ISSN: 1204-5357

ISSN: 1204-5357

First Author's Name: Bruce Budd, DBA

First Author's Title/Affiliation: Associate Professor, College of Business Sciences, Zayed University, Dubai, UAE.

Postal Address: College of Business Sciences, PO Box 19282, Zayed University, Dubai, UAE

Author's Personal/Organizational Website:

Email:bruce.budd@zu.ac.ae (please use to correspond with the authors)

Brief Biographic Description: Dr. Bruce Budd is an Associate Professor at Zayed University. His research area is financial institutions in the Middle East.

Second Author's Name: Daniel Budd, BSc

Second Author's Title/Affiliation: School of information Technology Management, Edith Cowan University.

Postal Address: School of information Technology Management, Edith Cowan University, Joondalup, Western Australian 6027

Author's Personal/Organizational Website:

Email:

Brief Biographic Description: Daniel Budd is a graduate student in Information Systems and is now studying at Business at Edith Cowan University for a Masters in Business.

Visit for more related articles at Journal of Internet Banking and Commerce

intermediation, functionality-interactivity matrix cell.

The UAE banks are now entering a crucial stage of banking development and harmonisation associated with global competition. Over recent years the UAE banks have moved closer to western banking models introducing new products and services beyond the traditional banking activities of attracting deposits and using them to provide loans. An imminent new banking law is expected to fully liberalise the financial and banking sectors in the UAE. In addition, the implementation of the three pillars of the Basel II capital accord, (solvency ratio, market discipline and supervisory action), is expected to be effective in 2007. This will require that banks (world-wide) have the technology to capture, report and store data, and determine the minimum level of capital required.

As income per capita rises, information technology improves, and telecommunications liberalises, the UAE banks now have the opportunity to move closer to western banking models where much of the labour intensive services are now delivered online. Improved quality of trade services and access to more accurate information simultaneously improving the possibilities of exposing any potential data malpractices has improved the efficiency and security of the banking industry. The UAE banks can now profit from these new opportunities by exploiting the competitive advantages that were not achievable by previous traditional banking methods.

Increased productivity and cutting of transaction costs are the most obvious benefits of e-banking. The dramatic difference in cost and speed between traditional ‘brick-to-brick’ banking and Internet-mediated financial ‘brick-to-click’ banking services and related information delivery has led to rapid growth of online payments, e-banking and online credit risk management, thus bringing about profound changes in the whole system of financial services and intermediation. Online versions of nearly all existing payment methods are appearing globally.

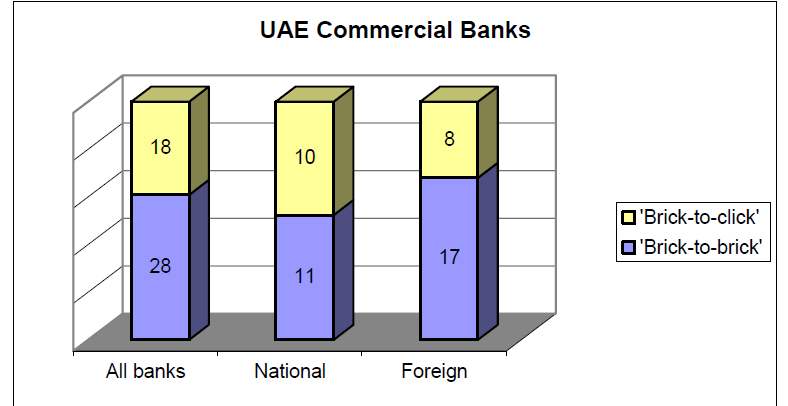

While many banks especially in Europe and the U.S. have adopted internet banking, this preliminary research shows that the majority of banks in U.A.E. are still in the early stages of developing e-banking. Only 18 of the 48 banks (2005) in this oil-rich nation have well-developed e-banking facilities, despite all banks having an internet banking website for the convenience of their customers. This survey shows that many banks launch e-banking as an additional service rather than a substitution for traditional branching operations. Further, banks, and in particular their corporate customers, are also concerned about security issues even though some of these have been alleviated with the introduction of the 128-bit key technology encryption.

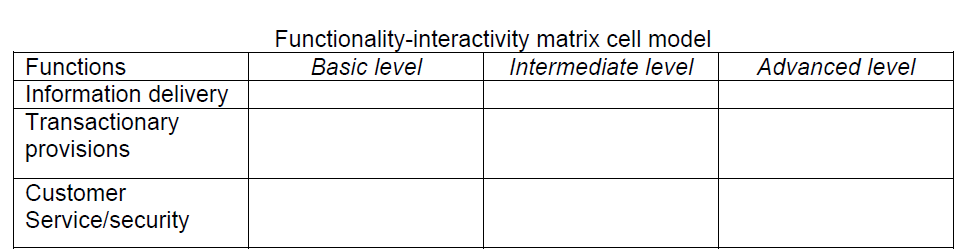

It is against this backdrop that very important research questions are asked. Namely, what is e-banking? What services does e-banking provide in the UAE to-date, and what provisions are being made to improve customer service and security? Using a functionality-interactivity matrix cell, 18 UAE banks are surveyed identifying three distinct functions of e-banking: information delivery, transactionary operations, and customer service and security provisions. The levels of sophistication of development of these functions are identified by three ranges: basic, intermediate and advanced. The extent and quality of financial intermediation can therefore be quantified.

