ISSN: 1204-5357

ISSN: 1204-5357

Natalia Nikolaevna Kunitsyna*

North-Caucasus Federal University, Stavropol, Russian Federation

Elena Vladislavovna Sitnikova

North-Caucasus Federal University, Stavropol, Russian Federation

Visit for more related articles at Journal of Internet Banking and Commerce

The problem of optimal portfolio of banking services under current conditions is one of the priorities of the banking system dynamics. Enhancement of the currency risk hedging mechanism for company’s customers, especially during the period of unstable exchange rate fluctuations, shocks in the foreign exchange market and economic sanctions becomes one of the directions of its development within an innovative vector. In the article, the authors describe the assessment mechanism of currency risk impact on the customers of credit organizations. Different alternatives of individual hedging schemes to ensure their efficient sales in the form of a banking product are suggested. The research is based on the system, structural and dynamic analyses as well as abstract, logical, economic, statistical and other methods. As a result, the currency risks hedging mechanism will allow commercial banks to improve their financial results and to advance the quality of credit portfolios.

Currency Risks, Hedging, Corporate Clients, Commercial Banks

The problem of the optimal portfolio of banking services under current conditions has become one of the major directions of economic development in a banking system. A service is a traditional form of the financial entrepreneurship seeking to increase banks’ revenue and to satisfy the needs of private and corporate customers for the development of national economy.

As a bank is one of the most reliable institutions aimed to provide sustainable development of the economy, stability of the banking system depends on many factors and conditions, including the state of the economy and the strategies of its development as well as reliability and stability of monetary policy and operating activities of banks.

Under conditions of the world financial crisis that has brought down the national currency rate, outflow of foreign investors’ funds and deficit of resources are obvious. As a result, this raises the problem of currency risk management.

The promotion of the currency risk hedging mechanism for corporate customers, especially in the period of unstable exchange rate fluctuations, shocks in the exchange market and economic sanctions becomes one of the directions of their enhancement within an innovative profile.

After early transition of Russian economy to the floating Ruble rate the dependence of the companies’ financial results on currency rates has increased significantly. In most cases, similar risks cannot be well addressed by the entities of the real production sector. They either does not pay due attention to them or their risk-management involve considerable costs. Thus, active promotion of services in currency risk hedging by Russian banks is crucial.

After preliminary risk analysis of the existing and prospective banks’ clients, it is necessary to recommend particular programs on the revealed risks minimization.

At the first stage, the information about potential consumers of hedging is to be collected. In order to be able to offer customers the optimum solutions to their problems, a bank has to create a profile of a customer risk and to identify the degree of its dependence on the changes in currency markets [1]. The information can be received from the following sources: Websites, publications in mass media, analytical reviews, and resources from specialized information systems (SPARK, SKRIN, FIRA, etc.).

During the preliminary analysis of current and prospective customers the following groups can be selected:

• Producers that use imported raw materials;

• Trading companies importing products to sell to their consumers;

• Entities exporting a considerable share of their products;

• Companies paying credits and leasing payments in foreign currency;

• Employers paying salary to their employees in foreign currency;

• Entities having considerable financial investments in foreign currency;

• Companies that use imported equipment to implement their projects;

• Producers that are both exporters and importers of products (if the incoming and outgoing currencies are different).

Applying these criteria, a bank can make a list of potential consumers of hedging.

At the following stage, the impact of a currency risk should be estimated for every customer. For this purpose, it is reasonable to use such methods as the calculation of net foreign exchange position and stress testing [2].

Net foreign exchange position (NFEP) can be assessed by calculating requirements R and liabilities L for the company in each currency (Formulas 1 and 2).

Ri=CFi+Ri+FIi+ORi, (1)

where CFi – cash flow in i currency;

Ri – Receivables in i currency;

FIi – Financial investments in i currency;

ORi – Options requirements in i currency.

Li=APi+CLi+OBLi+OLi, (2)

where APi – accounts payable in i currency;

CLi – Credits and loans in i currency;

OBLi – The sum of off-balance liabilities in i currency;

OLi – Options liabilities in i currency.

