ISSN: 1204-5357

ISSN: 1204-5357

Dr. Agboola A. A., Obafemi Awolowo University, Ile-Ife.

Email: aaagboola2002@yahoo.com

Visit for more related articles at Journal of Internet Banking and Commerce

The paper examined electronic payment systems and tele-banking services in Nigeria. Thirty six out of the 89 banks in Nigeria as at the end of 2005 were selected for the study. Questionnaire method was used to gather data from bank workers. Findings revealed that there has been a very modest move away from cash. Some payments are now being automated and absolute volumes of cash transactions have declined. Connectivity via the use of Local Area Network (LAN) and wide area network has facilitated electronic transfer of funds. Thirty five out of the 36 banks studied have fully networked their systems to ease communication of account information. The use of Smart Cards, Point of Sales System and Computerized Credit Ratings were not very popular as less than half of the studied banks had fully adopted them. The least fully adopted technologies were ATM, Electronic Home and Office Banking and Telephone Banking. Low rate of adoption of these technologies might be due to low level of economic development, ineffectiveness of NITEL, epileptic supply of power, high cost, fear of fraudulent practices and lack of facilities necessary for their operation. The paper concluded that Tele-banking is capable of broadening the customer relationship, retain customer loyalty and enable banks to gain commanding height of market share if their attendant problems are taken care of.

Payment systems have passed through a lot of ages. Prior to 700 BC when cowries were introduced in Asia Minor, barter remained the only medium of exchange. With the Introduction of coins and notes, the era of cash as payment system emerged. In AD 1000, the first bank notes appeared in China. This was later followed by the use of cheque as written instructions to transfer precious metal coins from one holder to another. Other written instructions such as credit transfers, postal orders, money orders, and travellers’ cheques have also been used. The next great age of payment system that followed paper instructions is electronic payments. Some payments are now being automated and absolute volumes of cash transactions have declined under the impact of electronic transaction brought about by the adoption of ICT to the payment system, especially in the developed countries.

David (1982) confirms that there has been a very modest move away from cash. Patrick (1985) also contends that the advantages of cash diminish as the value of transactions increases. Consequently, the use of non-cash payments rises with increasing value. All these have been brought about by the advancement in (ICT) Information and Communication Technology. ICT has streamlined the processes for cash lodgements (deposits) and withdrawals locally and internationally. Tellers are today equipped to issue receipts (deposit slips) for cash deposits. The service of ordering bank drafts or certified cheques made payable to third parties has also been increasingly automated (Irechukwu, 2000).

Writing on new technologies and performance enhancement in the banking industry, (Ovia, 1997) states that the new technologies have created unparalleled wired economy. The transfer of money from point ‘A’ to point ‘B’ has resulted in turning the actual money into bits and bytes through satellite transponders, fibre optic cables or regular telephone lines. Bill (1996) contends that for banks, the new technologies present not only a challenge to adapt but also many opportunities to utilise.

Information and Communication Technology (ICT) is the modern handling of information by electronic means which involves access to, storage of, processing, transportation or transfer and delivery (Ige, 1995) It is the acquisition, processing, storage and dissemination of vocal, pictorial, textual and numerical information by a micro-electronic based combination of computing and telecommunications (Lucey 1987). The focus of ICT is on telecommunication and computerisation (Lucey, 1987). It implies the convergence of computing and communication (Telecommunication) technologies and its uses or application for global Internet, Intranet, Extranet, World Wide Web (WWW), Visual reality, Cyberspacethe New Digital Mentality and Culture (Uwaje, 2000). Communication Technology comprises the physical devices and software that link (connect) various computer hardware components and transfer data from one physical location to another (Laudon and Laudon; 2001). Connectivity has facilitated the use of electronic delivery channels. Distances and geographical locations are no longer barriers to financial transactions.

Full online, real-time capabilities have revolutionized electronic transfer of funds. Electronic fund transfer (EFT) is an electronic oriented payment mechanism. It allows customers accounts to be credited electronically within 24 hours (Ugwu, et al., 1999). Mark (1975) classified the basic elements of EFT system into three: Clearing network characteristics, remote service or point of sale characteristics and pre-authorized debit and/ or credit characteristics.

