ISSN: 1204-5357

ISSN: 1204-5357

Cohen Gil

Department of Business, Western Galilee Academic College, Israel

Mahmod Qadan

Department of Business Administration, University of Haifa, Israel

Visit for more related articles at Journal of Internet Banking and Commerce

In this research, we test whether common trading oscillators can outperform the buy and hold strategy (B&H) using six popular ETFs for the period of the last twenty years. We found that the Relative Strength Index (RSI) combined with Chaikin Money Flow (CMF) gained positive returns for all examined ETFs and also outperformed by 79% the corresponding B&H strategy for the XLF. The Commodity Channel Index (CCI) and Bollinger Bands (BB) were found to be the best technical tools for trading the examined ETFs. No technical tools were found to be more effective than B&H strategy for the QQQ

Algorithmic Trading; Oscillators; Buy and Hold; Technical Trading

The Technical analysis approach, commonly used by practitioners, relies on historical data for the sake of forecasting prices in stock, commodity, foreign exchange, and futures markets. These trading tools are usually being used according to the setups recommended by their initiators. However, some oscillators are frequently disappointing investors who apply them, and lead them to substantial losses. Cohen et al. found in some survey-based research that professional and non-professional investors both use fundamental and technical analysis together to buy and sell stocks [1]. Tylor and Allen [2] used a survey to inform that in the foreign exchange market, there is a skew towards reliance on technical, as opposed to fundamentalist, analysis at shorter horizons, which becomes steadily reversed as the length of horizon considered is increased. Neely et al. using generic programming found strong evidence that technical trading rules can produce significant excess returns for each of six exchange rates over the period of 1981-1995 [3]. Menkhoff survey of fund managers shows that technical analysis is the most important form of analysis for forecasting short term US equity market [4]. Marshall et al. study technical trading rules tested on SPDR (Standard and Poor’s Depositary Receipts) found that technical analysis is not profitable [5]. Yamawaki and Tokuoka analyzed the effectiveness of technical indicators on eight stocks traded at NYSE showed that moving average based rules were convincingly profitable and combination of indicators make more accurate signals than any individual indicator [6]. Zhu and Zhou show that an investor might add value to his investment by using technical analysis, especially the Moving Average (MA), if he follows a fixed allocation rule that invests a fixed portion of wealth into the stock market, as dictated by the random walk theory of stock prices or by the popular mean–variance approach [7]. Tylor have applied momentum oscillators for to the Dow Jones Industrial Average (DJIA) stock index over the period 1928–2012 and found that the momentum oscillator’s performance depends on market conditions [8].

As appears in the financial literature, there is a clear debate whether the technical analysis methods can help investors gain better results than simple Buy and Hold (B&H) strategy. The current research is attempting to challenge popular algorithmic trading setups against B&H for a very long period of time that consisted different economics environments for six popular ETFs that covers almost the entire American economy. Our new approach includes not only testing the ability of popular trading oscillators to perform better than B&H, we also try to optimize them using unique technique that would be explained later in the paper.

Testing the ability of a certain technical investment rule to outperform the B&H strategy demands to apply the rule to the data for a long period of time that includes different trading environments in the form of high vs. low volatile periods, and uptrend versus down trend periods. In this research, we tested common algorithmic trading tools that were applied to the data of twenty years of trading (1999-2018). The tested ETFs were: SPY, QQQ, IWM, XLF, XLK and XLI that follows the S&P500, Nasdaq, Russel 2000, financial sector, technology sector and the industrial sector, respectively.

Because of the complexity of our optimization, we used Multi Objective Optimization (MOO) formula. Multi-objective formulations are realistic models for many complex optimization problems. In many real-life problems, objectives under consideration conflict with each other, and optimizing a particular solution with respect to a single objective can result in unacceptable results with respect to the other objectives. A reasonable solution to a multi-objective problem is to investigate a set of solutions, each of which satisfies the objectives at an acceptable level without being dominated by any other solution. Many MOO processes were developed over the years and they were used to find solutions to varies complex problems. In this research we selected Particle Swarm Optimization (PSO) that was developed by Kennedy and Eberhart (Kennedy and Eberhart 1995, Eberhart, Simpson and Dobbins 1996) as our primary optimization method [9,10]. Eberhart and Shi demonstrated that PSO can successfully applied to tracking and optimizing dynamic systems for most optimization problems however, the most promising applications of this process can be found in robotics application, decision making and simulations that describes our mission [11].

The PSO concept consists of changing the velocity of each particle toward their best location by a step wise process. Implementing the global version of PSO and adjusting it to our problem we used the following steps:

• Since we are applying predesigned technical oscillators to our data, we used the values of the particles for each trading strategy suggested by the inventor of that strategy, as our initial setup.

• For each setups of particles, we evaluate the desired optimization fitness function using our predefined goals which are: Max Profit Factor (PF), and Max Net Profit (NP).

• Compare setups fitness evaluation with "pbest"1. If current value is better than "pbest"1 then set the "pbest"1 value to the current value.

• Compare fitness evaluation with the population's overall previous best. If current value is better than "gbest"2 then reset "gbest"2 to the current value and setups.

