ISSN: 1204-5357

ISSN: 1204-5357

Muniruddeen Lallmahamood

DBA (UniSA)/ University of South Australia

Postal Address: 6, Malakoff St, Port Louis, Mauritius.

Email: muniruddeen@gmail.com

Muniruddeen Lallmahamood obtained the degree of Master of E-commerce from Central Queensland University, and Doctor of Business Administration from University of South Australia. He is currently the Managing Principal of Global Management & Business Consulting Ltd, Mauritius. His areas of interest are business strategy & management.

Visit for more related articles at Journal of Internet Banking and Commerce

E-commerce, Privacy & Security, Internet Banking, Technology Acceptance Model

The inception of the World Wide Web (WWW) and users’ response to this technology has opened opportunities for many businesses, ranging from small to large corporations, including financial institutions. Banks are currently amongst the largest beneficiaries of WWW technology. In particular, Internet banking or online banking has created new ways of handling banking transactions for banking related services and for e-commerce related transactions such as online shopping.

There are several reasons for banks’ global rush for Internet banking namely accelerating customer demand, increased competition among banks themselves and new entrants, the drive to minimizing costs and increasing efficiency, and the deregulation of the financial services market (NOIE et al. 1999). Internet banking is reported to be the fastest growing service that banks offer in order to gain and retain new customers (Moody 2002). By the end of 2002, about 120 of the largest banks in the United States were offering online banking services (Pyun, Scruggs & Nam 2002).

While Internet banking has grown rapidly, there is not enough evidence of its acceptance amongst consumers. Robinson (2000) reported that half of the people that have tried online banking services will not become active users. Another author claims that Internet banking is not living up to the hype (Weeldreyer 2002). Highly publicized cases involving major security failures might have contributed to the public’s concern and lack of acceptance of Internet banking. For example a businessman in Malaysia who reported that RM 100, 000 (USD 27,000) had been transferred from his account by an unknown party via an internet transaction (Rahman 2003)

The present study aims at examining the impact of perceived security and privacy on the acceptance of Internet banking in Malaysia. The results of this study will be useful to Malaysian domestic banks for the assessment of the impact of security and privacy and for the formulation of appropriate strategies to raise customers’ confidence level in Internet banking.

Studies on Internet banking are important given that they are useful to the banking industry in formulating marketing strategies to promote new forms of Internet banking systems in the future (Wang et al. 2003, p.502).

Internet banking in this study is defined as banking services over the public network (the Internet), through which customers can use different kinds of banking services ranging from the payment of bills to making investments.

Internet banking in Malaysia

On June 2000, the Bank Negara, Malaysia’s central bank, announced that government has given its approval for commercial banks to offer Internet banking services (Shanmugam, Suganthi & Balachandler 2002). Currently, only banking institutions licensed under the Banking and Financial Institutions Act 1989 and the Islamic Banking Act 1983 are allowed to offer Internet Banking services in Malaysia. These include 25 commercial banks and 7 Islamic banks (BNM 2005).

Prior to June 2000, some Malaysian banks were offering electronic banking services via proprietary software and connection to the bank (Sohail & Shanmughma 2003) for instance the PhileoAllied Bank provided e-banking services via its proprietary system named PALDIRECT/PALWORLD. The bank merged with Malayan Bank during the biggest consolidation of banks (Asia times, 2000), and “Maybank2u” has become the leading Internet banking services provider in the country (DeSilva 2003). By July 2002, this number had doubled; twelve banks were providing Internet banking services (Ng 2002).

Internet banking became a new channel for banks to deliver services during the consolidation of the banking sector. As a result banks were increasingly offering their services online. Internet banking became more beneficial to the banks than to the consumers.

However, customers’ acceptance and confidence in the system remain a prime factor in ensuring the success of Internet banking. It was reported that only 31 percent of Malaysians indicated an interest in banking on the Internet in future, and a further 66 percent were worried by security concerns (Mckinsey & Company cited in NG 2002, p. 27). In Thailand for instance, bank customers still hesitated to adopt Internet banking (Larpsiri et al. 2002), whereas in Singapore, Liao and Cheung (2002) reported that Internet e-retail banking was still in the introduction stage. In Hong Kong, it was recently reported that Internet banking is still in its infancy with a scarcity of information on its use (Chan & Lu 2004, p. 37).

Information technology (IT) acceptance has been the subject of much research in the past two decades (Lai & Li, 2004, p.1). Researchers have concentrated their efforts on identifying the conditions or factors that could facilitate the integration of information system (IS) into business (Legris, Ingham & Collerette 2002).

