ISSN: 1204-5357

ISSN: 1204-5357

Faculty of Economics and Management of Sfax, University of Sfax, Tunisia

Boudabbos SamiFaculty of Economics and Management of Sfax, University of Sfax, Tunisia

Visit for more related articles at Journal of Internet Banking and Commerce

Purpose: Financial institutions are always in touch with customers, therefore, many support for commercial performance needs to be addressed in order to be more competitive. Then, this research is an attempt to present some aspects of this performance. Indeed, the performance of companies represents a very varied field of study. And, through its mechanisms, governance is a tool for improving performance. The purpose of this article is to inspect the effects of internal governance mechanisms on the commercial performance of Tunisian financial institutions. Result: Data econometrics is used to study a sample of 34 financial institutions. We find that the results dealing with the impact of governance on commercial performance are mixed. Some mechanisms have a positive effect while others have a negative effect. Only the variables “effectiveness of the board, confidence, organizational culture and importanceof the existence of an auditing” has positively and significantly affected the commercial performance of Tunisian financial institutions. On the other hand, the variable “incentive system of managers by the remuneration” negatively affects this performance. Originality/value: Theoretically, the commercial performance of Tunisian financial institutions is an extension and a supplement to the literature on financial institutions. This article is, therefore, a source of ideas and information on the Tunisian financial sector. And, empirically, this study is an attempt to assess the existing association between commercial performance and internal governance mechanisms in the Tunisian financial sector.

Commercial Performance; Internal Mechanisms of Governance; Human Capital; Audit Committee

In the Tunisian economy, financial institutions (banks, leasing, factoring) constitute the foundation of the economy. Thus, the firm’s performance is a major challenge for management studies. Besides, corporate governance has been the subject of various disciplinary fields (law, economy, finance…).

Indeed, various researchers have tried to apprehend the report between the system of governance and the performance. Some of them have studied the correlation between the system of remuneration of manager (for example stock options) and the stock market performance. Some others have checked the relationship between ownership structure or composition of the board of directors and financial performance. However, the conclusions are various.

It is in this context that reflection is focused on the following question: did the internal mechanisms of governance affect the commercial performance of Tunisian financial institutions?

To answer this question, our article is structured as follows: a first part is interested in the theoretical framework and the research hypotheses. A second part presents the methodological aspects. And in a final part, we present the analysis and discussion of our results. Finally, the conclusion summarizes the main conclusions of this research, the limits and the field of opening for further research.

The literature establish many researches, such as that of Schmid and Zimmermann [1], Suntraruk [2], who tried to test the effect of governance on performance. Most of this work has shown that governance has a significant effect on the firm's performance and on its market value for different contexts and types of performance.

Impact of the Effectiveness of the Board of Directors on the Performance

To evaluate the effectiveness of the board of directors, it is necessary to assess the activity and the quality of the internal functioning of the board.

Beaker and Frye [3] argue that financial institution managers should have more power over their boards for several reasons. First, banks are responsible for the allocation of capital. Secondly, the members of the bank's board do not seem to be distinguished according to their supervisory capacities, but preferably according to their expertise in regulation and business development. Finally, bank managers have good human capital following their expertise in the field. This gives them more power. As well, to continue to operate effectively, it is recommended that the board, its committees and each member should of course periodically assess their own performance and effectiveness. They must report on their activities to internal and external stakeholders.

In effect, the board of directors must be competent in order to be able to play its role in the development of the strategy. In this context, Lamarque [4] stipulate that there are personality characteristics of directors such as expertise, competence and courage to stimulate the board's involvement in strategic action.

And therefore, our hypothesis to check will be:

H1: The effectiveness of the board of directors has a positive impact on the performance.

Impact of the Audit on the Performance

The existence of an auditing committee aims to support the interests of shareholders and other stakeholders. Moreover, its effectiveness is subject to its specificities, which essentially relate to the independence of its members [5], the size of the Committee [6], frequency of meetings and the expertise of the members, especially at the accounting and financial level [7]. In the same furrow, the auditing supports the interests of shareholders and to ensure the credibility of the information disclosed.

