ISSN: 1204-5357

ISSN: 1204-5357

Raymond Trémolières, Docteur es Sciences

Professor, Institut d'Etudes Politiques, Science-Po and FEA, Paul Cezanne University Aix en Provence, France

IEP, 25 rye Gaston de Saporta, F-13100 Aix en Provence.

Author's Personal/Organizational Website: www.credocom.fr, www.sciencespo.aix

Email: rtremolieres@cetfi.org

Prof. Raymond TREMOLIERES is the Director of AFERIA, Association Française d'Etudes et de Recherches en Intelligence Artificielle, His areas of interest are Finance, Technical and Quantitative Management, Data Analysis, and Optimization

Anton Turko, Docteur en Sciences de Gestion

Research Associate, FEA, CETFI, and Science-Po-Aix, University of Paul Cezanne , Aix en Provence

27 rue du petit puits, Marseille, 13002 France

Author's Personal/Organizational Website: www.credocom.fr, www.sciencespo.aix

Email: antturko@yahoo.fr

Dr. Anton TURKO is a Research Associate, FEA, CETFI, and Science-Po-Aix, University of Paul Cezanne, Aix en Provence, France. His current research interests are Finance, Derivatives, and Options Market.

Copyright: © Raymond TREMOLIERES and Guillaume MARCEAU and Marc NASSIM 2009.

Visit for more related articles at Journal of Internet Banking and Commerce

In this study our aim is to give an overview of the main valuation methods that are or can be used to valuing internet firms. We extend this study to the case of acquisitions or mergers and also to real options modelling. This article follows MARCEAU, NASSIM, TREMOLIERES devoted to the problem of valuation of internet firms mainly in the framework of mergers and acquisitions. We show that mergers and acquisitions creates value in Europe, but very weekly in America.

mergers, acquisition, valuation methods, internet firms

We report here several studies about valuation of internet firms in the context of mergers and acquisitions. In fact the subject of internet firm valuation has interested many Investors since the rise of internet systems in the middle of the 90th where a phenomenal increase could have been observed until the year 2000 where a sudden market crash appeared. This was accompanied by many mergers & acquisitions (M&A)

-The first one is to determine if the publicity makes about M&A has an effect on the shareholder values.

-Second we shall try to identify the differences between internet firms and traditional on.

-Third if the reactions to this announcement are the same according to countries.

-Fourth whether reactions of investors depends on the nature of the operations.

First of all it is worthwhile to identify which firms can be considered as internet firms. We have decided to adopt the following criteria:

-at least 51 % of the turnover must comes from pure internet activities

-the increase of the economic model must depend of the technical progress and adaptation to new technnologies

-tangible assets must be limited

Practical valuation methods

Because of the importance of the non tangible assets the classical accounting methods are seldom used and other approaches must be used as:

-EVA-Economic Value Added

-FCF-Free Cash Flows

-Steve HARMON Ratios

-Pratical PER, Price Earning Ratios

-Relative Methods

Specific Financial Methods are also invoked as

-DCF - Discounted Cash Flows

-Reverse valuation

-Expected values and scenarii

-Real options

When M&A are considered and one of the two firms is not an internet firm other approaches, are also used as

-adjusted net book value

-market comparisons

-similar transactions

-market multiples

-fair market value

We just recall the main characteristic of EVA (Stuart and al. )

NOPAT = Net Operating Profit After Taxes,

EVA = Economic value added =NOPAT – Invested Capital x Cost of Capital).

This has been generalized in the new EVALUCE model by one of the authors.

We can recall the main reasons of M&A operations involving internet firms--

Operational, Financial, Strategic, Human Synergies

-External or Internal development strategies

-Diversification

-Horizontal or Vertical integration

-Hubris Hypothesis (Roll, 1986)

-Agency Theory (Jensen, 1986)

Main articles

-M&A of technological firms ( Kohers, Kohers, 2000)

-joint ventures of intra-european firms (Goergen, Renneboog, 2003)

-joint ventures of french firms (Husson, 1988)

- choice of the payement methods (Travlos, 1987)

-importance of synergies ( Bradley and al., 1988)

-effectiveness of M&A on the creation of value (Bhagat et al, 2001)

The Data Base has been taken from ‘Thomson One Banker’, whose a part of ‘Thomson Financial’ which groups all M&A operations of the world since 1984.

The announcement date being the most important among all the other sources of events, sometimes other information of the same type where taken to precise the used data.

