasons for not using digital banking | Frequency | Percent | Cumulative Percent |

|---|---|---|---|

| not aware about it | 7 | 17.5 | 17.5 |

| concerned about security | 2 | 5.0 | 22.5 |

| difficult to access | 8 | 20.0 | 42.5 |

| Don’t get time | 10 | 25.0 | 67.5 |

| no computer related knowledge | 2 | 5.0 | 72.5 |

| not interested | 11 | 27.5 | 100.0 |

| Total | 40 | 100.0 |

The other reasons were ‘not aware about digital banking’ with 17.5% and concerned about security along with the reason that ‘no computer knowledge’ standing at 5% each (Figure 1).

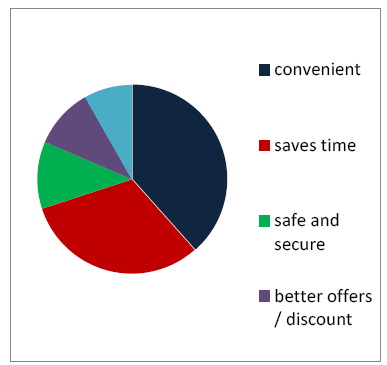

When the respondents using digital banking were asked to give reasons for using digital banking, the main two reasons given by customers were ‘convenient’( 38.4%) and time saver (31%). These were followed by safe and secure (11.6%), better discount offers (10.3%) and better cash flow management (8.2%) (Table 12).

Table 12: Reasons of using digital banking.

| Reasons of using | Responses | ||||

|---|---|---|---|---|---|

| N | Percent | ||||

| Convenient | 56 | 38.4% | |||

| Saves time | 46 | 31.5% | |||

| Safe and Secure | 17 | 11.6% | |||

| Better offers discounts | 15 | 10.3% | |||

| Cash flow management | 12 | 8.2% | |||

| Total | 146 | 100.0% | |||

|

|||||

The respondents were asked if they are aware of the digital banking facilities provided by HDFC bank. These facilities were net banking, mobile banking, credit card, debit card, chillr, payzapp, smartbuy and POS machine. The analysis of the same is given as follows:

Net banking, mobile banking and credit card: Table 13 analyses the awareness of respondents towards net banking, mobile banking and credit card facility offered by HDFC bank. 63.29% of the HDFC customers are using net banking while 36.71% of its customers are aware about this facility. It means that none of the customers of HDFC bank is unaware of net banking facility provided by the HDFC bank. However, in the category of non-customers as a representative of potential customers of HDFC bank, 24.07 percent people are unaware about net banking. 56.96% of the customers of HDFC bank are using mobile banking while 35.44% of them are aware about this facility but not using it. 7.59 percent people are not aware of this facility offered by the bank. Out of 54 non-customers, 22.22% people are not aware of mobile banking service offered by the HDFC bank. As far as the credit card facility is concerned, all the customers are either using this facility or are well aware of this product offered by HDFC bank. 30.8% of the respondents are using credit card while 60.2% of them are aware about this facility. Out of 133 respondents, only 12 respondents i.e., 9% are unaware about credit card. However, 22.22 percent people are not aware of this facility offered by the bank in no-customer category. In nutshell, people are well aware of net banking, mobile banking and credit card facility offered by HDFC bank.

Table 13: Awareness of net banking, mobile banking and credit card.

| Net banking | HDFC account | Mobile banking | HDFC account | Credit card | HDFC account | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | % | No | % | Yes | % | No | % | Yes | % | No | % | |||

| Yes, use it | 50 | 63.2 | 0 | 0 | Yes, use it | 45 | 56.9 | 2 | 3.7 | Yes, use it | 40 | 50.6 | 1 | 1.85 |

| Yes | 29 | 36.7 | 41 | 75.9 | Yes | 28 | 35.4 | 40 | 74.0 | Yes | 39 | 49.3 | 41 | 75.9 |

| No | 0 | 0 | 13 | 24.0 | No | 6 | 7.59 | 12 | 22.2 | No | 0 | 0 | 12 | 22.2 |

| Total | 79 | 100 | 54 | 100 | Total | 79 | 100 | 54 | 100 | Total | 79 | 100 | 54 | 100 |

Debit card, chillr and payz app: All the HDFC customers are well aware of the debit card facility offered by the bank and 88.61 percent customers are using it (Table 14). 59.4% of the respondents are using debit card while 36.1% of them are aware about this facility. As far as the use of Chillr and payz apps are concerned, 63.29 percent and 56.96 percent of actual customers are not aware of these products respectively. Only 17.72% and 20.25% customers are using chillr and payz app respectively. The table also shows that most of the non-customers of HDFC bank are not aware of Chillr (79.63%) and Payz app (83.33%). It means the bank needs to work hard to make the people aware about innovative products like chillr and payz app offered by the bank. Moreover, the bank should also work upon their existing customers to use its new kind of digital products.

