ISSN: 1204-5357

ISSN: 1204-5357

| JONATHAN OYERINDE ADEWOYE Deputy Dean Faculty of Management Sciences, Ladoke Akintola University of Technology (LAUTECH), Ogbomoso, Nigeria Postal Address: Department of Management and Accounting, Ladoke Akintola University of Technology (LAUTECH), Ogbomoso, Nigeria Author's Personal/Organizational Website: www.lautech.org Email: adewoyemgs@yahoo.com Jonathan Adewoye is the current Deputy Dean, Faculty of Management Sciences, Ladoke Akintola University of Technology (LAUTECH), Ogbomoso. He is presently a council member of the University, representing the Congregation. He is an Associate Professor of Management Information system in the above stated department. |

| NOSA VICTOR OMOREGIE Postal Address: Department of Management and Accounting, Ladoke Akintola University of Technology (LAUTECH), OGBOMOSO, Nigeria Organizational Website: www.lautech.org E-mail: omoregie2k@yahoo.com Nosa Omoregie is a junior research fellow in Department of Management and Accounting, Ladoke Akintola University of Technology (LAUTECH), OGBOMOSO. Nigeria. He holds a Master of Business Administration (MBA) with specialization in Cost Management and Masters in Transport Management (MTM) with specialization in Logistics. Nosa Omoregie is also a fellow of Institute of Chartered Accountants of Nigeria (FCA) and Certified Institute of Cost Management of Nigeria (FCCM). |

Visit for more related articles at Journal of Internet Banking and Commerce

Banks have intensified their adoption and usage of ATMs as a major e-banking tool to generate substantial contributions to their operations and financial results. Among the expectations of the banks in deploying and usage of ATMs is improving efficiency particularly cost efficiency. There is, however, no clear evidence of banks achieving the desired returns from ATMs investments in the Nigerian banking environment. The broad objective of this study was therefore to analyze the effect of the intensity of ATMs deployment on the cost efficiency of banks in Nigeria. The specific objectives were to ascertain the determinants of ATMs deployment and to evaluate the effect of ATMs deployment on the cost efficiency of Nigerian banks. The study was carried out on twenty two commercial banks post consolidation in which twenty were selected based on purposive and multistage sampling techniques. Secondary data obtained from the five years financial reports and internal operational records of the banks were analyzed using both descriptive and inferential statistical tools. In ascertaining the determinants of ATMs deployment of banks in Nigeria, five factors were considered, these are bank size, bank profitability, salary level, number of banks during period of study and value of ATM transactions. Three of the five variables were found to be significant. These are: bank size, salary level and value of ATM transactions. Also in evaluating the effect of ATMs deployment on the operating cost rate and Asset management rate of banks in Nigeria, four variables were used, number of ATMs as main independent variable and bank size, salary level as well as nonperforming loans being control variables. Number of ATMs, bank size and salary level were found significant. The results showed that bank size, salary level and value of ATM transactions were key determinants of ATMs adoption by banks in Nigeria .The result also revealed that the intensity of ATMs deployment made positive contribution to the cost efficiency of Nigerian banks.

Keywords |

| Information and Communication Technology (ICT), Automated Teller Machine (ATM), ATM investments, ATM intensity, Cost Efficiency. |

INTRODUCTION |

| The banking industry in Nigeria is investing greatly in information and communication technology (ICT) given the highly information sensitive nature of the industry which is in line with global trend. Banks invest in ICT consistently to achieve cost savings and enhance customers' satisfaction (Chin - S, Shin -Yuan, David and Fang - Chun, 2008). Although earlier studies from the mid 1980s until the mid 1990s theoretically justified the advantages of IT, but they obtained contradictory empirical evidence, empirically weak or no link between ICT and firm performance. (Brynjolfsson, 1993; loveman, 1994; Roach,1987; Strassmann, 1985,1990). Subsequent researches have provided empirical evidence of positive and statistically significant relation between ICT investment and some measures of business performance.(Dewan and Min, 1997; Lichtenberg,1995; Brynjolfsson and Hitt.1995.1996) Automated Teller Machine (ATM) has become a major indicator of ICT investment by banks. Globally, Automatic Teller Machines (ATMs) have been adopted and are still being adopted by banks. They offer considerable benefits to both banks and their depositors. The machines can enable depositors to withdraw cash at more convenient times and places than during banking hours at branches (Olatokun and Igbinedion ,2009) These potential benefits are multiplied when banks share their ATMs, allowing depositors of other banks to access their accounts through a bank's ATM (McAndrews, 2003). Banks have become the principal deplorers of ATMs because the cost of a single transaction performed at an ATM is potentially less than the cost of a transaction conducted from a teller, as ATMs are capable of handling more transactions per unit of time than Tellers (Laderman, 1990). |