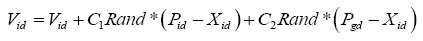

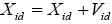

• Change the trading setups according to eqns. (1) 1nd (2) and calculate trading function results:

(1)

(1)

(2)

(2)

Where: Vid=the value of each particle of the setup, Rand=random number, Pid=particle initial identification and Pgd=particle global best identification.

• Loop to step 2 until best results are achieved.

The tested technical oscillators were: Relative Strength Index (RSI), Commodity Channel Index (CCI), Chickling Money Flow (CMF) and Bollinger Bands (BB). We tested each oscillator separately and also tried different combinations of them in order to improve strategies performance.

RSI

The Relative Strength Index (RSI) is a momentum indicator developed by Welles Wilder [12]. The oscillator compares the magnitude of recent gains and losses over a specified time period to measure speed and change of price movements of a security. This index is primarily used in attempt to identify overbought or oversold conditions in the trading of a security. The default time frame that was suggested by Wilder himself was 14 trading days. When the RSI values is 70 or above indicates that the security is overbought and 30 or below indicates an oversold condition (Table 1A). Next, we generated other setups through our optimization MOO programing system in order to improve performances and got the following setup for the RSI: The length of time to measure the RSI should be 10 days (compared to the original 14) and the overbought and oversold levels should be 62 and 38 (Table 1B). Last we added the RSI based trading strategy a money flow indicator (Chaikin Money Flow – CMF3) that adds volume information to the price action measured by the RSI4 (Table 1C).

Table 1: Algorithmic trading results.

| Table 1A: Original RSI Algorithmic Trading Results | |||||||

| SPY | QQQ | IWM | XLF | XLK | XLI | ||

| 1 | Profit Factor | 0.946 | 1.067 | 1.13 | 0.506 | 0.607 | 0.974 |

| 2 | NP | -10.15 | 8.07 | 13.91 | -19.41 | -27.26 | -1.56 |

| 3 | RSI % P/L | -9.93 | 13.09 | 25.69 | -91.94 | -76.50 | -5.90 |

| 4 | B&H % P/L | 154.36 | 102.72 | 168.80 | 29.60 | 22.62 | 176.60 |

| 5 | 4-3 | 164.29 | 89.63 | 143.11 | 121.54 | 99.12 | 182.5 |

| 6 | St. Dev | 1.21 | 1.77 | 1.48 | 1.96 | 1.60 | 1.32 |

| Table1B: Optimal RSI Algorithmic Trading Results | |||||||

| 7 | Profit Factor | 1.10 | 1.17 | 1.37 | 1.13 | 1.244 | 1.405 |

| 8 | NP | 40.65 | 41.76 | 72.12 | 7.47 | 25.79 | 39.17 |

| 9 | RSI % P/L | 30.94 | 75.32 | 139.74 | 40.48 | 72.38 | 157.05 |

| 10 | B&H % P/L | 101.07 | 193.29 | 194.69 | 49.67 | 85.23 | 196.43 |

| 11 | 4-3 | 70.13 | 117.97 | 54.95 | 9.19 | 12.85 | 39.38 |

| 12 | St. Dev | 1.21 | 1.77 | 1.48 | 1.96 | 1.60 | 1.32 |

| Table 1C: RSI CMF Algorithmic Trading Results | |||||||

| 13 | Profit Factor | 1.31 | 1.58 | 1.72 | 1.75 | 1.60 | 1.53 |

| 14 | NP | 56.76 | 62.65 | 49.73 | 23.87 | 30.75 | 31.62 |

| 15 | RSI % P/L | 44.48 | 104.83 | 98.16 | 129.03 | 88.48 | 125.12 |

| 16 | B&H % P/L | 108.04 | 164.87 | 205.46 | 50 | 95.68 | 197.70 |

| 17 | 4-3 | 63.56 | 60.04 | 107.3 | -79.03 | 7.2 | 72.58 |

| 18 | St. Dev | 1.21 | 1.77 | 1.48 | 1.96 | 1.60 | 1.32 |

Notes: The profit factor is a factor which measures by the gross profit divided by the gross loss including commissions for the trading period. NP is the dollar value Net Profit of the strategy. RSI % P/L is the percentage profit or loss. B&H % P/L is the percentage of profit or loss of the B&H strategy for parallel period of time and St. Dev denotes the standard deviation of the ETFs prices.

Table 1 shows a poor performance of the original RSI setups for all tested ETFs. Not only the RSI based returns failed to beat the B&H strategy, it produces a negative return for four out of six ETFs. The optimized setups have improved the trading results to above one profit factor for all six examined ETFs, however, the strategy still failed to outperform the B&H. The result of the combined optimal RSI with CMF has been proven fertile (Table 1C). The strategy profit factors have risen for all six examined ETFs and also outperformed the B&H strategy by 79% for the XLF5.