The results obtained allow us to calculate the company’s net foreign exchange position in the corresponding currency and its balance sheet position (formulas 3 and 4).

NFEPi = Ri – Li, (3)

To assess the company’s currency risk, net foreign exchange position in every currency and the value of the balance sheet position in national currency are to be compared to the company’s equity.

At the final stage, the total of net foreign exchange positions in different foreign currencies is calculated by adding up all long positions (including long balance sheet position in national currency).

The acceptable value is within 25% of the company’s equity for every currency (including balance sheet position) and 50% of the equity for the total of all long positions in different foreign currency.

The second part of the analysis includes stress testing. Here, it represents the modeled change in currency rates by a certain value and the assessment of an impact of this change on the financial position of the company.

The criterion for the client’s financial stability is the interest coverage ratio (IC) exceeding 1. This ratio is calculated by the following formula 5:

where EBIT – earnings before interest and taxes for the last 12 months;

I – Interests to be paid for the last 12 months.

In stress testing each indicator is replaced by its stress value calculated by the formula 6:

Where Iref – Initial value of the indicator;

Wi – Relative weight of i currency in the initial value of the indicator,%;

ΔCRi – The change of i currency rate against ruble,%.

1) Thus, modeling of the following stress scenarios is recommended:

2) Simultaneous increase in USD and EUR exchange rates against national currency over 50%;

3) Simultaneous decline in USD and EUR rates against national currency over 25%;

4) Increase in USD exchange rate against national currency over 25% at stable EUR exchange rate;

5) Increase in EUR against national currency over 25% at stable USD exchange rate.

If the value of the interest coverage ratio is lower than 1 at the abovementioned modeling, the test is failed, and the customer is considered to be subject to a currency risk [2]. If no evidence of high currency risk has been identified as a result of net foreign exchange position calculation and stress testing of a company, it is excluded from the list of potential customers.

Then, individual hedging strategy based on the results of previous calculations (Table 1) is developed for each customer [3].

Table 1: Development of currency risk hedging strategy.

| Failed stress test | Net foreign exchange position | Hedged pair | Recommended hedging instruments |

|---|---|---|---|

| Simultaneous growth in USD and EUR to RUR exchange rates by 50% | Short position in USD | USR/RUR EUR/RUR |

a foreign exchange future to buy currency, a call option |

| Simultaneous decline in USD and EUR against RUR exchange rates by 25% | Short position in EUR | RUR/USD RUR/EUR |

a foreign exchange future to sell currency, a put option |

| Increased USD against RUR exchange rate by 25%atconstant euro exchange rate | Long position in USD | USD/EUR | a combination of a call option for USD and a put option for EUR |

| Increased EUR against RUR exchange rate by 25%at constant USD exchange rate | long position in EUR | EUR/USD | a combination of a call option for EUR and a put option for USD |

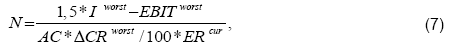

The amount in which the particular hedging instrument has to be purchased is calculated by the formula 7:

Where worst Iworst – interests to be paid in 12 months in the worst stress scenario for a customer;

EBITworst – EBIT in 12 months in the worst stress scenario for the client;

AC– adjustment coefficient (it equals 1 for the future to buy currency and the call option; -1 for the future to sell currency, the put option);

ΔCRworst– change in currency exchange rate against RUR in the worst stress scenario for the customer,%;

ERcur – current exchange rate.

Next, to assess efficiency of the chosen strategy, the interest rate coverage ratio is calculated for the following three scenarios:

• Stress test failed by a customer;

• Stress test opposite to the test failed by a customer;

• Constant currency rate.

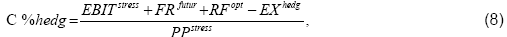

The interest coverage ratio in each case is calculated by the following formula 8:

Where FRfutur – financial result of currency futures exercise;

FRopt – financial result of currency option exercise;

EXhedg – other expenses involved in hedging.

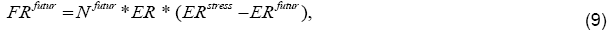

Depending on the chosen stress test, the financial result from the future exercise can be both positive and negative (formula 9).

where Nfutur – amount under the futures contract;

ERstress – foreign exchange rate within a stress test;

ERfutur – foreign exchange rate under the futures contract.