| In Nigeria the adoption of ATM by banks and its use by bank customers is just gaining ground and has burgeoned in recent times. This has happened especially after the recent consolidation of banks, which has in all probability, made it possible for more banks to afford to deploy ATMs or at least become part of shared networks (Fasan, 2007). There has been growing investment in ICT devices by banks without any definite study on the impact of these investments especially in terms of ATM deployment and cost efficiency. This study is expected to fill this gap by analyzing the effect of the deployment of ATMs on the cost efficiency of Nigerian banks in order to justify its level of investment This study by measuring the effect of ATMs on the cost efficiency of banks, will provide more convincing evidence to understand the returns of ICT investment in the banking industry and by implication the extent to which Nigerian banks investment in ATMs has contributed to improving the cost efficiency of the banks. |

| To achieve the objectives above, the following hypotheses were tested: |

| I, there are no significant determinants of ATMs deployment in Nigerian banks; |

| ii. ATMs deployment do not have significant effect on the operating cost rate and asset management rate of Nigerian banks |

| The findings from this study would provide useful information for banks, ATM firms and researchers to understand better the relationship between ATM investment and firms cost efficiency. It would therefore assist management in ICT investment decision making. |

ADOPTION OF ATM BY BANKS IN NIGERIA |

| ATM was conventional introduced in Nigeria as an electronic delivery channel in 1989 and was first installed by National cash registry (NCR) for the defunct Societe Generale Bank of Nigeria in the same year. They were operated as elitist services designed for those desirous of exclusive service. Cards were rare and the process for obtaining them tortuous. |

| Agboola (2006) indicated that although only a bank had an ATM in 1998, by 2004, fourteen of them had acquired the technology. He observed that the adoption of ICT in banks has produced largely positive outcomes such as improved customer services, more accurate records, ensuring convenience in business time, prompt and fair attention and faster services etc. |

| Fanawopo (2006) opined that Nigeria's debit card transactions rose by 93 per cent between January 2005 and March 2006 over the previous year's owing to aggressive roll out initiatives by Nigerian banks, powered by Interswitch Network. According to him more than 800 ATMs have been deployed on the network, while about 2 million cards have been issued by 23 banks as at March ,2006. A survey conducted by Intermarc Consulting Limited revealed that ATM services provided by banks and non-financial institutions stood as the most popular e-business platform in Nigeria (Intermarc Consulting Limited, 2007). Modern banking services such as electronic banking, Internet Banking, Point of Sales (POS) transactions, money transfer, ATMs emerged as the most popular with 96 percent awareness level. ATM awareness also ranked higher than awareness level about current accounts and slightly below savings account (Omankhanlen, 2007). Initially banks try to induce and encourage customers to embrace the technology by not charging customers any fees for using ATMs. In time, some banks started charging customers for not using ATMs that is a charge for each time a customer uses a Teller for a service that could be performed by an ATM. According to Central Bank of Nigeria (CBN) Annual Activity report (2005), post consolidation of the banks in 2005, the number of ATM deployed by the banks in Nigeria rose from 184 in 2004 to 425 in 2005 with 131percent increase. CBN (2009), reported that the upsurge of ATMs as a dominant payment channel with 84.51 percent and 80.08 percent in volume and value of transactions respectively had continued at the end of June, 2009.The CBN report (2011) revealed that ATM remained the most patronized accounting for 98.8 percent with a transaction worth of 764.14 million naira. |

