ISSN: 1204-5357

ISSN: 1204-5357

Adediran Oluwasogo S*

Department of Economics and Development Studies, Covenant University, Ota, Nigeria

Oduntan, Emmanuel

Department of Economics and Development Studies, Covenant University, Ota, Nigeria

Matthew Oluwatoyin

Department of Economics and Development Studies, Covenant University, Ota, Nigeria

Visit for more related articles at Journal of Internet Banking and Commerce

Financial development is a multidimensional concept that constitutes a potentially important mechanism for long run growth in an economy. However, short-run gains at the expense of long-run growth coupled with various exogenous factors could have precipitated economic fluctuations in Nigeria. Therefore, efforts to moderate these fluctuations by successive federal authorities must have prompted them to adopt various economic policy measures including Stabilization Policy, 1981- 1983, Structural Adjustment Programe (SAP), 1986-1992; Medium Term Economic Strategy, 1993-1998 and the Economic Reforms 1999-2007, on the basis that such policy actions can engender economic growth in the long run. This was eventually the driving force behind various financial policy reforms in Nigeria. However, in spite of all these reforms, the associated problems that exist still include: inefficiency in the allocation of funds to the productive sectors, lack of long-dated funding and decline in domestic credit to the private sector. All these frustrate inclusive growth experience in the country. Therefore, the important issues of concern are: what level of financial development is required for growth to be inclusive? How can the economy create and support inclusive growth through the financial sector? Hence, the objective of the paper is to examine the impact of financial development on inclusive growth in Nigeria using a multivariate model (Bound testing approach), this study obtained new evidence for the finance-growth nexus in Nigeria.

Financial Development; Inclusive Growth; Economic Growth and Nigeria

The major economic challenge facing most developing countries in Africa, with Nigeria inclusive in recent time, is how to make the growth in Gross Domestic Product (GDP) more inclusive. Several developing countries across the globe are growing faster than most of the supposed high-income economies of Europe, Asia and North America but poverty, unemployment and income inequality rates have remained very high in these regions in the last decade, in spite of the continuous impressive economic growth recorded. Although, some level of growth may be necessary for poverty reduction, but this may not be sufficient enough for economic development, for the simple reason that most people may not benefit equally from the growth.

In the case of Africa countries, the late 1970s and early 1980s economic data, showed severe distortions in their economic performance indicators, as a result of various macroeconomics shocks experienced, these includes: foreign debt which created financial short falls in the execution of socio-economic developmental programmes; inappropriate policy response to observed economic trends in terms of timing direction and magnitude; disequilibrium between rural and urban sectors which prompted rural-urban drift; terms of trade changes as a result of over-valuation and changes in economic structure. All these must have prompted most countries in Africa to adopt a number of policy measures, particularly the Structural Adjustment Programme (SAP) which was aimed at restoring macroeconomic stability and economic growth. Interestingly, financial sector reform was a major component of the broad-based economic reforms to boost the real sector and promote inclusive growth.

In Nigeria, between 1986 and 1993, the pace of financial sector reforms evolved tremendously with various restrictions removed in a bid to foster liberalization of financial markets, improve access and availability of long-term credit to all interested lenders, including the rich and the poor. But, in spite of all these, the associated problems still include: lack of long-dated funding, decline in domestic credit by the banking sector to the more vulnerable economic agents and a considerable liquidity mismatch in the Nigerian economy. Hence, growth is inclusive when it creates equal access to opportunities without social exclusion linked to institutional; market and policy factors [1]. Inclusive growth increases the social welfare function that depends on how the average population has equal access to opportunities, including employment, education, health and basic amenities. Hence, Nigeria is still contending with development policy options on how to make growth inclusive by focusing on those productive sectors (such as industrial, agricultural and financial sector) that can create job opportunities, reduce poverty and inequalities.

Theoretical literature established that financial development, if well-developed has the capacity to accelerate growth because of its potential influence on capital accumulation, technological innovation, resource allocation and productivity growth. Through mobilization of funds from surplus units to productive investments, the financial sector has the tendencies to promote economic growth. Hence, the theory of finance and growth focused on how finance impact on growth via resource allocation decision by performing specific functions such as mobilization of savings, provision of extant information, exerting corporate governance, allocation of capital and monitoring investments, and facilitating trading, diversification and management of risks [2].