Similarly, Internet banking acceptance has received special attention in academic studies. Several researches on Internet banking were carried out whereby the technology acceptance model has received more attention. (Kolodinsky 2004; Chan & Lu 2004; Lai & Li 2004; Pikkarainen et al. 2004; Wang et al. 2003; Chau & Lai 2003; Suh & Han 2002; Karjaluoto, Mattila & Pento 2002).

The Technology Acceptance Model (TAM) (Davis 1989) has been applied in different contexts to investigate a wide range of information technologies (IT) (Lai & Li 2004, p.1) and to determine the acceptance of various information systems (IS) in the past decades (Suh & Han 2002)

TAM (Davis 1989) is an extension of the Theory of Reasoned Action (TRA) (Ajzen & Fishbein 1980) and the Theory of Planned Behavior (TPB) (Ajzen 1985, 1991). TAM appears to be the most widely accepted model among information systems researchers. Argawal and Prasad (1999) claimed that TAM has become popular amongst research because of its prudence approach and the amount of recent empirical support for it.

The model posits that a user’s adoption of a new information system is determined by his intention to use the system. TAM (Davis 1989) is about determining the intended adoption behavior to use an information system, which in turn is determined by two main beliefs about the system; mainly perceived usefulness and perceived ease of use.

Davis’ definition of the two beliefs is as follows:

….”perceived usefulness is the extent to which a person believes that using a particular system will enhance his or her performance, while perceived ease of use is the extent to which a person believes that using a particular system will be free of effort” (Davis1989, p.320).

Davis (1989) also noted that future technology acceptance research needs to address how other variables would affect usefulness, ease of use, and user acceptance and intention. Moon and Kim (2001, p. 218) added that to increase external validity of TAM, it is necessary to further explore the nature and specific influences of technological and usage–context factors that may alter the user’s acceptance. For instance, recent research has indicated that “trust” has a striking influence on users’ willingness to engage in online exchanges of money and sensitive personal information (Hoffman, Novak & Peralta 1999). Another example is the perceived risk, Kim and Prabhakar (2000) claimed that perceived risk is a major determinant of the adoption behavior in a business-to-consumer (B2C) e-commerce environment.

Therefore, perceived ease of use and perceived usefulness may not fully reflect the users’ intention to adopt Internet banking, thus the need to search for additional factors that better predict the acceptance of Internet banking. Legris, Ingham and Collerette (2002, p.191) suggested that while TAM is a useful model, it should be integrated into a broader model which would include variables related to both human and social change processes, and to the adoption of the innovation model.

It clearly appears that perceived usefulness and perceived ease of use are subjected to the influence of external variables and TAM is used as a framework to investigate the impacts of external variables on system usage. Hong et al. (2001, p.100) suggested that

“…by manipulating these external variables, system developers can have a better control over users’ beliefs of the system, and subsequently their behavioral intentions and usage of the system”.

One of these external variables is individual difference. Past studies reported that individual differences play a crucial role in the implementation of any technological innovation in a wide variety of disciplines, including information systems, productions, and marketing (Harison & Rainer 1992; Majchrak & Cotton 1988 cited in Wang et al. 2003, p. 504).

Although prior studies such as in (Agarwal & Prasad 1999; Venkatesh & Davis 2000; Hong et al. 2001; Yi & Hwang 2003) reported on the relationship between individual differences and IT acceptance via TAM. Chen, Czerwinski & Macredie (2000) claimed that the effects of individual differences on the use of new IT have yet to be explored. This may be supported by Wang et al. (2003) assertion that most of the previous studies on TAM aimed at relatively simple IT, such as personal computers, email applications and the WWW. For instance, Lederer et al. (2000) investigated TAM for work-related tasks with the WWW as the application. Chen, Czerwinski & Macredie (2000) added that some precautions need to be taken when applying the findings developed for the earlier generations of IT to the new virtual environment. An example is the demographic profile; age, level of education and household income of an Internet user which may have a direct or indirect influence on users’ intention and acceptance of Internet banking. Hartwick and Barki (1994) claimed that it is vital to study the acceptance of new technologies with different user populations in different contexts.

Internet banking is only one of many IT applications used by Internet users and is rated the sixth application in order of importance of use after email, searches, travel, education and health. (Eurobarometer survey cited in Centeno 2005). For this reason, additional explanation and factors may be explored about how individual differences influence users’ acceptance of Internet banking via TAM’s two beliefs constructs. Therefore, in this research, the theory of the Technology Acceptance Model is also proposed to measure intention to use Internet banking.