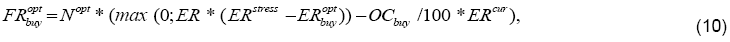

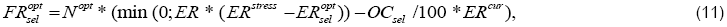

In its turn, the mechanism of calculating financial result from an option will vary with the client being either a buyer or a seller (formulas 10 and 11).

where Nopt – amount under option contract;

– exchange rate under option purchase contract;

– exchange rate under option purchase contract;

ÃÂÞCbuy – cost of option purchase, % of transaction.

where  – exchange rate under option sale contract;

– exchange rate under option sale contract;

ÃÂÞCsel – cost of option sale,% of transaction.

Other customer’s expenses on hedging include all types of charges paid to the stock exchange and the bank which organized hedging:

where CBdep – bank fee for security deposit placement at the stock exchange;

CC– clearing charges;

EC– exchange charges;

BChedg – bank fee for hedging arrangement.

Thus, theoretical research allows us to develop the program of the customer’s currency risk minimization which includes 5 consecutive stages (Figure 1).

When the decision on the strategy is made and the calculations of an interest coverage ratio for each stress scenario are done, the received values are compared to a sum without hedging, which allows us to assess the efficiency of the chosen strategy [4]. If it is effective, bank employees prepare a presentation for the client who includes basic elements of the suggested strategy and results of calculations.

Then, at a meeting, this presentation is delivered to the client and, if he is interested in this service, the corresponding hedging agreement is to be prepared. We suppose the suggested mechanism will be efficient both for credit organizations and for regional entities subject to a currency risk (Table 2). Its main outcome will be higher predictability of a company’s performance in the real economy that will allow it to focus on the improvements in its economic activities instead of wasting resources on financial transactions unusual for it [5].

Table 2: Benefits of the currency risk hedging mechanism.

| Participant | Main benefits |

|---|---|

| Bank | 1. Higher percentage of successful transactions compared to sales without hedging mechanism. 2. Extra fee-revenue. 3. Increased loyalty of existing clients as a result of higher satisfaction of their requirements. 4. Acquisition of new consumers of other banking products. 5. Lower credit risk level of current borrowers of a bank due to minimized negative effect of adverse change in currency exchange rates. |

| Regional entities | 1. Zero expenses on currency risk calculation and selection of hedging instruments within a company. 2. Better testing of the hedging program due to considerable human and methodological resources of a bank. 3. Increased company’s appeal to investors as the result of cooperation with the professional participant of the market in risk hedging. |

To assess the applicability of the suggested algorithm, the potential consumers of services in currency risk hedging have been selected among the entities of North Caucasus Federal District which represent various economic sectors. In order to ensure confidentiality, they are marked as Client 1, Client 2 and Client 3 (Table 3).

Table 3: Basic data about potential consumers of currency risk hedging services.

| Indicator | Client 1 | Client 2 | Client 3 |

|---|---|---|---|

| Type of business | Production of artificial sapphires | Plastics and synthetic resins industry | Production of mineral waters and soft drinks |

| Revenue in 2014, million Rubles | 2,524 | 8,264 | 1,068 |

| Indicators of currency risks | Prices for products sold are nominated in USD while the most expenses are paid in RUR | Principal suppliers of raw materials are the European Union companies. Settlements with them are nominated in EUR while prices for products in this industry are traditionally set in USD. | The company’s credit portfolio is nominated in USD while currency earnings are insignificant. |

Results of NFED calculation of the selected companies (Table 4) show that all of them are substantially subject to a currency risk.