However, the empirical debates on the finance-growth nexus in the last three decades have been mixed and inconclusive, thereby producing different hypotheses. The supply-leading hypothesis opines that finance leads to growth, while the demand-following hypothesis deposits that economic growth promotes financial development [3-5]. The feedback hypothesis supports bidirectional causality between finance and growth, while the neutrality hypothesis found no evidence of any causal relationship between finance and growth [6-8].

The above empirical evidence indicates that well developed and efficient financial sector has the capacity to create jobs, provide financial services that could cater for all, including the poor with a view to raising their living standard. Though a large body of literature [9-11] has accessed the link between financial development and growth by examining the finance-growth nexus, within a bivariate framework, but the nexus with inclusive growth (reduction in unemployment, inequality and poverty rates) have not been thoroughly explored. This study intends to contribute to the existing literature by investigating the impact of financial development on inclusive growth within a multivariate framework approach. Therefore, the important issues of concern in this study are: what is the impact of financial development on inclusive growth in Nigeria? What level of financial development is required for growth to be inclusive? And how can the economy create and support inclusive growth through the financial sector? Investigating these relationships would improve policy making and an informed strategy that could boost an all-inclusive growth in Nigeria.

The remainder of this article is structured as follows. Section 2 presents the review of theoretical, empirical and methodological literature. Section three features the methodology used for the study, while section four gives the empirical results and section five is the concluding part.

Conceptual Issues

The concept of inclusive growth is not a new concept in the literature. As a result of this, it has not been unanimously defined, given the evolutional dimension of growth in the last few years. A commonly used definition, however, is that inclusive growth is an absolute reduction in poverty associated with a creation of productive employment rather than direct income distribution schemes. It should accommodate both the pace and pattern of growth [12]. For growth to be inclusive, the nexus of both economic growth and income distribution need be achieved. Inclusive growth addresses absolute poverty as against the case of relative poverty in pro-poor growth. Putting these together, it suggests that a robust inclusive growth strategy will complement policies to stimulate economic growth with those that foster equality of opportunity, alongside a social security net to protect the most vulnerable. As such, economic policies to promote structural transformation and creative productive employment for the poor people will need be complemented by investments in human capital and other programmes to support social inclusion and equal access to jobs [13,14].

The Finance-Growth theories advocate that financial development creates enabling conditions for growth through either through a supply-leading direction, in which financial development spurs growth or through demand-following direction, where growth generates demand for financial products channel. Until the evolution of the studies [15-17] on financial development and economic growth relationship, the earlier Schumpeterian thought on development hypothesized that a rise in inequality and concentration of wealth was inevitable in the early stages of development [18]. As such, early literature focused on the need to develop an extensive financial system that could tap savings and then channel the funds so generated to a wide spectrum of activities [19].

The more recent development theory perceives growth in the financial system characterized by growth in access to finance as a critical factor in fast tracking economic growth. In other words, a large body of empirical literature suggests that developing the financial sector and improving access to finance may accelerate economic growth along with a reduction in income inequality and poverty. This implies that lack of access to finance is responsible for persistent income inequality as well as slower growth [20]. Against this background, the next section of the article review studies on the linkage between financial development and improvement in social welfare

Empirical and Methodological Review

There are numerous empirical studies that have examined empirically the impact of financial development on growth. However, scanty studies have focus on inclusive growth. The available studies in the finance and growth literature have focus on components of inclusive growth such as income inequality and poverty reduction. The empirical findings from past studies in the literature suggest that the findings in the literature can be categorized into two main strands. The first strand of studies found support for the [21] hypothesis that financial development help reduce income inequality between the rich and the poor. The poor is expected to have better access to credit to finance their investment such that gaps between the rich and the poor become reduced due to the development of the financial sector. These studies documented negative relationship between financial development, income inequality and poverty reduction. The second strands of studies documented positive relationship between financial development, income inequality and poverty reduction [22]. Represents one of the foremost studies that examine the interaction between financial development and poverty reduction in developing countries. The paper submitted that financial market imperfections are key constraints to pro poor growth. He therefore suggested that public policy that are directed towards correcting these market failures are essential to ensure financial development contributes to growth and poverty reduction in developing countries.