Among the sources of information on M&A announcements we can cite

-the most important economic journals (Les Echos, Wall Street Journal, Financial Times),

-the Internet sites of these firms,

-the internet sites of the regulation organisms as (AMF-France, SEC in US, FSA en

Great-Britain and many other sites (Yahoo Finance, Zephyr, Corpfin Worldwide, Merger Market, etc.)

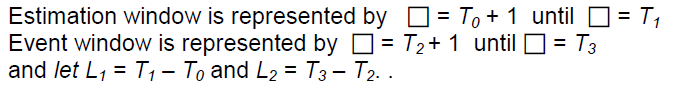

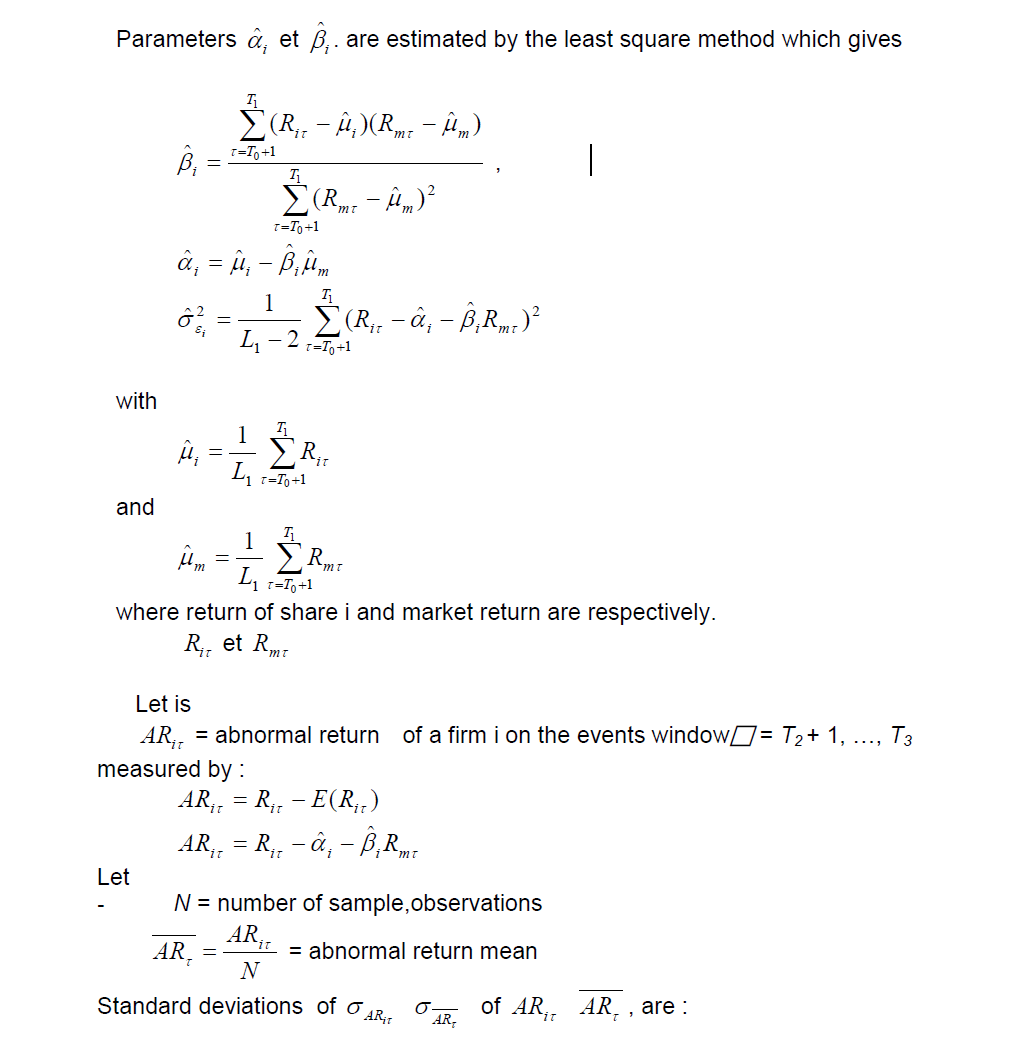

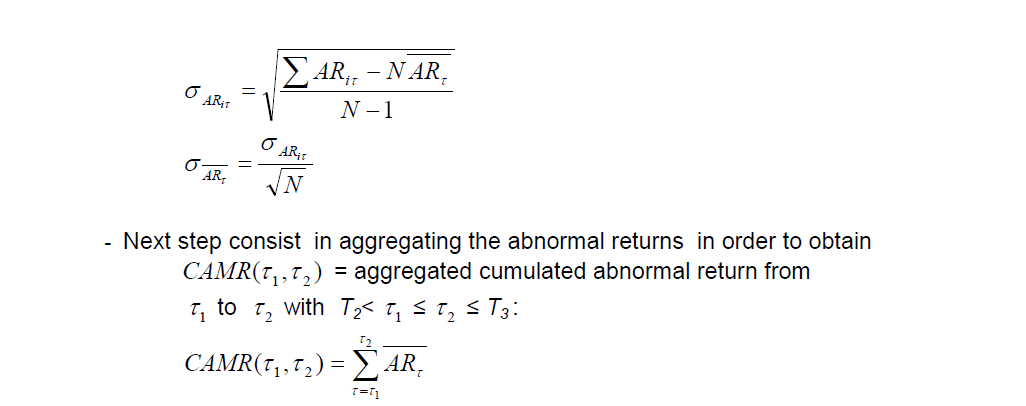

On the chosen sample we have elaborate an empirical model of the kind of MACKINLAY (1997); which relies share returns and market return.

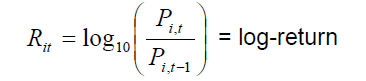

- Let