Many prior research efforts have been carried out on the extensions of the TAM. This extension is referred to the introduction of other variables and measuring its impact on the acceptance to use an Information system. Venkatesh and Davis (2000) extended the model to explain how subjective norms and cognitive instrumental processes affect perceive usefulness and intentions. Amoako-Gyampah and Salam (2003) claimed that the research devoted to extensions of TAM is about examining the antecedents of those two belief constructs underlying TAM. According to Wixom and Todd (2005), researchers have sought to extend TAM primarily in one of three ways; by introducing factors from related models, by introducing additional or alternative belief factors, or by examining antecedents and moderators of perceived usefulness and perceived ease of use.

In the context of Internet banking, Chan and Lu (2004) used TAM and social cognitive theory to identify factors that would influence the adoption and continued use of Internet banking in Hong Kong. Lai and Li (2004) investigated the attitude to use as an intervening variable to validate perceived usefulness and ease of use towards the intention to use internet banking. Pikkarainen et al. (2004) studied consumer acceptance of online banking in Finland in the light of the TAM added with new variables such as perceived enjoyment, information on online banking, security and privacy and quality of Internet connection. Wang et al. (2003) examined a new construct “perceived credibility” to enhance the understanding of an individual’s acceptance behavior of Internet banking amongst Taiwanese adult population. Chau and Lai (2003) examined four additional variables; personalization, alliance services, task familiarity and accessibility that are theoretically justified as having influence on perceived usefulness and perceived ease of use towards the intended users of Internet banking. In another study by Karjaluoto, Mattila and Pento (2002), the examination of four factors related to experiences namely, computer, technological personal banking and reference group, influencing the formation of attitude towards Internet banking was studied.

Kolodinsky (2004) recently explored factors that affect the intention to adopt e-banking technologies by online consumers in U.S while applying the theories of technology acceptance and the diffusion of innovations.

Based on the above, the use of an extended TAM as a theoretical framework is adopted to examine the effect of an external variable on the intention to use Internet banking. In addition to TAM being a widely used and proven model, other reasons for the adoption of this model are because TAM is simple and Internet banking is an information system and an application used by many internet users.

The proposed research model in this study is shown in Figure 1 below. In the extended model, like in other studies of TAM, the model includes an external variable “perceived security & privacy” (PSP) and the two beliefs variables; perceived usefulness (PU) and perceived ease of use (PEOU) as the independent variables and Intention to use (ITU) Internet banking as the dependent variable.

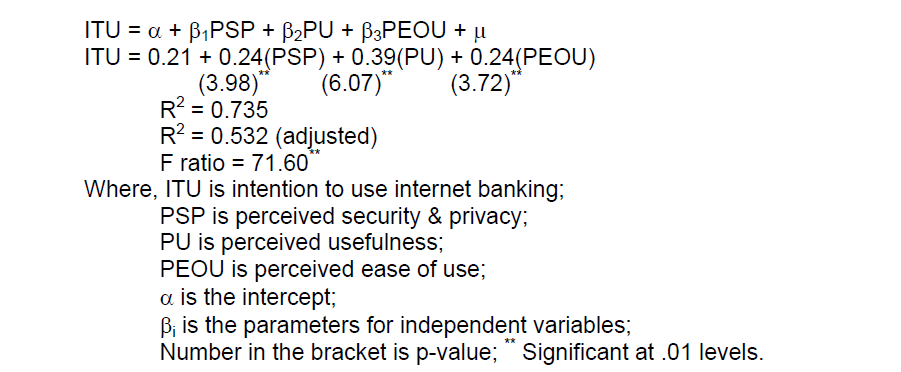

The research model in figure 1 primarily predicts that the independent variables have an impact on the dependent variable. This is explained in the following regression model;

ITU = α + β1PSP + β2PU + β3PEOU + μ

In addition to the primary focus, this research paper is examining the impact of the independent variables on one another. This is explained by a simple regression analysis;

Independent variable (as a dependent variable) = α + β1 (Independent Variable) + μ

The above focus is suggested via a list of proposed hypothesis.

Perceived security and privacy

The importance of security and privacy concerns in an online environment has been broadly discussed and reported in many studies. Godwin (2001) reported that privacy and security concerns were found to be a major barrier to Internet shopping. This concern has been extended to the Internet banking environment. Security has been widely recognized as one of the main obstacles to the adoption of electronic banking (Aladwani 2001), and privacy issues have proven important barriers to the use of online services (Westin 1998). White and Nteli (2004) reported that the level of increase of Internet banking usage for banking purposes has not changed in the UK because of the continuing consumer fear about security. In a study about the adoption of Internet banking, Sathye (1999) reported that privacy and security were found to be significant obstacles to the adoption of online banking in Australia.