DETERMINANTS OF ATM INVESTMENT |

| The drivers of ATMs deployment in banks have also been of interest in some previous studies. According to Retail Banking Research (RBR), 2008, the most notable ATMs growth in the world in a space of two years took place in Nigeria where the installed base expanded from only 581 terminals in 2005 to 3676 at the end of 2007, which equates to a six fold growth. It stated that the growth is being driven in large part by the rapid increase in the bank branches and the ensuring influx of cash-hungry customers. The availability of low cost ATMs and the introduction of ambitious non - deployers are also playing their role in Nigeria impressive growth. Chin S. et al., (2009 ) indicated that operating scale, banking deposit service and operating cost are all significant determinants of ATM investment in the Taiwan banking. Hannan and Mcdowell (1984) examined the relationship between the decision of new IT adoption and its determinants. They observed that wage rate and firm size had positive effects on the decision to adopt ATM . That is, in regions of higher wage rates, banks tend to install more ATM to replace expensive labor. In addition, consistent with the economic scale theory, larger banks tend to introduce more ATM than small banks do. |

| Thong and Yap (1995) studied the determinants of IT adoption for small businesses. They suggested that two main classes of variables are crucial in determining adoption of IT. |

| The first class is the individual CEO characteristics, and the other is organizational characteristics. Three identified CEO characteristics include innovativeness, attitude toward IT, and IT knowledge. Two identified organizational characteristics include business size and competitiveness of environment. The intense competition among banks trying to carve a niches in the stock market and heavy personnel expense pressure, alongside the large size of potential customer patronage (as a result of the large population of the country) makes ATM adoption for banks very crucial. In the Nigerian banking environment, there is a tremendous growth in the deployment of ATMs but without a clear evidence of the specific factors that drives it as there appear to be limited previous studies that have focused on this. This study will therefore also focus on ascertaining the key determinants of ATMs deployment in Nigerian banks. |

ICT INVESTMENT AND BANKS PERFORMANCE |

| Past studies found inconclusive relationship between IT investments and the profitability of banks. The relationship can be seen to be insignificant especially in the short run due to high costs of investments in ICT (Furst, Nolle and Robberson, 1999; Furst,Lang and Nolle, 2002;Sullivan, 200o; Saythe, 2005; De-young, 2006; Siam ,2006) However latest studies seems to find a positive relationship between ICT and profitability. Milne(2006) supported this view when he stated that modernization of IT has set the stage for extraordinary improvement in banking procedure throughout the world. Brynjolfsson and hit (2002) study revealed that IT brings down the operational costs of the banks. Internet technology facilitates and speed up banks procedures to accomplished standardized and low value added transactions. Past studies in developing countries did not reflect any significant empirical relationship between ICT investment and banks profitability. Previous studies in Nigeria don't depict any significant empirical relationship between ICT investments and the profitability of banks in Nigeria (Adewoye, 2007). Ugwuanyi and Ugwuanyi (2013) suggests that IT expenditure has a negative relationship with banks profitability due to the fact that investment in IT increases expenditure as well as increases assets thereby reducing operating profits as well as return on assets(ROA). Studies have confirmed the benefits of ATM investments to banks profitability in Nigeria (Olatokun and Igbinedon, 2007). What remain unexplored is the exact relationship between the level of IT expenditure and the profitability of banks in Nigeria |

ATM DEPLOYMENT AND COST EFFICIENCY |

| There is however limited studies on the linkage between ATM deployment and its determinants as well as cost efficiency in developing countries, In terms of reduction in cost of operation, Batiz-Lazo and Barrie (2005) study argued that during the 1990s, Information Technology in banking (as measured by ATM) led to reduced operating costs, coupled with increased output (number of transactions) that resulted in greater efficiency. The authors concluded that the introduction of ATM was profitable for banks as well as customers. Their study indicated that the adoption of ATM by banks was of overall benefit to banks in developed countries. |

| In Nigeria, information and communication technology has revolutionised banking, transforming it into a vibrant enterprise (Adeosun, Adeosun and Adetunde, 2005;Oghenemkeybe, 2007: Adewoye, 2007,2011) the transformation implies that the Nigerian banking industry has continue to invest in information technology. Ayantokun (2008) reported that Nigeria commercial banks spent 114 million dollars yearly on information technology equipment in 2008. Within the banking sector in Nigeria, there is obvious increase in the deployment of Automated Teller Machines (ATM) along with other ICT based devices indicative of the fact that banks have channeled substantial financial resources on ICT investment. ATMs have been acclaimed to be able to process routine transactions and therefore a close substitute to Teller labour (Chin-S et al., 2008: Jayamaha .2008). They stated that investment in ATM result in ATM labour substitution effect which lower the operating cost and thereby improve their cost efficiency of banks. Labour substitution arises, therefore, when the use of ATM reduces Tellers' work with the attendant decrease in labour demand of banks. So banks with heavy personnel expense pressure tend to install more ATM to replace Teller labour costs. |