Dayan sees that auditing utilizes all missions that can improve performance including the analysis of persistent risks and deficiencies in order to provide advice and recommendations, to set up procedures and to provide new strategies (ensuring the quality of internal information, encouraging staff, ensuring the application of management instructions, ensuring the reasonable use of resources…).

Of this fact, the assumption will be:

H2: The audit committee has a positive influence on the performance.

The Impact of Confidence on the Performance

The confidence is omnipresent in the firm. Similarly, the confidence, under its various aspects (confidence in oneself, confidence in the other actors in the firm), is the concern of the firm’s performance. This mechanism affects the quality of the reports and the effectiveness of the management.

In this context, Ekoka [8] indicate that the confidence loyalty to the goals of the company, intimacy in human relations, and the dissemination of convictions by the various managers and creators are the key to competitiveness between firms. The confidence appears, therefore, as a specific mechanism of regulation of the various transactions that maintains the firm with its various partners (the stakeholders). Thus, Amara and Zghal [9] stipulate that confidence has become an intermediate variable of trade, which is all the more reinforced if the employee behaves ethically. However, several behaviors, such as deception, fraud, traffic, pose a threat to confidence between the client and the firm.

Of this fact, the assumption will be:

H3- confidence improves the performance of the company.

Impact of Culture on the Performance

Culture is an important instrument for the manager. Otherwise, if it is used wisely, it produces a gain in productivity. This means that in order to achieve the desired result, the manager must use his skills, knowledge and expertise. It must also use all mechanisms to assemble the personnel and ensure cohesion. Culture aims to guarantee the usual functioning of the company according to the defined codes. But, in case of difficulty, it manages the structural changes. Culture, then, generates decisions that enable the achievement of objectives. And consequently, it guarantees improved efficiency.

The two Harvard professors, John Kotter and James Heskett, looked at the relationship between a firm's culture and its long-term economic performance. Their research, in an American context, studied 207 American firms derived from 22 different sectors. They calculated the economic performance of these firms based on a set of information collected using a questionnaire. The findings indicate a weak relationship between culture and performance. Then, these authors studied the case of firms with high culture and poor results. The results show that the strong culture has a negative impact by producing dysfunctions within the firm. Nevertheless, culture is not necessarily an asset for the success of the firm.

Therefore, our hypothesis is:

H4-culture positively affects the performance.

Impact of the Remuneration System

Yermack has found that the relationship performance-remuneration of the manager decreases with the size of the board, which suggests that, the board’s small size grant to managers more financial incentives, but forcing them to resist more risk. While, Brian and Jeffrey, in their article entitled "Are CEOs really paid like bureaucrats? », note the subsistence of a strong correlation between remuneration of managers and performance of their society taking into account of stock options and shares held. These are considered as the main tool of the incentive to the performance and allow, consequently, untying the problem of conflict of interests with the shareholders.

On their part, Caby and Hirigoyen [10] distinguish that financial incentives are intended to resolve the problem of agency in linking the remuneration of executives to the firm’s performance. Thus, according to Magnan [11], stock-options have a favorable impact on the recruitment and preservation of talent managers. They are considered, therefore, as a primary tool of incitement to the improvement of the organizational performance.

Such a notice is shared by Hergli [12] who consider that an executive compensation moderate and related to the performance (accountant or in terms of market value) is a factor that impacts positively on the value of the firm. For this reason, this type of compensation is considered as a good governance mechanism. In fact, the remuneration of the managers depends on several factors: the criteria relating to the business (its size), the criteria relating to the personal characteristics of the manager (age, education, seniority…), the criteria of the system of governance including the Board of Directors (size, composition, the presence of external administrator and duality of functions…) and the structure of property.

Of where our hypothesis will be:

H5- a better remuneration promotes the performance of the company.

Our study focuses on the impact of governance mechanisms on commercial performance: the case of Tunisian financial institutions. Thus, this research is based on a method of quantative analysis based on a questionnaire.

Data and Sample

Our study will mainly be based on the Tunisian financial sector. There are 34 financial institutions: credit institutions (21 banks), leasing establishments (nine leasing companies), two factoring companies and two investment banks.

Overview of the Variables

The data defining our variables stem from two distinct sources: those representing the variables of corporate governance and those representing the variables of commercial performance.

The Dependent Variable

The commercial performance which is represented by the range of products and services.