The first one (clearing network characteristics) deals with automated clearing service and this manifests in he use of (MICR) Magnetic Ink Character Reader in Nigeria. The remote service or point of sale characteristics address the units of banking activities that transfer funds from one bank current or savings account to another bank’s current or savings account. The transfer is always authorized and the record is kept on file of that authorisation. There is also a second-generation remote service unit that is capable of electronically placing a third party into the customer-financial institution communication link. This is known as POS (Point of Sale terminals). POS terminals handle cheque verifications, credit authorisation, cash deposit and withdrawal, and cash payment. This enhances electronic fund transfer at the point of sale (EFTPOS). EFTPOS enables a customer’s account to be debited immediately with the cost of purchase in an outlet such as a supermarket or petrol station (Ugwu, et al., 1999). It consists of the accumulation of electronic payment messages by the retailer, which are subsequently passed on to appropriate institutions for processing. The purchase price is debited on the buyer’s account and credited on the seller’s account. The basic components of every EFTPOS system are Recognition, Authorisation, Message-Entry and Message-Processing. By 1985, many major banks had embraced EFTPOS on line system accepting all types of visa and master card (Patrick 1985).

Pre-authorized debit and/ or credit characteristics of the EFT manifest in the use of cards. Plastic cards are used to identify customers and pass same to machines to initiate a paper or electronic payment. It is a mechanism by which personal customers could interface with electronic banking industry (Steve, 1996). Electronic cards are microchips that store electronic card, which is only cheque guaranteed (Ugwu, et al., 1999). Financial institutions issue credit cards in order to provide credit facilities to their customers and debit cards to ease payment system. Credit cards are used as means of borrowing or as a convenient method of payment. Debit Card is a charge card designed as a convenient method of payment in place of cash or cheque.

Electronic fund transfer has also been variously designed to ease international transfer of money. In 1977, the international payment system known as SWIFT (Society for Worldwide Inter-bank Financial Telecommunication) became operational. SWIFT enables user banks to use electronic mode to transfer international payments, statements and other banking messages. In Nigeria, first Bank’s Western Union, Monogram of United Bank for Africa among others perform international funds transactions.

Banks have explored a new technology brought about by the convergence of telephoning and computing power to bring the virtual branch into people’s homes. This is based on Tele-banking which means telecommunications-based banking. It is an authorized banking service that allows the customer to access, instruct, and receive information at convenient locations, using telecommunication as the prime link (Stan, 1997). Generally speaking, Tele-banking makes use of three forms of delivery channels (Stan, 1997). The first is Automated Voice Response (AVR), which is used where the customer’s hardware comprises a telephone. Communication is done through tone generation with automated voice response. It can also be done by speech or voice recognition with automated voice response. The second form is person to person where contact is directly made by telephone to carry out transactions or make enquiries. The third from is through the use of screen where the hardware is a keyboard and TV screen or visual display unit. Prominent among the devices of tele-banking are interactive television, telephone, and the Internet. The key feature of all is the use of telecommunication network.

Interactive television is now being developed as a means of entering customer’s households to sell product and services (financial products inclusive). It requires an intelligent decoder, which acts as a computer attached to the cable of television network. It is also possible to combine satellite TV with the telephone network to enable interaction outside the cable network. This helps to provide sales and loan information on the screen. The first bank to use interactive television for banking services is Natwest, which provided it to about 2,500 homes in Ipswich and Colchester in 1995. It made use of Home-link concept pioneered by Nottingham Building Society Bank of Scotland but updated to the advantage of technological development (Stan, 1997)

This is the most familiar of the tele-banking devices and it allows customers to transact banking business over the phone. It can be used as an alternative to the traditional branch banking or in conjunction with it. In Britain, Midland Bank combined its use with branch service for its business customers while Halifax decided to extend its use to areas other than where current accounts exist (Stan, 1997).

Laudon and Laudon (2001) point out that the world’s largest and most widely used network is the Internet. Internet is the main vehicle for Public Access Computing (P A C). Internet offers an excellent environment for banks to experiment with the delivery of home banking (Bill, 1996). It has been used to develop virtual reality bank branches in the United States of America. A prototype of this is the Electronic Courtyard developed by the Global Payment System Visa and the US software firm Worlds Inc. It allows customers to cheque account balances, transfer funds and apply for loans. It uses threedimensional graphics to enable customers to move into different rooms and communicate with virtual bank tellers, loan arrangers and financial advisers. It uses visa’s remote banking subsidiary, visa interactive, to link banks with customers and provide secure technology for the safety of account data transferred.