| Chin-S et al., (1980) confirmed that ATM intensity has positive effect on bank cost efficiency. In addition, they found that bank scale is also positively related to cost efficiency, while non-performing loans and salary level have negative impact. As for sustainability of income gained, earlier adopters could have cost improvements by replacing tellers with ATM. The conclusion was consistent with Laderman (1990) that ATM could reduce human resource costs of tellers and branch establishment costs According to Haynes and Thompson (2000), ATM can process routine transactions and therefore reduce tellers' work indirectly. He further stated that this will also decrease the labour demand of banks. In the same vein they observed that banks with heavier personnel expense pressure tended to install more ATMs to replace teller labour costs, because of the substitution effect and operating cost consideration aiming to achieve the goals of operation efficiency. The contribution of ATM investment to the banking industry in Nigeria has not been adequately quantified despite several studies that have discussed the impact of ATM investment in the banking sector. |

| There are dearth of data and research providing evidence of Nigerian banks achieving a lower operating cost as a result of the effect of labour substitution due from ATM investment despite the impressive growth of ATMs deployment. This has provided a gap needed to be filled by this study. The gap could have far reaching ICT investment implications, such as wrong investment policy, increasing labour expenses, low profitability even with increasing ATM investment. Apart from ATMs there are other complimentary factors that influence the cost efficiency of banks. Previous studies have indicated that bank size, salary level and nonperforming loan ratio also influence the cost efficiency of banks (Chin S et al., 2008) and Girardone et al., 2004). It is important that this study consider the effects of these factors on the cost efficiency of Nigerian banks. This study obtained data on the actual number of ATM, operating data and financial data of the banks to provide the actual ATMs investment data for measuring the effects of the intensity of ATM on cost efficiency of Nigerian banks. |

SCOPE OF STUDY |

| The study was carried out on banks in Lagos State , Nigeria. Lagos state was selected on the basis of the clustering of banks and being the commercial nerve centre of Nigeria. The study period covered the five post merger and consolidation years from 2007 - 2012. This period has been chosen because it was the period that actually witnessed major development in ICT investment in banks as indicated by the increased level of ATM deployment (Fasan, 2007). |

THEORETICAL AND CONCEPTUAL FRAMEWORKS |

Cost efficiency measurement |

| The literature on this subject presents a lot of arguments for and against particular models. However, there are no explicit conclusions which approach is the best. Charnes, Cooper and Rhodes (1978), proposed the non-parametric DEA method which became of increasingly popularity in measuring efficiency in the countries with developed banking systems. These authors, relying on Farell's concept of productivity, in which the efficiency measure was defined as a ratio of a single input to a single output, applied the method in a multidimensional situation in which there were more than one outputs and more than one inputs. In this method, any units on the efficiency frontier are said to be efficient and their efficiency rates equal 1. The units below the efficiency frontier line have efficiency rates less than 1, which show a level of their inefficiency. The efficiency rate defined in this way takes the values from 0 to |

| According to Grazyna (2008), a comparison of results achieved both by the DEA method and the classical method of financial indicators seems to be interesting. Two basic indicators of financial analysis, i.e. return on equity (ROE) and employment efficiency rate (presented as a ratio of the financial result produced by one employee) and also two efficiency measures assessed by means of DEA have been chosen to compare the results and shows a convergence of results achieved by both methods (financial indicators and DEA). The results achieved by both methods show an increase in the efficiency of banks' performance in recent years. This model has been challenged on the ground that while ratios are useful and give some indication of the level and changes in efficiency over time, they represent a final outcome and do not allow for identification of the sources of inefficiency and where improvements are necessary. |

| DeYoung (1997) stated that accounting-based expense ratios were misleading and that statistics based "efficient cost frontier" approaches often measure cost efficiency more accurately. Cost frontier analysis uses statistical techniques to simulate a hypothetical best practice bank similar to the real bank that is under evaluation. Cost inefficiency is estimated by comparing the expenses actually incurred by the real bank to the simulated expenses for the best practice bank. He further stated that although the Stochastic Cost Frontier (SCF) method-or either of the other frontier efficiency approaches discussed above-can be used to correct for any identified biases of the traditional accounting method, implementing these methods require a great deal of time and statistical expertise. |