The paper is structured as follows: section two provides a brief background of UAE e-banking; section three describes the methodology. Section four describes the results. Section five provides discussion and conclusion.

E-banking broadly refers to the ability of banks to operate internal and external banking transactions and information securely through an array of electronic technological devices and software. As a result new business models are replacing outdated ones and organizations are re-thinking business process designs and practices, and customer relationship management strategies.

Emirates Bank International was the first to offer e-banking in UAE in 1996. By the end of 2005, ten national banks from a total of twenty-one, and eight foreign banks from a total of twenty-five, launched their electronic banking services.

UAE commercial banks have been investing heavily in their ICT infrastructures. By the end of 2005, an electronic inter-bank switch system was connected to forty-three national and foreign banks to link their automated teller machines (ATMs) nationwide.1 The UAE commercial banks’ total IT operating and capital budget in 2005 was estimated at $190 million, including an estimated $40 million for IT employees’ salaries. (Madar Research 2006). In contrast the majority of some individual UAE banks have been rather slow to meet the potential growth of customer electronic banking demands which has been stimulated by the rapid pace of domestic broadband connection and internet penetration in the country. With membership to the World Trade Organisation and subsequent entry of foreign competition into the UAE, national banks will have to be prepared for potential future challenges. Hence in order to retain their share of the market, improvements in cost effectiveness as well as offering more competitive and value-added services to their existing and potential clients is needed. There are no e-banking standards governing the provisions of services, nor technology in use, in the country. Generally e-banking services are divided into retail and corporate clients, though sub-divided into further categories reflecting the customers value and business dealings. The e-banking services on offer are largely similar across both national and foreign banks. Retailing e-banking incorporates mainly transfer of funds between accounts within the same bank, and sometimes with other banks, the payment of bills and account and balance enquiries.

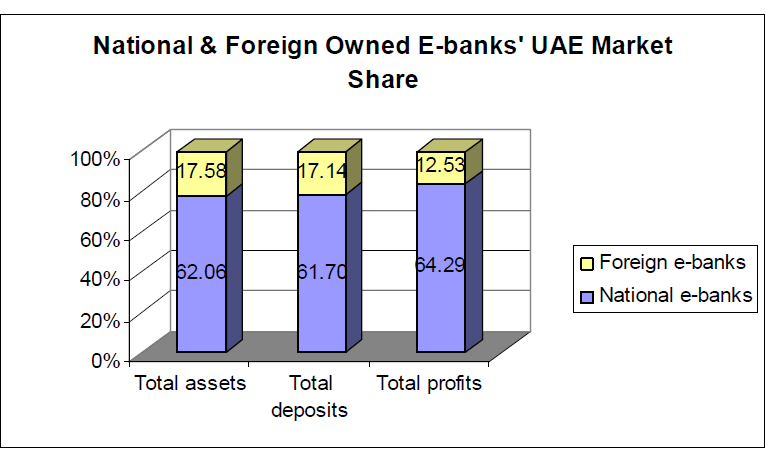

In addition to retail e-banking services, five national banks and six foreign banks offer corporate services from a total of 18 banks. All the major national banks, in terms of highest total assets, profits and market share of deposits, dominate the e-banking market. This suggests that it may be the size of market share (customer demand) and cost of technology that may be important considerations when establishing e-banking for the first time in the UAE. National banks dominate the market share of total deposits, total assets and total profits, as seen in the diagram below.

Using a functionality-interactivity matrix cell model, 18 individual banks are surveyed.

Three separate interactive functions are identified and within each function, three different levels of development are measured: basic, intermediate and advanced.2 The extent and quality of financial intermediation can therefore be quantified.

The first category identifies the range and level of development of information delivery provided by banks. The basic level identifies the existence of account and balance enquiries, information procedures to request and cancellation of ATM cards, information about products and services; clear, informative and user friendly website which is easy to access, suggestion forms for complaints and general feedback, opinions and request services in a generic way, clear channels and directions for service requests. Easy to find and customer details such as bank balances, interest rates, prices of transactions; economic information such as financial reports availability and download; general information such as interest rates, inflation rates, and general macroeconomic data; and requests for cheque books. Intermediate level identifies: setup and cancellation of standing instructions; search engines, opening new accounts, redemption of reward points; email access, and requests for credit cards. The advance level identifies: interface customization (changing the desk-top format to user friendly), demonstrations/simulations, interactive features to facilitate client banking; corporate banking; on-line insurance information; on-line wealth management information; commercial real estate information.