Security is defined as a threat which creates “circumstances, condition, or event with the potential to cause economic hardship to data or network resources in the form of destruction, disclosure, modification of data, denial of service and/or fraud, waste and abuse” (Kalakota & Whinston 1997). Security threats usually occur at the network level (the server), the communication channel or the user’s personal computer (the client). In the context of Internet banking, security threats can either be through network, or data transaction & transmission attacks or through unauthorized access to the account by means of false authentication (Yousafzai, Pallister & Foxall 2003, p. 7).

Privacy, a major impediment to e-commerce (US Public Interest Research Group 2000), represents the control of transaction between users and others (usually the sites). This concern was discussed several decades ago. Margulis (2003) claimed that the ultimate aim is to minimize vulnerability of the personal data. In the context of Internet banking, information privacy is defined as the claim of individuals, groups, or institutions to determine when, and to what extent, information about them is communicated to others (Agranoff 1991).

Thus, for the purpose of this research, “perceived security and privacy” (PSP) is defined as users’ perception of protection against security threats and control of their personal data information in an online environment. On the whole, perceived security and privacy is about the self-belief that a user has in the system to conclude a transaction securely and to maintain the privacy of personal information. Therefore, this research poses the following hypotheses:

“H1 A customer’s perceived security and privacy has a positive impact on his/her intention to use Internet banking” which is tested by model 1: ITU = α + β1PSP + μ and because TAM is used as the baseline model, this research paper explores the influence of the external variable (perceived security and privacy) on perceived usefulness and perceived ease of use on Internet banking verification in the following hypothesized relationships:

“H2 A customer’s perceived security and privacy has a positive impact on his/her perceived usefulness of Internet banking” which is tested by model 2: PU = α + β1PSP + μ

“H3 A customer’s perceived security and privacy has a positive impact on his/her perceived ease of use of Internet banking” which is tested by model 3: PEOU = α + β1PSP + μ

Perceived usefulness & Perceived ease of use

Similarly, TAM posits that perceived usefulness (PU) is a significant factor affecting acceptance of an information system (Davis 1989), and similarly perceived ease of use is a major factor that effects acceptance of an Information system, therefore it would appear that an information system or an application perceived to be easier to use than another is more likely to be accepted by users. By applying these into the Internet banking context, the following hypotheses are proposed:

“H4 A customer’s perceived usefulness has a positive impact on his/her intention to use Internet banking” which is test by model 4: ITU = α + β1PU + μ

“H5 A customer’s perceived ease of use has a positive impact on his/her intention to use Internet banking” which is tested by ITU = α + β1PEOU + μ

“H6 A customer’s perceived ease of use has a positive impact on his/her perceived usefulness of Internet banking” which is tested by PU = α + β1PEOU + μ

The list of the items of the above hypotheses is illustrated in the table 1.

Perceived usefulness

PU1 Using the Internet banking systems make it easier for me to conduct banking transactions.

PU2 I would find the Internet banking systems useful in conducting my banking transactions.

PU3 Overall, I find Internet Banking useful.

Perceived ease of use

PEOU1 My interaction with the Internet banking systems is clear and understandable.

PEOU2 Learning to use the Internet banking systems is easy for me.

PEOU3 It would be easy for me to become skillful at using the Internet banking systems.

PEOU4 I would find the Internet banking systems easy to use.

PEOU5 I believe that Internet banking will be frustrating and cumbersome

PEOU6 I find Internet banking system to be flexible to interact with

PEOU7 Internet banking in Bahasa Malaysia Language is easier to interact

Perceived Security & Privacy

PSP1 Using internet banking is financially secure

PSP2 I trust the ability of Internet Banking to protect my privacy

PSP3 I trust an internet banking as a bank

PSP4 Matters on security has no influence in using Internet Banking

PSP5 The bank provides secure communication to secure all payment transactions between the client and the bank

PSP6 The bank provides the latest encryption technology to prevent unauthorized intrusion

PSP7 I feel safe when I release credit card information to the bank

PSP8 The bank provides firewall technology to prevent unauthorized intrusion

PSP9 The bank ensures all its operating systems are updated with the latest security patches

PSP10 The bank updates its anti virus software periodically to safeguard its clients data

PSP11 The bank provides third party assurance to help authenticate the identity of the bank

PSP12 The bank provides security level password to help authenticate the identity of the user

Behavioral Intention to use

ITU1 In the future I intend to maintain my relationship with this bank.

ITU2 I will frequently use Internet banking in the future.

ITU3 I will strongly recommend others to use Internet banking.