The Independent Variable

In our research, governance is the exogenous variable which is presented by the variables in the culture, the confidence, efficiency of the board of directors, audit and of incentive measures of personal.

The Control Variables

For better persuade the impact of the dependent variables in our model; our database includes three control variables.

The size of the firm: is a capital variable in the clarification of the performance. We retain the following measure: t=log (book value of total assets).

The age of the company (age): In a general way, according to Brown and Caylor [13], the variable Age of the firm is expressed by the logarithm of the number of years of fiscal year. So, AGE=Log (number of years).

The debt of the company (DT): This measure was worn by the majority of the creators that insert the debt of the Organization as a variable in their models [12]. As well, we have: DT=accounting value of the debt/total assets.

Descriptive Analysis

According to the results of the Table 1, the coefficients of skewness indicate that the distribution is skewed to the left (the values are not close to 0) and reject the normal distribution for the majority of the series. This result is confirmed by the values of kurtosis (coefficient of flattening) which are far from the normal value (3). Therefore, the series have a character End. Where, the assumption of normality of Jarque- Bera is not verified.

Table 1: Descriptive statistics (according to the SPSS software).

| N | Minimum | Maximum | Average | Standard deviation | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|

| Conf | 136 | -6,17 | 3.71 | 19,927 | 2,32,811 | -2,456 | 5,739 |

| Cult | 136 | -3,06 | 3.99 | 22,806 | 1,85,294 | -2,009 | 2,963 |

| Incent | 136 | -4,72 | 3.5 | ,9474 | 2,02,681 | -,940 | ,301 |

| Audit | 136 | -3,11 | 4.62 | 14,856 | 2,25,847 | -,804 | -,612 |

| Cons | 136 | -3,06 | 3.71 | 16,347 | 1,94,550 | -,734 | -,797 |

| Perfc | 136 | -3,06 | 3.99 | 24,592 | 1,60,260 | -2,338 | 4,879 |

| Perf | 136 | -3,06 | 3.99 | 23,688 | 1,83,932 | -1,944 | 2,581 |

| Valid N | 136 |

Analysis of the Correlations

The study of the correlation, depending on the Software E-views, allows studying the accentuation of the link that can exist between two variables. As well, the correlation is recognized by the calculation of the coefficient of the linear correlation. This correlation coefficient takes a value between -1 and 1 (Table 2).

Table 2: Correlations of Pearson (source: SPSS).

| VCONF | VCULT | VCONS | VINCIT | VAUDIT | ||

|---|---|---|---|---|---|---|

| VPERFC | Correlation Coefficient | .889 ** | .806 ** | .478 ** | -.103 | .504 ** |

| Gis. (bilateral) | .000 | .000 | .000 | .231 | .000 |

*The correlation is significant at the 0.05 level (bilateral).

**The correlation is significant at the level 0.01 (bilateral).

According to the correlation table of Pearson, it is necessary to conclude:

The variable "VCONF" is correlated positively and in a manner clearly significantly with the dependent variable VPERFC. This dependence is the order of 0.889 and in the company of a probability of meaning attached such to 0.00. This probability is lower than the threshold of meaning common to 1% and 5%. Subsequently, this correlation is called significant.

The variable "VCULT" is correlated positively and in a meaningful way with VPERFC. As well, the rate of linear correlation is 0.806 with a probability of equal significance to 0.00 Less than 1% and 5%. Of this fact, the variable "VCULT" is known as significant for the commercial performance.

The variable "VCONS" is correlated positively and significantly with the dependent variable VPERFC. In effect, the rate of correlation is equivalent 0.478 and the probability is also significant (is worth 0.00). Subsequently, this correlation is significant qualified for the commercial performance.

The variable "VINCIT" is negatively correlated and in a manner not significant, given that the rate of Pearson correlation is worth -0.103 respectively with probabilities of respective significance to the order of time: 0.492 that are above the threshold of 1% and 5%. And therefore, the variable "VINCIT" is not significant for the two types of commercial performance.

The variable "VAUDIT" is correlated positively and significantly with the dependent variable VPERFC. In effect, the rate of correlation is equivalent 0.239 and probability, which is worth 0.00, is significant to threshold 1%. Where, the correlation is appointed significant for the commercial performance.