Table 4: Calculation of net foreign exchange position of potential buyers of hedging services.

| Indicator | Value for 01.01.2015 in RUR equivalent | |

|---|---|---|

| USD | EUR | |

| Client 1 | ||

| Absolute value, RUR | ||

| Currency requirements | 2,191,484,000 | 149,111,000 |

| Currency liabilities | 2,964,885,000 | 24,746,000 |

| Net foreign exchange position | -773,401,000 | 124,365,000 |

| Balance sheet position | 649,036,000 | |

| The amount of all long net foreign exchange positions in each foreign currency | -773,401,000 | |

| Against equity,% | ||

| Net foreign exchange position | -27.7 | 4.5 |

| Balance sheet position | 23.2 | |

| The amount of all long net foreign exchange positions in each foreign currency | -27.7 | |

| Client 2 | ||

| Absolute value, RUR | ||

| Currency requirements | 346,708,000 | 103,032,000 |

| Currency liabilities | 1,764,794,000 | 9,128,939,000 |

| Net foreign exchange position | -1,418,086,000 | -9,025,907,000 |

| Balance sheet position | 10,443,993,000 | |

| The amount of all long net foreign exchange positions in each foreign currency | -10,443,993,000 | |

| Against equity,% | ||

| Net foreign exchange position | -2,124.2 | -13,520.1 |

| Balance sheet position | 15,644.3 | |

| The amount of all long net foreign exchange positions in each foreign currency | -15,644.3 | |

| Client 3 | ||

| Absolute value, RUR | ||

| Currency requirements | 12,044,00 | 0 |

| Currency liabilities | 816,461,000 | 0 |

| Net foreign exchange position | -804,417,000 | 0 |

| Balance sheet position | 804,417,000 | |

| The amount of all long net foreign exchange positions in each foreign currency | -804,417,000 | |

| Against equity,% | ||

| Net foreign exchange position | -1,168.9 | 0 |

| Balance sheet position | 1,168.9 | |

| The amount of all long net foreign exchange positions in each foreign currency | -1,168.9 | |

So, for Client 1, short foreign exchange position in USD is RUR 773,401,000 or 27.7% of its equity. Despite some compensation from a long foreign exchange position in EUR (RUR 124,365,000), the overall risk level due to the fall in RUR exchange rate can be regarded as quite high.

In its turn, Client 2 has considerable short positions both in USD and EUR (RUR 1,418,086,000 and RUR 9,025,907,000 respectively). Taking into account the lowest size of equity (RUR 66,759,000), even insignificant fluctuations in currency rates can lead to its total loss.

Client 3also possesses a considerable short USD position – RUR 804,417,000, which is almost 12 times higher than its equity value. This could be explained by extensive borrowing in USD, which can lead to an increased risk of considerable losses in case of adverse change in currency rates.

Thus, the final decision about the company’s exposure to a currency risk and the need for its hedging can be made only after the analysis of possible changes in its financial result through stress testing [6,7]. Its results (Table 5) showed that considerable short position of Client 1 in USD was completely compensated by sufficient earnings in this currency. With simultaneous growth of USD and EUR exchange rates by 50% (test No. 1) the company’s EBIT increases much faster than its expenses for interest payments (5.3 times and 1.4 times respectively). This will raise interest coverage ratio from 1.20 to 4.52 (3.8 times) under the expected devaluation of RUR and result in much higher financial sustainability of the company.

Table 5: Results of stress testing (thousands).

| Indicator | Actual data for 2014 | Stress tests | |||

|---|---|---|---|---|---|

| No. 1 | No. 2 | No. 3 | No. 4 | ||

| Client 1 | |||||

| EBIT, RUR | 188,213 | 991,018 | -213,189 | 593,578 | 184,251 |

| Interests, RUR | 156,351 | 219,211 | 124,921 | 187,781 | 156,351 |

| Interest coverage ratio | 1.20 | 4.52 | -1.71 | 3.16 | 1.18 |

| Client 2 | |||||

| EBIT, RUR | 1,206,945 | 1,427,845 | 1,096,495 | 2,737,138 | -212,798 |

| Interests, RUR | 418,769 | 628,154 | 314,077 | 516,756 | 425,475 |

| Interest coverage ratio | 2.80 | 2.27 | 3.49 | 5.30 | -0.50 |

| Client 3 | |||||

| EBIT, RUR | 115,190 | 95,725 | 124,923 | 113,882 | 106,766 |

| Interests, RUR | 88,389 | 132,584 | 66,292 | 110,486 | 88,389 |

| Interest coverage ratio | 1.30 | 0.72 | 1.88 | 1.03 | 1.21 |

However, much stronger RUR to the world’s major currencies (Test No. 2) can cause disastrous consequences for Client 1. In this case, its operating profit becomes negative (RUR -213,189,000), and the company will not be able to fulfill its credit liabilities.