| In accounting/financial performance indicators, one possible approach is to regress the chosen ratio like Cost/Income Ratio on a set of variables including the variable thought to be causing the bias. Appropriate benchmarks are generated by substituting these values into the right-hand-side of the formula. Chin-S et al., (2008), in their study to determine if ATM investment can improve bank cost efficiency adopted the simple traditional accounting/financial performance indicators by choosing operating cost rate and asset management rate as dependent variables while the main independent variable was number of ATM relative to labour utilization. In order to provide for any exogenous bias they included control variables such as bank size, salary level, non performing loan and new bank dummy. This study has used the simple traditional accounting/financial performance indicators approach in estimating the effect of ATM intemsity on the cost efficiency of Nigerian banks because the essence of the study was not to embark on measuring the efficiency of banks but given any obtained cost efficiency to evaluate how the cost efficiency has been affected by the intensity of ATMs deployment. |

Automatic teller machine deployment determinants |

| Chin S, David C, and Chia-Sheng (2009), examined the determinants of automatic teller machine (ATM). According to them, the factors that are expected to have impact on IT investment in general and on ATM investment in particular are identified from three perspectives, namely operating scale perspective (banking scale, number of branches, branch growth), deposit service perspective (deposit intensity, demand deposit intensity, demand deposit growth), and operating cost perspective (operating cost ratio, salary cost ratio, operating cost growth). They modeled the relationship between ATM deployments and its determinants as presented in figure 2.1 below. Figure 2.1 used scale perspective, Deposit service and cost perspective as independent variables and information technology investment as the dependent variable. |

|

| Operating cost rate and Assess management rate were used as measure of cost efficiency. Chin S et al.(2008) similarly modeled a relationship between Cost efficiency and ATM Intensity controlling for bank size, salary level, non performing loan and bank age as independent variable and an output measure using operating cost rate and asset management rate for cost efficiency (dependent variable) as represented in figure 2.2 below: |

|

| Banks capacity consists of the Asset base, profitability and the salary level of the banks. While banks market factors is the number of banks in existence reflecting the degree of competition and the value of ATM transactions. |

|

RESEARCH METHODOLOGY |

|

|

| The study area was Lagos, the commercial nerve centre of Nigeria, where almost ninety percent of the commercial banking activities takes place. It is also in Lagos that most of the commercial banks have their headquarters.. The study population consisted of the 22 Commercial banks in Nigeria registered by the Nigerian stock exchange, with branches all over the country. The sample size shall be the 20 of the 22 commercial banks whose headquarters are in Lagos, the remaining two have their headquarters in Abuja and were therefore excluded purposively. This implies that results obtained from this research work can be adequately used for determining what obtains in the banking industry in Nigeria. The relevant information for the study was obtained from the headquarters of selected banks because the head of system department at the headquarters has access to key information on ICT devices and from published reports of the Nigerian stock exchange. |

METHOD OF DATA ANALYSIS |

Dependent variables |

| The study investigated the relationship between the ATMs determinants and ATM deployment as well as the impact of the intensity of ATM deployment on cost efficiency, with cost efficiency operationalised as operating cost rate and asset management rate. In the Model 1, the dependent variable is the number of ATMs (NATMs) deplored by banks In model 2, the dependent variable is Cost Efficiency. The two cost efficiency measures used are; operating cost rate and asset management rate are the dependent variable and are defined as follows: |

| a) OCR = OE/TR |

| Where |

| OCR = Operating cost rate |

| OE = Operating expense |

| TR = Total revenue |

| The operating cost rate (OCR) measures the cost efficiency of a bank's operating activities, the higher the measure, the lower the cost efficiency of the operating activities. (b) AMCR = OE/TA Where AMCR = Asset Management Cost Rate |

| OE = Operating expense TA = Total Assets The Asset Management Cost Rate (AMCR) measures the efficiency of asset management activities. Similar to the OCR, the higher the AMR measure, the lower the asset management efficiency for the sample banks |