Extended the finance growth studies to capture the impact of financial development on poverty reduction in 42 low-income countries by employing panel data regression method [23]. The findings indicate that financial development help reduce income inequality between the rich and the poor as the poor is expected to have better access to credit to finance their investment such that the gap between the rich and the poor becomes reduced due to the development of the financial sector. The ARDL bound test co-integration approach [24]. The results indicate that financial development and financial liberalization helped reduce income inequality while financial liberalization was found to increase or worsen the inequality between the rich and the poor in India. The author noted that underdevelopment of the financial system in India tends to hurt the poor more than the rich. Therefore, he submitted that the [21] hypothesis that financial development help reduce the income inequality between the rich and the poor is not plausible in India context. The results of this study were found to be robust to different measures of financial development and financial liberalization. As a departure from other previous studies that have employed co-integration methods to capture long run relationship between financial development, income inequality and poverty reduction.

Reported that financial development and income inequality was found to be negatively related [25]. This suggests that the development of the financial sector provide better financing opportunities for the poor especially access to credit. It also implies that financial development could also help reduce the income gap between the rich and the poor. This finding is similar to the result documented [26] on financial development and poverty reduction in Pakistan. He also reported negative relationship between financial development and poverty level but found financial instability to increase poverty level in Pakistan. In a cross country study used the instrumental variable method to investigate whether financial development disproportionately increases the income of the poor and alleviate their poverty [27]. This study reported that the development of the financial sector induces the income of the poor to grow faster than the average GDP per capita. The study further found out that income inequality falls faster and poverty rate reduces more rapidly with the development of the financial sector.

Employed the trivariate causality test to examine the dynamic relationship between financial development, growth and poverty in South Africa [28]. The study reported that financial development and economic growth granger cause poverty reduction. The paper also found economic growth to granger cause financial development and in the process lead to poverty reduction in South Africa. Similar result was found [29] in his study of the relationship between financial development, savings mobilization and poverty reduction in Ghana. He reported that financial development helped reduce poverty in Ghana but does not Ganger cause savings mobilization. However, [30] documented that financial development Granger cause savings mobilization and poverty reduction in Kenya. Also, he reported feedback effect between domestic savings and poverty reduction. He found similar result in Zambia when he examine whether financial development Granger cause poverty reduction.

Found financial development to be Granger caused by poverty reduction [31]. The result reported by this study indicated that the outcomes depend largely on the measure of financial development employed in the study. He noted that when M2 as percentage of GDP was used as measure of financial development, it was found to be Granger caused by poverty reduction, but when private credit as percentage of GDP was employed to proxy financial development, unidirectional causality was reported between financial development and poverty reduction. These findings imply that the relationship between financial development and poverty reduction is sensitive to the measure of financial development employed by the study [32].

Furthermore, [33] examine the impact of financial development on poverty reduction of 89 developed and developing countries using the three stages least squares method. The study found positive and significant effect of financial development on poverty reduction through savings, insurance services and access to credit. These were found to outweigh the indirect negative effects through growth and inequality. He noted that institutional quality plays a crucial role for financial development to have impact on poverty. Evaluated the impact of financial development on poverty reduction through the development of manufacturing industry in Pakistan [34]. They employed the error correction model and found positive relationship between financial development and poverty reduction through industrial growth.

From the above review of empirical studies, the relationship between financial development, income inequality and poverty reduction have been mixed and inconclusive with limited focus on inclusive growth. This informs the need for fresh empirical evidence on the relationship between financial development and inclusive growth in Nigeria. Therefore, this study focuses on this interaction with a view to add to knowledge in this area.

To examine whether a long-run co-integration relationship exists between financial development and inclusive growth in Nigeria, Bounds testing (also known as Autoregressive Distributed Lag or ARDL) approach as developed [35] and later extended [36] is used in this study. This approach which is multivariate in nature has advantages over some other co-integration approaches including: [37,38], because it can be applied whether the variables in the model are endogenous, integrated of order one or zero, and even if the sample size is small [35]. In addition to this, ARDL approach requires that none of the variables in the model should be integrated of order two, and the variables should have long-run co-integration relationship. Hence, the study conducts unit root test using Augmented Dickey-Fuller (ADF) to ascertain the stationarity of the series before carrying out the co-integration test. After establishing the existence of long-run co-integration relationship, the study investigates both the longrun effects and the short-run dynamics using the Error Correction Model (ECM) approach. The source of the annual data for the study is from World Development Indicators with the sample period of 1970-2015.