Pi,t = share value of share i at the end of day t,

Rmt = market return

and

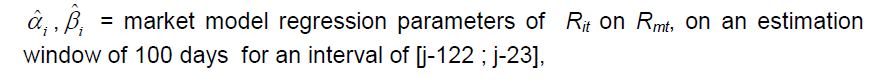

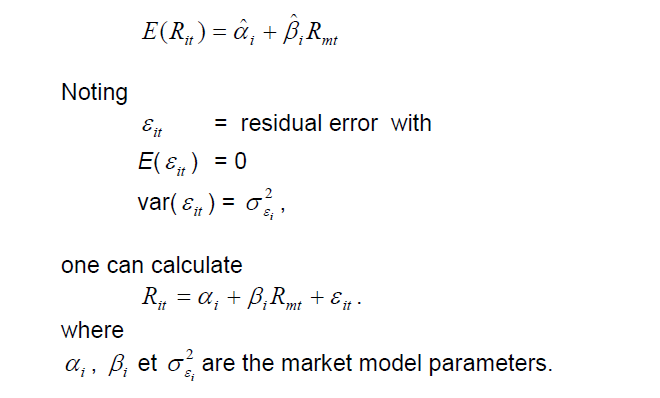

The expected return E(Rit) of share i for the day t is measured by :

According to countries, the market return index is taken as the NASDAQ Composite for US, , les TechMark for British Isles, the Nemax for Germany, the IT CAC for France.

We set

- With respect to N we compute parameters ‘z’ ou ‘t’ for testing the null hypothesis as in the following table:

Hypothesis testing

μ = observed sample mean

μo = theoretical mean

In our case:μ0= 0 and

Ho: μ≤ μo

H1: μo >0

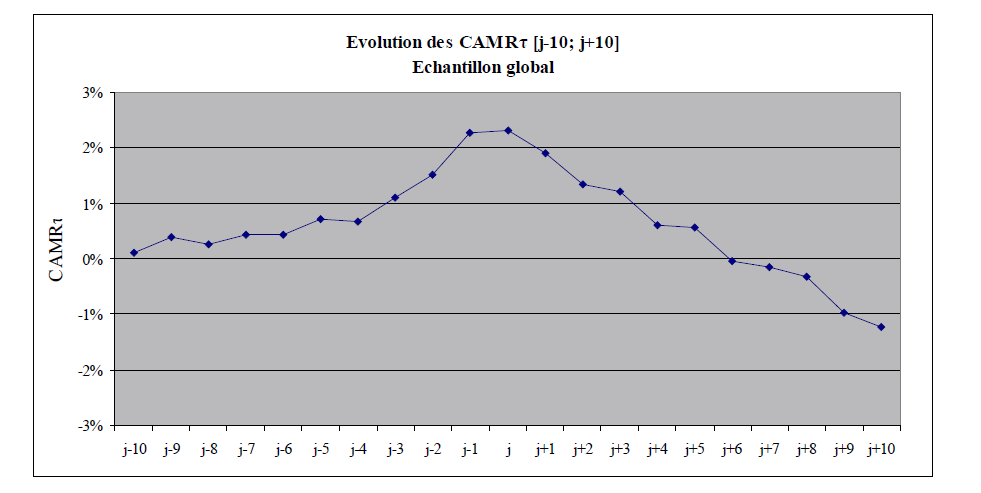

The next Figure presents the Global sample graphic.