Independent Variables |

| In model 1, the independent variables are banks capacity and banks market factors proxy by banks capital base, Salary level of bank, banks profitability and Value of ATM transaction of bank, number of banks respectively. In model 2, the main independent variable is the number of ATMs (NATMs) deplored by the banks. |

Control Variables |

| Apart from NATMs that could impact on the cost efficiency of banks in Nigeria other factors such as bank size (BS), salary level (SL), nonperforming loan ratio (NPLR) can. These factors are adjusted for as control variables. This also in line with the work of Chin-S et al. (2008) The control variables proposed are derived as follows: |

|

DISCUSSION |

| In research, the main preoccupation is whether there is a relationship or whether two or more variables co-vary as multiple measures of co-variation or association exist (Frankfort and Nachmias, 1996). Multiple regression was used in this study to parametise the relationship in the models. In model one (1) focusing on the determinants of ATM deployment by banks in Nigeria, the number of ATM deployed was used as the dependent variable to correlate bank size, profitability, salary level, number of banks and ATM transactions. Five (5) years annual reports of each of the twenty (20) banks chosen as case study were used. In model two (2), the cost to income ratio and asset management rate were used as the dependent variables to correlate with the intensity of ATM deployed by banks, nonperforming loans ratio, bank size and salary level as independent variables. |

| The model focuses on the effects of a unit increase in one independent variable on the dependent variable. |

The determinants of ATM deployment by banks in Nigeria |

| In order to achieve objective one of the study which is to ascertain the determinants of ATMs deployment in Nigerian banks a multiple regression analysis was employed. Five factors were considered in the model as determinants in line with the work of Chin S et al., (2009); they are bank size, bank profitability, salary level, number of banks during period of study and value of ATM transactions. The result is as shown below in table 4.1 |

|

| The adjusted R2 is 0.7219 which implies that 72.19 percent of the variation on number of ATM deployed by banks is being explained by the five variables considered in the model. Three of the five variables are significant. These are: bank size, salary level and value of ATM transactions. Specifically, the coefficient of bank size is 68.8768. It is positive and statistically significant at p<0.05. This shows a significant effect of bank size on banks ATM deployment while the positive sign implies that a unit increase in bank size will tend to 68.88 unit increase in ATM deployment by banks. This in line with the works of Hannan and McDowell (1984) which in examining the relationship between the decision of new IT adoption and its determinants found out that firm size has positive effects on deciding ATM adoption. In addition, consistent with economic of scale theory, larger banks tend to introduce more ATM than smaller banks do (Humphrey, 1994 and Chin S et al., (2009). This suggests that adopting ATM is likely to be more profitable for relatively larger institutions. Generally speaking, it is assumed that the firm size variable can capture the effect of scale. The coefficient of salary level of banks is 0.0757881 significant and positive at p<0.05 which implies that additional unit increase in salary level of the bank will tend to 0.076 unit increase in the number of ATM deployed by the banks. This is also in line with the works of Hannan and McDowell (1984) which in examining the relationship between the decision of new IT adoption and its determinants found out that wage rate has positive effects on deciding ATM adoption and stating that in regions with higher wage rates, banks tend to install more ATM to replace expensive labour. The coefficient of the value of ATM transactions is 0.1212075 is positive and significant at p<0.05 which implies that a unit increase in the value of ATM transactions will tend to 0.12 unit increase in the number of ATM deployed by banks. This is indicative of the response of the banks to the growing demands of ATM usage. The coefficients of bank profitability and number of banks are -139.0728 and -298.1285 respectively. They are negative and not are not statistically significant at p<0.05. The implication of these is that the extent of ATM deployment is not really dependent on the bank profitability and number of banks. The hypothesis which states that ‘there are no significant determinants of ATM deployment by banks in Nigeria' is hereby rejected and consequently, there are significant determinants of ATM deployment by banks in Nigeria. |