The Survey

The research method for this study is primarily a quantitative approach, and a survey instrument in the form of questionnaire was developed through data collected from previous studies on TAM, and acceptance of Internet banking. According to Sekaran (2000), to ensure the content validity of the scales, the items selected must represent the concept about which generalizations are to be made. Therefore, items selected for the constructs are mainly adopted from the following prior studies (Chan & Lu 2004; Lai & Li 2004; Pikkaraine et al. 2004; Wang et al. 2003; Chau & Lai 2003; Suh & Han 2002; Chellapa & Pavlou 2002; Karjaluoto, Mattila & Pento 2002; Aladwani 2001) to ensure content validity.

The main survey consists of two parts. Part one contains 18 questions on the demographic profile, the technology usage of a participant and includes two opened-ended questions in which participants were asked to state the main reason for using Internet banking and why they have not tried Internet banking.

Part two consists of 26 questions. Participants were asked to indicate their opinion on a likert scales (1-5) with anchors ranging from “strongly disagree” to “strongly agree” for all questions, except for 7 items in the last question in which participants were asked to rate seriousness of the main concerns on a scale of 1 to 10, where 1 meant it is not serious at all, and 10 meant it is extremely serious. The last question was basically an indication of some factors that drive the intention to use Internet banking. It is also a measure that indicates consistency with selected items proposed for the hypotheses. Aladwani (2001) claimed that several factors drive the introduction of an ecommerce application like online banking. He added that ..

“…any organization seeks to adopt advanced technologies, internal and external pressures and [influences] are critical challenges to its growth and survivability, for instance external influences on a bank in the form of technological changes and/or competition would necessitate the mobilization of all the resources to establish and sustain a competitive posture”. (Aladwani 2001, p. 217).

Data collection

The survey was mailed and distributed amongst 500 participants in the urban cities. The participants include members of Malaysian Institute of Management; participants ranging from executive to professional in the ICT sector; executive MBA students and college students. This sample was expected to cover a wide spectrum of Internet users and Internet banking adopters. Cheah, Sanmugam and Tan (2005) found that a typical Internet banking adopter is of age 29 with tertiary education, working in private sector or self employed and residing in urban area. 197 respondents were received from the distribution, out of which 10 were eliminated. The rate of response is therefore 39.4 percent. The rejected cases were mainly due to the non-completion of at least one of the sections of the survey.