Model Specification

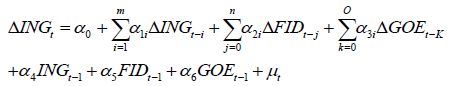

Following [36], the ARDL model to investigate the long-run co-integration relationship between financial development and inclusive growth in this study is given as follows:

(1)

(1)

Where: ING=inclusive growth proxied by real per capita GDP; FID=financial development proxied by ratio of domestic credit to GDP; GOE=ratio of government expenditure to GDP and μt=disturbance term. The variables are in natural logarithms. The first section of Equations 1 (that is α1, α2 and α3) examine the short-run dynamic relationship while the second section (that is α4, α5 and α6 investigates the long-run relationship between financial development and inclusive growth.

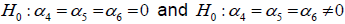

In selecting the number of lags as denoted by m, n and o, the study considered Akaike Information Criterion (AIC). To test for the co-integration relationship using the ARDL approach based on the F-statistic or Wald statistic, we state null hypothesis of no cointegration against the alternative hypothesis of co-integration among the variables in the model as follows:

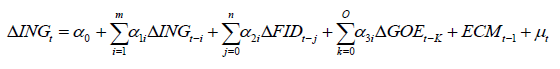

The acceptance or rejection of the hypothesis is based on comparison between the calculated F-statistic and the F-statistic tabulated [36]. The tabulated F-statistic has both upper and lower bounds critical values and if the calculated F-statistic is higher than the upper bounds, the null hypothesis is rejected and the alternative hypothesis is accepted that there is co-integration relationship between the variables. But if the calculated Fstatistic is lower than the lower bound critical value, the null hypothesis is accepted and the alternative hypothesis is rejected, meaning that there is no co-integration relationship between the variables. However, the test is inconclusive if the calculated Fstatistic lies between the lower and upper bound critical values. Once a co-integration relationship is established between the variables, the study proceeds to examine the long-run effect and the short-run dynamics using ECM equation given as follows;

(2)

(2)

Where; ECMt-1 is the lagged error correction term.

Summary of Descriptive Statistics

Table 1 shows the summary of descriptive statistics of the variables included in the model. It shows the existence of high average values for all the growth enhancing variables during the sample period 1970-2015. For instance, the average real per capita GDP (proxy for inclusive growth) and domestic credit to private sector (FID1) are $719 and 13.2 percent and respectively. While, the average values of broad money supply (FID2) at 22.57 percent and government expenditures (GOE) at 11.60 percent during the period are high. This analysis indicates that growth enhancing variables performed better in Nigeria during the sample period.

Table 1: Summary of descriptive statistics.

| ING | FID1 | FID2 | GOE | |

|---|---|---|---|---|

| Mean | 719.008 | 13.282 | 22.578 | 11.160 |

| Std. Dev. | 805.696 | 6.435 | 7.238 | 3.807 |

| Skewness | 2.091 | 2.014 | 0.500 | -0.107 |

| Kurtosis | 6.348 | 8.434 | 3.279 | 1.540 |

Note: ING is the real per capital GDP, FID1 is the Financial Development proxied by domestic credit to private sector as a ratio of GDP, F1D2 is the Financial Development proxied by broad money supply as a ratio of GDP and GOE is the Government expenditures as a ratio of GDP.

Unit Root Test Results

The unit root test used to ascertain the order of integration of the variables in the model shows the result in Table 2. The results revealed that government expenditure is integrated at level I(0) while the other variables are integrated at order one I(1) at 1% significant level. Therefore, all the variables have satisfied the Bound testing approach requirement that, all the variables in the model should be stationary at either at level or at first differenced.

Table 2: Unit root test results.

| Augmented Dickey Fuller (ADF) | ||

|---|---|---|

| Variables | Level | First Difference |

| Y | -2.668 | -6.101*** |

| FID1 | -3.216 | -5.935*** |

| FID2 | -3.343 | -5.898*** |

| GOE | -3.628*** | -7.217 |

Notes: *** indicates significant at 1%.

Co-integration Test

To determine the appropriate lag order of the differenced variables in the model, the study chooses Akaike Information Criterion (AIC) using the unrestricted ARDL equation in Microfit Software.Thereafter, the ADRL-bounds testing approach is used to determine whether a long-run co-integration relationship exists between financial development and inclusive growth or not.

The results presented in Table 3 revealed that a long-run co-integration relationship exists between financial development and inclusive growth in Nigeria. The F-statistic of 6.112 is greater than the upper bounds critical values tabulated by both [36,39] at 1 percent significant level.