The impact of ATM on Cost efficiency of banks in Nigeria |

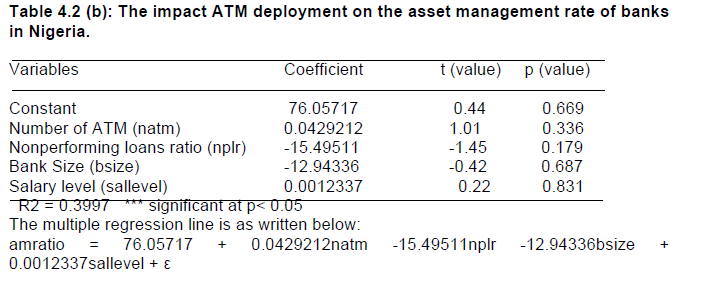

| In order to achieve objectives two and three of the study which is to evaluate the effect of ATMs deployment on the operating cost rate of Nigerian banks and to evaluate the effect of ATMs deployment on the Asset management rate of Nigerian banks a multivariate regression analysis was employed. The cost efficiency of the banks was operationalised using cost to income ratio and asset management rate as the measure of cost efficiency. These were regressed against the number of ATM deployed by banks while controlling for nonperforming loans ratio, bank size and salary level. This is in line with the work of Chin S et al., (2008). The result is as shown below in table 4.2 (a) |

|

| The adjusted R2 is 0.4940 which implies that 49.40 percent of the variation on cost to income ratio of banks is being explained by the four variables considered in the model. Three of the four variables are significant. These are: number of ATMs, nonperforming loans and bank size. Specifically, the coefficient of number of ATMs is 0.0046231. It is positive and statistically significant at p<0.05. This shows a significant effect of IATMs on cost to income ratio of banks while the positive sign implies that a unit increase in IATMs will tend to 0.46 unit increase in cost to income ratio of banks. This may reflect the effect of the initial stage of ATM deployment given the huge sunk cost involved in ATM deployment which is likely going to affect the operating cost and of course the cost to income ratio of the banks. Perhaps over a longer time frame the result might be different. |

| This in line with the works of Chin S et al., (2009) which in providing answers to the question ‘can ATM investment improve Bank Cost Efficiency?' confirmed that the intensity of ATM deployment has positive effect on the cost efficiency of banks in Taiwan. The coefficient of nonperforming loans is 1.057346, It is positive and statistically significant at p<0.05. This shows a significant effect of nonperforming loans on cost to income ratio of banks while the positive sign implies that a unit increase in number of nonperforming loans will tend to 1.05 unit increase in cost to income ratio of banks. The result confirms that nonperforming loans have a negative effect on operating efficiency of banks. The reason for controlling problem loans is that it is regarded as an exogenous influence coming from external unfortunate events (Berger and Humphrey (1997). Banks need to pay more attention to processing, monitoring, and managing nonperforming loans than performing loans. If a bank's nonperforming loan ratio is higher than that of other banks, its loan quality may also be affected. According to Girandone et al.., (2004), the nonperforming loan ratio is usually positively related to bank inefficiency with regard to the coefficient for the level of NPLs. |

| The coefficients of bank size is 3.6798 is positive and significant at p<0.05. The implication of this is that a unit increase in the bank size will tend to 3.68 unit increase in the cost to income ratio of banks. This is, however, at variance with prediction as in the work of Chin S et al., (2009), based on the theory of economic of scale which suggest that larger banks usually have cost advantages over small ones. The coefficient of salary level is -0.0002363 negative and not significant at p<0.05. This implies that a unit increase in salary level tends to no change in cost to income ratio of banks. The result shows that salary level do not significantly affect the cost income ratio and by extension the cost efficiency of banks. |

| The hypothesis which states that ATMs deployments do not have significant effect on the operating cost rate of Nigerian banks is hereby rejected and consequently, ATMs deployments do have significant effect on the operating cost rate of Nigerian banks. |

|

|

| The adjusted R2 is 0.3997 which implies that 39.97 percent of the variation on asset management rate of banks in Nigeria is being explained by the four variables considered in the model. The higher the asset management cost rate measure, the lower the asset management efficiency for the sample banks. Three of the four variables are significant. These are: number of ATMs, nonperforming loans and bank size. Specifically, the coefficient of IATMs is 0.0429212. It is positive and statistically significant at p<0.05. This shows a significant effect of number of ATMs on asset management ratio of banks while the positive sign implies that a unit increase IATMs will tend to 4.3 unit increase in asset management ratio of banks. This provides an indication that banks have not been able to leverage on ATMs deployment to achieve good asset management efficiency. This is contrary to the empirical results in the work of Chin S et al., (2009), which confirm that ATM intensity has positive effect on the cost efficiency of banks. |