The level of participation on the web varies among banks. Many banks do not go beyond putting up a sign (company logo and contact telephone number) on the web. Some banks go a little further by offering information about them and their products (annual report, description of their products, loan products, and card products) to allow customers access to information in a single place instead of scattering them in many records and documents. This has been described as ‘shop window’. Only very few banks have gone beyond the shop window level to include a range of extra elements. Some offer general financial advice with a level of interactivity. A good example is Toronto Dominion .

Bank in Canada, which offers Wealth Allocation Models that allows customers to answer questions about themselves to test their tolerance for risk and receive advice on how best to allocate their assets. Some banks have gone as far as selling financial products on the Internet. A local bank in Kentucky, America called Security First Network Bank has attracted significant attention in using the net to offer everyday transactions such as balance enquiry, transfer between accounts and bill payment. During the bank’s first two weeks on the internet, 750 people from 32 states opened accounts with it, a third of them from California. About 12 million people were estimated to be using Internet in 1995, and by the year 2000, 22 million households had Internet connection in the home (Lunt,)

Payment through the Internet will continue to expand in the next because it is very cheap and fast, some only cost the electricity that they use. Lynda (1999) wrote that the transaction costs of serving customers could be reduced, sometimes dramatically, by conducting transactions over the Internet. Laudon & Laudon (2001) observed that Internet is reshaping the way information systems are used in business and daily life. By eliminating many technical, geographic and cost barriers obstructing the global flow of information, the Internet is accelerating the information revolution, inspiring new uses of information systems and new business models.

One major attraction of Internet and other tele-banking devices is that they have facilitated Electronic Home and Office Banking (EHOB). Lynda (1999) defines EHOB as a subset of the business to consumer segment of electronic commerce. This device enables customers to carry out transactions with their banks through connection between the customer’s terminals in their homes and/or offices and the bank’s computer system through VSAT (Very Small Aperture Terminal) VSAT is a satellite communications system that serves home and business users. Customers with such terminals are able to contact the bank for any form of information required. Information on bank balances, deposits into and withdrawals from accounts etc may be gotten through this medium. EHOB thus allows costumers to keep a very firm grip on their financial transactions. With EHOB, customers can do their banking not only when but also from the convenience, comfort, privacy and security of their homes.

Thirty six out of the 89 banks in Nigeria as at the end of 2005 were selected to determine the extent of electronic banking in the country. Questionnaire and interview methods were used to gather data for the study.