Table 3: Co-integration test.

| Nigeria | |

|---|---|

| Function | F-test Statistic |

| Y=f(FD1) | 6.112*** |

| Y=f(FD2) | 6.901*** |

| Critical values by Narayan P. (2005) | |

| Lower Bounds I(0) | |

| 1% | 4.983 |

| 5% | 3.535 |

| 10% | 2.893 |

Note: *** is significant at 1%.

This result is not different from the one obtained using an alternative proxy (FID2) for measuring financial development as the existence of long-run co-integration relationship is also ascertained. Hence, we reject the null hypotheses that state the absence long-run co-integration relationship among the variables and accept the alternative hypotheses that support the existence of long-run co-integration relationships between financial development and inclusive growth.

Long-Run Effects

Having established the existence of a long-run co-integration relationship between financial development and inclusive growth, the next step is to investigate the long-run coefficients of the variables. The results presented in Table 4 indicate that financial development has positive impact on inclusive growth in Nigeria. Thus, one percent increase in financial development will increase inclusive growth by 2.3 percent. The robustness of this result is confirmed by the alternative proxy used to measure financial development as similar findings were obtained as shown in the Table 4. These findings agreed with some previous studies [40,41] who documented a positive relationship between financial development (measured by both broad money supply and credit to private sector) and growth in Nigeria.

Table 4: Long-run coefficients.

| Variables | Nigeria |

|---|---|

| Constant | 6.232 (5.962) |

| FID1 | 2.324*** (0.965) |

| GOE | 0.237 (1.081) |

| FD2 | 5.347***(2.503) |

| R-Squared | 0.962 |

| R-Bar-Squared | 0.951 |

| D.W | 1.963 |

| F-Stat | 90.107*** |

Notes: *** indicates a statistical significance at 1% level

These findings indicate that only financial development is responsive to inclusive growth in Nigeria in the long-run. Hence, the present level of government expenditures in Nigeria cannot spur reduction in the rates of unemployment, inequality and poverty.

Short-Run Dynamics

The results of the short-run dynamics of the variables estimated from the error correction model in Equation 2 presented in Table 5 shows that financial development and government expenditure have significant impacts on inclusive growth in Nigeria in the short-run. While, the alternative measure of financial development revealed similar results [40] also found similar short-run negative correlation between financial development and growth in Nigeria.

Table 5: Short-run results.

| Variables | Nigeria |

|---|---|

| Constant | -0.675 (0.681) |

| D(FID1) | -0.576*** (0.131) |

| D(GOE) | 0.186* (0.100) |

| D(GOE(-1)) | 0.174 (0.112) |

| D(GOE(-2)) | 0.351*** (0.093) |

| ECM(-1) | -0.106*** (0.043) |

| D(FID2) | -0.850*** (0.170) |

| R-Squared | 0.855 |

| R- Bar-Squared | 0.730 |

| D.W | 1.963 |

| F-Stat | 6.658*** |

Notes: *** and * indicates statistical significance at 1% and 10% levels, respectively. Figures in parenthesis are standard errors.

Furthermore, [42-44] found out that the impact of financial development on growth is influenced by the level of financial development, the level of par capita income, the level of inflation rates and the quality of institutions. Hence, the behaviour of financial development in Nigeria could be explained by the low level of financial development, low per capita income and low quality of institutions.

As expected, the lagged error correction term is negative and statistically significant. Since, the coefficients of the lagged error correction term is negative and significant, the coefficients reveal the speed at which the entire system adjust towards long-run equilibrium. The significance of the lagged error correct mechanism signifies the existence of long-run relationship between the variables.

The study investigated the existence of long-run co-integration relationship between financial development inclusive growths in Nigeria. It employs the Bounds testing technique as expressed [36], with 1970-2015 data sourced from World Bank’s World Development Indicators. Evidence from the study supports the existence of long-run co-integration relationship between financial development and inclusive growth. It was found that financial development has positive and significant impact on inclusive growth in Nigeria in the long-run. This implies that the financial sector can be used to address the high rates of unemployment, income inequality and poverty in the country. Meanwhile, the study found a negative relationship between government expenditure and inclusive growth. These findings are robust to alternative proxy of measuring financial development.

The implication of this study is that only financial development can promote inclusive growth. Therefore, to accelerate inclusive growth, it is necessary for the Nigerian government to strengthen its financial sector through policies and reforms with regards to domestic credit to private sector and broad money supply in order to reposition the economy for inclusive growth.

Copyright © 2024 Research and Reviews, All Rights Reserved