| The coefficient of nonperforming loans is -15.49511. It is negative and statistically significant at p<0.05. This shows a significant effect of nonperforming loans on asset management ratio of banks while the negative sign implies that a unit increase in number of nonperforming loans will tend to 15.49 unit decrease in asset management ratio of banks. The result is at variance with prediction that nonperforming loans have a negative effect on operating efficiency of banks. The reason for controlling problem loans is that it is regarded as an exogenous influence coming from external unfortunate events (Berger and Humphrey (1997). Banks need to pay more attention to processing, monitoring, and managing nonperforming loans than performing loans. If a bank's nonperforming loan ratio is higher than that of other banks, its loan quality may also be affected. According to Girandone et al.., (2004), the nonperforming loan ratio is usually positively related to bank inefficiency with regard to the coefficient for the level of NPLs. The coefficient of bank size is -12.94336 is negative and significant at p<0.05. The implication of this is that a unit increase in the bank size will tend to 12.94 unit decrease in the asset management ratio of banks. This is in line with prediction as in the work of Chin S et al., (2009), that as larger banks usually have huge capital; therefore large banks often make well-arranged asset management plans. We can say therefore that bank size has a positive effect on bank asset management efficiency. The coefficient of salary level is 0.0012337 positive and not significant at p<0.05. This implies that a unit increase in salary level tends to almost no change in asset management ratio of banks. The result shows that salary level do not significantly affect the asset management ratio and by extension the asset management efficiency of banks. The hypothesis which states that ATMs deployments do not have significant effect on the asset management rate of Nigerian banks is hereby rejected and consequently, ATMs deployments do have significant effect on the asset management rate of Nigerian banks. |

SUMMARY, CONCLUSION AND RECOMMENDATIONS |

| The results from the determinants of ATMs deployment showed that bank size, salary level and value of ATM transactions were the key determinants of ATMs deployment by banks. This shows that the growth in ATM deployment by banks was encouraged by the banks capacity to invest in IT, strategy of labour cost minimization attendant by ATM teller labour substitution as well as banks response to ATM usage. However, number of banks and profitability though were significant but were negatively correlated and therefore made no contribution to growth of ATMs. Findings from the impact ATM deployment on the cost to income ratio of banks in Nigeria showed that apart from number of ATMs which made positive contribution to cost to income ratio, nonperforming loans and bank size were also significant in contributing. However, given the relatively low R2 = 0.4940, other factors outside the variables used in the model also contribute to the cost income ratio of banks in Nigeria. The implication of this is that banks should look beyond ATMs deployment for improvement in cost efficiency. Also, the findings from the impact ATM deployment on the asset management rate of banks in Nigeria showed that apart from number of ATMs which made positive contribution to asset management rate, salary level was also significant in contributing. Again given the relatively low R2 = 0.3997, other factors outside the variables used in the model also contribute to the cost income ratio of banks in Nigeria. The implication of this is that banks should look beyond ATMs deployment for improvement in cost efficiency. |

| The following conclusions were drawn from the findings of this study: The banks in the study area were majorly influenced in their ATMs deployment by bank size, salary level and value of ATM transactions. This means that banks that can afford ATMs would invest in it. Also there is the desire of the banks to make ATM teller labour substitution. There is also a clear evidence of banks response to growth in ATM transaction in ATM deployment. The study also showed that the deployment of ATMs contributed to banks cost efficiency measured in terms of cost to income ratio and asset management rate. While it was positive, other factors such as nonperforming loans and bank size as well salary levels were found to have contributed. It was also revealed from the study that given the relatively low coefficient of determinant, other factors outside the model contributed to the cost efficiency of banks. |

| As a result of the above findings and conclusions, the following recommendations were made:- |

| i. Banks in Nigeria should continue to deploy ATMs as a strategic tool for improved cost efficiency |

| ii. Banks need however to also focus on other areas of IT for cost efficiency improvement |

| iii. Banks should strengthen their management of nonperforming loan and manage their size in their effort to improve cost efficiency. |

CONTRIBUTION TO KNOWLEDGE |

| The results of the study has provided useful information on the determinants of ATMs deployment by banks in Nigeria and the effect of ATM deployment on cost efficiency of banks. It has also provided information that should refocus the banks in their quest for improved cost efficiency demanding looking beyond ATMs deployment. |

References |

|

Copyright © 2024 Research and Reviews, All Rights Reserved