Estimation of a Model for a Measure of Commercial Performance and Social Conditions in the Tunisian Financial Institutions

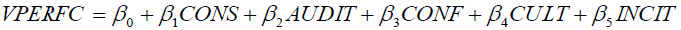

Our model to estimate is the following

With:

VPERFC: value of commercial performance.

VCONS: degree of effectiveness of the Council of administration within the company.

VAUDIT: degree of intervention of an audit committee within the company.

VCONF: level of trust between the leader of the firm and the rest of the personal.

VCULT: level of managerial culture of leaders.

VINCIT: magnitude of incentives for the improvement of performance of the leader.

These results indicate that the model of the commercial performance presents a significant power high (R²=0.924). As well, the rate of variability of VPERFC explained by the five explanatory variables is of the order of 92.4%. Similarly the test of Durbin-Watson allows you to assess, at the level of residues, the hypothesis of independence between the explanatory variables and the residues. The value of DW is between 0 and 4; the more it is close to 0 the autocorrelation is called positive, and the more it is close to 4 the autocorrelation is called negative. In fact, the autocorrelation is qualified positive given that the DW is worth 1.762 which is close to 2. It is a sign of weakness of autocorrelation of order 1 between the residues. This result will be confirmed later by the test of autocorrelation between errors (the test of Q-stat Box-Pierce) (Tables 3 and 4).

Table 3: Summary of Model.

| Model | R | R-two | R-two adjusted | Standard error of the estimate | Durbin-Watson |

|---|---|---|---|---|---|

| 1 | .961 | .924 | ,919 | ,45603 | 1.762 |

| A. The predicted values: (constant), Audit, cons, size, incent, cult, debts, age, conf | |||||

| B. Dependent variable: perfc | |||||

Table 4: ANNOVA.

| Model | Sum of squares | Df | Average Square | F | Meaning | |

|---|---|---|---|---|---|---|

| 1 | Regression | 320,312 | 8 | 40,039 | 192,531 | .000 |

| The residues | 26,411 | 127 | ,208 | |||

| Total | 346,723 | 135 | ||||

| A. The predicted values: (constant), cons, audit, size, incent, cult, debts, age, conf | ||||||

| B. Dependent variable: perfc | ||||||

The different results corresponding to the estimation of this model are exposed as follows:

As it has already been pointed out, according to the report between the explained variance and the total variance is largely sufficient to say that the model has a power of adjustment high. The residual variance is remarkably low. Accordingly, there has been obtained a value of Fisher highly significant. Indeed, the value of the statistic of Fisher (F calculated is worth 192.531) with a probability of zero meaning (probability=0.000), where the model is qualified overall significant (Table 5).

Table 5: Model of the commercial performance.

| Model | The coefficients not standardized | T | Meaning | Statistics of colinearity | |||

|---|---|---|---|---|---|---|---|

| B | Standard Error | Tolerance | Keen | ||||

| 1 | (constant) | 3,196 | ,416 | 7,674 | .000 | ||

| Age | -,357 | ,097 | -3,671 | .000 | ,424 | 2,358 | |

| Debts | ,119 | ,037 | 3,254 | .001 | ,516 | 1.937 | |

| Size | -,090 | ,031 | -2,874 | .005 | ,629 | 1,590 | |

| Conf | ,380 | ,032 | 11,917 | .000 | ,280 | 3,575 | |

| Cult | ,270 | ,034 | 5/16 | .000 | ,382 | 2.615 | |

| Incent | -,038 | ,030 | -1,261 | ,210 | ,447 | 2,235 | |

| Audit | ,124 | ,022 | 5,527 | .000 | ,603 | 1.658 | |

| Cons | ,139 | ,024 | $5,770 | .000 | ,646 | 1.549 | |

The estimated model, according to the previous table, is thus:

VPERFC=3.196-0.357. age-0.09 .taille+0.119 det tes+0.380 .VCONF+0.270 .VCULT+0.139 .VCONS-0.038 .VINCIT+0.124 .VAUDIT

According to the results of this table, it is necessary to disengage the following conclusions:

The variable "conf" is positively significant at the commercial performance given that the probability associated is less than the threshold. As well, trust, as belief vis-a-vis the others, contributes to improve the performance [14]. Otherwise, have confidence in someone means that it can act in a positive manner; that is to say be confident to the skills of others to accomplish effectively its tasks. Similarly, the concept of trust is omnipresent in any business. In effect, the concept of performance is very generally collaborator to the confidence which is considered as one of its direct vectors. This conclusion is confirmed by the work of Seppänen et al. [15] who see that a relationship of trust is reflected by the improvement of the performance via the reduction of the risk which discerned proliferates and/or strengthens a climate favorable to innovation, the reduction of opportunistic behavior, the mutual satisfaction of the various parties, the continuity of the long-term relationship, a stronger commitment, a greater propensity to cooperate.

Similarly, the variable "cult" presents a positive coefficient and a probability less than the threshold of significance. Therefore, the culture has a positive meaning vis-a-vis the commercial performance. Otherwise, the managerial culture of leaders represent a source of creativity, motivation, innovation, responsibility… in order to run the business and achieve therefore of good results. In this context, Schein and Marc Lebailly1 believe that culture is a tool to adapt to external changes and of internal integration and therefore promotes the performance. Similarly, Leidner and Alavi2 stipulate that the culture is a success factor favoring the performance.

The variable "incent" is negatively correlated to the commercial performance (negative coefficient and probability greater than the threshold). This means that a system of incentives is not conducive to the commercial performance. This conclusion is confirmed by the Work of Leonard, which deals with the effect of compensation policies on the performance of 439 U.S. companies of large size in the period 1981-1985. It notes that the performance is not significantly affected by the levels of remuneration of officers. Similarly, Andjelkobic, brown and Caylor [16] found no positive relationship between compensation and performance. Yet, Elayan et al. [17], for a study concerning 73 companies listed in the New Zealand during the period 1994-1998, has shown that a system of remuneration has no effect on the performance.

The variable "audit" is positively related to the commercial performance. This is justified by the important role of an audit committee within the company. The Committee therefore allows you to resolve conflicts of interest and to delineate the discretionary power of the leader, to correct the errors as a result of a control of financial statements… In this framework, Spira has developed that the audit committee is regarded as an effective body that has the task to maintain the interests of shareholders and to ensure the credibility of the information disclosed.

The variable "cons" presents a lower probability than at the level of the threshold and a positive coefficient. Of this fact, the variable board of directors has an effect on the commercial performance. In this sense, Wagner sees that the competence of the members of the Council is seen as a crucial pillar of the effectiveness of a system of governance. Similarly, Andres and Vallelado discerned a positive relationship between the activity of the Council and the performance of financial institutions [18-22].

The explanatory variables need to be linearly independent: that is to say that they should not unfold the same object. The test of this hypothesis is provided by the review of the Tolerance and the factor of inflation of the variance (VIF) which are two factors of diagnosis of collinearity. The tolerance is a measure of colinearity reported by most of the statistical programs such as SPSS; the tolerance of the variable is the 1-R2. And the inflation factor of the variance is defined as the opposite of tolerance: 1/(1-R2). It is always greater than or equal to 1. Thus, the rule of the test is based on the fact that the more the tolerances are close to 1 plus the absence of colinearity seems obvious. Also, a value of lesser keen to 2 means the absence of the collinearity. In applying this decision rule, we can generally testify the absence of the problem of colinearity in our model (Table 6).

Table 6: Summary of autocorrelation and partial autocorrelation (E-views).

| Autocorrelation | Partial autocorrelation | Q-stat | Likelihood | |

|---|---|---|---|---|

| 1 | 0.207 | 0.207 | 1.5957 | 0.207 |

| 2 | -0.072 | -0.120 | 1.7941 | 0.408 |

| 3 | -0.235 | -0.205 | 3.9760 | 0.264 |

| 4 | -0.171 | -0.094 | 5.1712 | 0.270 |

| 5 | 0.327 | 0.202 | 6.2643 | 0.281 |

| 6 | -0.078 | -0.245 | 6.5324 | 0.366 |

| 7 | -0.095 | -0.079 | 6.9458 | 0.435 |

| 8 | -0.152 | -0.083 | 8.0363 | 0.430 |

| 9 | -0.183 | -0.181 | 9.6672 | 0.378 |

| 10 | 0.004 | -0.081 | 9.6681 | 0.470 |

At the base of the corrélogramme of residue , there is the absence of the autocorrelation since for a level of delay equals 10 probabilities are higher than 0.05 (threshold of significance), therefore the correlation is not significant (Table 7).