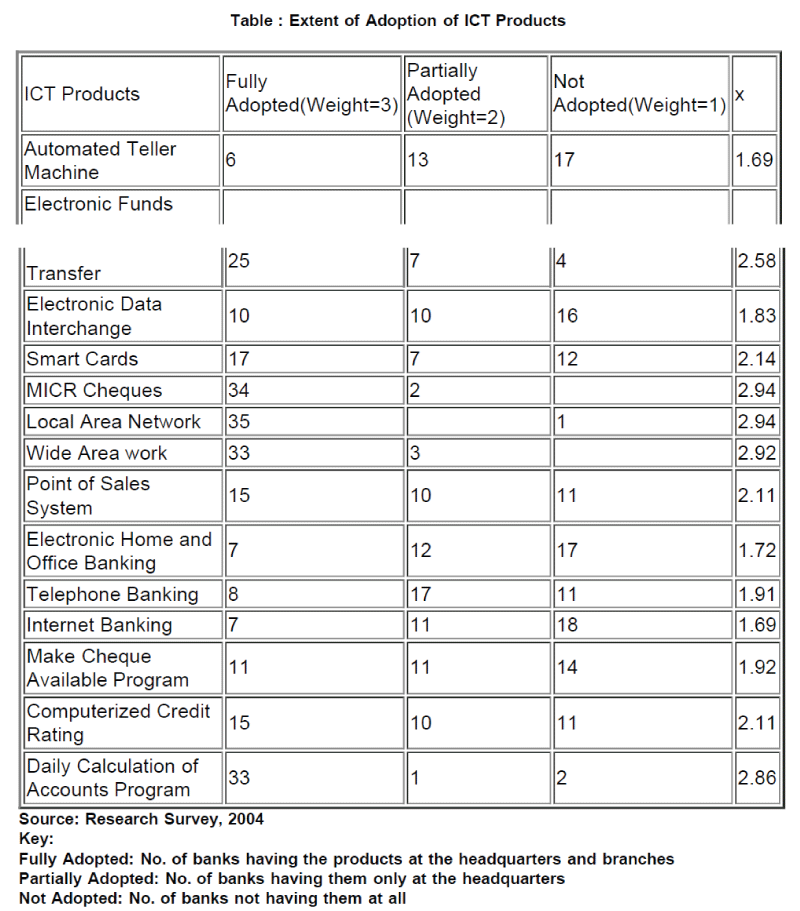

The table below shows the extent of adoption of electronic payment devices in the studied banks. The most widely adopted technology is the Local Area Network (LAN). Thirty five out of the 36 banks studied have fully networked their systems within the bank. This made communication of account information easy. MICR cheques were also highly utilized by the banks. Thirty four banks had fully adopted its use while the remaining two banks had partially adopted it. Findings revealed that one of the earliest developments in the use of computers in banking was based on the handling of cheques. It was borne out of the desperate need to overcome the problem of handling the growing volumes of cheque. This agrees with the finding of (David 1982) that the most significant development in clearing systems over the past decade has been the growth of Bankers Automated Clearing Services

Program for Daily Calculation of Accounts, Wide Area Network (WAN) and Electronic Funds Transfer (EFT) also ranked high in adoption among the studied banks. Smart Cards, Point of Sales System and Computerized Credit Rating were not very popular as less than half of the studied banks had fully adopted them. The least fully adopted technologies were ATM with only 6 (16.7%), Electronic Home and Office Banking with 7 (19.4%) and Telephone Banking with 8 (22.2%).

Low rate of adoption of these technologies might be due to cost, fear of fraudulent practices and lack of facilities necessary for their operation. EHOB has not been firmly rooted in Nigeria due to the inability of many households to afford terminals and all accessories required for effective connection, high capital investment required for its operation in banks, low level of economic development, ineffectiveness of NITEL and epileptic supply of power supply.

Tele-banking is capable of broadening the customer relationship, retain customer loyalty and enable banks to gain commanding height in market share Callender (1999) if their attendant challenges are taken care of. Fraud and insurgence of virus have posed serious threats to Internet banking. The use of familiar hardware like television appears sound and attractive but the system may be expensive and cumbersome. In Britain, personal users are faced with a monthly subscription of up to six thousand and five hundred pounds. AVR could have gained a wider spread use due to its simplicity, quick service and convenience but only tone phones can be used directly for it. Person-to person delivery channel has been found to be more successful.

Flexibility and variety of delivery channel is vital to the ability of banks to acquire, retain, and expand their customers. This approach will allow customers to deal with banks the way they wish. They must have freedom to change their minds and choose whichever channel is momentarily convenient. For customers to be able to decide on the most appropriate channel they need to be guided by making information available to them. Many major banks offer different types of delivery channels to different customers. The objective is to optimize profit from each of them. Telephone services can be used for high valued customers while ATMS and centralized low-cost telephone services can be used for low value customers. It is also possible to integrate person-to-person and AVR where the customers have the option of a fully automated enquiry or a personal contact. There is an in-built ability that allows the system to switch from one device to the other. A customer would require a personal computer (PC) equipped with a modem for connection to a digital telephone to enjoy full home or electronic banking services, and the bank which provides this service must implement a secure electronic banking software, integrated to its core banking applications software (Irechukwu, 2000)

Electronic banking operations have continued to change payment systems in Nigeria. A lot of efforts are however required to fully utilize its numerous capabilities. Banks in Nigeria should explore the Internet more intensely to avail themselves of the bountiful opportunities locally and globally. This can be done by utilizing the services of Internet Service Providers (ISPs). Banks should also ensure safety of financial transactions on the net and ATM via authentication, authorisation, data integrity, and nonrepudiation. Well-protected private networks should be employed where the source of the request for payment is recorded and proven. The devices such as message integrity, digital signature, digital wallet, secure electronic transaction (SET), electronic cash (e-cash), electronic cheque, smart cards, electronic bill payment and digital certificate can be used in this regard.

Electronic banking depends largely on regular supply of electricity. Unfortunately power generation and supply in Nigeria is far below what could make for efficient operations of banks using ICT devices. Lack of enabling environment to be provided by functioning electricity in the country has reduced the level of assimilation of the services and systems in the Nigerian Banking Industry. The Nigerian’s electric mains utility (Power Holding) should be revitalized to provide more reliable electric power supply to the consumers. Alternative sources of power such as generating plants should be used to avoid the damaging effect of erratic power supply. Independent Power Providers (IPPs) should be allowed to operate to give room for healthy competition. The national telecommunications carrier (NITEL) should be properly reengineered to improve on its efficiency in the provision of telecommunications services which give the necessary platform for full banking automation.

Copyright © 2024 Research and Reviews, All Rights Reserved