For Client 2 such catastrophic scenario can be significant devaluation of USD to EUR (test No. 4 in Table 5). This is caused by most company’s expenses being nominated in EUR and prices for products being set in USD. With the growth of EUR to RUR exchange rate and constant USD exchange rate, the operating profit of the company decreases by 25% from RUR 1,206,945,000 to RUR -212,798,000, and the interest coverage ratio becomes negative (-0.50).

In its turn, the Client 3 appeared to be subject to the risk of RUR exchange rate fall to the world’s primary currencies (test No. 1) due to considerable credit debt nominated in USD. Despite the fact that EBIT is still positive (RUR 95,725,000) in this scenario, it is insufficient to settle the increased interest payments (RUR 132,584,000), so the interest coverage ratio is below 1 (0.72).

Thus, it is possible to conclude that under conditions of high currency rates volatility hedging instruments should be applied to all three companies to maintain their financial sustainability.

The results received allow us to choose the best hedging strategy for each client (Table 6).

Table 6: Selection of hedging strategy (thousands).

| Indicator | Client 1 | Client 2 | Client 3 |

|---|---|---|---|

| Interests payable in the worst for the client stress test, RUR | 124,921 | 425,475 | 132,584 |

| EBIT in the worst for the client stress test, RUR | -213,189 | -212,798 | 95,725 |

| Hedged currency | USD | EUR | USD |

| Change in the hedged currency rate against RUR in the worst for the client stress test,% | -25 | 25 | 50 |

| Hedged currency rate on 01.01.2015, RUR | 56.2376 | 68.3681 | 56.2376 |

| Recommended hedging instrument | Buying a put option in USD | Buying a call option in EUR, selling a call option in USD |

A future to purchase USD |

| Amount of a hedging instrument in foreign currency | 28,491 | 49,790 | 3,668 |

As RUR exchange rate tends to fall against the world’s major currencies, we chose an option to sell USD instead of a future to hedge the currency risk of Client 1. Despite high cost of this tool, such choice will allow us not to limit the company’s profit with higher probability of increase in USD exchange rate. According to calculations, the amount of the purchased option will total USD 28,491,000.

For Client 2, to buy a call option in EUR in the amount of EUR 49,790,000,000 is the best decision that takes into account the company’s significant revenue in USD. For instance, the decision to sell an option in USD in the amount equal to the purchased option in EUR has been made to reduce expenses on hedging during the periods of constant EUR exchange rate.

When selecting a hedging instrument for Client 3, we took into account that within a year it has to pay interest rates under credit in USD. Therefore, it will need USD instead of money compensation in RUR. Assuming this, the future to purchase USD in the amount of USD 3,668,000,000 was chosen.

At the final stage, the efficiency of the chosen hedging strategy was assessed; the results are shown in Table 7.

Table 7: Efficiency of currency risk hedging, thous. RUR.

| Indicator | The broken stress test | Stress test opposite to the broken | Invariable currency rate |

|---|---|---|---|

| Client 1 | |||

| Financial result of currency futures exercise | 0 | 0 | 0 |

| Financial result of the purchased option exercise | 377,774 | -16,023 | -16,023 |

| Financial result of the sold option exercise | 0 | 0 | 0 |

| Bank fee for security deposit placement | 0 | 0 | 0 |

| Clearing charges | 1,279 | 1,279 | 1,279 |

| Exchange charges | 2,985 | 2,985 | 2,985 |

| Bank fee for hedging | 8,011 | 8,011 | 8,011 |

| Interest coverage ratio (with hedging) | 1.22 | 4.39 | 1.02 |

| Interest coverage ratio (without hedging) | -1.71 | 4.52 | 1.20 |

| Interest coverage ratio change after hedging | +2.93 | -0.13 | -0.18 |

| Client 2 | |||

| Financial result of currency futures exercise | 0 | 0 | 0 |

| Financial result of the purchased option exercise | 713,758 | -56,001 | -56,001 |