CCI

Commodity Channel Index (CCI) is a momentum based technical trading tool used most often to help determine overbought and oversold conditions. This oscillator was developed by Donald Lambert, the CCI is a stochastic oscillator that measures the change in price relative to a pre-defined moving average (MA) of the price divided by 1.5% of a normal deviation (D) from that average. Oscillating indicators in general are technical trading tools whose calculated values move back and forth between two pre-determined levels, the top level indicating a market that is in the condition of being overbought and the bottom one indicating a market that is in the condition of being oversold. We used standard 100 and -100 for overbought and oversold conditions. The results are shown in Table 2.

Table 2: CCI algorithmic trading results.

| SPY | QQQ | IWM | XLF | XLK | XLI | ||

|---|---|---|---|---|---|---|---|

| 1 | Profit Factor | 1.45 | 1.22 | 1.29 | 1.61 | 1.30 | 1.30 |

| 2 | NP | 236.62 | 79.69 | 101.89 | 50.74 | 50.28 | 47.21 |

| 3 | RSI % P/L | 193.34 | 161.80 | 194.70 | 258.74 | 205.22 | 188.38 |

| 4 | B&H % P/L | 121.39 | 239.28 | 193.44 | 46.71 | 97.27 | 195 |

| 5 | 4-3 | -71.95 | 77.48 | -1.26 | -208 | -107.95 | 6.62 |

| 6 | St. Dev | 1.21 | 1.77 | 1.48 | 1.96 | 1.60 | 1.32 |

Notes: The profit factor is a factor which measures by the gross profit divided by the gross loss including commissions for the trading period. NP is the dollar value Net Profit of the strategy. RSI % P/L is the percentage profit or loss. B&H % P/L is the percentage of profit or loss of the B&H strategy for parallel period of time and St. Dev denotes the standard deviation of the ETFs prices.

Table 2 presents an improved trading result. For four out of six ETFs the CCI trading strategy has outperformed the B&H strategy, with an excess return of 208% for the financial sector ETF (XLF) and 107.95 for the technological sector ETF (XLK). The only double figure defeat of the CCI strategy was for QQQ (77.48 differences).

Bollinger Bands

The last technical tool we tested was Bollinger Bands (BB) developed by famous technical trader John Bollinger. BB is a plotted two standard deviations away from a simple moving average. Prices move between the bands 90% of the time. The closer the prices move to the upper band, the more overbought is the asset and the probability for retracement to the down side increases. On the other hand, the closer the prices move to the lower band the more oversold the asset is and a positive retracement is expected. The setup we used here was 14 days for the moving average calculation with the original two standard deviations. The results are summarized in Table 3. investment in the Mudaraba accounts, without banks requiring clients to have a certain period of time to get their generated profits.

Table 3 shows a bigger than one profit factor for all traded ETFs. A superiority of the strategy over the B&H strategy was found for SPY, IWM, and XLI. It is important to note that the BB trading strategy is a more fertile strategy when you trade less volatile assets such as SPY and XLI than more volatile assets such as XLF and XLK.

Table 3: Bollinger bands algorithmic trading results.

| SPY | QQQ | IWM | XLF | XLK | XLI | ||

|---|---|---|---|---|---|---|---|

| 1 | Profit Factor | 1.75 | 1.55 | 1.95 | 1.03 | 1.16 | 1.83 |

| 2 | NP | 212.10 | 110.64 | 136.53 | 1.98 | 17 | 63.87 |

| 3 | RSI % P/L | 163.35 | 205.11 | 251.11 | 10.80 | 46.25 | 259.84 |

| 4 | B&H % P/L | 105 | 207 | 182.62 | 51.63 | 82.66 | 208.17 |

| 5 | 4-3 | -58.35 | 1.89 | -68.49 | 40.86 | 36.41 | -51.67 |

| 6 | St. Dev | 1.21 | 1.77 | 1.48 | 1.96 | 1.60 | 1.32 |

Notes: The profit factor is a factor which measures by the gross profit divided by the gross loss including commissions for the trading period. NP is the dollar value Net Profit of the strategy. RSI % P/L is the percentage profit or loss. B&H % P/L is the percentage of profit or loss of the B&H strategy for parallel period of time and St. Dev denotes the standard deviation of the ETFs prices.

In this research we tested whether common trading oscillators fits to trade six popular ETFs for twenty years of trading. We used Particle Swarm Optimization (PSO) to optimize the trading oscillators particles setups. We found that RSI alone failed to outperform the B&H strategy. Combined with CMF, the RSI achieved a positive profit factor for all examined ETFs and also outperformed the B&H strategy dramatically for the XLF by 79% for the entire period. CCI and BB were found to be the best technical tools to trade the examined ETFs. While the CCI performed better for the more volatile ETFs XLF and XLK the BB was superior for trading IWM and XLI which are less volatile. We also recommend the CCI strategy for trading the SPY. No technical tools were found to be more effective than B&H strategy for the QQQ ETF.

1"pbest"=The set up that achieved the best results of our target function: Max PF and NP.

2"gbest"=global best identification.

3Developed by Marc Chaikin in 2011.

4The volume information is known to be important information for traders.

5The other 5 examined ETFs underperformed the B&H strategy.

Copyright © 2024 Research and Reviews, All Rights Reserved