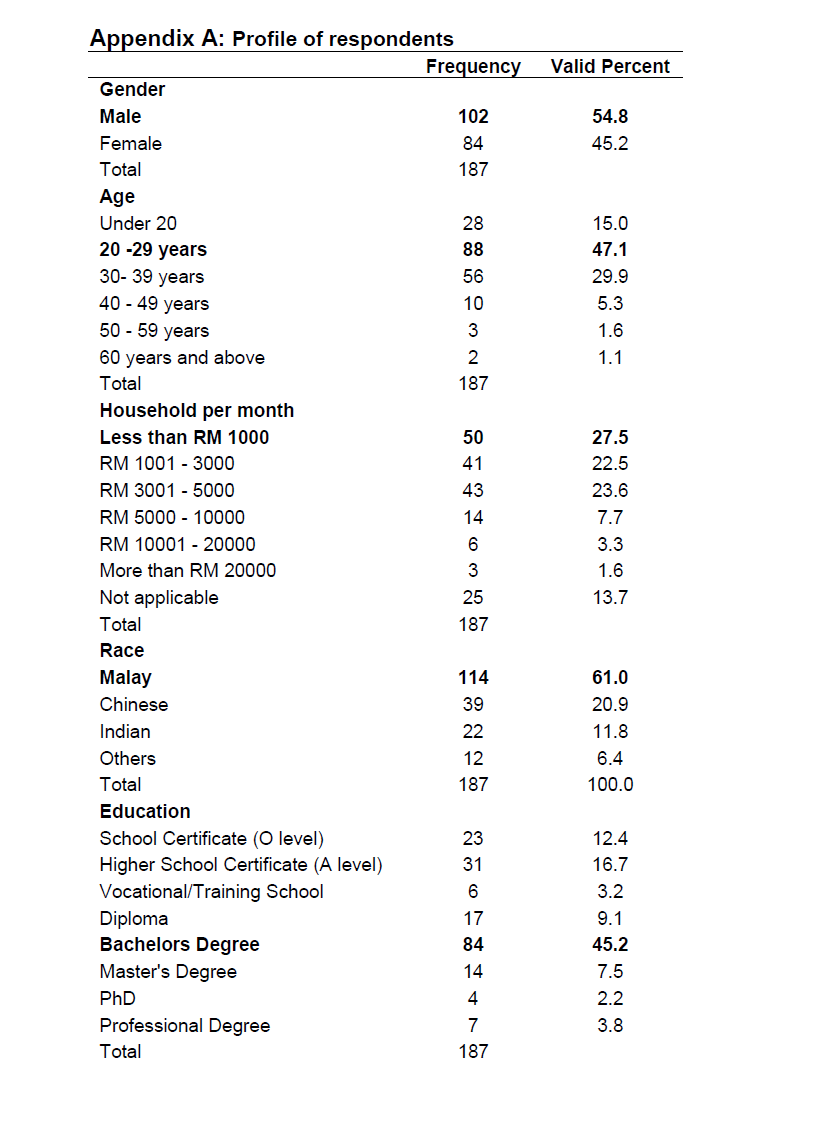

Demographic & technology access profile

A large pool of respondents was male representing 54.8 percent of the total sample size. The Malay ethnic group formed 61 percent of the total respondents. Most of the respondents were aged between 20-29 years; only 15 percent were below 20. However, 77 percent of the total respondents aged between 20 and 39 years old. Most of the respondents had a bachelor degree (45.2%). Household income varied from less than RM 1000 per month to over RM 20,000 per month. The largest group, 27 percent of the respondents earned less than RM 1000 as household income. A crosstabulation test of existing Internet banking user from the 187 respondents, shows that a typical Internet banking user is one with a tertiary education (a bachelor degree), earning a range of RM 1000 – 5000 within the age bracket of 20 - 29 years old. A complete demographic profile of the respondents is presented in appendix A.

Consumers’ technology access is illustrated in Table 3. Internet banking was used by 49.2 percent of respondents; however only 20.9 percent amongst the 49.2 percent of Internet adopters were conducting their banking transaction mostly via online. Merely 0.5 percent used WAP (mobile phone) for Internet banking. 60.4 percent of the respondents were customers of the Malayan Banking Berhad.

The pilot study & Reliability test

An invitation to participate to a web based pilot study was e-mailed to 50 members of the Malaysian Institute of Management, who are mainly business professionals. This sample represents the highest percentage of active Internet users. Only 27 participants took the online survey, among which 3 were invalid.

A reliability test of the pilot study as shown in table 4 below indicates that all measures have excellent reliability levels (> 0.73) with an average of 0.83. The perceived security and privacy scale achieved a reliability of 0.86.

Multiple regression analysis of the pilot study

Multiple regression analysis results of the pilot study reveal that the multiple correlation coefficients (R) analysis of (0.821) and the coefficient of determination (R Square) (0.674) have a strong relationship with the independents and dependent variable, i.e. more than half of the variations (R² = 0.674) of the variable “intention to use Internet banking” is explained by the model. The F-value of 13.798 also shows that the model is significant (at an observed significant 0.000).

Reliability test

The reliability test shows that the dependent and independent measures demonstrated sufficient reliability in terms of the coefficient alpha in Table 5 below.

Correlation analysis

The analysis of the bivariate correlation shows all positive figures (see table 6). This suggests that the correlations are positive between intention to use Internet banking and its independent variables; i.e. perceived usefulness, perceived ease of use, perceived security & privacy; and they are significant at 0.01% level.

Hypothesis Testing

For the evaluation of the hypotheses, a simple linear regression model is considered, Anderson, Sweeney and Williams (2001, p.539) claimed that it is the simplest type of regression analysis which one independent variable and dependent variable are involved.

The analysis details are illustrated in table 7. The results show that all the hypotheses are substantiated, and therefore we do not reject hypotheses.

Multicollinearity test

In this study, perceived security and privacy, perceived usefulness and perceived ease of use are all assumed to be independent variables. These independent variables are being used to predict and explain the value of the dependent variable; however Anderson, Sweeney and Williams (2001) claimed that most independent variables in a multiple regression problem are correlated to some degree with another. Therefore the model or equation may have a severe multicollinearity problem.

Studenmund (2000) suggested that it must first be recognized that some multicollinearity exists in every equation. He added that

…”it is virtually difficult in a real world example to find a set of explanatory variables in which the explanatory variables are totally uncorrelated with each other… the trick is to find variables that are theoretically relevant (for meaningful interpretation) and that are also statistically non multicollinear (for meaningful inference)” (Studenmund 2000, p. 255).

There are generally two ways to detect severe multicollinearity problem, they are high simple correlation coefficients (SCC) and high variance inflation factors (VIFs). It is suggested that all tests of simple correlation coefficients as an indication of the extent multicollinearity share a major limitation if there are more than two explanatory variables (Studenmund 2000, p. 256).

For this study, VIFs is used as a measure of multicollinearity. The variance inflation factor (VIF) is a method of detecting the severity of multicollinearity by looking at the extent to which a given explanatory variable can be explained by all the other explanatory variables in the equation.