| Financial result of the sold option exercise | 70,720 | -759,020 | 70,720 |

| Bank fee for security deposit placement | 0 | 0 | 0 |

| Clearing charges | 4,953 | 4,953 | 4,953 |

| Exchange charges | 11,557 | 11,557 | 11,557 |

| Bank fee for hedging | 34,041 | 34,041 | 34,041 |

| Interest coverage ratio (with hedging) | 1.22 | 3.62 | 2.80 |

| Interest coverage ratio (without hedging) | -0.50 | 5.30 | 2.88 |

| Interest coverage ratio change after hedging | +1.72 | -1.68 | -0.08 |

| Client 3 | |||

| Financial result of currency futures exercise | 100,343 | -54,366 | -2,796 |

| Financial result of the purchased option exercise | 0 | 0 | 0 |

| Financial result of the sold option exercise | 0 | 0 | 0 |

| Bank fee for security deposit placement | 1,579 | 1,106 | 1,263 |

| Clearing charges | 165 | 165 | 165 |

| Exchange charges | 384 | 384 | 384 |

| Bank fee for hedging | 1,031 | 1,031 | 1,031 |

| Interest coverage ratio (with hedging) | 1.45 | 1.02 | 1.24 |

| Interest coverage ratio (without hedging) | 0.72 | 1.88 | 1.30 |

| Interest coverage ratio change after hedging | +0.73 | -0.86 | -0.06 |

The calculations show that the chosen hedging instruments will allow the analyzed companies to prevent the disastrous consequences in case of the worst stress scenario.

For example, for Client 1 interest coverage ratio will increase from (-1.71) to 1.22. It will allow the company to continue its performance having settled with all creditors even under extremely adverse change in currency rates. In case of other scenarios, the amount of lost profit will be not so critical, and the interest coverage ratio will reduce from 0.13 to 0.18 compared to the model without hedging.

The hedging strategy chosen for Client 2 will also increase the company’s financial stability significantly under the most negative stress scenario. So, its interest coverage ratio will rise by 1.72 points and reach 1.22. Hence, the company will generate enough money to service its credit portfolio. At the same time, in case of turnaround in exchange rates, its potential losses will be considerable compared to the model without hedging. The client will not be able to reduce the interest coverage ratio below the comfortable level of 3.62.

However, hedging will allow Client 3 to fix relatively identical financial result despite any change in exchange rates. The interest coverage ratio will fluctuate from 1.02 to 1.45 under three chosen stress scenarios. It will allow the company’s management to focus on production without being involved in currency risks management.

It should be noted that the chosen hedging strategies will also be profitable for the banks which organized them. The latter will receive the highest revenue (RUR 34,041,000) from selling hedging services to Client 2 due to simultaneous application of two counter strategies to purchase and sell currency options. The lowest fee will be received from Client 3 (RUR 1,031,000), however payment for reservation of the bank’s own resources on the stock exchange account (from RUR 1,106,000 to RUR 1,579,000) should be added to the fee.

Banks will also benefit from significantly lower risks of loan delinquency of the abovementioned borrowers in case of adverse exchange differences.

The article describes the impact of fluctuations in the foreign exchange market on a company and hence, provides the evidence for the need to hedge its currency risks and develop programs aimed at currency risk minimization.

The conducted research shows that the suggested mechanism reveals peculiarities of a currency risk of every prospective client and enables banking institutions to develop and implement an efficient hedging strategy for a particular risk. Having such a tool, commercial banks will be able to expand the scope of their services, enhance their risk hedging services in the regional financial markets and improve their customer base.

To sum up, the aim of the instruments suggested in the article is to provide appropriate assessment of the current state of a banking system, and faster development of high-technology banking services. Their integrated use will eliminate negative effects of an adverse macroeconomic situation and provide high-quality updates of the regional markets of banking services.

Copyright © 2026 Research and Reviews, All Rights Reserved