The second category is “transactionary provisions”. With efficient electronic information financial intermediation becomes more effective and more cost efficient. The basic level of interactivity for transactions are: ability to transfer funds to another account from the same bank, transfer of funds to a third party (other) bank account, payment of additional bills such as utility, telephone, and credit card payment. Postal bills, outward remittances, purchases of deposit certificates, mortgage payments, standing orders, and payments of additional bills such as cable television, are categorizes under intermediate level. Advance level classifies electronic cash and electronic cheques as a way to develop transactions through the Web, on-line mutual funds transaction, on-line insurance and wealth management transactions, and any asset management or investment banking transaction avenues.

The third category is customer service and security, which at the basic level includes: complaints box, email facilities, contact and numbers etc for discussion and requests; banking products and services and provisions for improving customer-bank relationship; security SMS message announcing transaction; telephone call on remittances to nominated accounts not listed; anti-phishing techniques to prevent fraudulently acquiring sensitive information such as passwords and credit details; establishment of firewalls, and educating by mail customers of types of fraud. Intermediate level includes: monitoring on daily basis to ward off any virus attempts; RSA token which has a six digit code which changes every 60 seconds; what-if calculators, and advising. The intermediate level identifies links to other sites; exchange rates; application forms for job vacancies; financial reports; and access to databanks. Finally the advance level identifies the possible services such as: discussion groups, customizing resources, advising tools and demonstrations to help customers with advanced loan and investment decisions; corporate and investment banking services; on-line wealth management services; commercial real estate finance services; videoconference; and gathering information for product and service development3.

Ultimately the scores of each category and each stage of development are summated, and the model therefore derives comparative values, of each individual institution, which in turn measures the extent and quality of the electronic banking in UAE.

Evidence shows that the development of electronic banking services within the UAE are moving closer towards western models, albeit, slowly. Results from this preliminary survey show the existing 18 e-banks are well developed, though not predominately at the advance stage as many western banks. More foreign banks have better e-banking services than their UAE counterparts providing many additional retail and corporate commercial banking services such as: personal corporate services, investment, real estate finance, on-line wealth management, payment of bills on-line, remittance services, insurance, interface customization, and search engines for general economic information. This survey further shows that many banks launch e-banking as an additional service rather than a substitution for traditional branching operations. Further, banks, and in particular their corporate customers, are also concerned about security issues.

This survey reveals that four of the twenty-eight ‘brick-to-brick’ banks reflect a reluctance to whole-heartedly brace e-banking at the present moment because of present customer market share and security infiltration fears, that is, the fear of corporate hacking, electronic fraud or/and anticipated problems with customer deposit security. Three banks attributed technology costs and choice of software as their major reason; four banks suggested marketing costs and present customer market share as a reason for their lack of e-banking development to-date in the UAE; a further four banks posed insufficient customer demand; three banks were not interested and did not anticipate e-banking in the near future; and finally thirteen are ‘under construction’. Those under construction were predominately foreign banks whose development represents an on-going part of their global reconstruction and deployment.4

Inevitably the banking sector will be a leading player in future electronic commerce in the UAE. The dramatic difference in cost and speed between traditional and internet-mediated financial services and related information delivery has led to rapid growth of online payments, e-banking and online credit risk management, thus bringing about profound changes in the whole system of financial services and intermediation. As the UAE move closer towards full WTO membership compliance, the UAE banks must be prepared to meet global market demands and electronic financial competition. It is important that all banks continue to adopt and improve their information technology and electronic banking services. Domestic broadband connection per capita within the UAE is one of the highest in the world. Clearly online banking is an essential role for future UAE banking. Preliminary empirical results suggest that the UAE banking is at a crucial stage of development, supported by high ICT capital investment but by only a minority of individual banks. Only 18 of the 46 banks in this emerging nation have well-developed e-banking facilities, despite all banks having an internet banking website for the convenience of their customers. At the moment it is the larger banks providing these e-banking services. Small banks rely on their websites to provide information and financial direction. All banks need to provide electronic banking services.

1 Rafidain Bank, Janata Bank and Calyon Corporate and Investment bank are the exceptions.

2 Based on Diniz (1999) model.

3Extremely difficult, if not impossible, to access detailed information about individual bank security protocol.

4Survey data was collected by personal visits to each bank. No individual employee was prepared to formally complete a written questionnaire, nor were they prepared to be named or quoted. It is for this reason that no individual bank is named.

Copyright © 2026 Research and Reviews, All Rights Reserved