Therefore the following three models are proposed to detect multicollinearity problem:

Model 1: Perceived security and privacy as dependent variable.

PSPi = α0 + α1 PUi + α2 PEUi + μ i1

Model 2: Perceived usefulness as dependent variable

PUi = β0 + β1 PSPi + β2 PEUi + μi2

Model 3: Perceived ease of use as dependent variable

PEOUi = ƒ0 + ƒ1 PSPi + ƒ2 PEUi + μi3

Where μ 1,2,3, are error terms.

While there is no table of formal critical VIF values, a common rule of thumb is that if VIF (Bi) > 5, the multicollinearity is severe. Thus the results of 1.361 to 1.510 in table 7 are within the (1 – 5) brackets, which also explain that the independent variables do not have a severe multicollinearity problem.

Regression analysis of the model

Regression analysis results reveal that the three independent variables explain 53.4 percent (R Square) of variations of the intention to use Internet banking. The F value of 71.6 shows the model is significant (at an observed sig. = 0.000). The results also show that all the three independent variables are significant at 1% level (see Table 8). The effect of perceived security and privacy (B=0.244, p <0.01), perceived usefulness (B=0.392, p<0.01) and perceived ease of use (B=0.241, p<0.01) on intention to use Internet banking was significant, thus validating the proposed model. It may also be concluded that there are other variables that may explain the intention to use Internet banking but these variables are not included in the model.

As seen in table 8, it also appears that perceived usefulness has the highest number in the beta (0.392) which is significant at the 0.0001 level. This implies that among the three independent variables, Perceived usefulness explains more of the variance in intention to use Internet banking. Perceived usefulness in many empirical tests has been a consistently strong determinant of usage intention (Reichert 2000).

In order to complete the study on the issues relevant to the future of online banking in Malaysia, respondents were asked to rate the seriousness of 7 main concerns on a scale of 1 to 10, where 1 means not serious at all and 10 means it is extremely serious while using Internet banking. The results in table 9 show that personal data protection was rated as the top serious concern, followed by the security technologies provided by the bank for Internet banking. The types of services provided by the Internet banking and the presence of a third party assurance for authentication were least two serious.

The results in table 9 can also be interpreted that both internal and external influences on a bank in the form of technological changes are serious concerns amongst participants.