Table 7: Test of Kolmogorov (according to: E-views).

| Method | Value | Added value | Likelihood |

|---|---|---|---|

| Kolmogorov (D+) | 0.098578 | 0.588495 | 0.5002 |

| Kolmogorov (D-) | 0.077307 | 0.461508 | 0.6531 |

| Kolmogorov (D) | 0.098578 | 0.588495 | 0.8791 |

| Cramer-von Mises (W2) | 0.044224 | 0.033948 | 0.9131 |

| Watson (U2) | 0.043591 | 0.041694 | 0.7871 |

| Anderson-Darling (A2) | 0.307904 | 0.307904 | 0.9321 |

The test of adjustment of Kolmogorov-Smirnov is a nonparametric test to check the hypothesis H0 according to which the data studied are procréées by an act of theoretical probability considered as a suitable model. According to this test, the probabilities exceed the threshold of 0.05 and therefore the assumption of normality is accepted (Table 8).

Table 8: Test of Breusch-Pagan-Godfrey (source: e-views).

| F-statistic | 0.565163 | Prob. F(7,128) | 0.7771 |

| Obs*R-squared | 4.490194 | Prob. Chi-Square(7) | 0.7219 |

| Jarque-Bera | 0.481075 | Prob. | 0.7862 |

This table indicates that the probabilities exceed the threshold of 5%. Where we accept the hypothesis of homoskedasticity and, consequently, the residues are homoscédastiques. Similarly, we apply the test of normality of Jarque Bera including the null hypothesis is that of normality of the residues. The decision rule is to accept this assumption if the statistics of Jarque Bera JB is less at 5.99 to a risk of 5%. Similarly, according to the test of Jarque-Bera, the assumption of normality of residuals is accepted, given that the probability associated exceeds 5%. This also means that the series are stationary.

The concept of corporate governance has been the subject of a large part of the literature. As well, the theories of governance have evolved toward more complex models involving all the stakeholders in order to ensure the creation of a value. It is in this framework that, corporate governance has emerged to address the conflicts of interest between leaders and shareholders. Several researchers have tried to propose mechanisms for governance that aim to limit the opportunistic behavior of the leaders in order to improve the performance of the company.

The Governance of Financial Institutions occupies an important place for the financial system and deserves that we lend him particular attention given that these institutions, through their intermediation role and facilitating transactions, constitute a main guarantor of the strength of the economy. Similarly, the regulations of Basel on the banking supervision are intended to help control authorities to encourage the banks to opt a governance system healthy and adequate. It seems, therefore, essential to adopt good governance to win and render sustainable the confidence of the stakeholders of the financial system. The governance challenge exceeds, therefore, the simple maximizing the wealth of shareholders, but mainly consists in the guarantee of the continuity and sustainability of the activity. In other words, a system of governance directly influences the strategy of a financial institution.

Many studies have investigated the association between governance and performance. The conclusions assume that governance has an impact on the performance of the company. As well, the characteristics of the Board of Directors (nature and number of members, cumulation of functions of decision and control), the structure of property… are supposed to explain the performance of the companies. Still, the results are conflicting: currents that highlight a positive or negative impact of the mechanisms of the governance on the performance of firms, and another current of research finding an absence of impact.

For Tunisian financial institutions, this impact on commercial performance manifests itself in various aspects such as customer satisfaction; the marketing of quality products and services, continuous innovation, the development of the quality of the resources implemented… Is the marketing performance that allows developing the image quality and allows positioning well.

The limitations of this article are related to the notions of our research constitute fields where the questions are relatively recent and few references exist. In addition, the notion of commercial performance of financial institutions is little manipulate by the literature.

This study may open up the prospect for further research. Can we therefore conclude by expanding our sample or by taking a broader study that takes into account other variables?

Copyright © 2026 Research and Reviews, All Rights Reserved