0.Validation of the global sample using CAMR on

[j-10; j+10] = -1.22 %, AMR non significative

[j-10; j] = 2.31%, AMR non significative

1. Validation of the US global sample using CAMR on

[j-10; j+10] = -1.96 %, AMR significative at 5 times

[j-10; j] = 2.58%, AMR significative at 5%

2.Validation of the United Kingdom global sample using CAMR on

[j-10; j+10] = -0.12 %, AMR significative at 2 times

[j-10; j] = 0.72%, AMR non significative

3.Validation of the Continental Europe global sample using CAMR on

[j-10; j+10] = 5.49 %, AMR non significative

[j-10; j] = 2.47%,

4.Validation of the US acquisition sample using CAMR on

[j-10; j+10] = 0.11%, AMR significative at 5 times

[j-10; j] = 4.01%, AMR non significative

5.Validation of the Continental Europe mergers sample using CAMR on

[j-10; j+10] = 2.51.11%, AMR non significative

[j-10; j] = 4.22%, AMR non significative

6. Validation of the US acquisition sample using CAMR on

[j-10; j+10] = -1.31%, AMR significative at 6 times

[j-10; j] = 2.19%, AMR non significative

7. Validation of the US cash financed operations sample using: CAMR on

[j-10; j+10] = 0.59%, AMR significative at 1 time

[j-10; j] = 2.43%, AMR significative once

8. Validation of the UK before e-crach operations sample using CAMR on

[j-10; j+10]= 17.19%, AMR significative at 1 time CAMR on

[j-10; j]= 18.90%, AMR non significative

9. Validation of US after e-Crach sample: CAMR on

[j-10; j+10] = -1.96%, AMR significative at 5 time

[j-10; j] = 2.58%, AMR non significative.

In this article, w e have proved that the M&A operations of internet firms are not destructive of value. The US acquisition firms realize a lower value within the events window of [-10, +10] days around the announcement of the acquisition, although the UK firms face only one lesser value. The investors’ reactions of various studied countries are not significantly different from each others, excepted for the sample financed by cash. This empirical study brings a new point of view as to M&A operations involving internet firms. It could be improved by concentrating on more specific firms. Real options methods technological goodwill considerations are recalled in our preceding article.

-http://www.decformations.com/comptabilite/ancc.php

-http://www.secondventure.com/business-valuation-methods.asp

-http://www.secondventure.com/business-valuation-methods.asp

We remind the classical internet Harmon's evaluation ratios that can be completed.

1.Market capitalization/users. A reference for comparables and peers, an indicator of overall value per reach.

2.Market cap/page views. Indicates what a basic page view is valued at by investors

3. Market cap/ad views. Page views generating revenue rather than sitting blank

4;Private market value. What private deals go for either in merger or in bidding situation

5.Customer acquisition cost. What it costs to gain a new subscriber or buyer; valuable in evaluating ISPs, retailers, auctioneers, wholesalers, manufacturers that sell on the Web

6.Valuation/customer acquisition cost . Useful when comparing peers to see which may be valued at a relative discount based on customer growth efficiencies.

7.Enterprise value. Subtract cash and add debt to market cap to determine core value of the company; particularly useful in valuing potential takeover targets

8. Revenue multiple (or market cap/revenue). Primary method for valuing Internet stocks since most firms are not earnings positive. Or if they are, the P/E is often off the charts still

9.EBITDA cash flow multiple. The way mature mediacompanies are valued.

10.Revenue per subscriber Primary way to value ISPs

11.Lifetime value of an e-buyer. This is the metric we think will be key very soon in valuing Internet companies, especially e-tailers

12.Effective deal value. What a deal went for after factoring cash and debt or other considerations that affect the outcome of the offer

13.Market cap/POP. A ratio for comparing ISPs that have points of presence

14.Market cap or PMV to potential market share. Helpful in determining future revenue, cash flow and earnings to see if the firm is under or overvalued to its potential

15.Market cap/total Internet users. The value of a firm's reach globally per user

16.Revenue/direct e-marketing . Shows yield of campaign efficiency, useful for direct sellers

17.Marketcap/Websteader. Useful for valuing community of free home page providers

18.Price/discounted earnings . Project earnings and discount back to current stock price; especially useful for firms with losses today

19.Sales/employee. How lean and mean a company operates: 1 engineer to 10 lightbulbs or 10 engineers and 1 lightbulb?

Copyright © 2024 Research and Reviews, All Rights Reserved