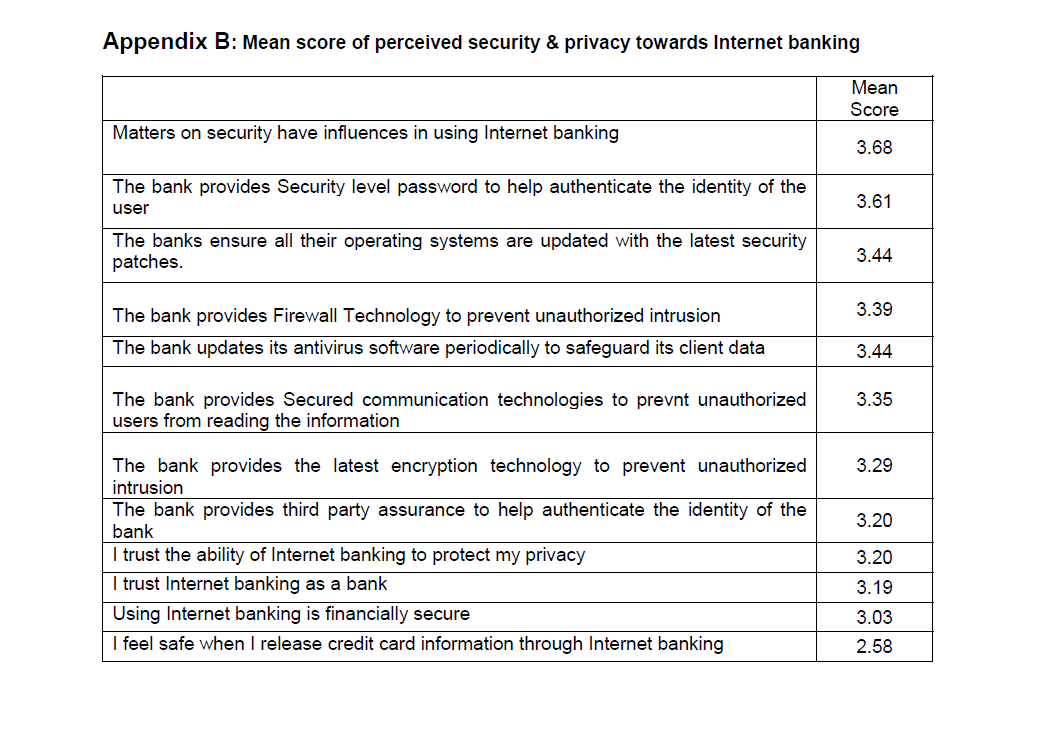

In addition, the items of perceived security and privacy in terms of mean score showed that “matters of security have an influence in using the Internet banking” has scored the highest mean (see appendix B), and security technologies such as latest security patches, firewall, antivirus and encryption dominated the top tier indicating their seriousness. Therefore, it may be concluded that security and privacy appear to be the top concerns of the users in an Internet Banking environment. It was also found that respondents feel safe to release credit card details with their banks. Generally, Malaysian Internet users feel comfortable to provide personal information in a scenario which involves the banks (Lallmahamood 2005).

On Internet banking future in Malaysia from the data in table 10 it may be suggested that more Malaysians will use online banking while the banks are managing the securities issues and technologies of the service. For instance, ease of use is one of the contributing significant factors amongst the Internet banking users and the lack of Web sites in local language (Bahasa Malaysia) does not affect the usage of Internet banking. Only 7 percent of all the respondents strongly agree that Internet banking in local language would be easier to use.

In the two opened-ended questions, it is reported by the 49.2 percent of the Internet banking adopters that convenience, ease of use and time saving are largely the main reasons for using Internet. The remaining 50.8 percent of non-Internet banking customers have not migrated to the online services mainly due to security, trust and privacy concerns.

This study proposes some practical applications in the development and adoption of Internet banking. It suggests that Internet banking sites or portal developers should provide useful and easy to use features on their Web sites to encourage users to adopt the services. It was also found that respondents put much emphasis on issues like convenience and security level password in conducting Internet banking transactions.

While ecommerce is largely dependent on credit cards payment, the study shows that disclosing credit cards details to a bank was not a major issue, thus it may imply here that the banks can play a role in e-payment of ecommerce transaction. Credit card has become the currency of the Internet, and is the most popular method of payment (Singh 2004). Finally trying to minimize or resolve security concerns and privacy protection are perceived to be part of the overall service to customers by Internet banking service providers.

Although the results can be considered statistically significant, the study has several limitations that affect the reliability and validity of the findings. First of all, the survey is not representative of the whole Malaysia. The sample was collected only from urban cities. Therefore, caution needs to be taken when generalizing these research results to user groups in other geographies and environment.

The other limitation of this study concerns the measures for user acceptance. TAM studies have found that perceived usefulness and perceived ease of use are not the only predictors of technology acceptance (Pikkarainen et al. 2004). Studies of TAM are not consistent or clear and lack many significant factors that influence adoption (Legris, Ingham & Collerette 2002). In this study, the research model explains over half of the variance of the intention to use Internet banking [R2 = 0.532 (adjusted)], the unexplained 47 percent of variance suggests that the model may have excluded other possible factors influencing the acceptance of Internet banking. For instance the study did not consider other beliefs, such as trust and its precedents.

Lastly, in this study the collection of data is mainly from Internet users, or Internet banking adopters in the category of a B2C environment, which explicitly excludes business customers of Internet banking.

These limitations pave the way for future studies. Similarly, other factors such as convenience, user involvement, and user experience were not taken into consideration and warrant the need for future research in the field of Internet banking acceptance. The future researches considering these factors could enhance the understanding of users’ acceptance of Internet banking,.

This paper employs regression analysis of survey data to measure the impact of perceived security and privacy on the intention to use Internet banking. An extended Technology Acceptance Model (TAM) is used to explore the relationship of perceived security and privacy, and TAM two beliefs: perceived usefulness, perceived ease of use towards the intention to use Internet banking. Six hypothetical situations were proposed in this study.

Results of the regression analysis supported the model and all the six proposed hypotheses were substantiated. While perceived usefulness is a critical factor in explaining users’ intention to use Internet banking, it is important to pay attention to the security and privacy of users’ of Internet banking.

Convenience, ease and time saving are the main reasons for the adoption of Internet banking, where as security, trust and privacy appear to be the top main concerns for non-Internet banking users. This may also imply that security concerns and privacy protection are perceived to be part of the overall service provided by the Internet banking services providers. Other factors such as password security level and the bank as a e-payment gateway for ecommerce transaction will help to raise the level of customers’ confidence and benefit in the industry.

Lastly, while the local language (Bahasa Malaysia) did not contribute to the ease of use of Internet banking, Internet security, Internet banking regulations, and customers’ privacy therefore remain future challenges of Internet banking acceptance.

Copyright © 2026 Research and Reviews, All Rights Reserved