Table 14: Awareness of Debit card, Chillr and Payz app.

| Debit card | HDFC account | Chillr | HDFC account | Payz app | HDFC account | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| yes | % | No | % | yes | % | No | % | Yes | % | No | % | |||

| yes, use it | 70 | 88.6 | 9 | 16.6 | yes, use it | 14 | 17.7 | 1 | 1.85 | yes, use it | 16 | 20.2 | 0 | 0 |

| Yes | 9 | 11.3 | 39 | 72.2 | Yes | 15 | 18.9 | 10 | 18.5 | yes | 18 | 22.7 | 9 | 16.6 |

| No | 0 | 0 | 6 | 11.1 | No | 50 | 63.2 | 43 | 79.6 | no | 45 | 56.9 | 45 | 83.3 |

| Active Margin | 79 | 100 | 54 | 100 | ActiveMargin | 79 | 100 | 54 | 100 | Active Margin | 79 | 100 | 54 | 100 |

Smartbuy, POS machine: As evident from the Table 15, only few people are using the smart buy (12.66%) and POS machine facility offered by HDFC bank. Otherwise, most of the people in general as well as customers of the bank are not aware of the facilities offered by HDFC bank.

Table 15: Awareness of smart buy and POS machine.

| Smart buy | HDFC account | POS machine | HDFC account | ||||||

|---|---|---|---|---|---|---|---|---|---|

| yes | Percent | No | Percent | yes | Percent | No | Percent | ||

| yes, use it | 10 | 12.66 | 0 | 0 | yes, use it | 15 | 18.99 | 0 | 0 |

| Yes | 21 | 26.58 | 11 | 20.37 | Yes | 16 | 20.25 | 9 | 16.67 |

| No | 48 | 60.76 | 43 | 79.63 | No | 48 | 60.76 | 45 | 83.33 |

| Active Margin | 79 | 100 | 54 | 100 | Active Margin | 79 | 100 | 54 | 100 |

Purpose of using e-banking: The respondents were asked to specify the reasons of using net banking. This was a multiple choice question where the respondents could choose more than one option. So most of the respondents choose to ‘check the account balance’ (24%), ‘bill payment’ (23.7%) and followed by checking the account statement (14.10%). The other reasons are described in Table 16.

Table 16: Purpose of using E-banking.

| Purpose | Responses | |

|---|---|---|

| N | Percent | |

| Check balance | 68 | 24.00% |

| Liquidate | 14 | 4.90% |

| Account statement | 40 | 14.10% |

| Cheque status | 20 | 7.10% |

| Request cheque book, DD | 12 | 4.20% |

| Tax e-filling | 16 | 5.70% |

| Bill payments | 67 | 23.70% |

| Mutual funds | 7 | 2.50% |

| Demat account | 6 | 2.10% |

| Avail discounts | 16 | 5.70% |

| Open FD or RD | 17 | 6.00% |

| 283 | 100.00% | |

Frequency of using e-banking: Most of the respondents used net banking about 1-3 times a month standing at 24.7% followed by 5-10 times a month with 21.5% respondents. The other options were less than one time (19.4%), 3-5 times (18.3%) and more than 10 times (16.1%) (Figure 2 and Table 17).

Table 17: Frequency of using E-banking.

| Frequency | Percent | Cumulative Percent | |

|---|---|---|---|

| less than one time | 18 | 19.4 | 19.4 |

| 1-3 times | 23 | 24.7 | 44.1 |

| 3-5 times | 17 | 18.3 | 62.4 |

| 5-10 times | 20 | 21.5 | 83.9 |

| more than 10 times | 15 | 16.1 | 100 |

| Total | 93 | 100 |

Digital mega trend is profoundly impacting all businesses globally and HDFC bank is a leading participant of the same with the introduction of considerable amount of innovative digital products. Therefore, a study has been carried out to check the awareness and preferences of customers for digital products offered by HDFC bank. For this purpose, the actual as well as potential customers of HDFC bank have been taken into consideration. The data have been collected using questionnaire and same has been analysed using SPSS. The result of the study shows that the government banks like State bank of India and Punjab national bank are most preferred choice of the customers for their banking services other than the HDFC bank. It means people are still banking upon public sector banks over private sector banks. Coming to the digitalization of the banking system, the age of the customers is an important factor while using digital banking. People between the age group of 18-29 years are most comfortable with computer based services due to its convenience and time saving. The most commonly used digital products of the HDFC bank are net banking, mobile banking, debit cards and credit cards. However, the people are not very much aware of other innovative products like smart buy, payz app, chillr and POS machine. So, the bank should market their products aggressively and induce the customers to buy their products by providing certain offers and incentives. Marketing of these products should be done through virtual media especially by television media so as to pitch maximum audience.

The main purpose of using e-banking is to check the account balance, to pay their bills and to get the account statement of their respective account. The brick and mortar based banking is shrinking over the time and the same is evident from the study as most of the people are visiting their branches less than a month. The main reasons for visiting the branch were cash deposits and seeking advice on investment.

When the respondents were interacted through one to one communication, their main concern regarding digitalization of banking system was the security of their funds as cyber frauds are more prevalent in the age of digitalization. The other main reason was the fact that some people lack knowledge to use these facilities, hence find it difficult to operate. Therefore, Tutorials for using e-banking especially designed for uneducated and elderly people, should be provided. Immediate grievance addressable mechanism should be in place in order to check any frauds or malfunction of digital banking.

Copyright © 2026 Research and Reviews, All Rights Reserved